How to get URL link on X (Twitter) App

https://twitter.com/therealclementm/status/1867588768880111889Bell Pottinger was co-founded in part by Sir Tim Bell in 1987 who later become Sir Bell.

1996, Vodafone and VenFin sold a 5% stake in Vodacom Group to a BEE company, Hosken Consolidated Investments for R118 million.

1996, Vodafone and VenFin sold a 5% stake in Vodacom Group to a BEE company, Hosken Consolidated Investments for R118 million.

Astron Energy, a Glencore group company, is a leading supplier of petroleum products in Southern Africa, with a vast network of service stations and is the second-largest petroleum network in the region.

Astron Energy, a Glencore group company, is a leading supplier of petroleum products in Southern Africa, with a vast network of service stations and is the second-largest petroleum network in the region.

https://twitter.com/leadersjournal_/status/1707332271399637262In 1985, the Kagiso Trust began its development work to help promote the struggle against apartheid.

60% in the restaurant brands Doppio Zero, Piza e Vino and Modern Tailors,with a portfolio of 37 franchised and company-owned

60% in the restaurant brands Doppio Zero, Piza e Vino and Modern Tailors,with a portfolio of 37 franchised and company-owned

https://twitter.com/lebohangbokako/status/1634141552934092801

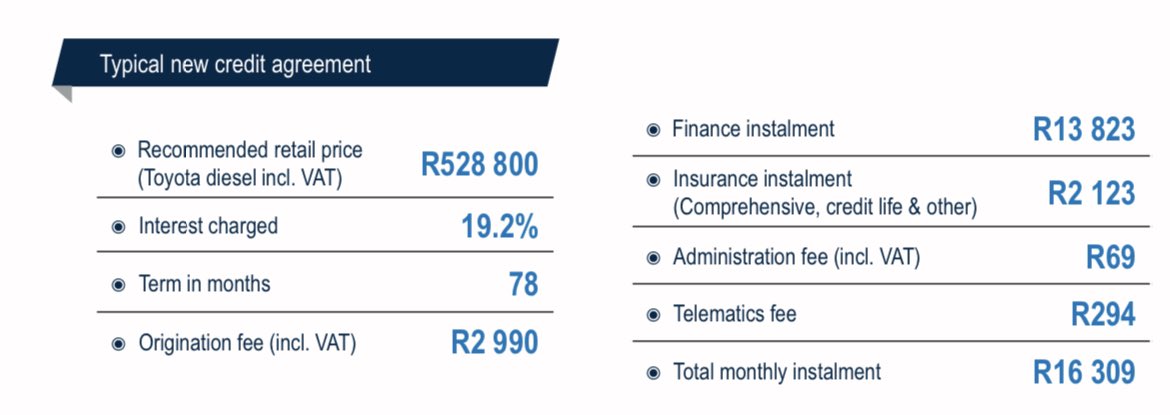

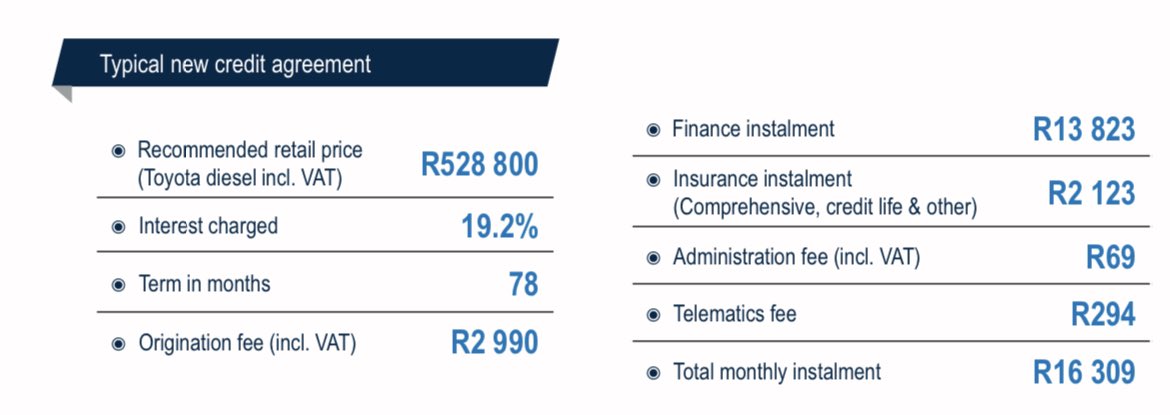

SA Taxi provides asset-backed developmental credit lending for an

SA Taxi provides asset-backed developmental credit lending for an

August 2022, Walmart and Massmart reached an agreement for Walmart to potentially make an offer to buy all the outstanding shares (47.6%) in Massmart that it did not already own for R62 in cash for each ordinary share.

August 2022, Walmart and Massmart reached an agreement for Walmart to potentially make an offer to buy all the outstanding shares (47.6%) in Massmart that it did not already own for R62 in cash for each ordinary share.

15 Nov 1999, Nedcor announced a proposed merger offer of 1 Nedcor share for 5,5 Standard Bank shares.

15 Nov 1999, Nedcor announced a proposed merger offer of 1 Nedcor share for 5,5 Standard Bank shares.

Retirement Investments and Savings for Everyone is a retirement fund administration and asset management business.

Retirement Investments and Savings for Everyone is a retirement fund administration and asset management business.