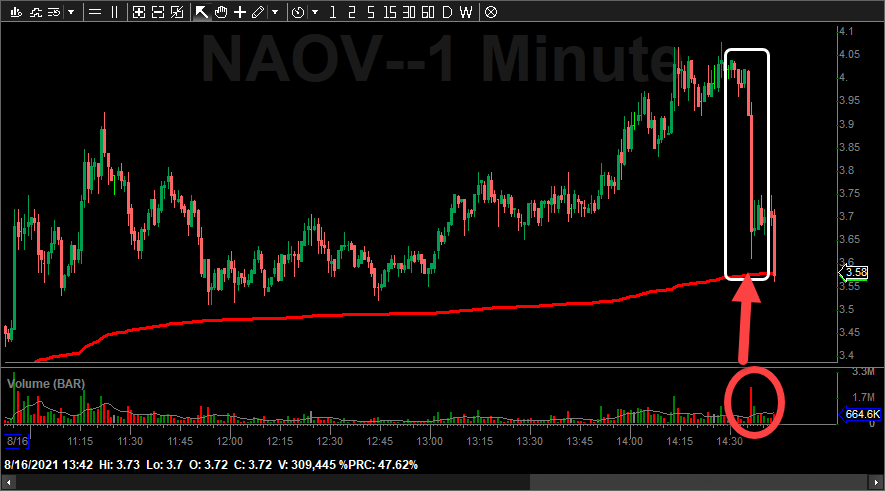

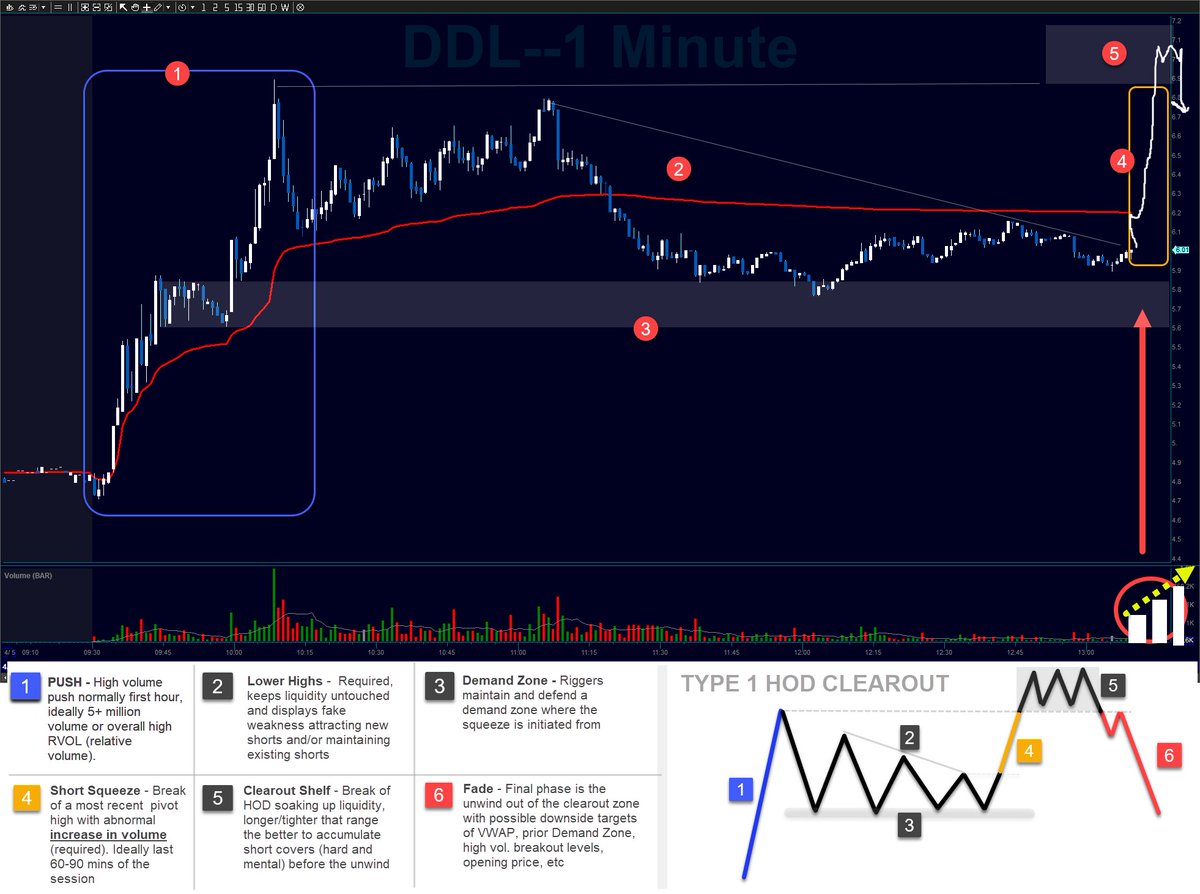

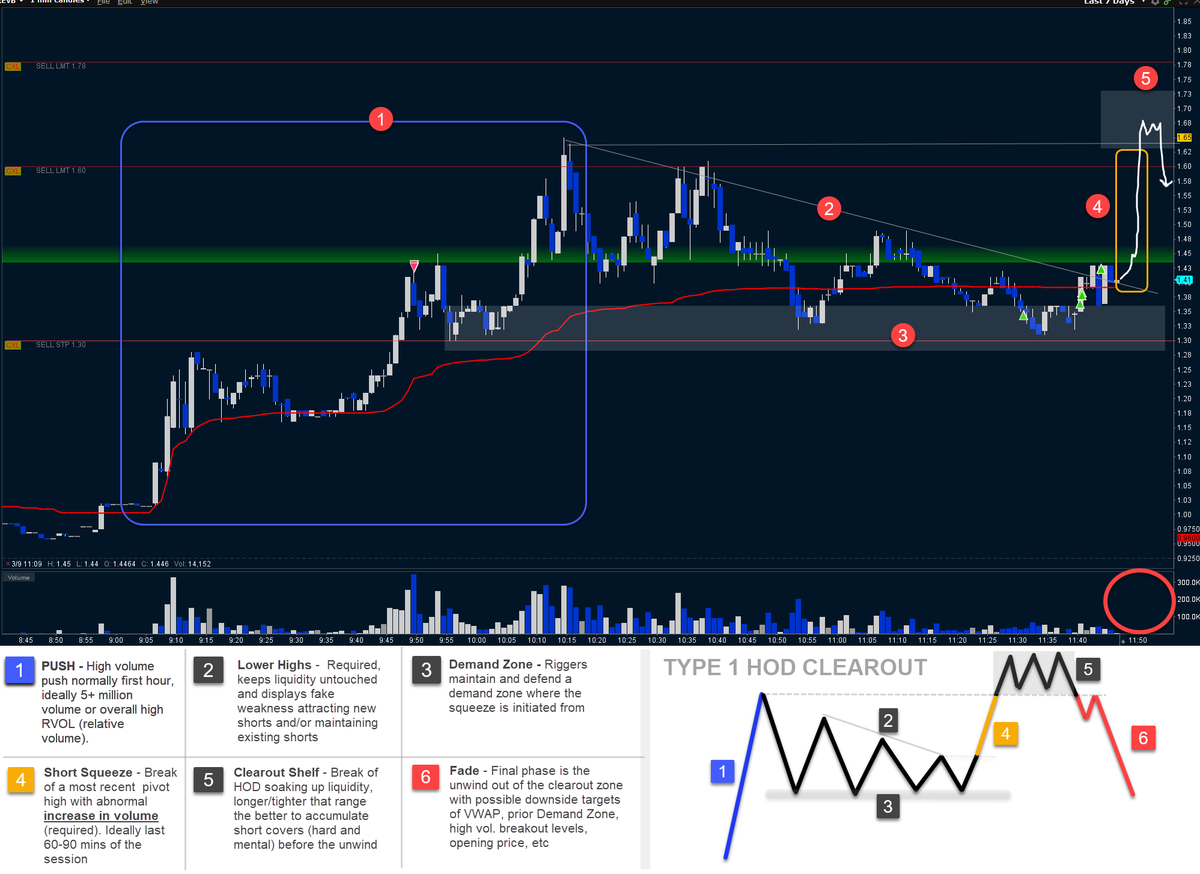

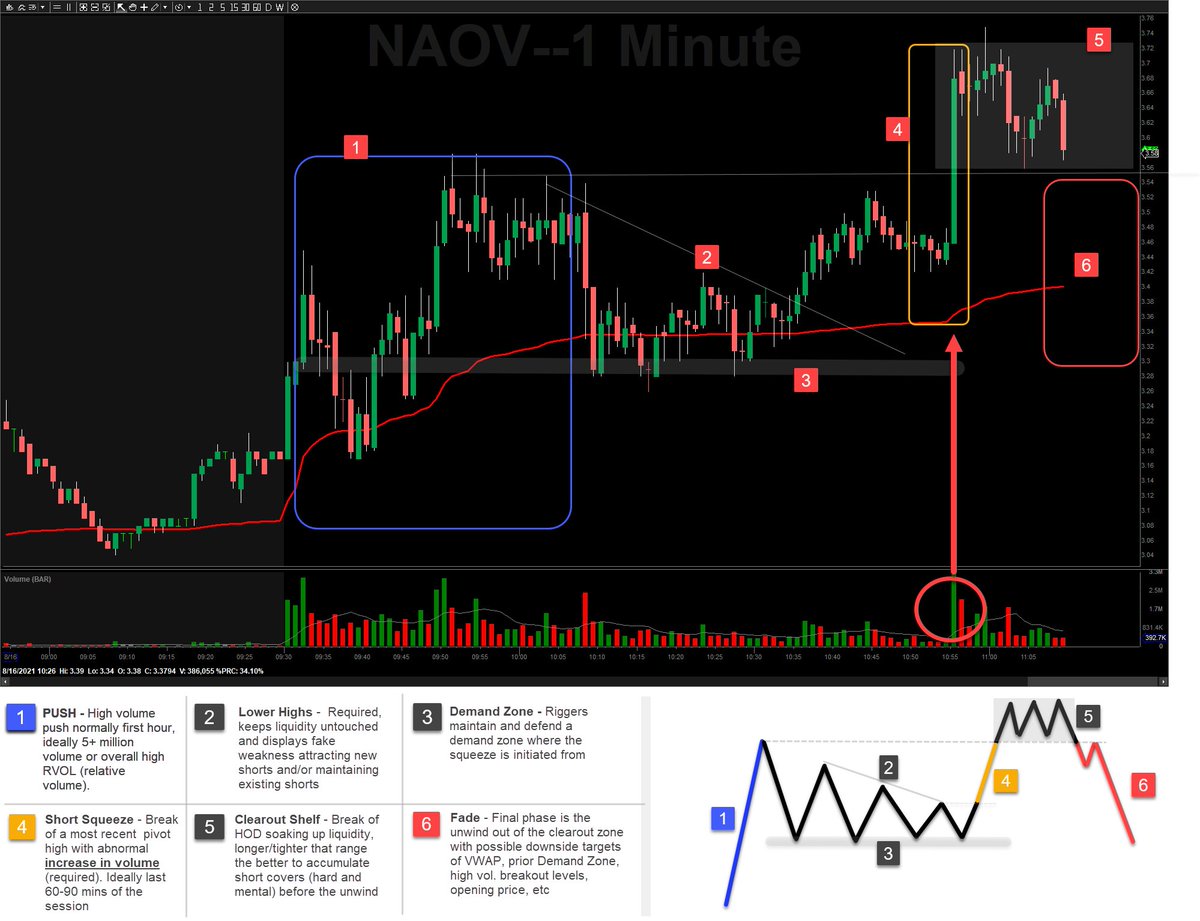

Still can't trade $NAOV, but this is the short signal I would have entered on. HOD clearout, shelf, then higher volume break. If it reclaims 3.45 plus might push higher, other wise 3.10s and lower would have been targets

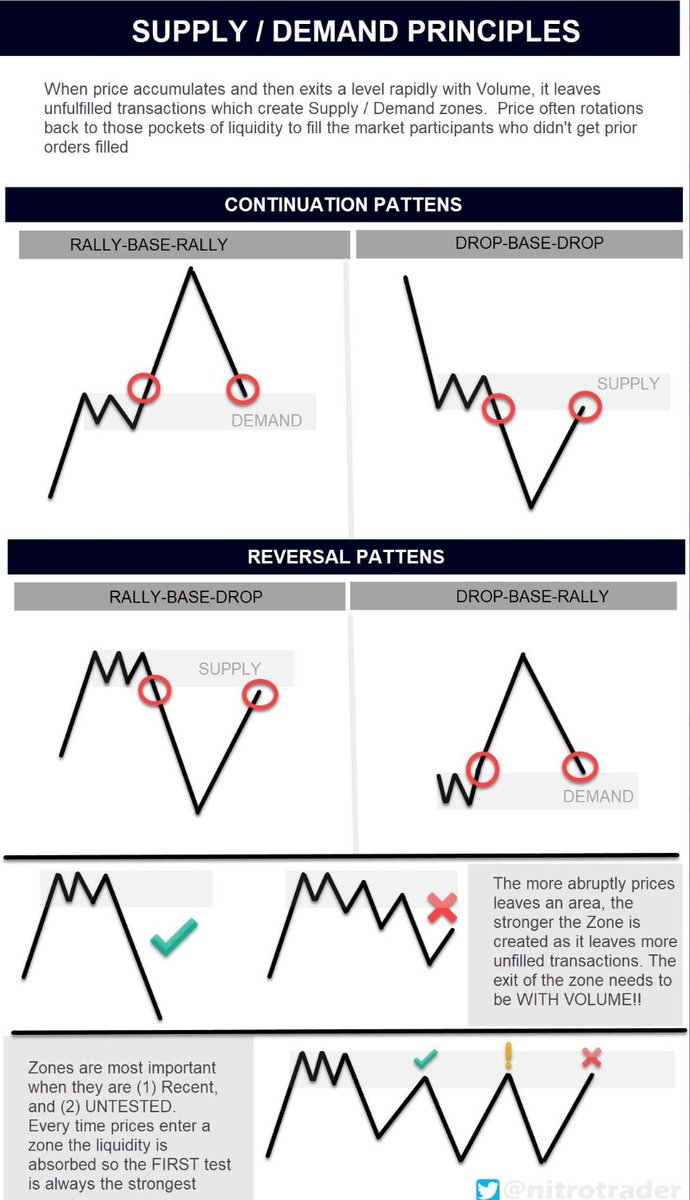

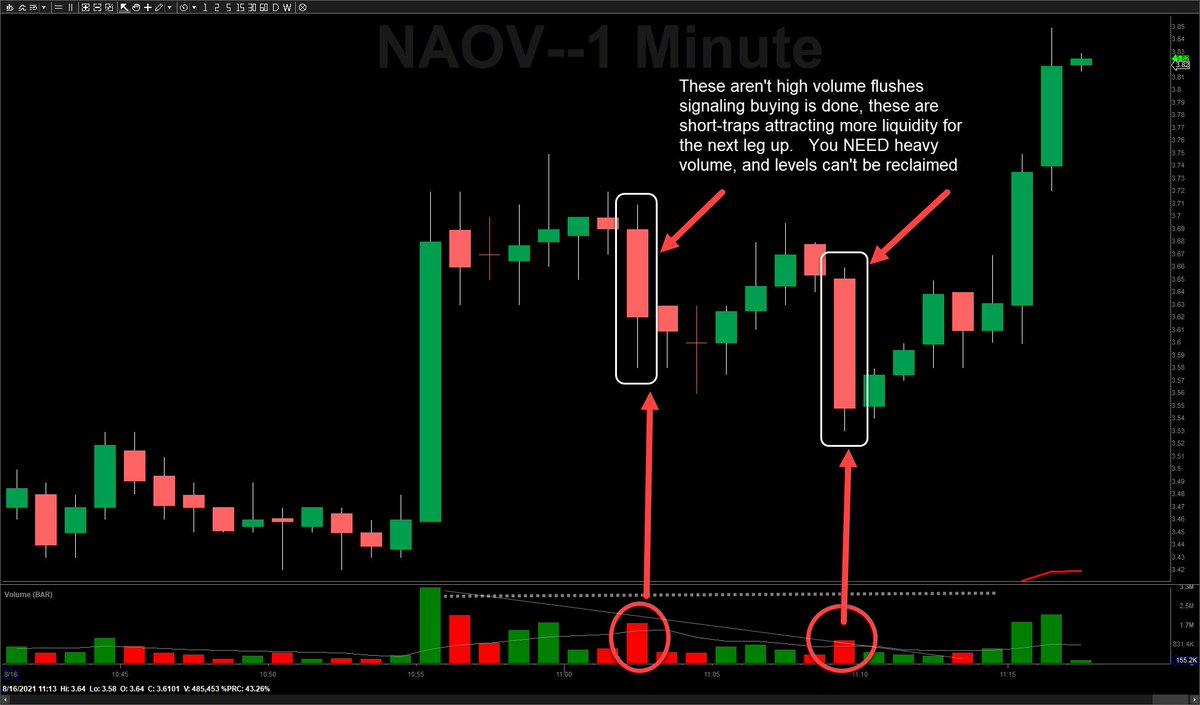

Think of the range that's created by flush moves like a stoplight...lower zone good (Green), mid zone warning (yellow), top of zone bad (red).

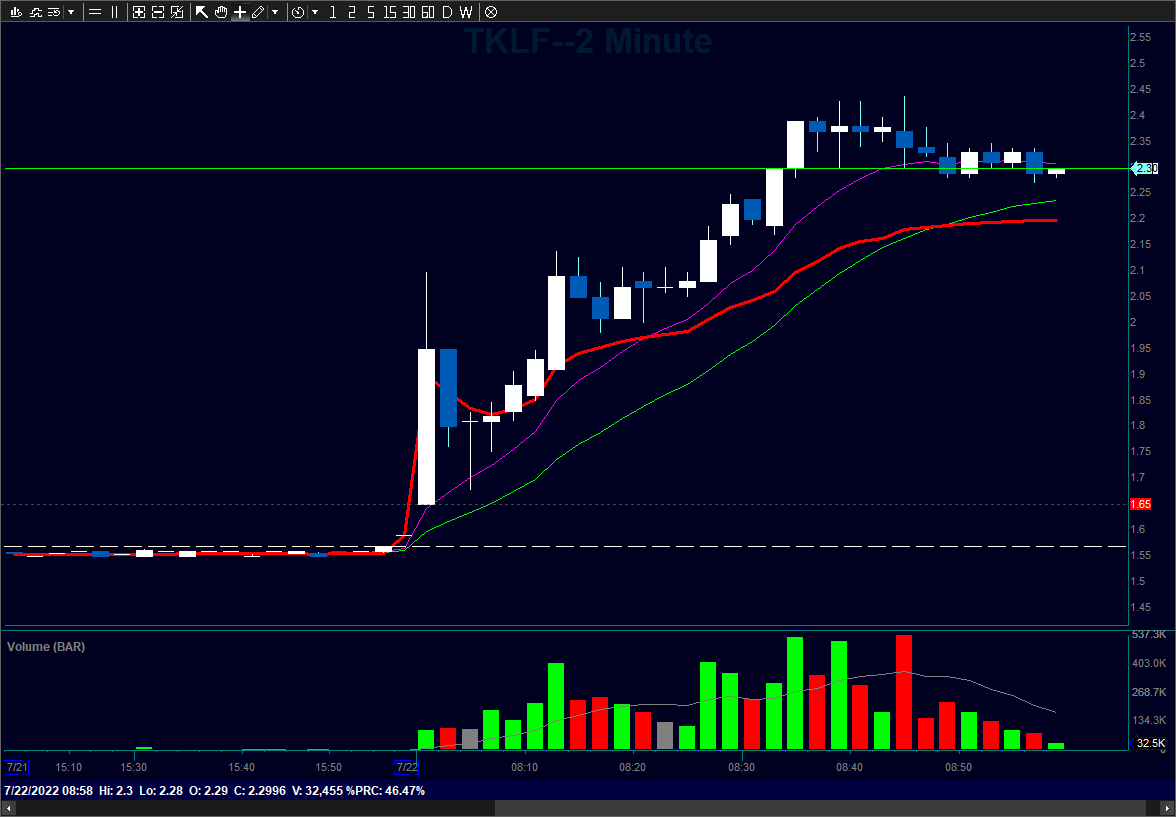

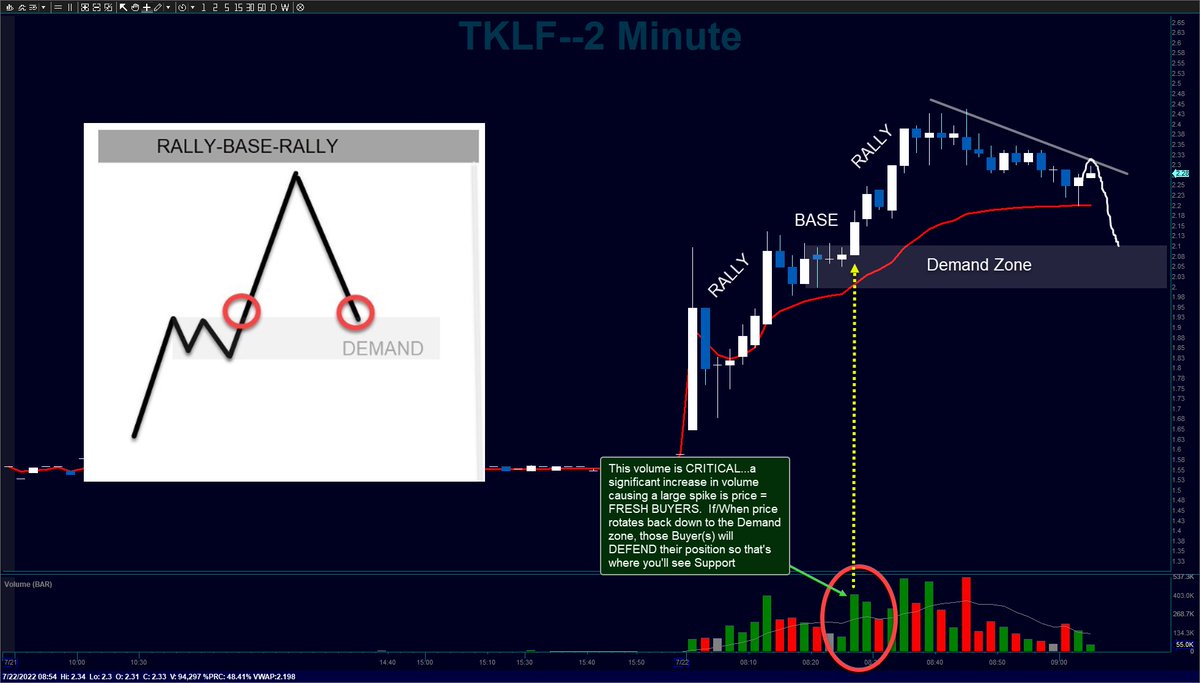

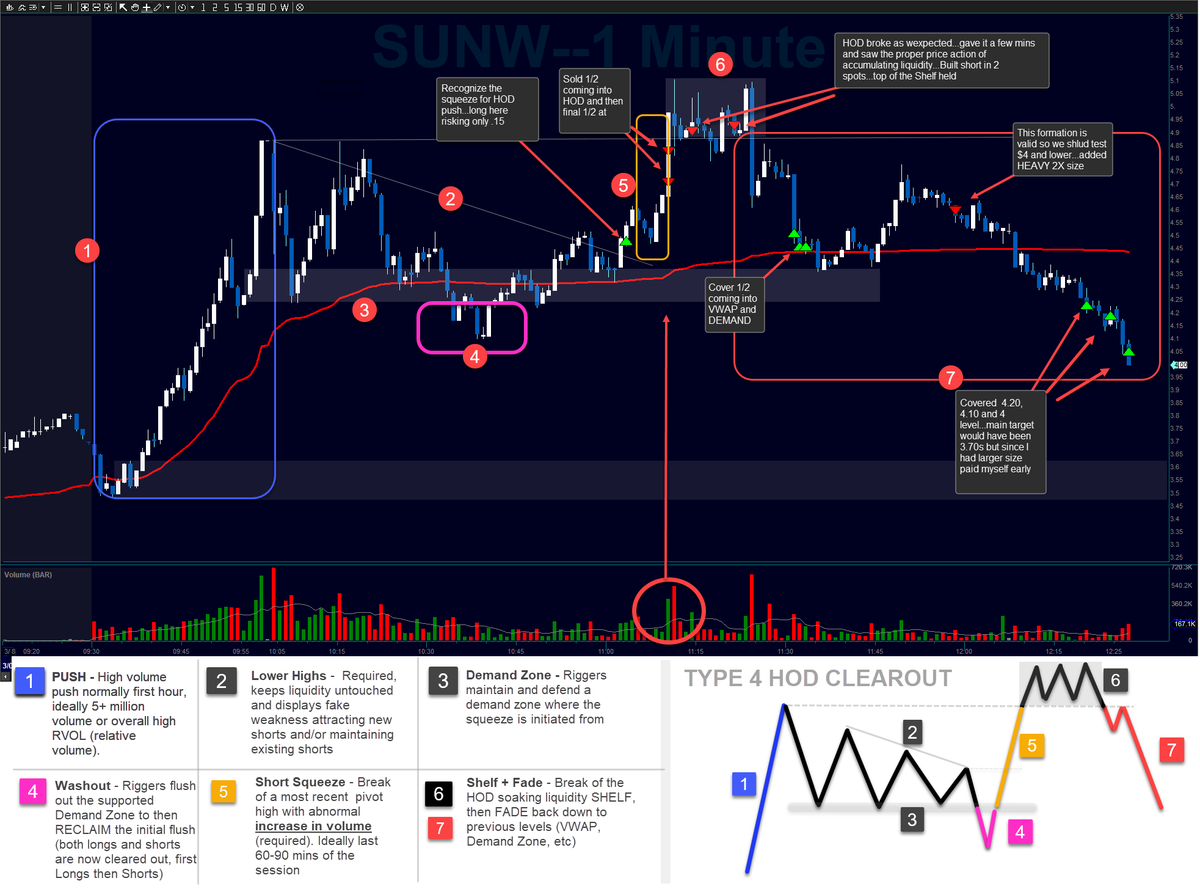

Shelf above HOD = Accumulation....then breaks on flush with increasing volume. Then we see VWAP basing = accumulation...then break on volume pop. VOLUME is key especially at critical levels

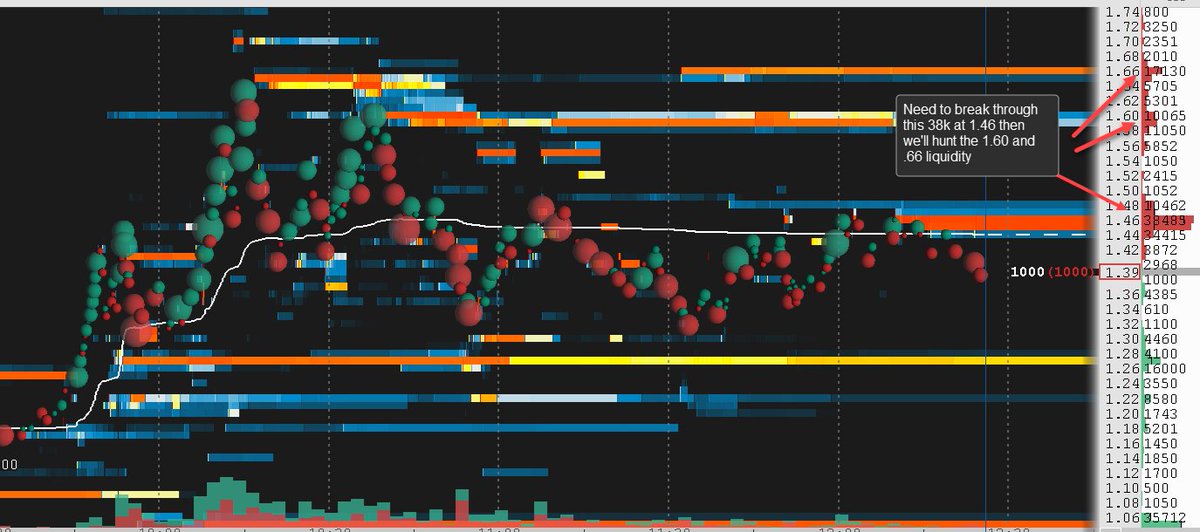

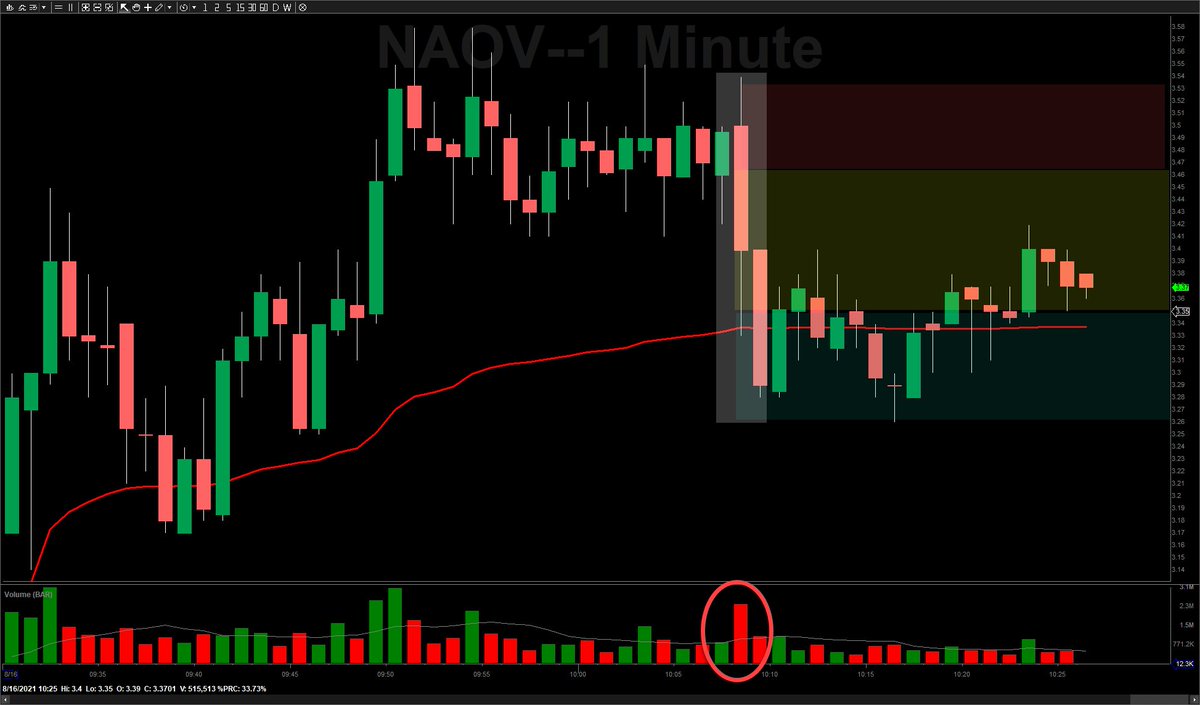

Still early in the day and plenty of rigging could unfold....BUT lots of structure signs are there on NAOV. A High volume (2.3M) flush candle would be nice....just observing

Remember, volume confirms the move....earlier 'flushes' were on lower volume = TRAP, not trend change

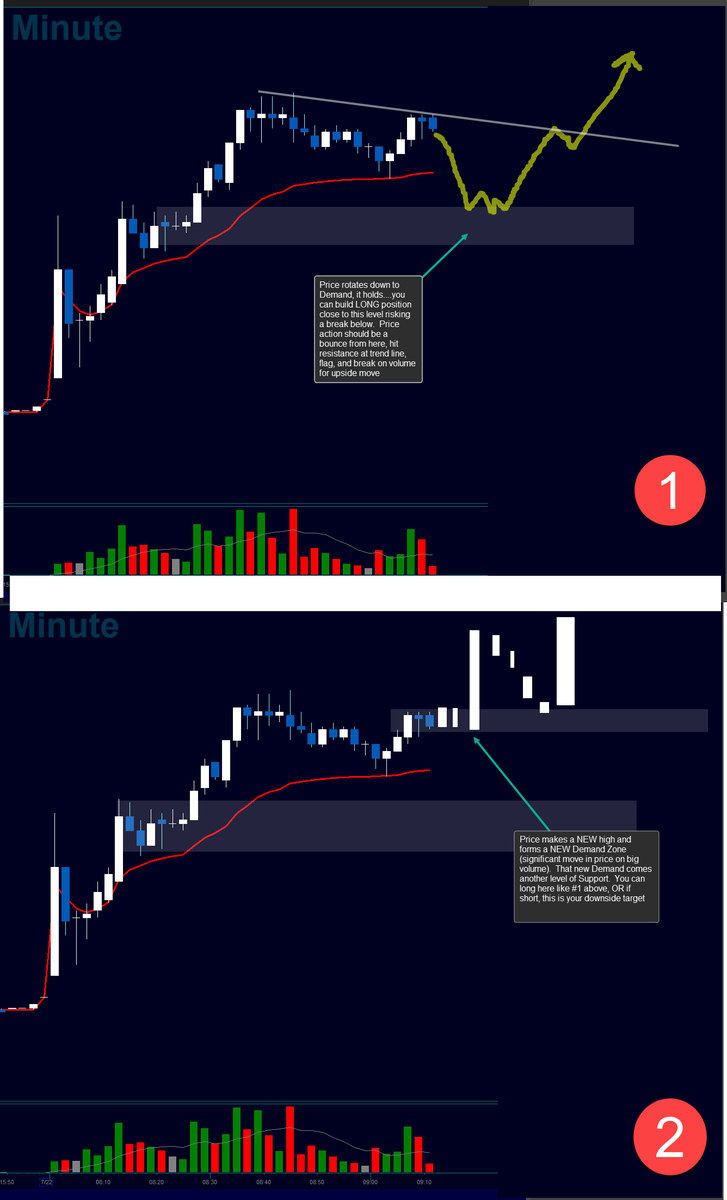

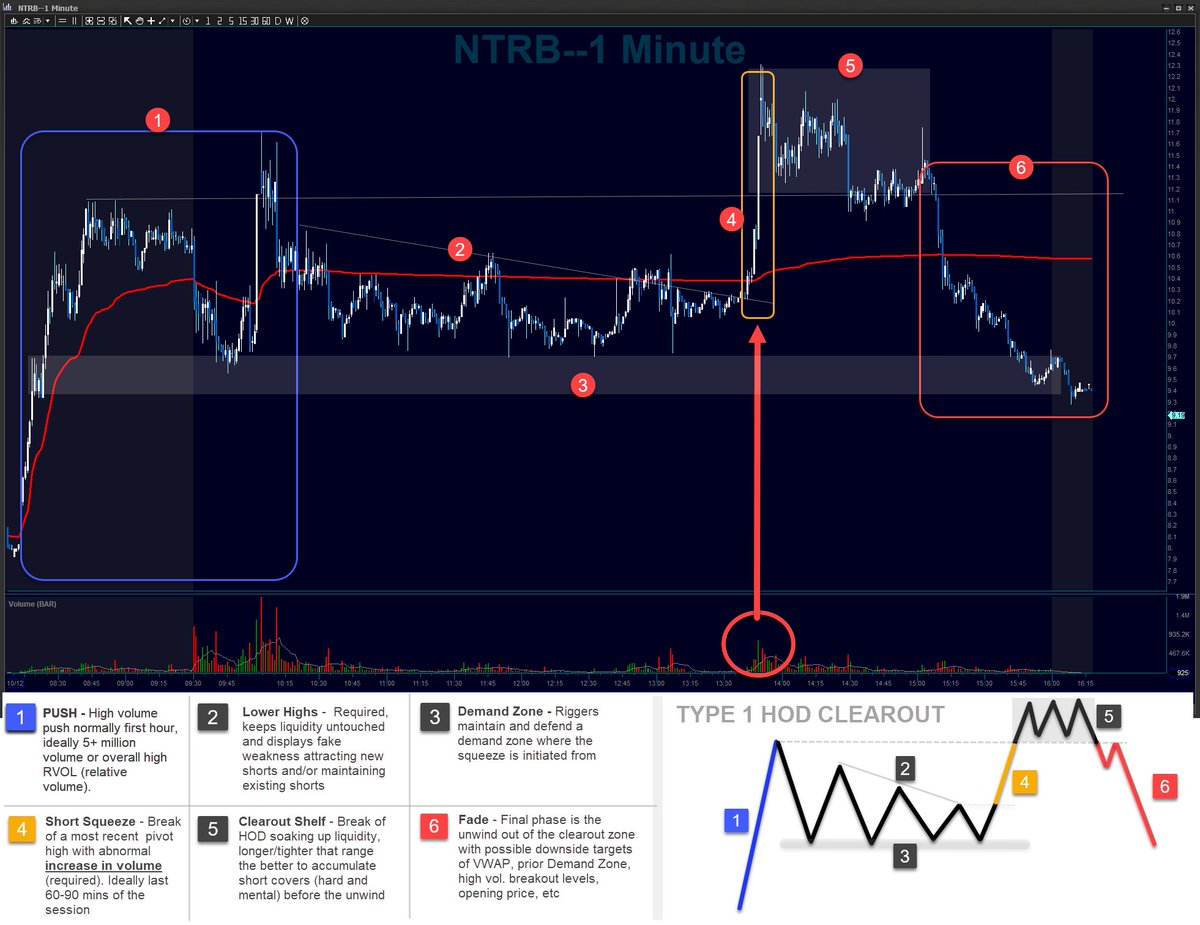

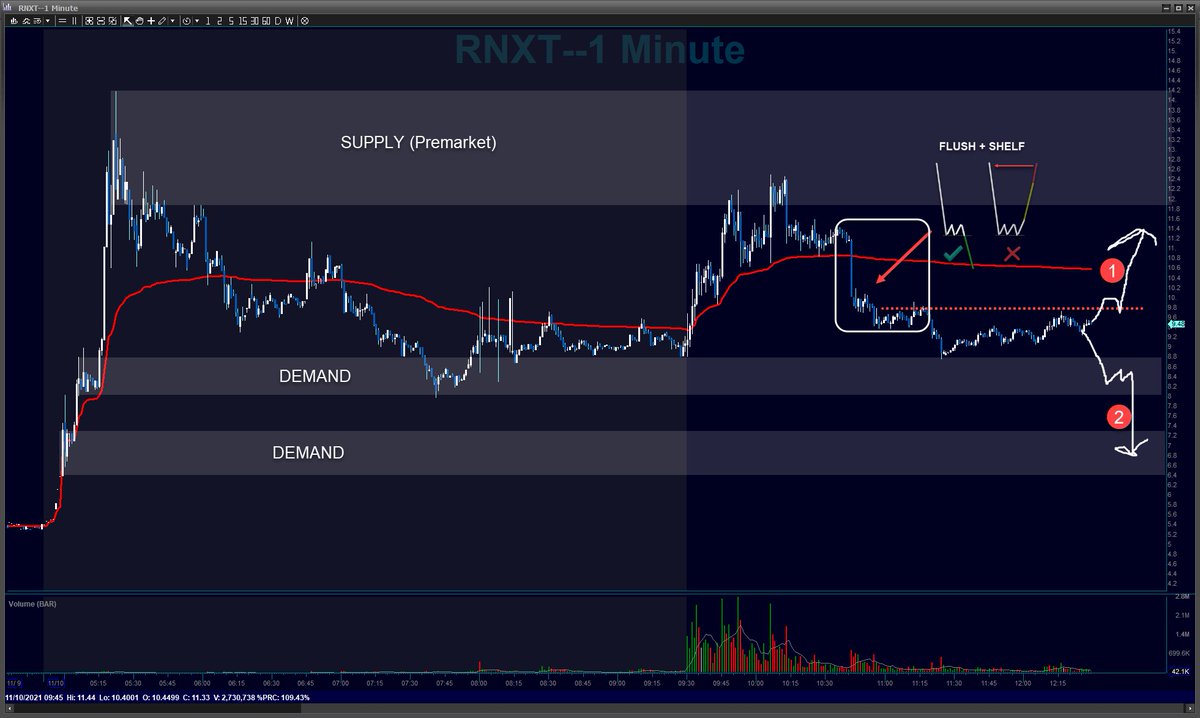

Accumulation (grey boxes) followed by strong moves out (yellow boxes) = rigging...that's not normal price behavior (obviously). Price rotated down to first Demand zone, next target would be green 'untested' Demand in the 3.20-.40 level

• • •

Missing some Tweet in this thread? You can try to

force a refresh