My personal trade log for intra-day and swing trades. Tweets are personal opinions, not investment recommendations

3 subscribers

How to get URL link on X (Twitter) App

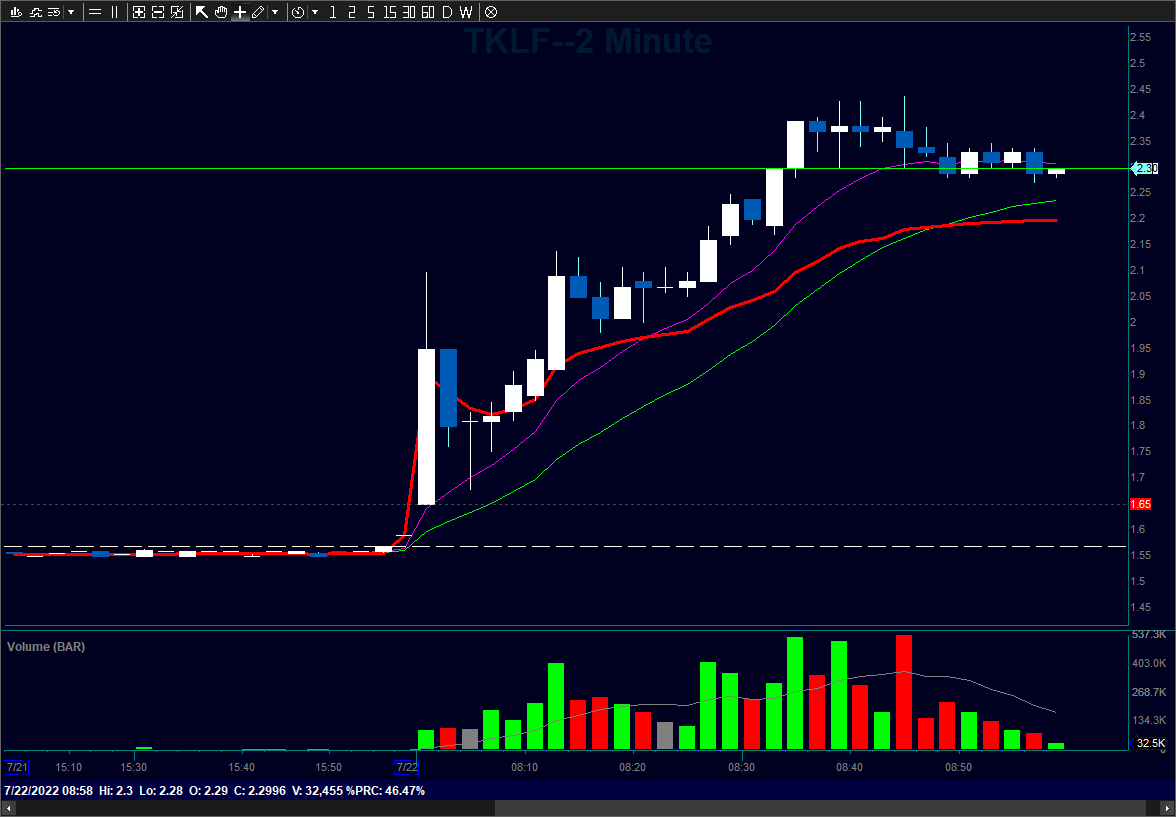

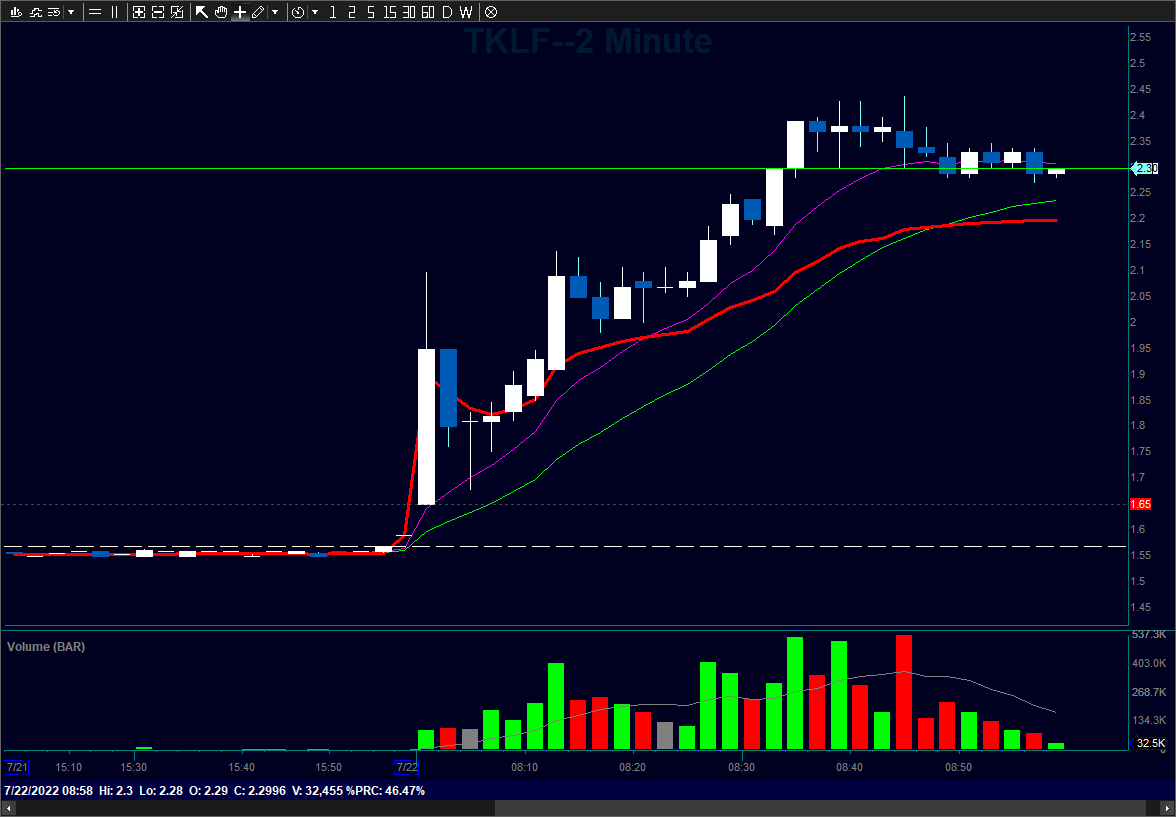

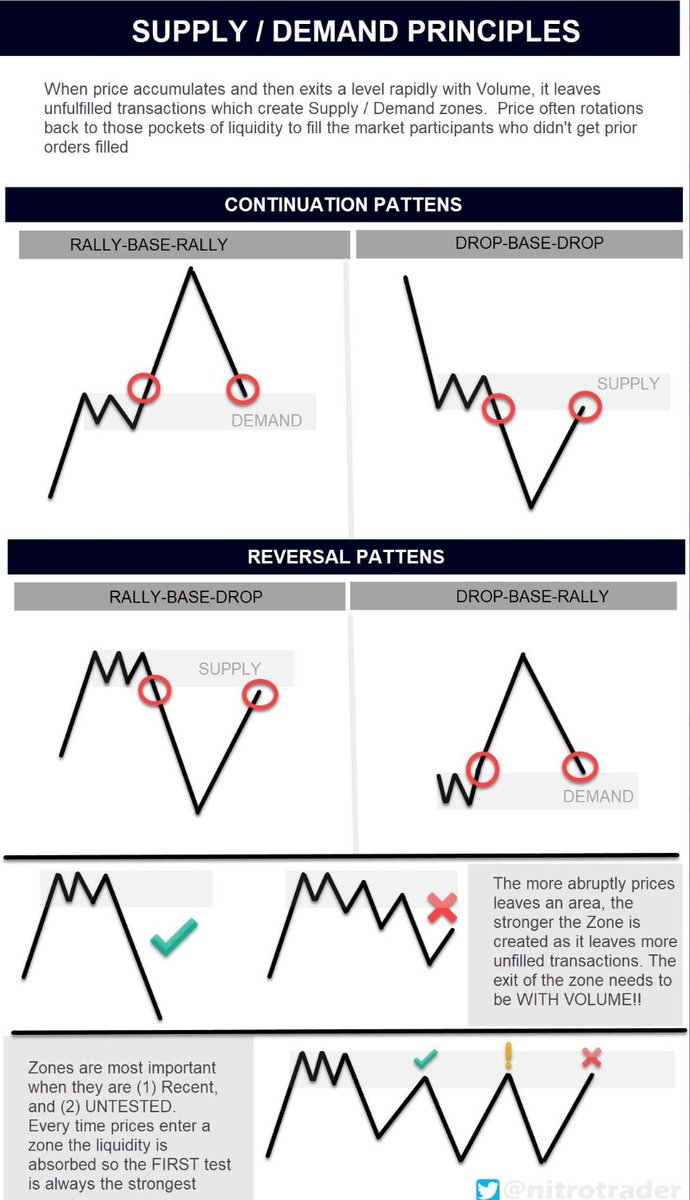

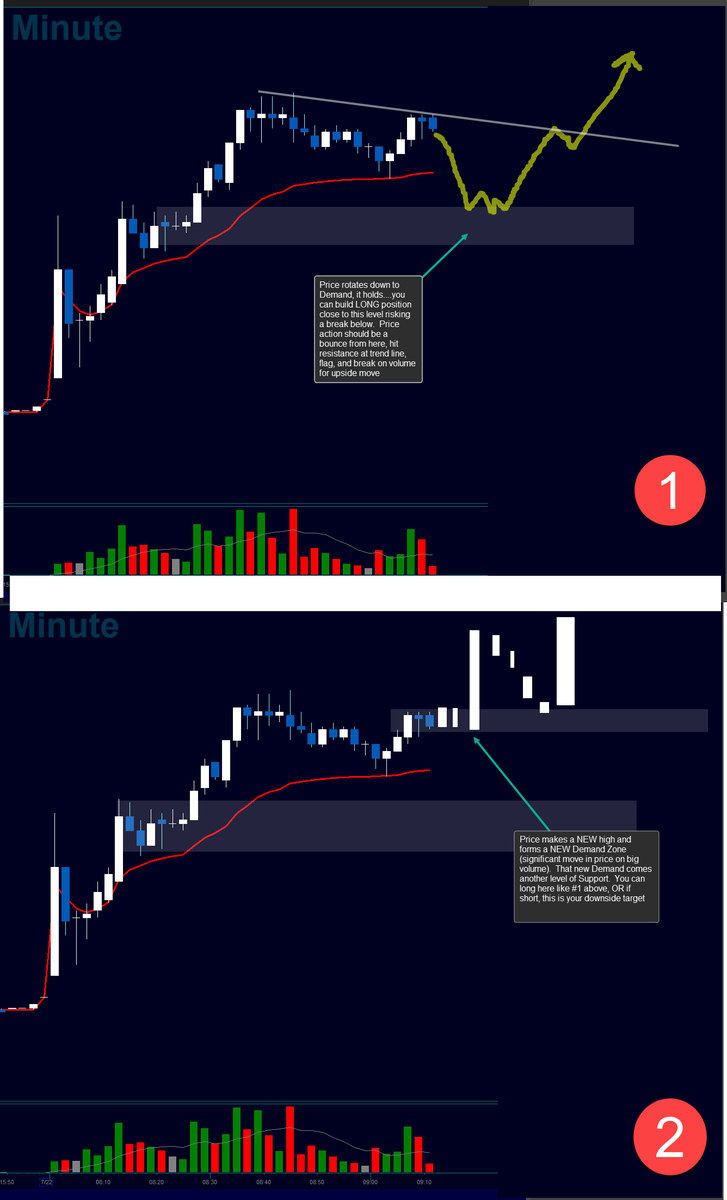

SPOILER (Answers). (1) Pattern is a Rally-Base-Rally, (2) current Demand Zone is that 2.05-2.11 area, and (3) here are a couple of ways you can approach trades....

SPOILER (Answers). (1) Pattern is a Rally-Base-Rally, (2) current Demand Zone is that 2.05-2.11 area, and (3) here are a couple of ways you can approach trades....

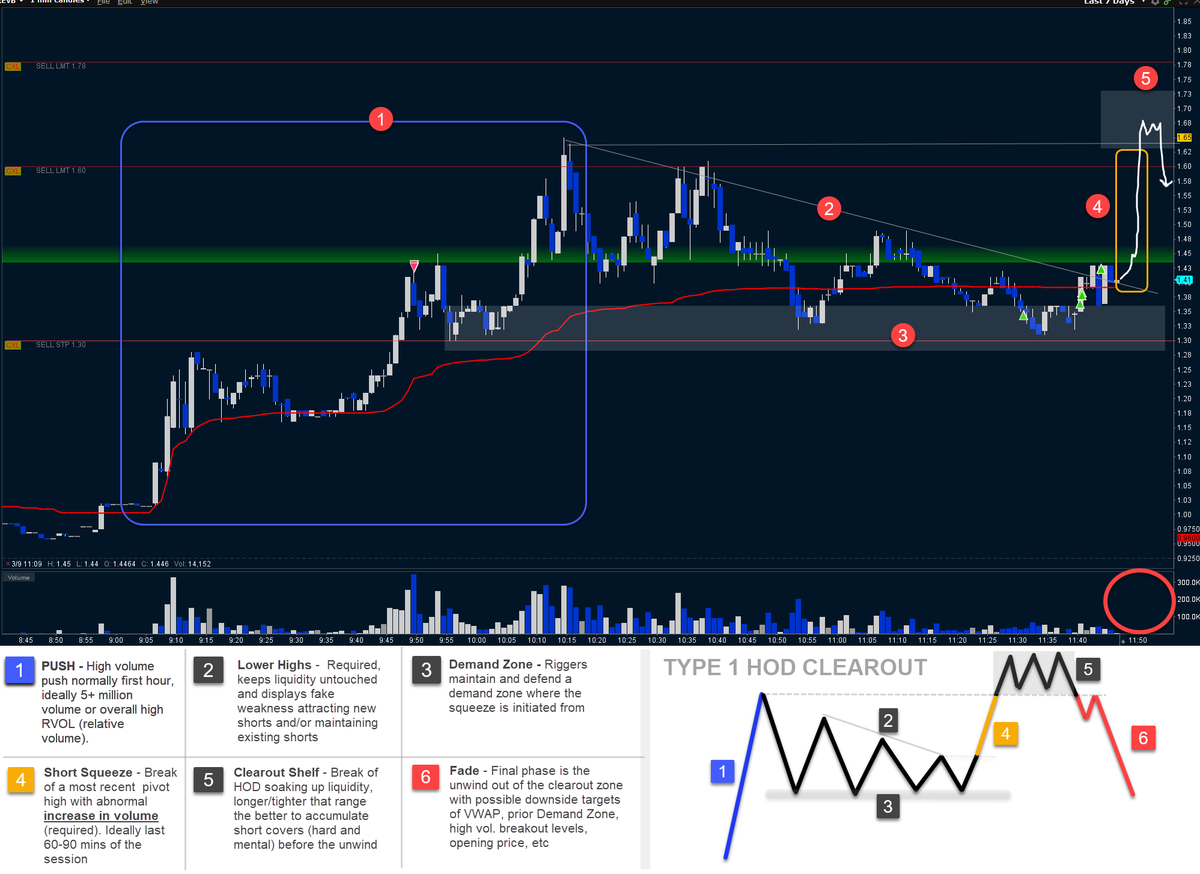

Flags near VWAP = early indications of buying possibly coming in. Watch if flag breaks WITH VOLUME (needs larger than average vol. and sustained over several minutes). LONG: on flag break risking below, target HOD - SHORT: After HOD clearout, then fade. Again, NOT microfloat!!

Flags near VWAP = early indications of buying possibly coming in. Watch if flag breaks WITH VOLUME (needs larger than average vol. and sustained over several minutes). LONG: on flag break risking below, target HOD - SHORT: After HOD clearout, then fade. Again, NOT microfloat!!

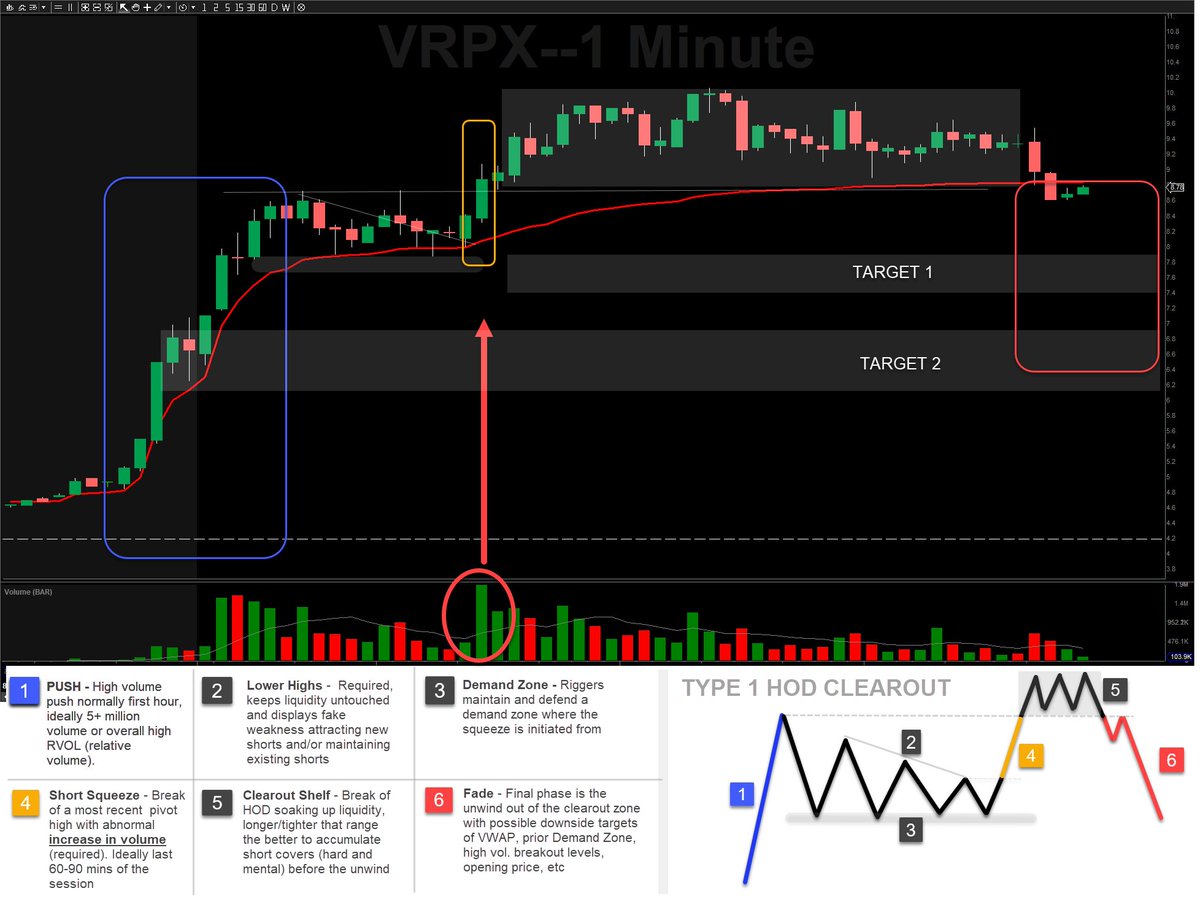

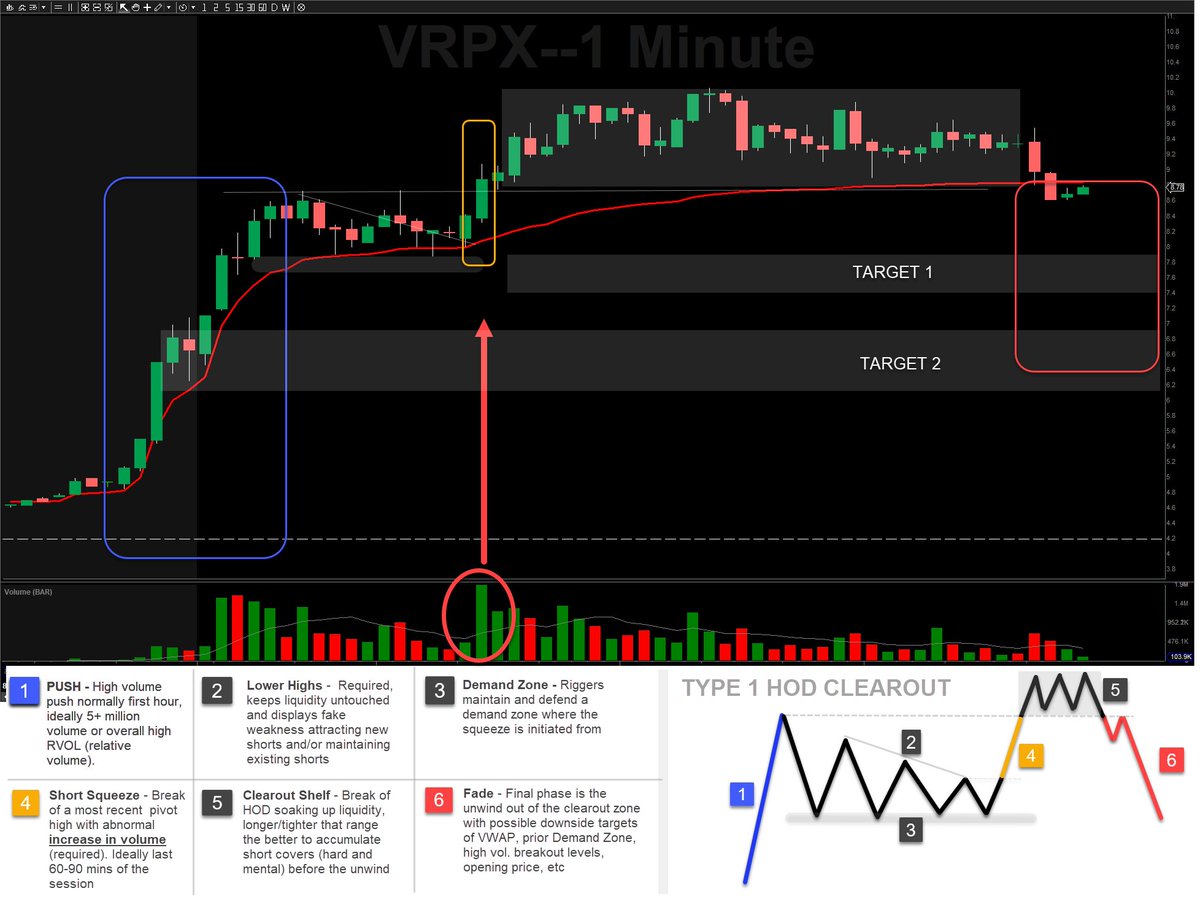

Flagging above VWAP, that's positive sign for the squeeze...the timing and structure is right, now it's all about VOLUME...should happend in the next 2-10 mins if it's going to squeeze)

Flagging above VWAP, that's positive sign for the squeeze...the timing and structure is right, now it's all about VOLUME...should happend in the next 2-10 mins if it's going to squeeze)

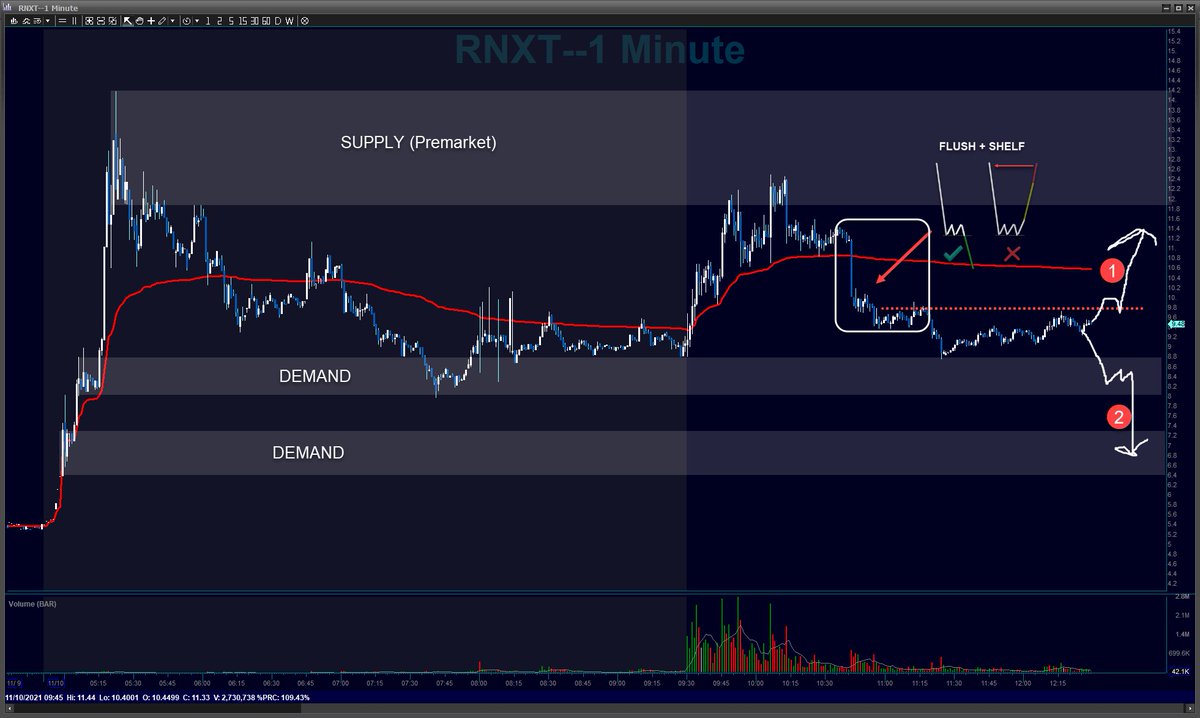

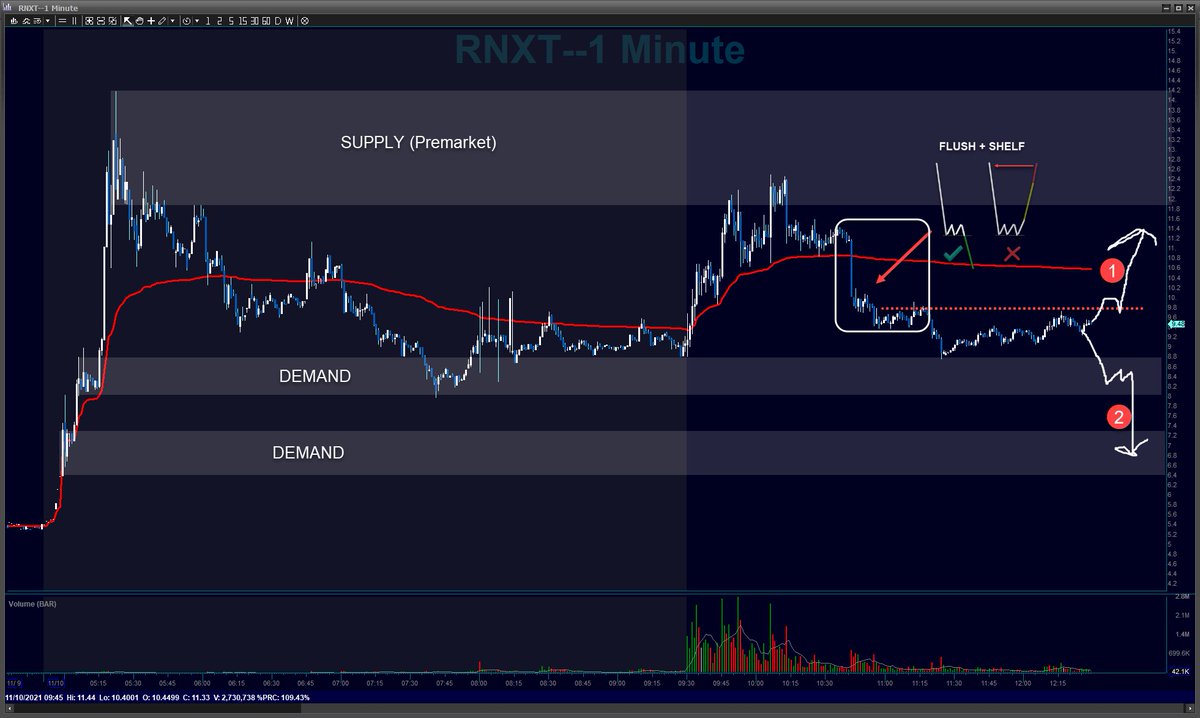

Volume picking up, flagging, $10 break....$11 reclaim should be about to happen

Volume picking up, flagging, $10 break....$11 reclaim should be about to happen

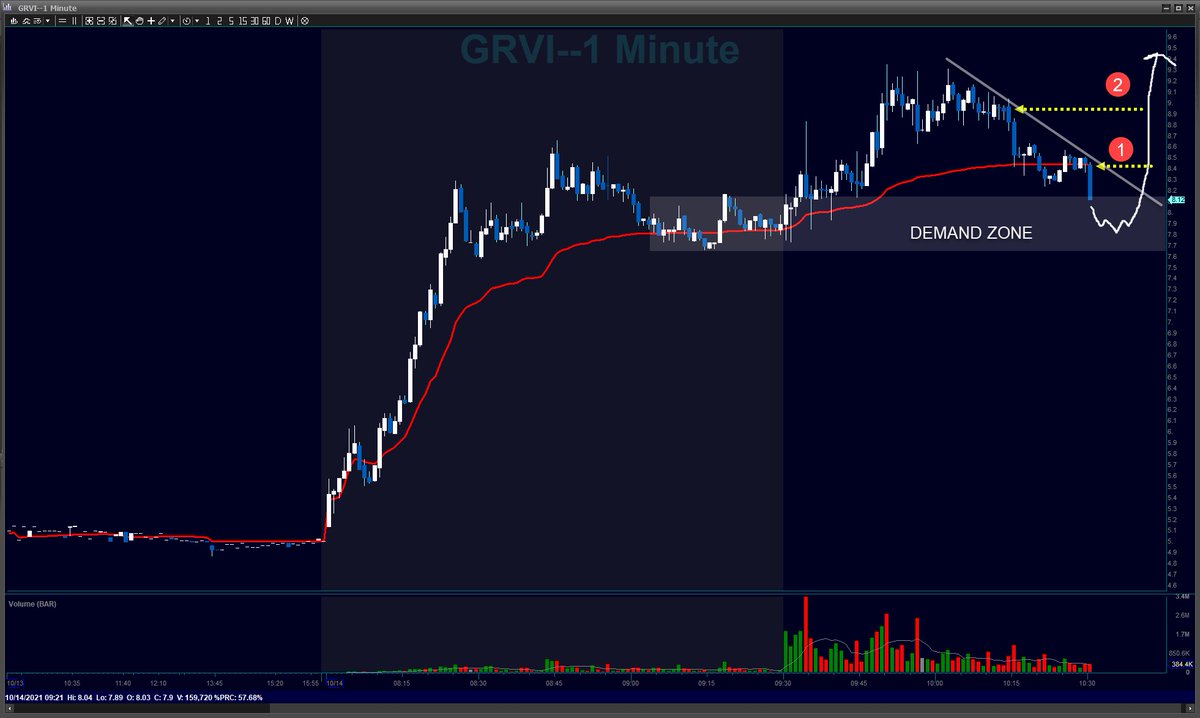

Zoomed in....Flush and microshelf, then another flush with microshelf right into Demand Zone...this 'should' be where buyer(s) defend...watch VOLUME to come in otherwise another flush is possible on 7.60s break

Zoomed in....Flush and microshelf, then another flush with microshelf right into Demand Zone...this 'should' be where buyer(s) defend...watch VOLUME to come in otherwise another flush is possible on 7.60s break

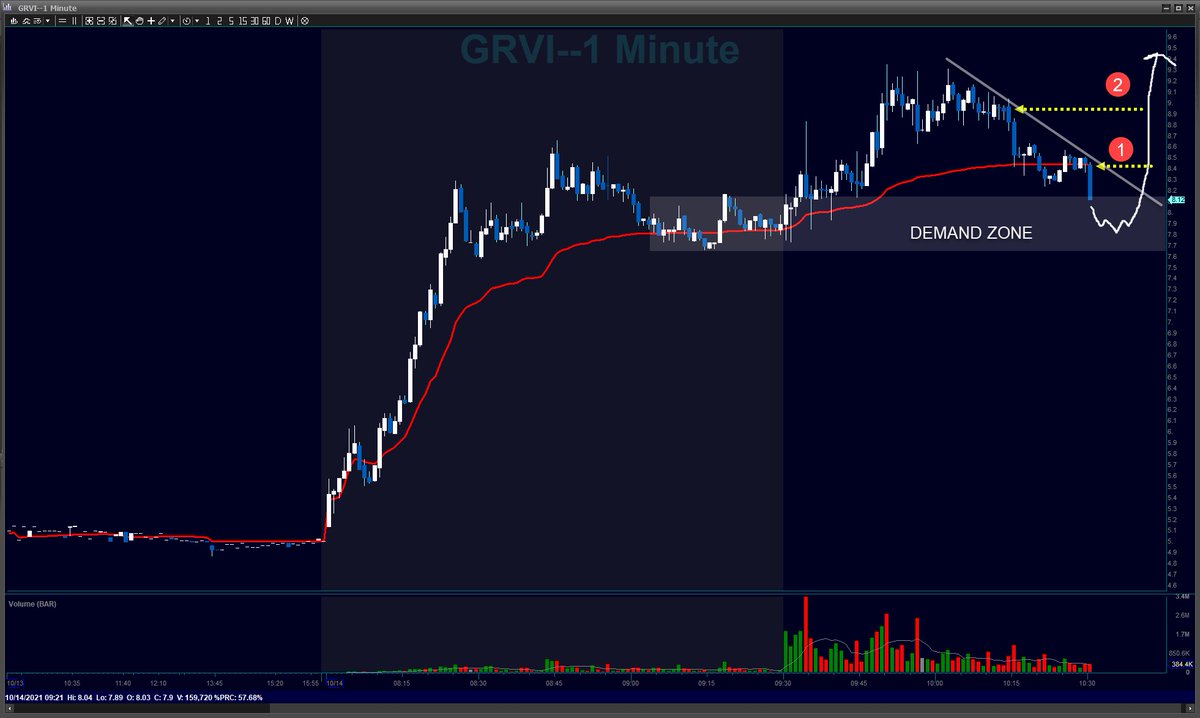

First target hit in this 8.15 supply zone Don't be surprised if a bounce happens here....still super early in the day, plenty of time for riggers agenda to unfold.

First target hit in this 8.15 supply zone Don't be surprised if a bounce happens here....still super early in the day, plenty of time for riggers agenda to unfold.

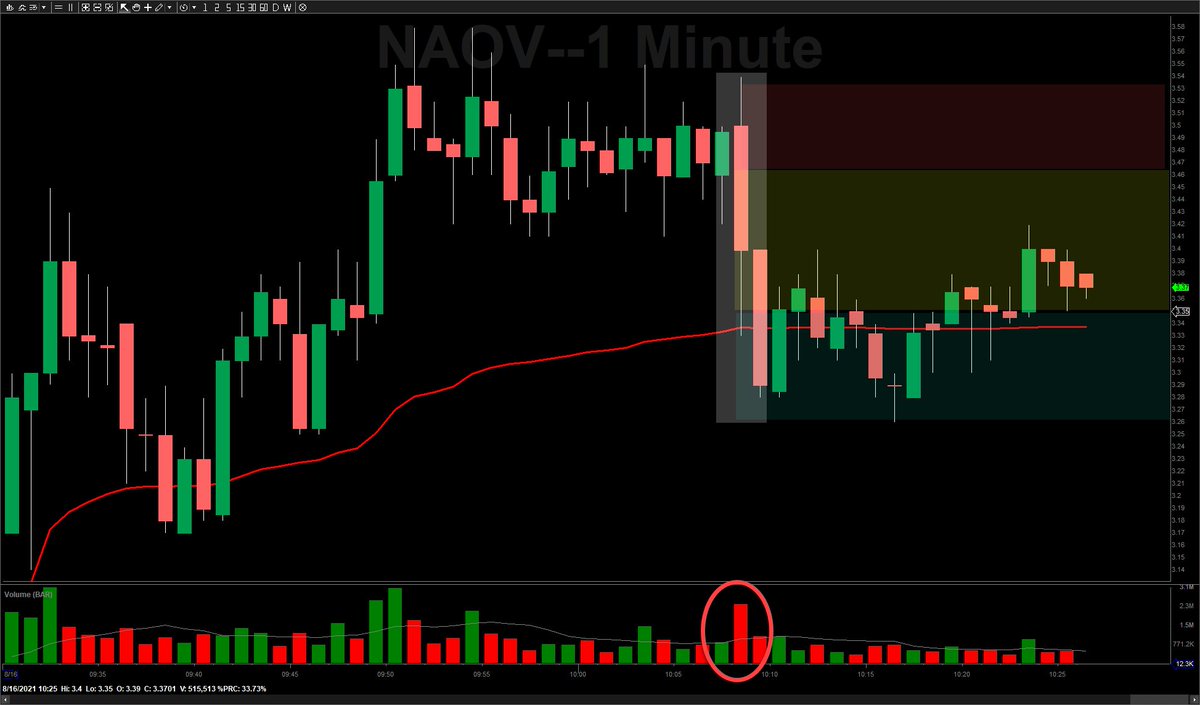

Think of the range that's created by flush moves like a stoplight...lower zone good (Green), mid zone warning (yellow), top of zone bad (red).

Think of the range that's created by flush moves like a stoplight...lower zone good (Green), mid zone warning (yellow), top of zone bad (red).

UPDATE: As planned/mentioned, covered some LOD test, and have added back on pops and confirmed weakness. Still expect ADF but 11.50 is key Demand zone

UPDATE: As planned/mentioned, covered some LOD test, and have added back on pops and confirmed weakness. Still expect ADF but 11.50 is key Demand zone

Push up into supply to gobble up unfilled orders, now next leg down....if/when $17 demand zone breaks then $16 next target as scripted

Push up into supply to gobble up unfilled orders, now next leg down....if/when $17 demand zone breaks then $16 next target as scripted