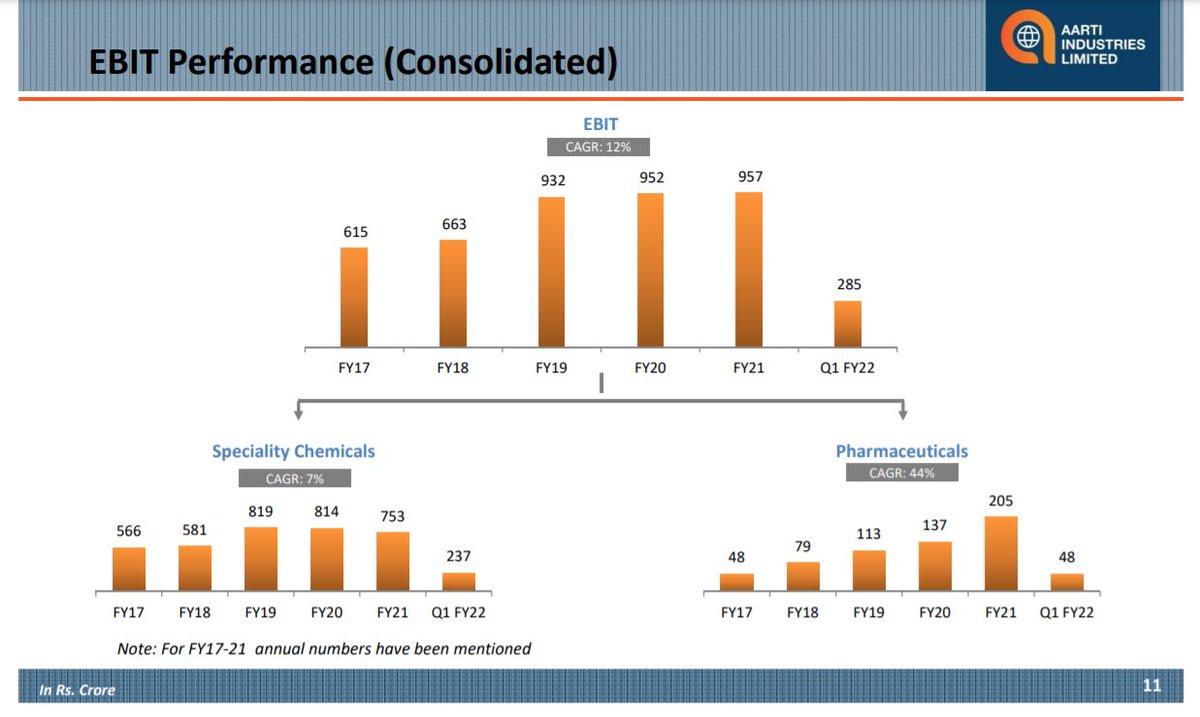

Numbers for Pharma arm of Aarti Industries 👇

https://twitter.com/bsescreener/status/1427242332970053646

EBIT too growing much faster for Pharma vs Spec Chem

Pharma EBIT CAGR at 44% vs Specialty Chemical EBIT CAGR of 7%

Pharma EBIT CAGR at 44% vs Specialty Chemical EBIT CAGR of 7%

• • •

Missing some Tweet in this thread? You can try to

force a refresh