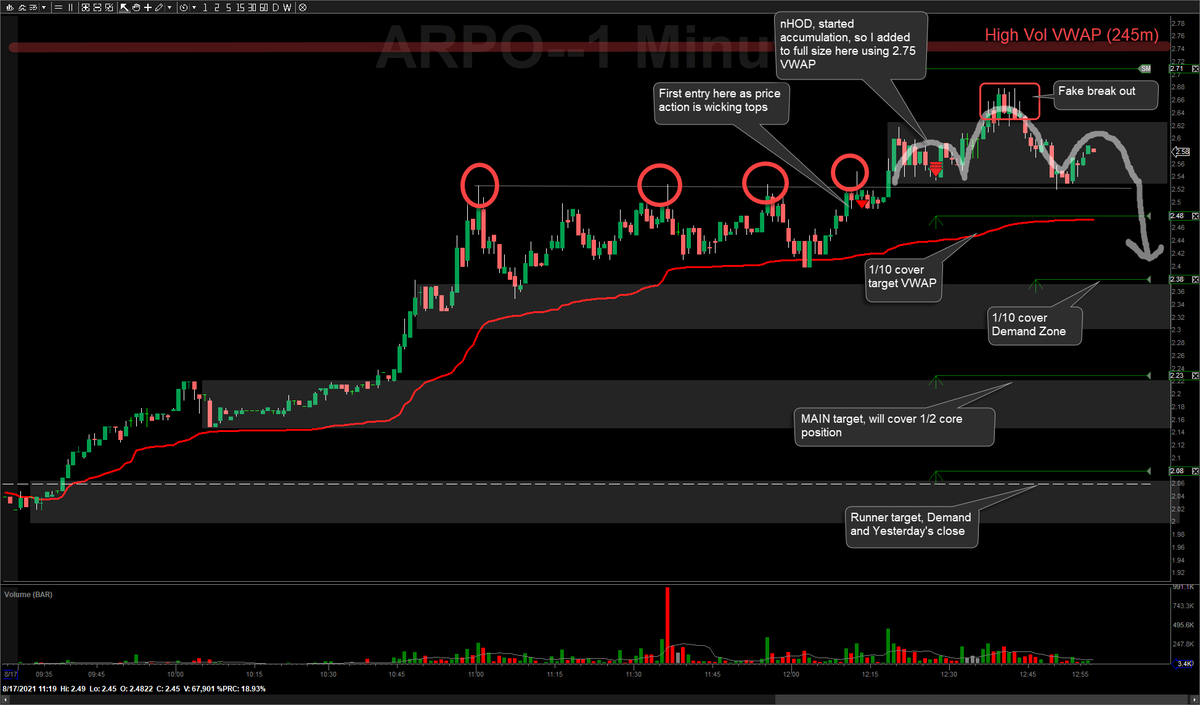

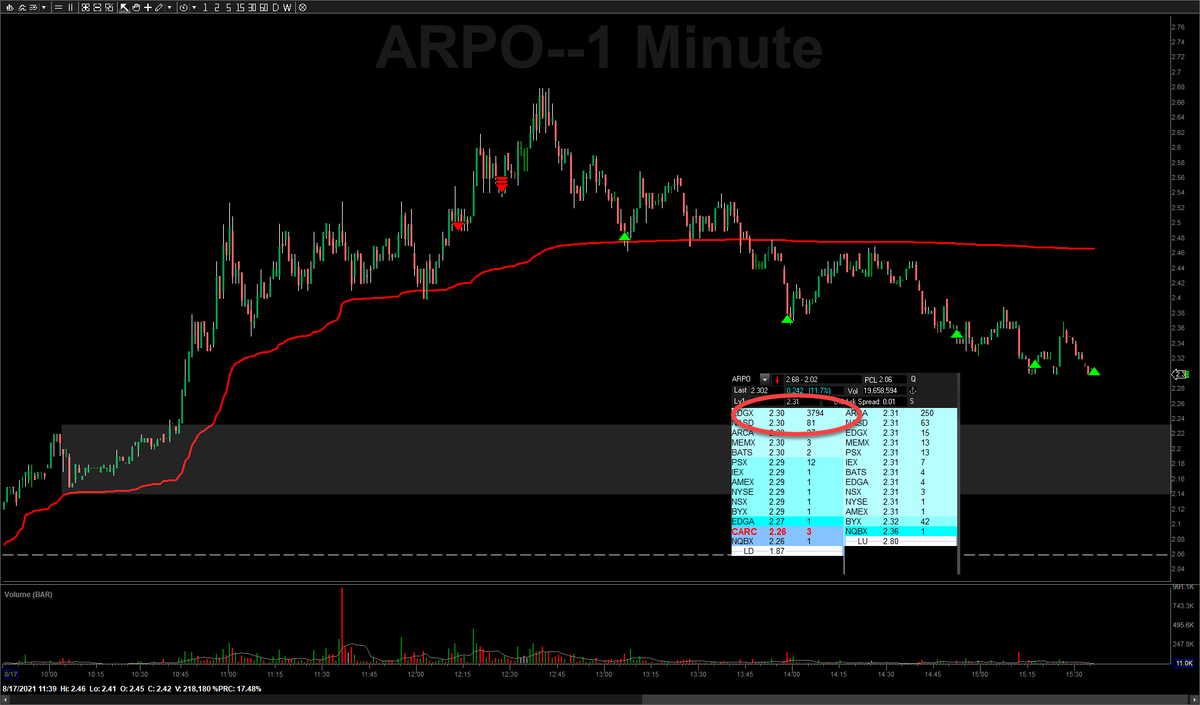

$ARPO trade plan (still open full position), built short knowing high-volume VWAP was above. Downside targets are noted and reasoning/thoughts behind the trade

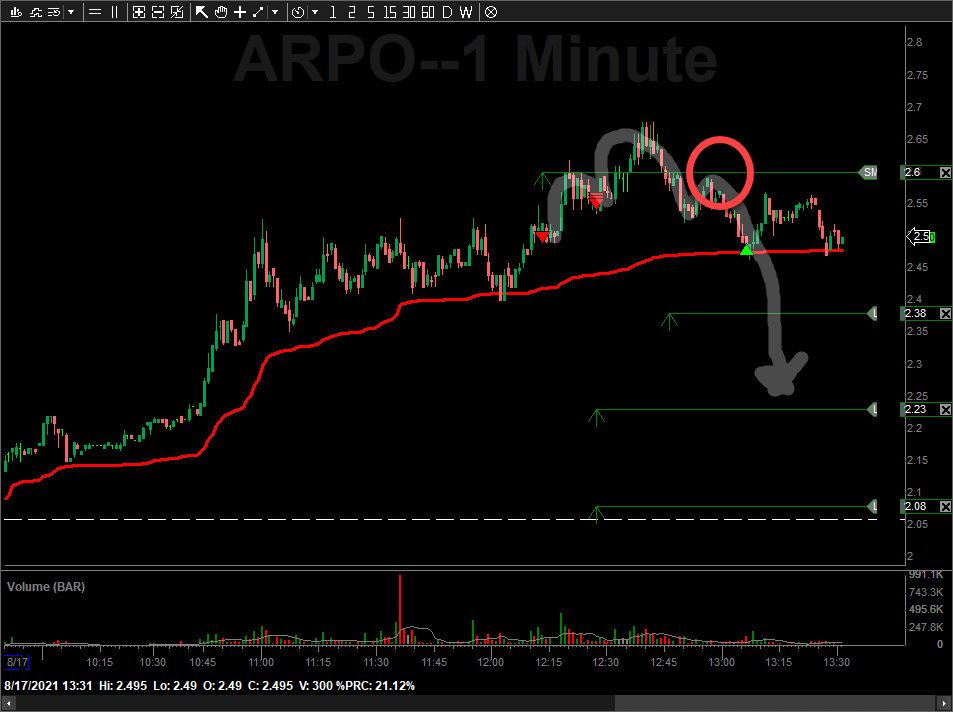

Minimizing risk by tightening stop over H/S pattern. Don't want this to base at VWAP and push to 2.75+

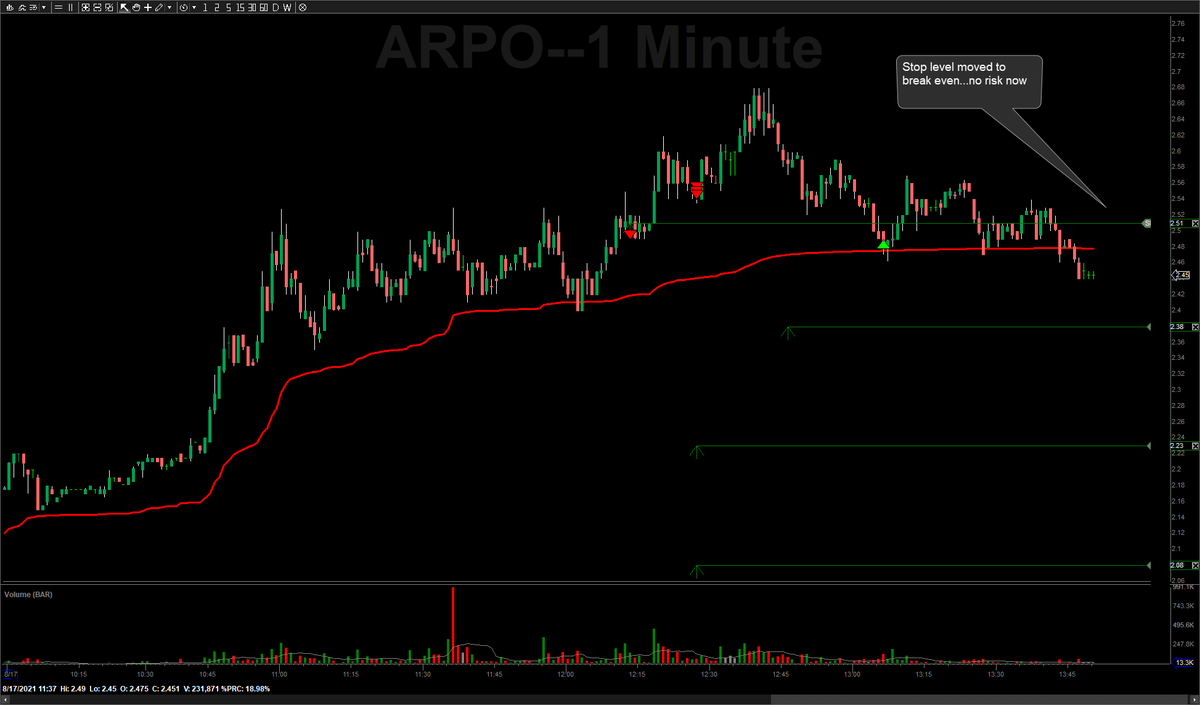

Stops on remaining shares moved to break-even so all risk is now removed. Either rotates down to my lower targets for NICE green, or retraces to my stop and I paid for commissions.

UPDATE: More planned covers but only light shares, but still holding MAJOR portion targeting 2.20s as main level to cover

Flat ARPO for ALMOST full rotation. I saw this big block sitting at 2.30 and it wasn't chipping away, so covered all (session almost over). Sometimes fighting for that last nickle of profit isn't worth the dime of mental capital. Healthy green overall on the trade

• • •

Missing some Tweet in this thread? You can try to

force a refresh