Asian tobacco:

5.3 trillion cigarettes are sold each year to 1 billion smokers. Would be unwise to exclude the industry from your universe just because of ESG / unpopularity.

5.3 trillion cigarettes are sold each year to 1 billion smokers. Would be unwise to exclude the industry from your universe just because of ESG / unpopularity.

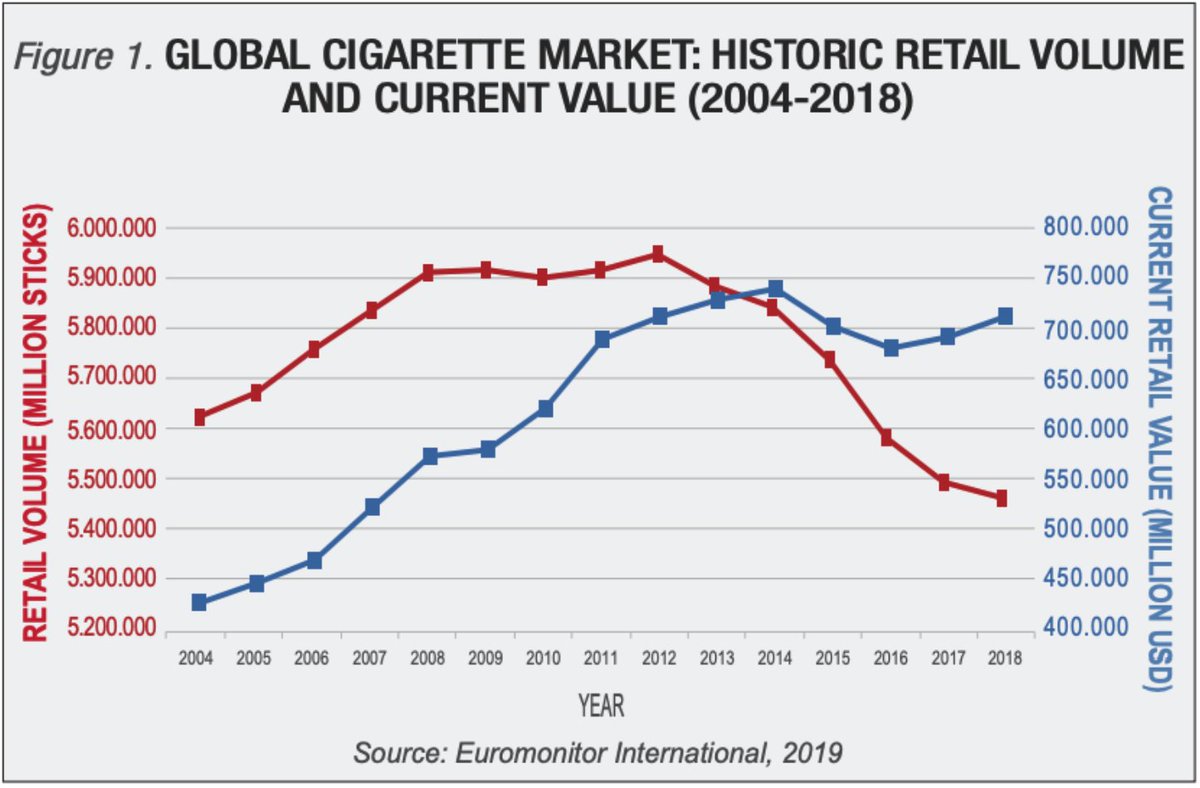

While volumes have dropped globally, retail value has stayed flat. It would have increased was it not for the stronger dollar since 2014.

Vaping is to a large extent banned across Asia. Heated tobacco products rule, but only in South Korea / Japan where consumers can afford them. NGPs have no impact on Asian EM tobacco markets.

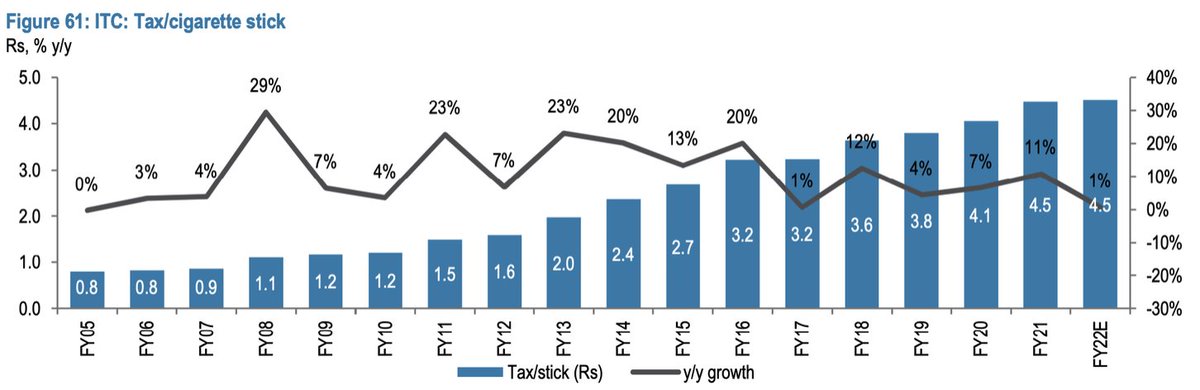

In Asian EMs on the other hand, what matters is tax policy. It's been a headwind in Malaysia, and to some extent also India and Sri Lanka.

Having the combo of a supportive tax policy, low risk of competition from NGP, low consumption per capita and rising incomes helps catapult earnings growth forward.

It also helps if the multiple is low. But almost the entire industry trades at low teens P/E if not lower.

It also helps if the multiple is low. But almost the entire industry trades at low teens P/E if not lower.

I just wrote a post on the Asian tobacco industry on my Substack. Free trial link here:

asiancenturystocks.com/51f131ab

asiancenturystocks.com/51f131ab

• • •

Missing some Tweet in this thread? You can try to

force a refresh