My first thread on $ALBT for new comers.

EASY TO UNDERSTAND FOR EVERYONE

To have a basic understanding of $ALBT one has to have a basic understanding of capital markets because that is what $ALBT hopes to achieve in their vision.

EASY TO UNDERSTAND FOR EVERYONE

To have a basic understanding of $ALBT one has to have a basic understanding of capital markets because that is what $ALBT hopes to achieve in their vision.

“AllianceBlock is building the world’s first globally compliant decentralized capital market.”

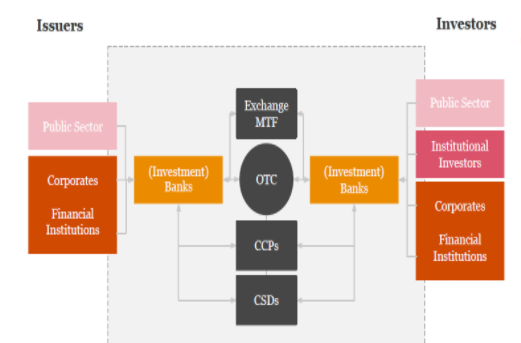

1)This is what a capital market looks like.

On the left we have ISSUERS who are part of the PRIMARY MARKET

On the right we have INVESTORS who are part of the SECONDARY MARKET.

1)This is what a capital market looks like.

On the left we have ISSUERS who are part of the PRIMARY MARKET

On the right we have INVESTORS who are part of the SECONDARY MARKET.

In the middle we have FINANCIAL INTERMEDIARIES who are the MIDDLE-MEN of the capital markets.

To understand capital markets and a deeper understanding for what ALLIANCE BLOCK are going to create you need to understand what each part of the capital market does.

To understand capital markets and a deeper understanding for what ALLIANCE BLOCK are going to create you need to understand what each part of the capital market does.

2)The role of the primary market is to

-Structure an IPO (like in crypto an ICO)

-Debt issuances

Debt Issuance: “The financial obligation that allows the ISSUER to raise funds by promising to repay the LENDER at a certain point in time.

-Structure an IPO (like in crypto an ICO)

-Debt issuances

Debt Issuance: “The financial obligation that allows the ISSUER to raise funds by promising to repay the LENDER at a certain point in time.

ISSUERS are comprised of

-Public sector entities = central , state, local governments

-Banks

-Corporations

So one example of debt issuance is GOVERNMENT BONDS or a company releasing an IPO:

The government or business NEED money NOW.

-Public sector entities = central , state, local governments

-Banks

-Corporations

So one example of debt issuance is GOVERNMENT BONDS or a company releasing an IPO:

The government or business NEED money NOW.

So they need to gather funds from all the LENDERS in the SECONDARY MARKET.

LENDERS are comprised of

-Institutional investors (Warren Buffets Berkshire Hathaway)

-Corporates (Amazon, Apple, Tesla)

-Financial institutions (Banks)

-Public Sector (Government)

LENDERS are comprised of

-Institutional investors (Warren Buffets Berkshire Hathaway)

-Corporates (Amazon, Apple, Tesla)

-Financial institutions (Banks)

-Public Sector (Government)

Secondary Market is where the IPO’s and DEBT ISSUANCES are TRADED where they are created in the primary market.

The secondary market is your

-New York Stock Exchange (Cryptos Binance)

-London Stock Exchange

The secondary market is your

-New York Stock Exchange (Cryptos Binance)

-London Stock Exchange

Going from ISSUERS TO LENDERS is not so simple which is why there are so many INTERMEDIARIES.

Intermediaries consist of

-Investment Banks

-Stock Exchanges (New York, London, Asia)

-Multilateral Trading Facilities

-Organized Trading Facilities

-CCP’s + CSD’s

-Auditors/Law

Intermediaries consist of

-Investment Banks

-Stock Exchanges (New York, London, Asia)

-Multilateral Trading Facilities

-Organized Trading Facilities

-CCP’s + CSD’s

-Auditors/Law

Think of when people used to have to go to the bank to buy paper stocks with a guy on a box yelling at them what to buy 100 years ago.

That is why the CAPITAL MARKET was created to create a more efficient way for

Government, banks and businesses to receive funding.

That is why the CAPITAL MARKET was created to create a more efficient way for

Government, banks and businesses to receive funding.

How would you buy a stock if the New York Stock Exchange didn’t exist. If there was no platform for you to buy the stocks like your bank, robinhood. How would you buy Bitcoin or XRP if there was no Binance or Kucoin?

Remember when we are buying CRYPTO’s for the most part we are investing in a COMPANY. You are a LENDER and the TOKEN is ISSUED by the company.

THEREFORE, IT IS IMPERATIVE FOR CAPITAL MARKETS TO BE ABLE TO PROVIDE FINANCING (MONEY).

How did Tesla at inception raise money for its cars. The CAPITAL MARKET.

What if there was NO CAPITAL MARKET.

How did Tesla at inception raise money for its cars. The CAPITAL MARKET.

What if there was NO CAPITAL MARKET.

CAPITAL MARKETS ARE CRITICAL FOR

1)ECONOMIC GROWTH

2)TECHNOLOGICAL INNOVATION

WHICH ultimately improves everyone’s lives. With out capital markets there would be no electric car, phones, air conditioning, fast computers, amazon, facebook, Instagram.

1)ECONOMIC GROWTH

2)TECHNOLOGICAL INNOVATION

WHICH ultimately improves everyone’s lives. With out capital markets there would be no electric car, phones, air conditioning, fast computers, amazon, facebook, Instagram.

Hint: Soon you’ll see how ALLIANCE BLOCK comes into play

But before that lets see some of the problems/pain points of the current system

But before that lets see some of the problems/pain points of the current system

Pain Points for Crypto:

1)Right now, crypto is not heavily regulated. In one way of thinking government will only “allow” cryptocurrency to exist if they are able to monitor the LENDERS AND BORROWERS within the capital market.

1)Right now, crypto is not heavily regulated. In one way of thinking government will only “allow” cryptocurrency to exist if they are able to monitor the LENDERS AND BORROWERS within the capital market.

2)Investment banks, government, institutions, corporates (LENDERS) want to be able to ENTER the market of crypto. But because of unregulated market there are tons of hurdles to overcome. Are they just supposed to register for a coinbase or binance account like you do?

3)How does traditional finance enter the crypto market and remain regulated?

Paint Points for current Capital Market:

1)Basically, all the INTERMEDIARIES (services in between issuers and lenders) eat a lot of fee’s because they need to continue to provide the service

Paint Points for current Capital Market:

1)Basically, all the INTERMEDIARIES (services in between issuers and lenders) eat a lot of fee’s because they need to continue to provide the service

2)Regular investors cannot invest in blue-chip projects because that’s reserved only for the institutions, bank and “wealthy” investors (IPO’s in the primary market)

Pain Points for regular investors / the regular person:

Pain Points for regular investors / the regular person:

1)Did you also know technically by having your money inside a bank you are a LENDER?

Banks are able to therefore lend all the people’s pooled money as a lender for let’s say 5%+ to businesses and governments that need capital for markets.

Banks are able to therefore lend all the people’s pooled money as a lender for let’s say 5%+ to businesses and governments that need capital for markets.

You “lending” to the bank you get like half of 1% or not even!

ENTER ALLIANCE BLOCK:

To really summarize what Alliance Block will do … they will become the decentralized central market by

“collapsing the multiple layers of traditional investment banking”

To really summarize what Alliance Block will do … they will become the decentralized central market by

“collapsing the multiple layers of traditional investment banking”

What have you learned a capital market consists of?

1)ISSUERS (companies and governments that need money)

2)LENDERS (people that lend money for shares of company or interest)

3)INTERMEDIARIES (services that connect issuers and lenders)

1)ISSUERS (companies and governments that need money)

2)LENDERS (people that lend money for shares of company or interest)

3)INTERMEDIARIES (services that connect issuers and lenders)

So in order for Alliance Block to become a decentralized central market they have to be able to

1)Offer services that intermediaries do

2)Connect lenders and intermediaries

3)Provide financing and liquidity (money)

1)Offer services that intermediaries do

2)Connect lenders and intermediaries

3)Provide financing and liquidity (money)

THIS WILL BE DONE BY:

They will streamline (remove the unnecessary parts of) (REMOVE ALL THE MIDDLE-MEN THAT EAT UP FEE’s AND EXPENSIVE COSTS)

They will streamline (remove the unnecessary parts of) (REMOVE ALL THE MIDDLE-MEN THAT EAT UP FEE’s AND EXPENSIVE COSTS)

1)Issuance (receiving money)

2)Validation (example: people trying to pitch to investors on shark tank)

-Connect lenders and borrowers very easily

3)Governance (encouraging companies to be economically friendly)

2)Validation (example: people trying to pitch to investors on shark tank)

-Connect lenders and borrowers very easily

3)Governance (encouraging companies to be economically friendly)

So …

ALBT WILL BECOME THE ‘ECOSYSTEM’ for Decentralized Finance and Traditional Finance to interact

“The decentralisation of financial services refers to the elimination – or reduction in the role – of one or more intermediaries or centralized processes that have ...

ALBT WILL BECOME THE ‘ECOSYSTEM’ for Decentralized Finance and Traditional Finance to interact

“The decentralisation of financial services refers to the elimination – or reduction in the role – of one or more intermediaries or centralized processes that have ...

have traditionally been involved in the provision of financial services.”

Where …

1)Anyone can be a lender

2)Any company can receive funding

3)Companies/banks can invest in a REGULATED and GOVERNED ecosystem (the decentralized ecosystem of ALBT)

1)Anyone can be a lender

2)Any company can receive funding

3)Companies/banks can invest in a REGULATED and GOVERNED ecosystem (the decentralized ecosystem of ALBT)

ALBT will be:

The ecosystem that allows for

1)Regulatory Assurance (Government)

2)Surveillance (Government)

3)Providing Data (Intermediary)

4)Creation of Tokens (Primary Market)

5)Providing Money (Lender)

6)Issuance (Raising capital / Borrower)

The ecosystem that allows for

1)Regulatory Assurance (Government)

2)Surveillance (Government)

3)Providing Data (Intermediary)

4)Creation of Tokens (Primary Market)

5)Providing Money (Lender)

6)Issuance (Raising capital / Borrower)

I will not dive too deep into the main components of Alliance Block because the main reason for this thread was for anyone to have a deeper grasp of capital markets and the real role Alliance Block wishes to provide for not just crypto for but for even the smallest investors ...

who needs more money or someone that wants to start up a business as their own dream.

Alliance Block will become everything needed in a capital market.

Alliance Block will become everything needed in a capital market.

For further information on HOW Alliance Block will do these things like the:

-Data Tunnel

-Liquidity Mining

-Alliance Bridge

-Defi Investment Terminal

-Trustless KYC/AML and Identity Verification

-Cross Border Regulatory Compliance Rule Engine

-Compliant P2P and NFT

-Data Tunnel

-Liquidity Mining

-Alliance Bridge

-Defi Investment Terminal

-Trustless KYC/AML and Identity Verification

-Cross Border Regulatory Compliance Rule Engine

-Compliant P2P and NFT

-Pricing Engine

Go to their website:

allianceblock.io/#

Read their green paper:

allianceblock.io/AllianceBlock_…

Go to their website:

allianceblock.io/#

Read their green paper:

allianceblock.io/AllianceBlock_…

Shout-out to these guys for red-pilling me on ALBT:

@albtmaxi

@phantom4ir

@Dcrypto25

@wizai777

@fibonaccious

@qntmami

@albtmaxi

@phantom4ir

@Dcrypto25

@wizai777

@fibonaccious

@qntmami

This is my first thread, so thanks for reading if you did. It might be all over the place.

$ALBT

#NoMercy

$ALBT

#NoMercy

• • •

Missing some Tweet in this thread? You can try to

force a refresh