1/ a quick thread on NFTs and why JPEGs are worth spending some time and energy understanding

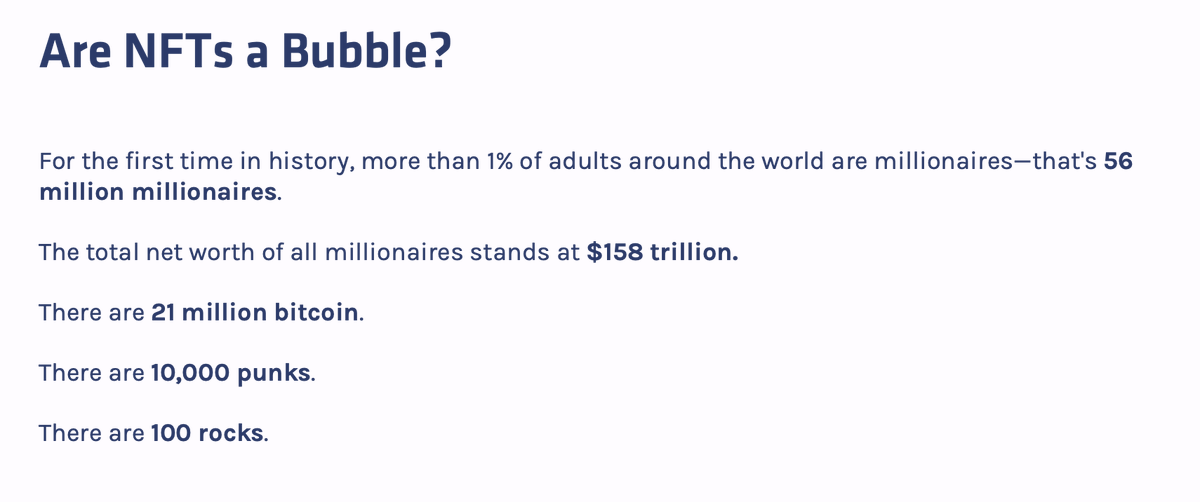

are NFTs a bubble?

no.

wealth is a bubble. 1% of the global adult population are now millionaires.

are NFTs a bubble?

no.

wealth is a bubble. 1% of the global adult population are now millionaires.

2/ the global market for luxury goods i.e. conspicuous spending is absolutely massive

NFTs are digital flex / status symbol for a new class of consumers, but unlike the traditional markets of wealth and status, they are open to anyone, anywhere with verifiable scarcity

NFTs are digital flex / status symbol for a new class of consumers, but unlike the traditional markets of wealth and status, they are open to anyone, anywhere with verifiable scarcity

3/ for those who says spending millions on JPEGs is dumb and we should be solving world hunger, please give the folks on the trad art collector list a call first

people are spending $200M on blobs of paint. how is spending $2M on blobs of pixels any less noble?

people are spending $200M on blobs of paint. how is spending $2M on blobs of pixels any less noble?

4/ as noted by @Rewkang, look at the relative market caps of these companies

the addressable market for artificially scarce status symbols is in the trillions

the addressable market for verifiably scarce digital status symbols is likely just as big, if not bigger

the addressable market for artificially scarce status symbols is in the trillions

the addressable market for verifiably scarce digital status symbols is likely just as big, if not bigger

5/ and unlike bags, watches, and shoes, digital status symbols can be fractionalized, enjoy shared ownership, and used as collateral in on-chain financial markets

@MessariCrypto highlighted the massive financialization opportunities for NFTs

@MessariCrypto highlighted the massive financialization opportunities for NFTs

6/ so there are three options

1: do nothing 🙃

2: embrace NFTs, dive in, and attempt to learn and understand; and

3: mock NFTs as a bubble and nothing more than elaborate money laundering, just as you mocked bitcoin 5 years ago

i choose 2

1: do nothing 🙃

2: embrace NFTs, dive in, and attempt to learn and understand; and

3: mock NFTs as a bubble and nothing more than elaborate money laundering, just as you mocked bitcoin 5 years ago

i choose 2

• • •

Missing some Tweet in this thread? You can try to

force a refresh