Asian Granito (AGL) scrambling to ensure the upcoming Rs 225 Cr rights issue doesn't run into headwinds. Promoters recently sold 12% of AGL to invest into a related party, and promoters will now invest back into AGL via rights issue! What's up 👇 (1/7)

Promoters justify 12% stake sale in AGL for investment into a related entity Adicon Ceramica LLP, where they state they have no holding. Weak argument, because business is intertwined and a designated partner of the LLP is a director in all material subsidiaries of AGL. (2/7)

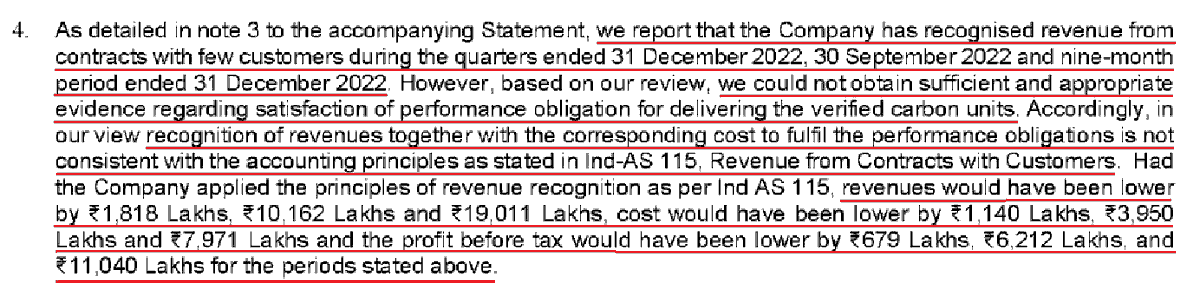

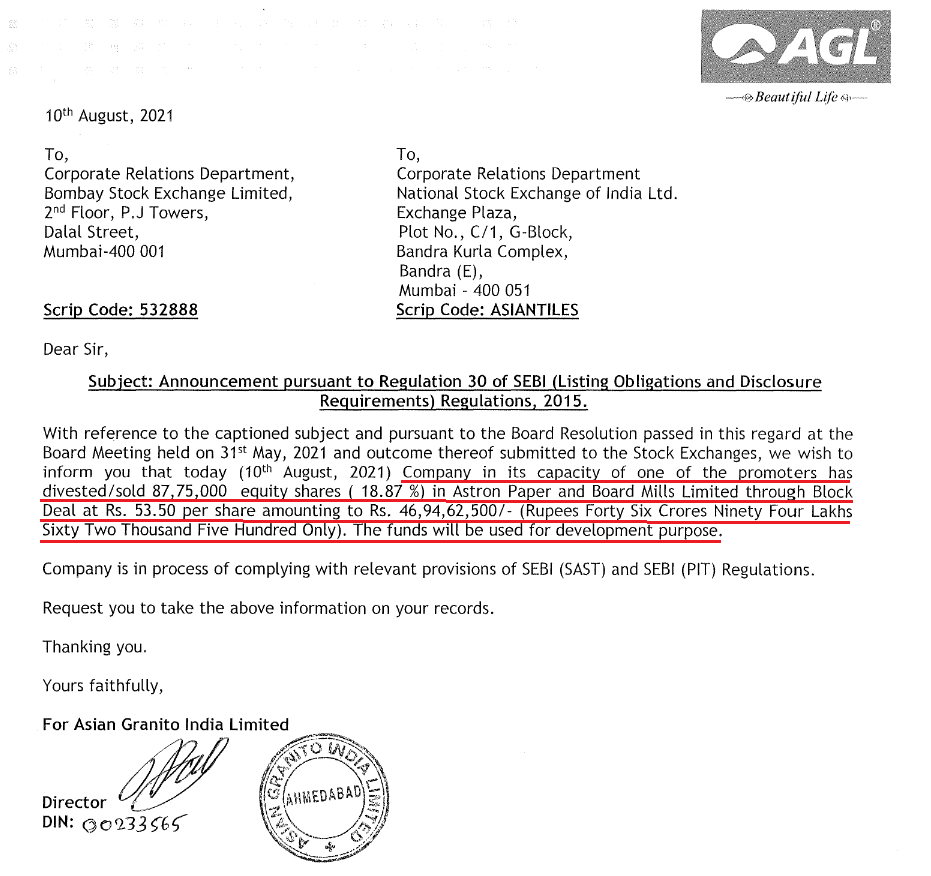

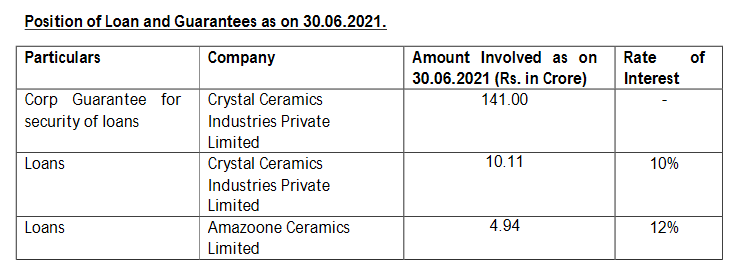

AGL recently sold 18% holding in an associated listed company Astron Paper & Board, for 47 Cr. Now, promoters in this clarification state the rights funds will be used to primarily clear debt of Crystal Ceramics (CCL). But CCL isn't heavily indebted, debt is only Rs 140 Cr. (3/7)

AGL holds only 70% of Crystal Ceramics, rest 30% probably held by promoters or other third parties. If Crystal Ceramics did right issue and AGL put Rs 47 Cr sale proceeds into the rights issue, promoters would put in Rs 19 Cr for total Rs 66 Cr, addressing 50% of the debt. (4/7)

AGL with 74% public holding funds CCL to the extent of 100%, but promoters/third parties keep 30% of CCL for free without putting in a penny more. By the way, director of Adicon Ceramica LLP is also a director in CCL - they might be part of the 30% minority in CCL. (5/7)

By the way, spare a thought for minority shareholders of Astron Paper and Board - imagine waking up to find promoter sold 18% of the company. None of the last 3 Annual Reports of AGL talk about disposing Astron stake. Its valuation is also at historic low. (6/7)

Capital-raising events like these should be looked into very thoroughly, this could be another example of fund-raise for growth/debt reduction that wouldn't be needed if not for the leakages. (7/7)

• • •

Missing some Tweet in this thread? You can try to

force a refresh