I asked, “What are the first metrics that you look at when evaluating a new stock?”

I received 322 replies

Here are 10 great metrics to look at first (and how to find them):

I received 322 replies

Here are 10 great metrics to look at first (and how to find them):

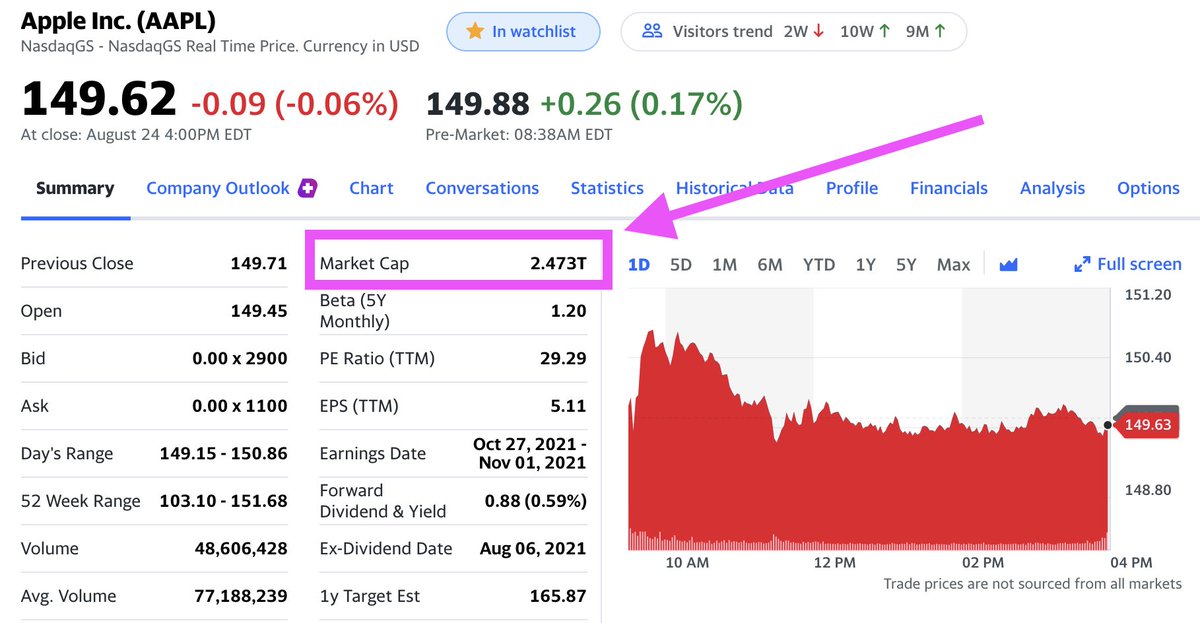

1/ Market Capitalization

Why: Shows the current size/scale of the business

Where: @YahooFinance (image), @theTIKR , @KoyfinCharts ...etc

Why: Shows the current size/scale of the business

Where: @YahooFinance (image), @theTIKR , @KoyfinCharts ...etc

2/ Sales Growth Rate

Why: Shows the business model works & current growth rate

Where: @stockcardhq (image), SEC filings, @theTIKR...etc

Why: Shows the business model works & current growth rate

Where: @stockcardhq (image), SEC filings, @theTIKR...etc

3/ Free Cash Flow

Why: Is business generating cash or burning cash?

Where: @YahooFinance (image), SEC Filings, @stockrow1...etc

Why: Is business generating cash or burning cash?

Where: @YahooFinance (image), SEC Filings, @stockrow1...etc

4/ Returns on capital (ROE, ROIC, ROA)

Why: Shows capital efficiency of business

Where: @stockrow1 (image) , @ycharts , @YahooFinance...etc

Why: Shows capital efficiency of business

Where: @stockrow1 (image) , @ycharts , @YahooFinance...etc

5/ Margins

Why: Shows current profit profile of products, spending rates, & potential for operating leverage

Where: @ycharts (image), @theTIKR, @stockrow1...etc

Why: Shows current profit profile of products, spending rates, & potential for operating leverage

Where: @ycharts (image), @theTIKR, @stockrow1...etc

6/ Total Addressable Market

Why: Shows market size & long-term growth potential of business

Where: Investor presentation (images from $FVRR), 10k, @Gartner_inc

Why: Shows market size & long-term growth potential of business

Where: Investor presentation (images from $FVRR), 10k, @Gartner_inc

7/ Long-term (5-year+) Stock Performance vs. market

Why: Has the stock created or destroyed value so far?

Where: @ycharts (image), @YahooFinance, @stockrow1....etc

Why: Has the stock created or destroyed value so far?

Where: @ycharts (image), @YahooFinance, @stockrow1....etc

8/ Current Valuation (Price to sales / Price to earnings)

Why: How expensive is the stock?

Where: @YahooFinance (image), @stockcardhq, @KoyfinCharts...etc

Why: How expensive is the stock?

Where: @YahooFinance (image), @stockcardhq, @KoyfinCharts...etc

9/ Mission Statement

Why: Why does this company exist??? What is it trying to do?

Where: Investor Relations Page ( $SHOP image), 10K, Glassdoor, company presentation

Why: Why does this company exist??? What is it trying to do?

Where: Investor Relations Page ( $SHOP image), 10K, Glassdoor, company presentation

10/ Inside Ownership

Why: Do insiders have skin in the game?

Where: SEC Filings (Proxy statement -- form DEF 14A -- search “ownership” -- image shows @elonmusk ownership of $TSLA )

Why: Do insiders have skin in the game?

Where: SEC Filings (Proxy statement -- form DEF 14A -- search “ownership” -- image shows @elonmusk ownership of $TSLA )

I received a TON of great replies to this thread

but this one by @OphirGottlieb stood out:

but this one by @OphirGottlieb stood out:

https://twitter.com/OphirGottlieb/status/1417964415417131009?s=20

Want to learn more about how to find & use these metrics?

@brian_stoffel_ and I teach people how to invest on my YouTube Channel

Subscribe here: youtube.com/brianferoldiyt…

@brian_stoffel_ and I teach people how to invest on my YouTube Channel

Subscribe here: youtube.com/brianferoldiyt…

You can read all of the answers to the thread here:

https://twitter.com/BrianFeroldi/status/1417951861215268868?s=20

Summary:

1: Market Cap

2: Sales Growth

3: FCF

4: Returns on Capital

5: Margins

6: TAM

7: Stock Performance

8: Current Valuation

9: Mission Statement

10: Inside Ownership

1: Market Cap

2: Sales Growth

3: FCF

4: Returns on Capital

5: Margins

6: TAM

7: Stock Performance

8: Current Valuation

9: Mission Statement

10: Inside Ownership

• • •

Missing some Tweet in this thread? You can try to

force a refresh