(0) Since our last report on Dec 17th, 2020, the Web3 narrative had moved far beyond single-chain #DeFi to prompt another iteration – this time on where we are re: Web3, #DeFi, token gov & fundamentals, & new primitives.

EN: docsend.com/view/9x4a3reuv…

CN: docsend.com/view/np5dhyyc9…

EN: docsend.com/view/9x4a3reuv…

CN: docsend.com/view/np5dhyyc9…

(0.5) Quick side-note, you may notice the new primitive section being a bit barren – that’s because a single person can no longer cover the space by him/herself (aka me aka ngmi :/). Folius needs help and is hiring (more on this later), but plz do reach out if you are interested!

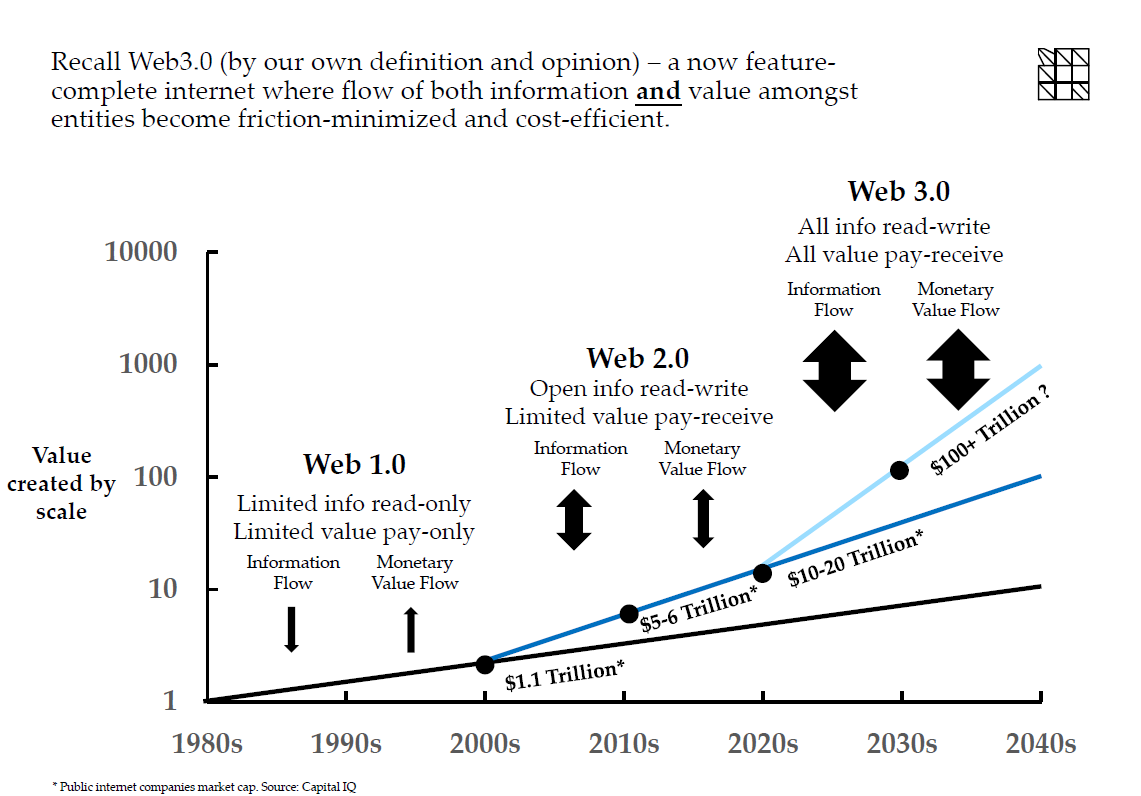

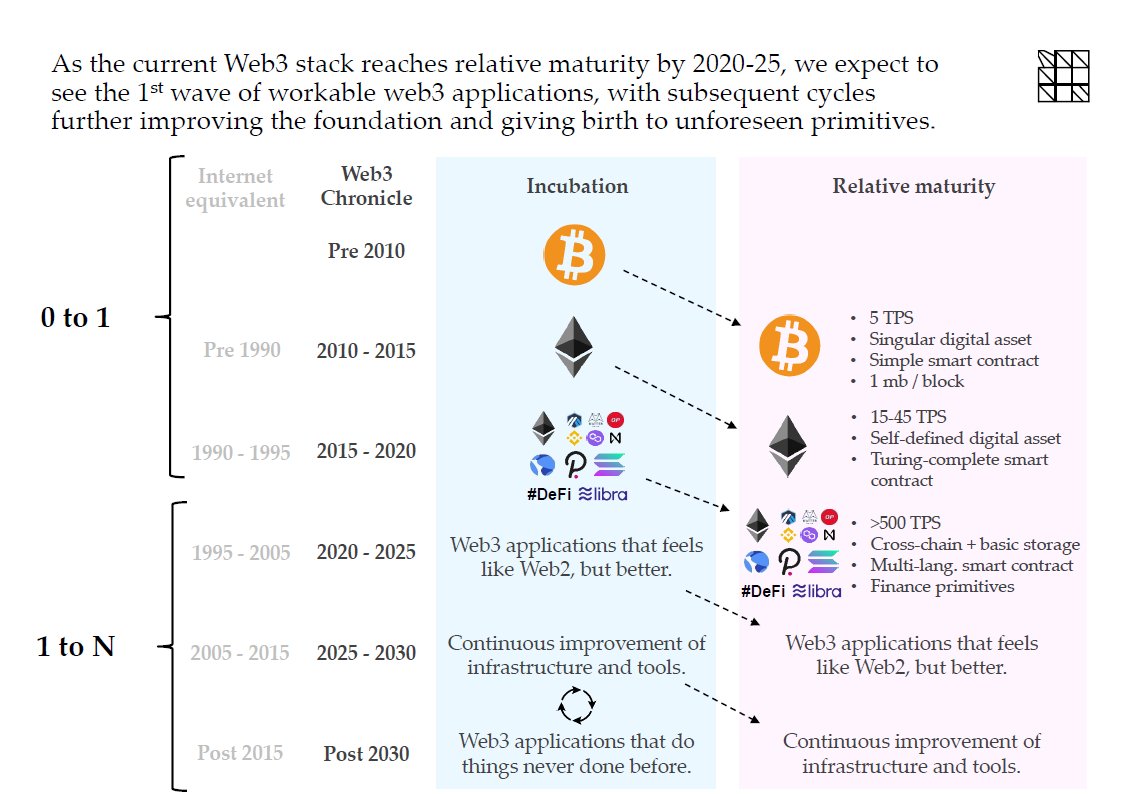

(1) A feature-complete Web3 to us is a friction-and-cost-minimized info & value transfer network, and while BTC is closer to early-adopter status, the broader Web3 with ~5-10 mm MAU is more like the internet in the mid-1990s.

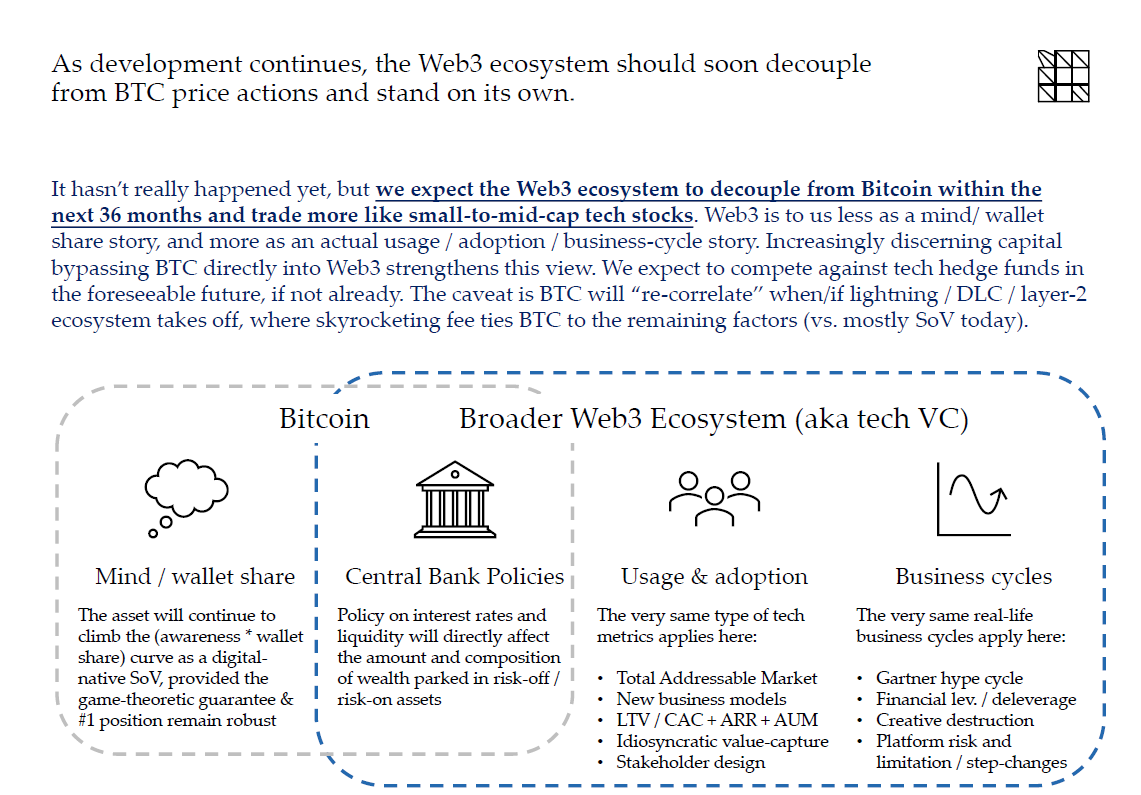

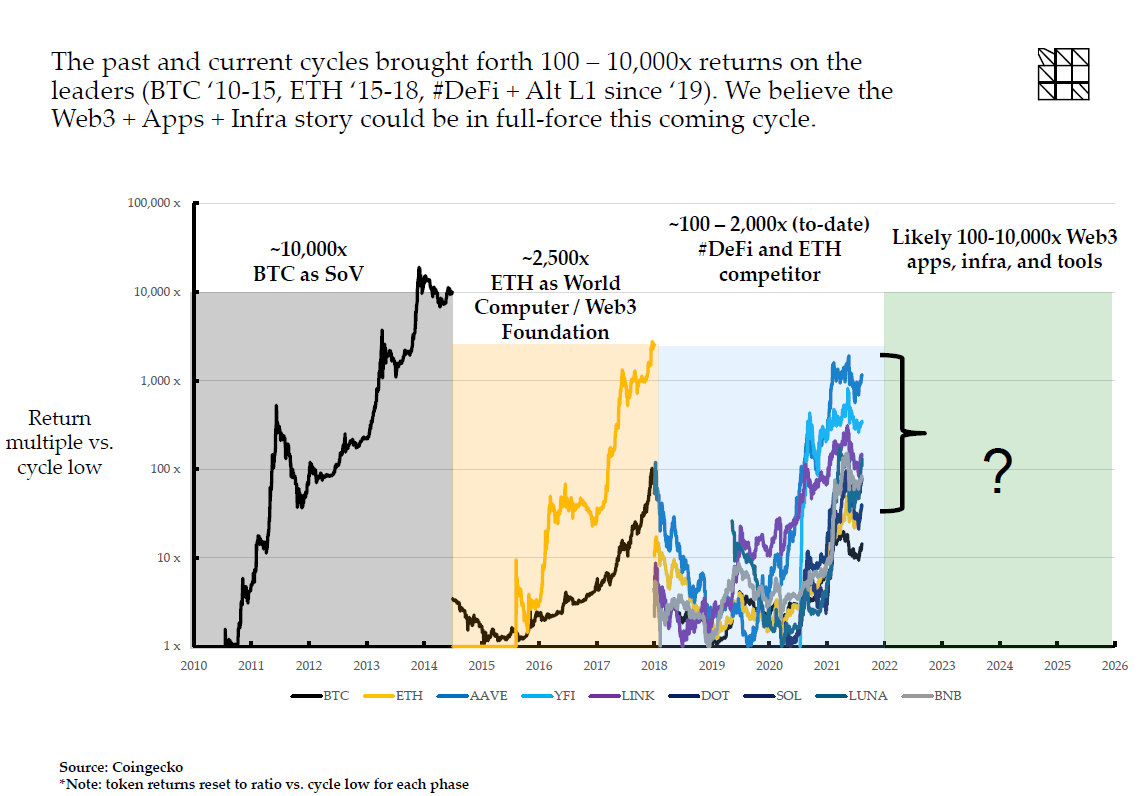

(2) As Web3 evolves, its drivers, narratives, and price correlation will all decouple from BTC. The 0-to-1 moment likely already occurred – and we are entering the 1-to-N phase where infrastructure & applications recursively improve one another.

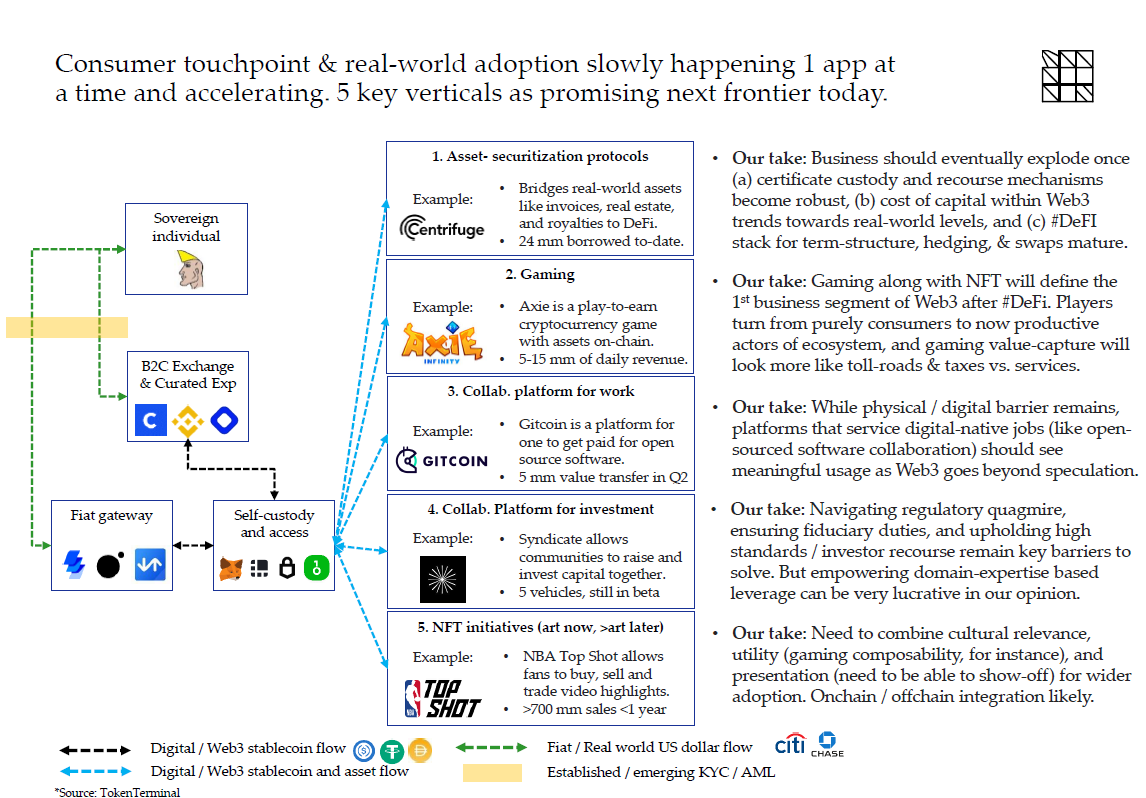

(3) Since late 2020, the Web3 ecosystem saw explosive DeFi primitives, better infra / data / tools, and finally real attempts at business applications beyond just speculation – in particular around asset securitization, gaming, collab. platforms, and NFTs.

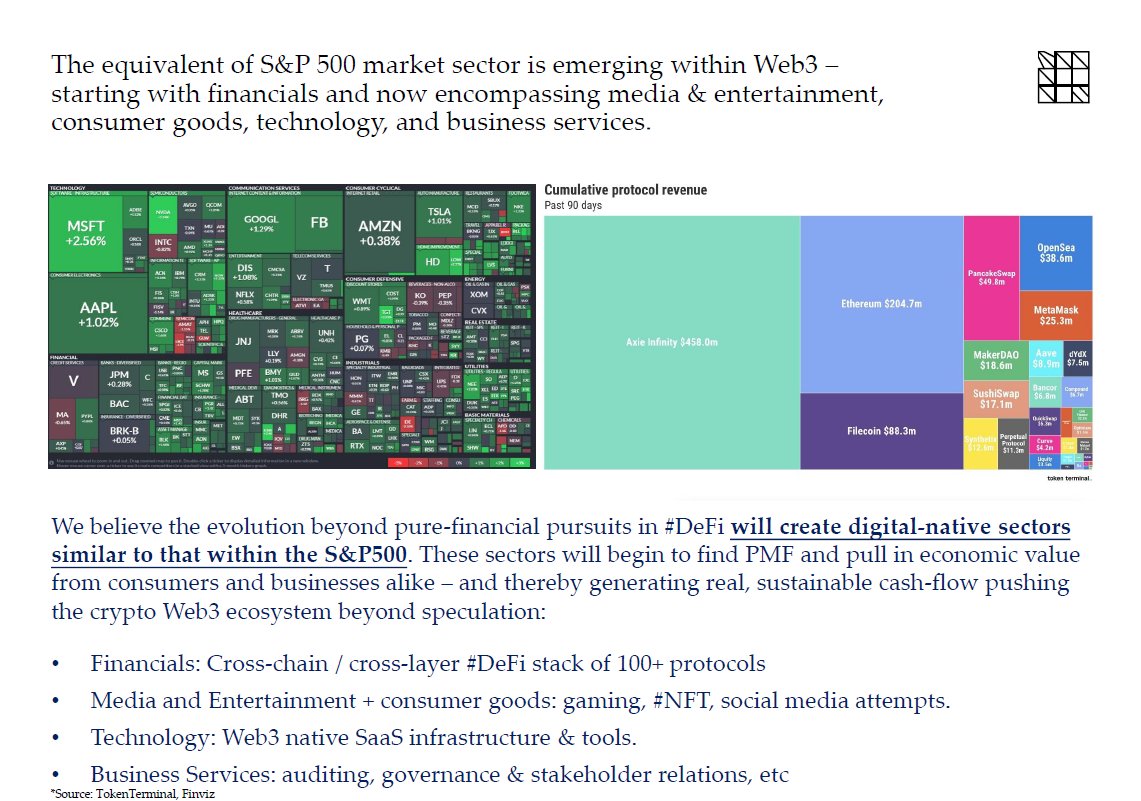

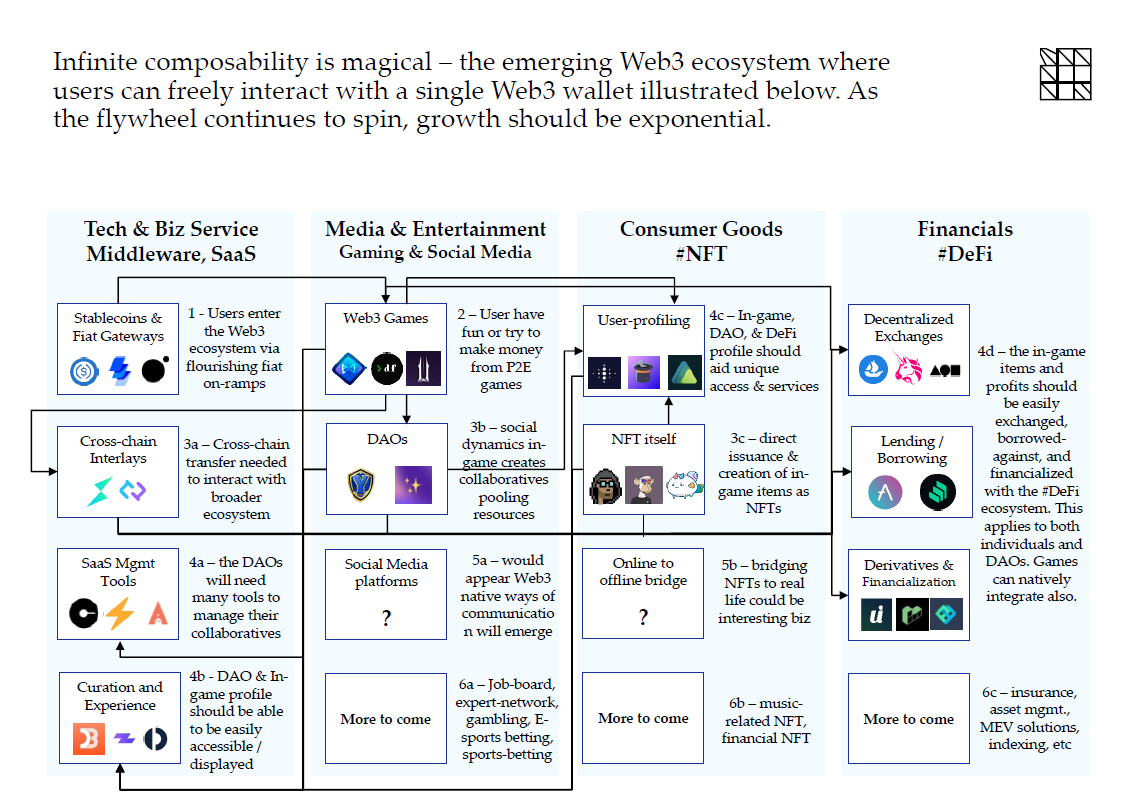

(4) … in other words, industry sectors begin to form beyond just the #DeFi financial sector. I expect the Web3 ecosystem to eventually mirror that of the S&P500, where countless protocols and users interact with infinite composability. Growth should be exponential.

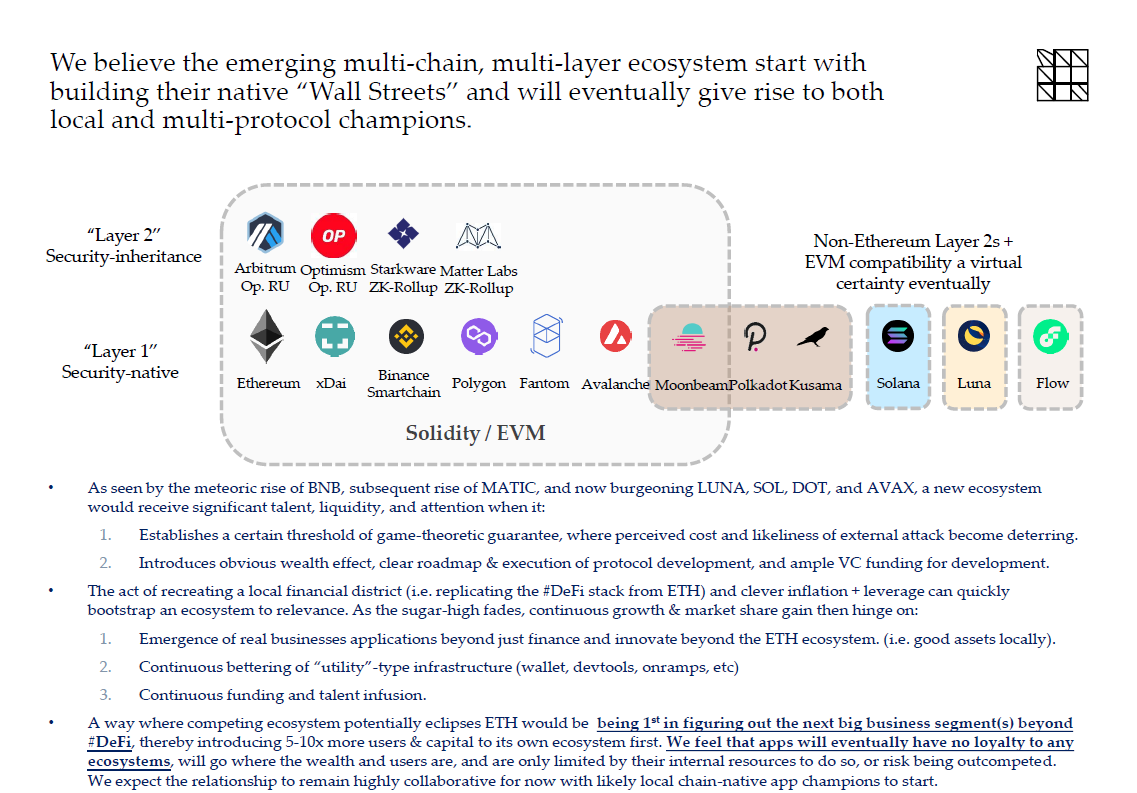

(5) It also seems clear to me that a multi-chain, multi-layer (MLMC) world is upon us. A playbook is emerging to bootstrap an ecosystem via subsidized #DeFi forks, but for a new chain to really win, it’d have to onboard real biz that’s not on ETH.

(6) On lending, we think the solid incremental features would be imminent across protocols, but the broader feature sets would require real economic activities atop to take hold. Undercollateralized and non-standard asset lending may remain niche for now.

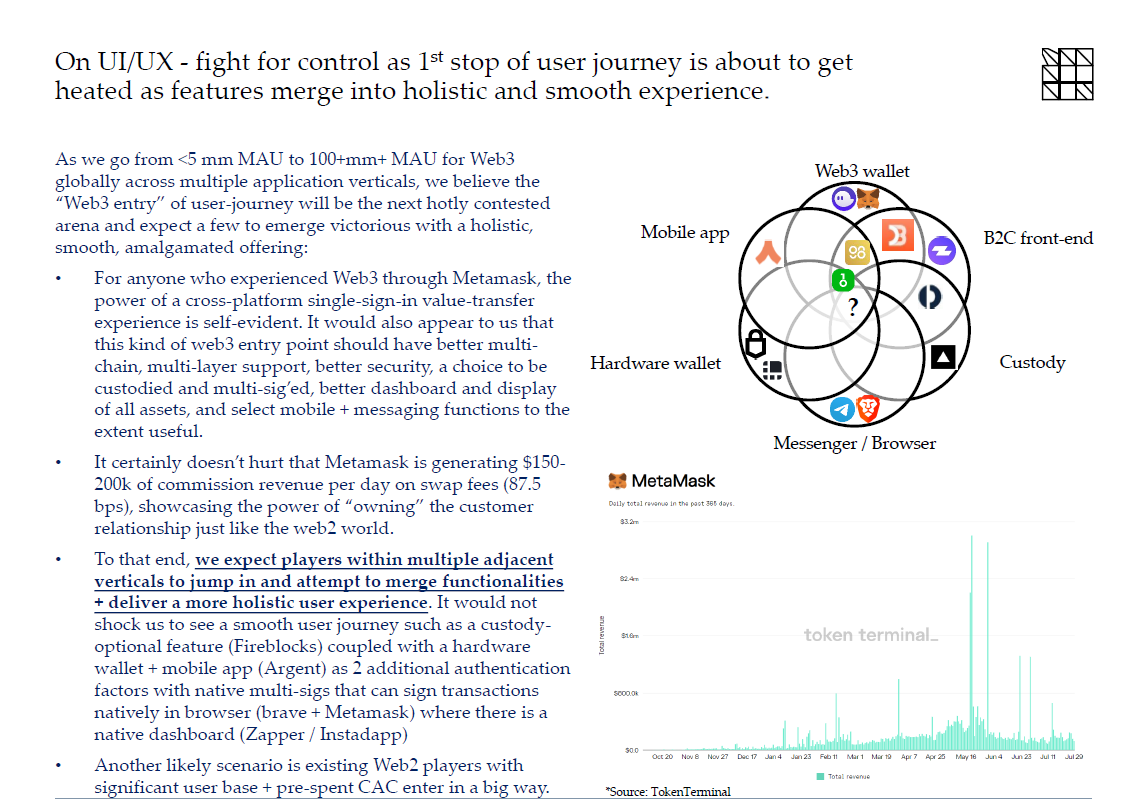

(7) On UI/UX, we feel that the 6 key verticals that face the users everyday could merge into a more holistic and smooth experience. Metamask’s 75 mm+ revenue proves that owning the user is still an amazing way to monetize and it’s their game to lose.

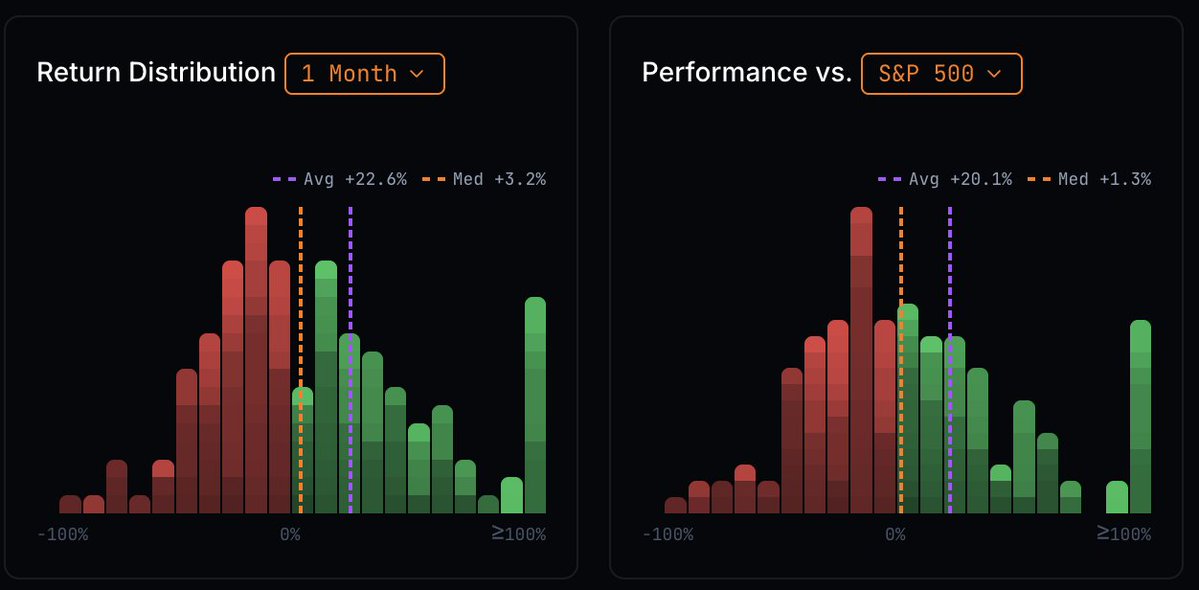

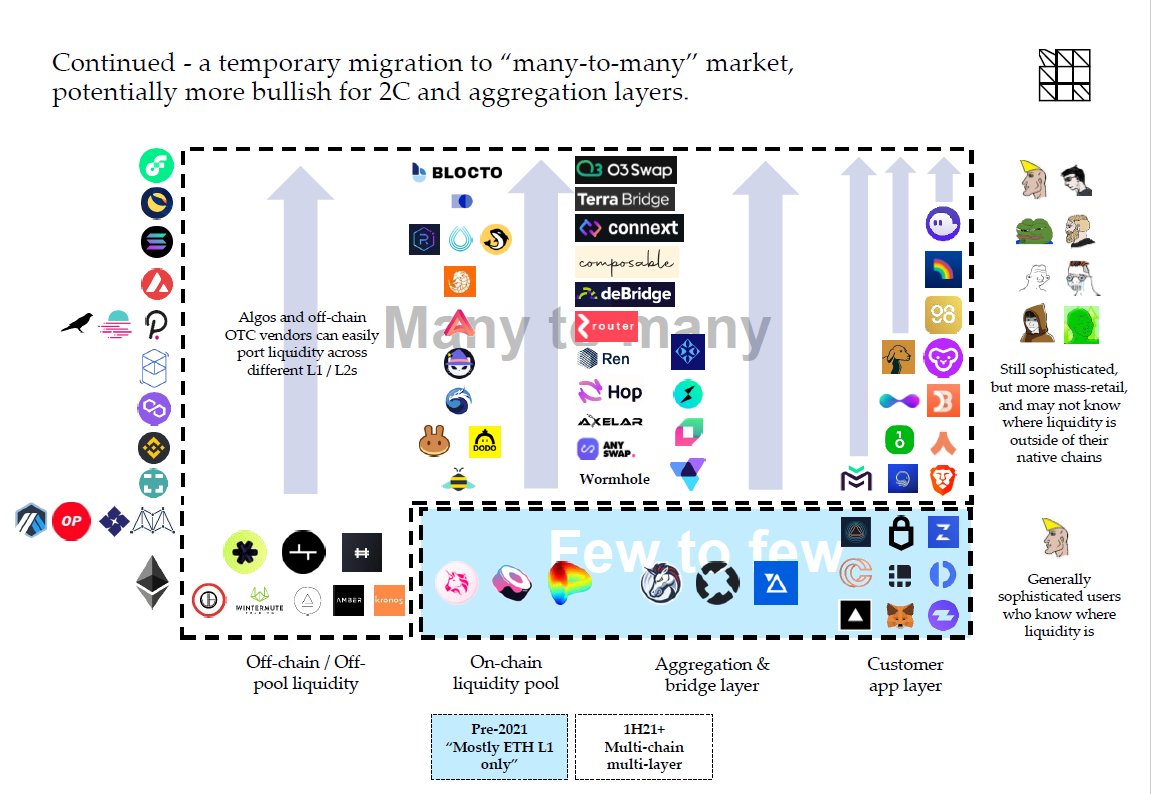

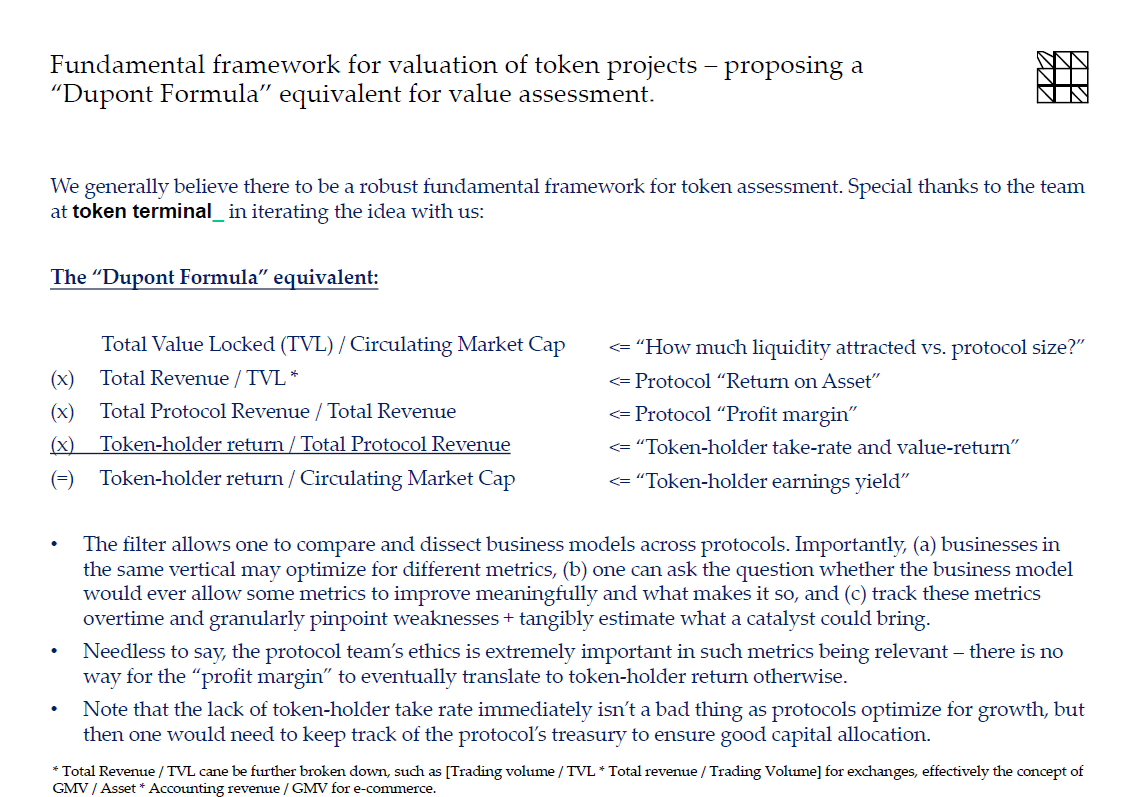

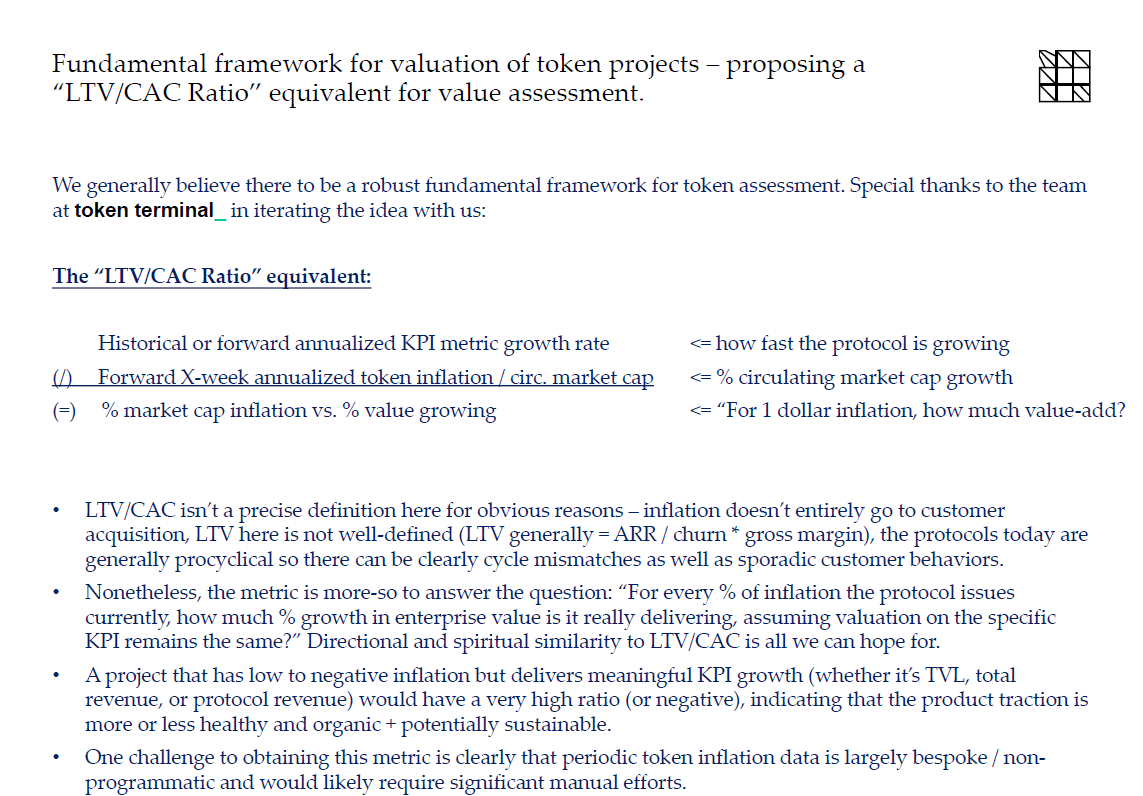

(8) On DEX & aggregators, the MLMC future along with liquidity moving to off-pool / RFQ and the 2C app becoming more segregated as # of users explode is quite conducive to a temporary “many-to-many” market structure which helps 2C apps and aggregators.

(9) On derivatives, we generally buy into the 6–24-month secular growth story. Although a clear winner hasn’t emerged yet. We think cross-margining + pioneering solid new products (like @DavidWhite ‘s everlasting option) is how this space really eclipses its CEX counterparts.

(10) We generally like the attempts on insurance towards more curated, more B2B, and more automatic direction; we also feel that the 2C layer may be able to shoulder the insurance cost, while audit / insurance seems synergistic as a holistic SaaS offering.

(11) Here’s a short list of things that intrigue us in #DeFi today…if you are buidling them feel free to get in touch. In particular, we eagerly await elegant solutions that specifically tackle long-tail assets beyond P2P Bazaar & xy=k models.

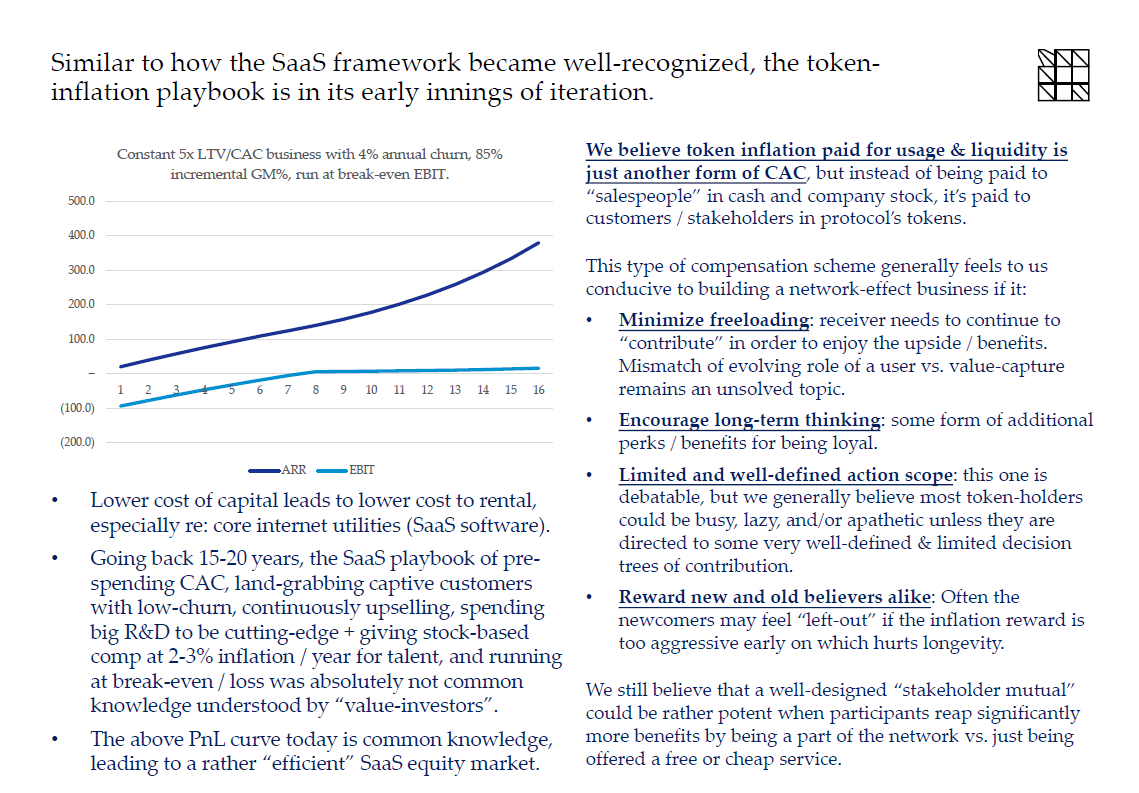

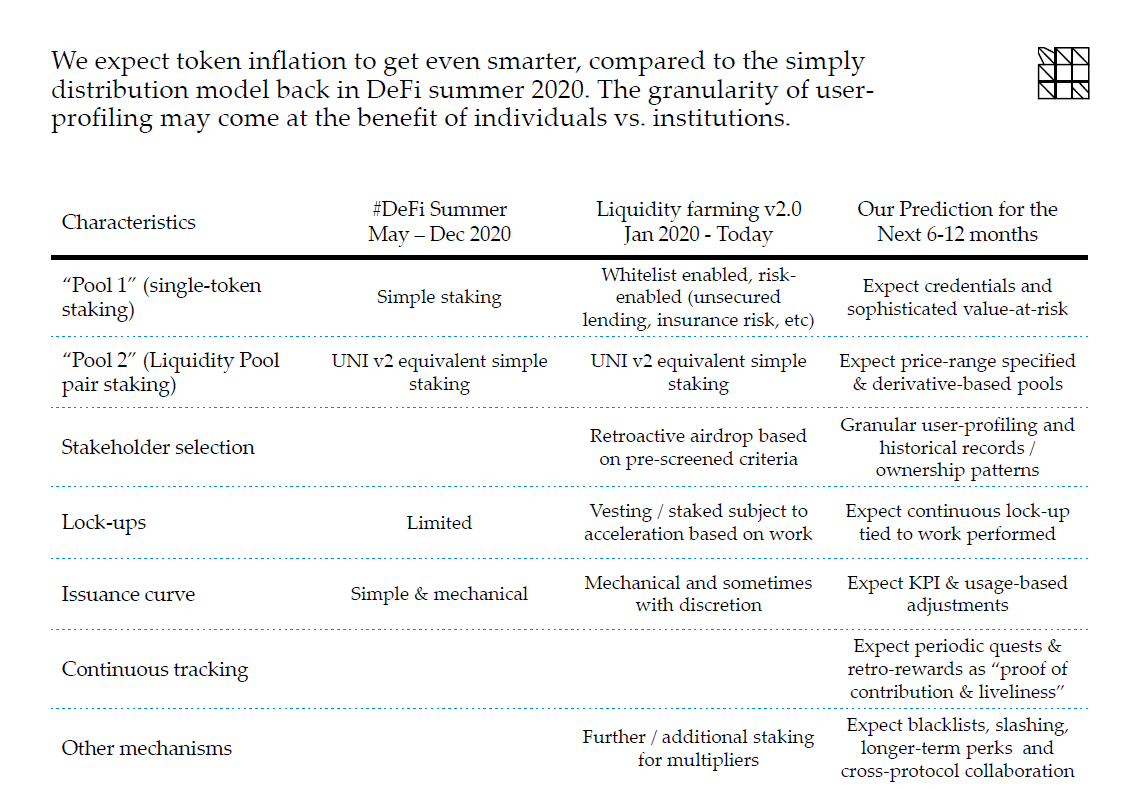

(12) Token-incentive-mechanism remains unsolved, with real challenges around balancing the evolving user-involvement vs. ownership & rent-extraction permanency. Nonetheless, it feels similar to us as an alternative SaaS playbook of growth-hacking+

(13) We generally feel the equivalent of Dupont formula and LTC/CAC should exist in crypto fundamentals analysis and took a crack at it. Projected key metric growth vs. circulating supply growth as a ratio may be one of the highest alpha signals.

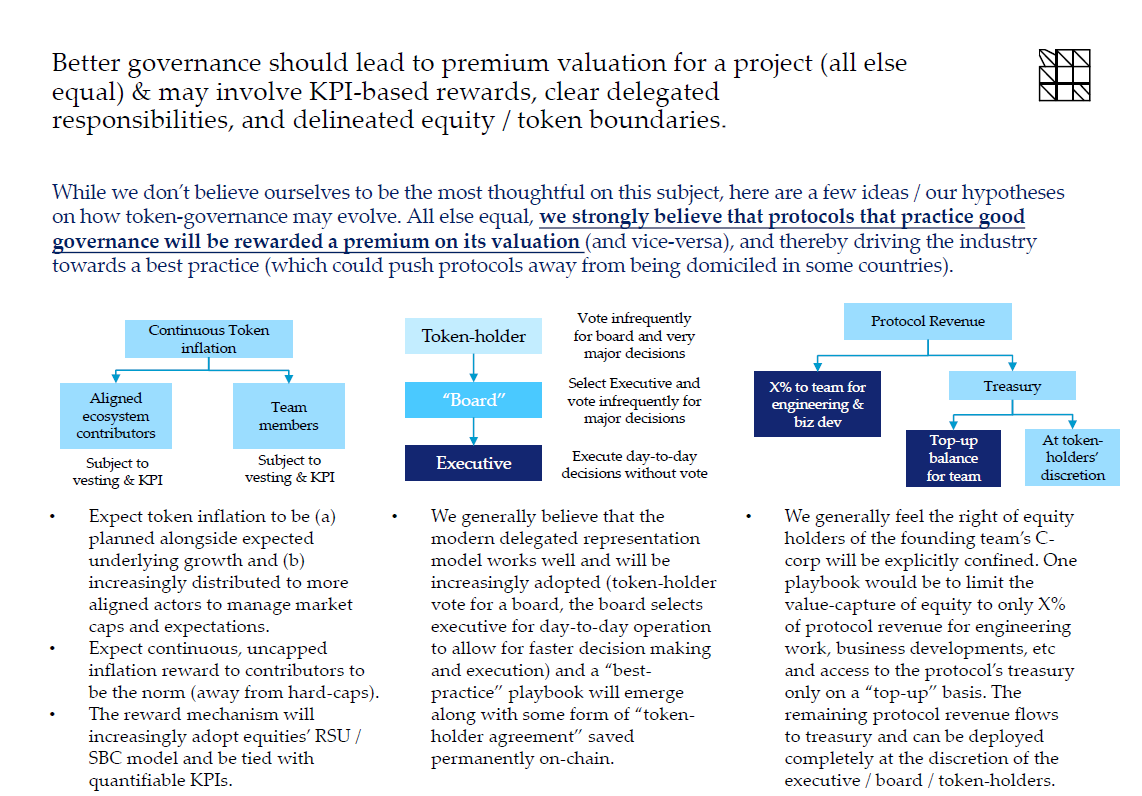

(14) …but token-econ don’t matter if founding team isn’t “ethical”. Tokens today are gentlemen’s agreements & optionality on protocol line-items. We are generally bullish on token-gov evolution (akin to equity corp-gov playbook). Tokens w/ good token-gov should deserve a premium

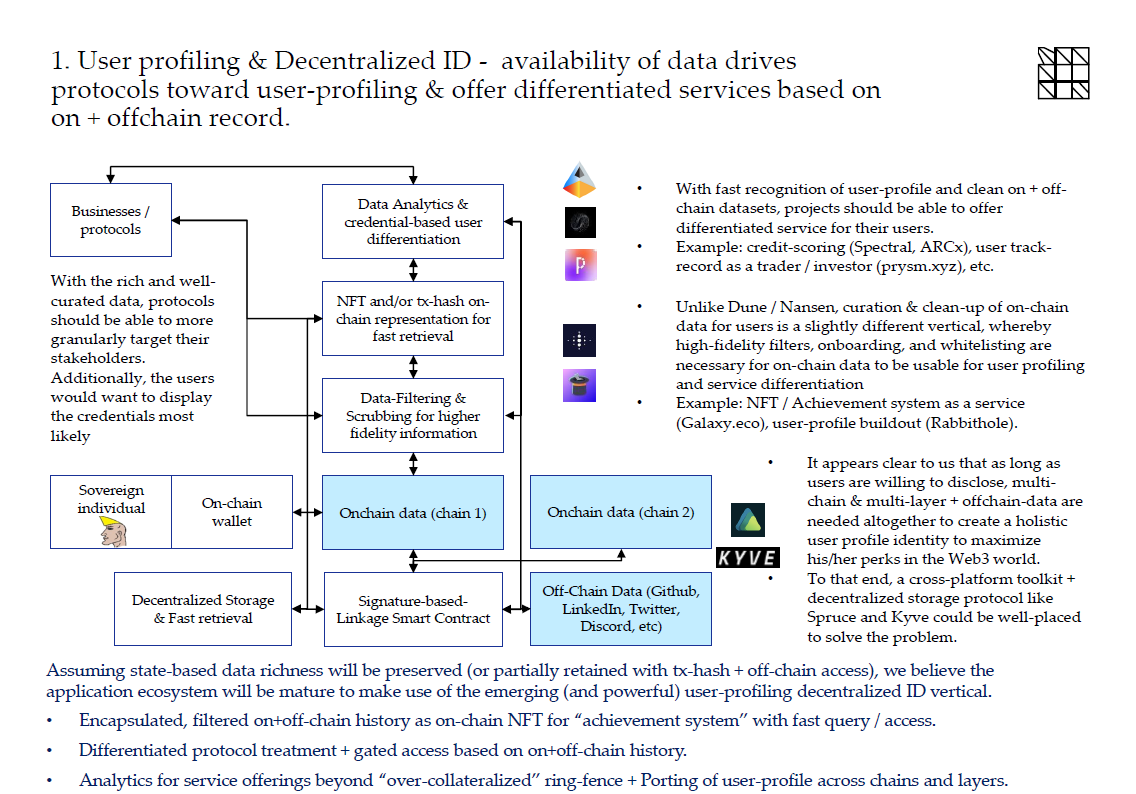

(15) Regarding new verticals. User-profiling is one – where richness of on+offchain data and ecosystem finally gives rise to a stack that empowers differentiated services to customers, whereby the positive effect should compound with NFT, gaming, and other new verticals.

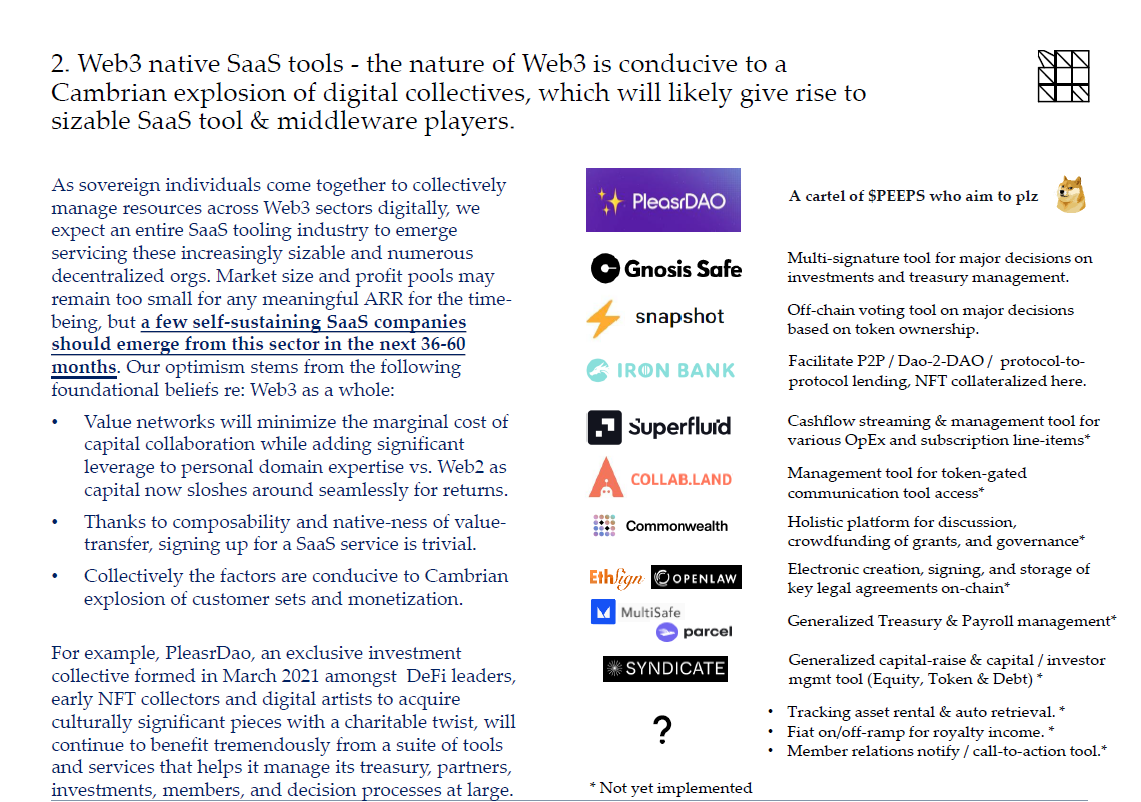

(16) A new SaaS tooling stack is forming along with the proliferation of protocol treasuries and individual collaboratives. The TAM & ARR opportunity is still a bit small today, but the PMF is pretty immediate and we eagerly look for key winners here.

(17) Via bestowing property rights & human rights (i.e. ability to extract ROI from game vs. pure subscription), gaming companies go from SaaS biz to gov-like toll-road models on in-game economy. Gaming is likely the 1st initiative to deliver real, sizable economic value to Web3.

(18) NFT as encapsulation of arbitrary, non-standardized data carries sizable scope beyond art and can bring paradigm shifts to Web3 similar to ICO-to-#DeFi. We think financialization, extrinsic rights assignment, and online-to-offline will all occur in this cycle.

(19) The scope for new vertical is rather expansive – we generally think display & SaaS tools would emerge alongside various tech & gaming verticals spanning job boards, expert networks, RTS games, gambling, music copyright financialization, etc.

(20) As usual, had I had more time & help, the text would make more sense & be shorter, and there'd be more charts, more data, and generally more actionable insights. Deep appreciation goes to all the buidlers and thinkers in the space that inspired.

• • •

Missing some Tweet in this thread? You can try to

force a refresh