🧐Time for a random exploratory wallet investigation.

Stream of consciousness - no idea where it takes us.

Background - was looking at top Coinbase Commerce merchants and came across this highly active merchant at the top:

Stream of consciousness - no idea where it takes us.

Background - was looking at top Coinbase Commerce merchants and came across this highly active merchant at the top:

That volume suggests it's not an individual, so I'm happy to explore it in public.

Hour-of-day activity indicates Asia-based:

Hour-of-day activity indicates Asia-based:

Below are the top USDC depositors into the wallet.

Most are CB Commerce wallets (when customers pay them). But there's also a >$10m migration (?) from another wallet. And $400k withdrawn from Binance.

Most are CB Commerce wallets (when customers pay them). But there's also a >$10m migration (?) from another wallet. And $400k withdrawn from Binance.

Now what about where the funds go?

Two main Binance deposit wallets, but also BlockFi, Huobi, Crypto .com, Coinbase, and more.

In total 169 destination addresses.

Two main Binance deposit wallets, but also BlockFi, Huobi, Crypto .com, Coinbase, and more.

In total 169 destination addresses.

But who is this merchant? What do they sell?

One idea is to look at the distribution of prices. That might give us a clue.

Below are the most commonly used prices for their payment transactions.

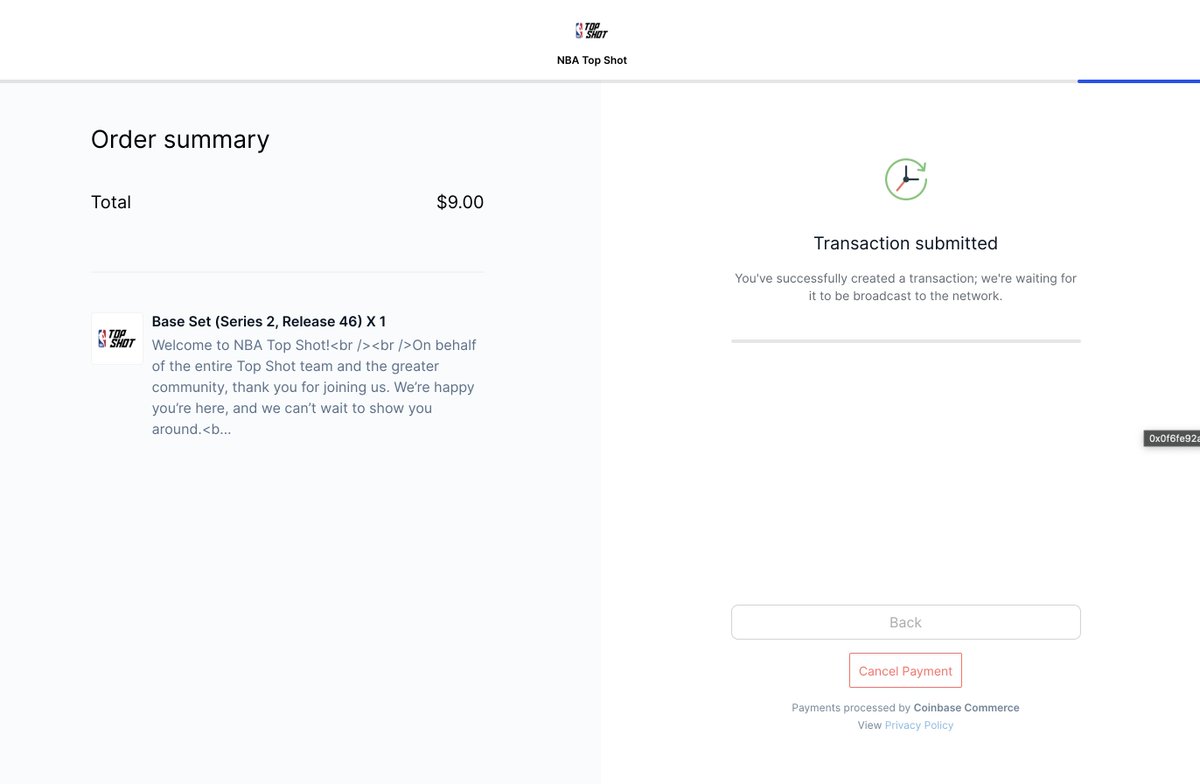

$9, $14, $100, $1,000, ... - does this ring a bell?

One idea is to look at the distribution of prices. That might give us a clue.

Below are the most commonly used prices for their payment transactions.

$9, $14, $100, $1,000, ... - does this ring a bell?

hang on! mainly Asia-based and NBA Topshots seemed off.

the Topshots one is actually wallet #2 (not #1) on the merchant list. so still a useful discovery despite my error - lucky!

the Topshots one is actually wallet #2 (not #1) on the merchant list. so still a useful discovery despite my error - lucky!

brb tagging NBA Top Shot deposit wallets to exchanges.

broadcast shall resume shortly.

broadcast shall resume shortly.

Looks like the NBA Top Shot team uses Kraken and Circle to off-ramp USDC. But will park that for now and go back to the #1 wallet.

The price distribution trick was quite useful.

Let's do that again - this time on the correct wallet.

It looks pretty weird tbh, with $475 as the most common price:

Let's do that again - this time on the correct wallet.

It looks pretty weird tbh, with $475 as the most common price:

BINGO.

Found a YouTube video where they describe how to order one of these miners.

I grabbed the receipt URL and confirmed the USDC goes to our target wallet. commerce.coinbase.com/receipts/WZ25R…

Found a YouTube video where they describe how to order one of these miners.

I grabbed the receipt URL and confirmed the USDC goes to our target wallet. commerce.coinbase.com/receipts/WZ25R…

• • •

Missing some Tweet in this thread? You can try to

force a refresh