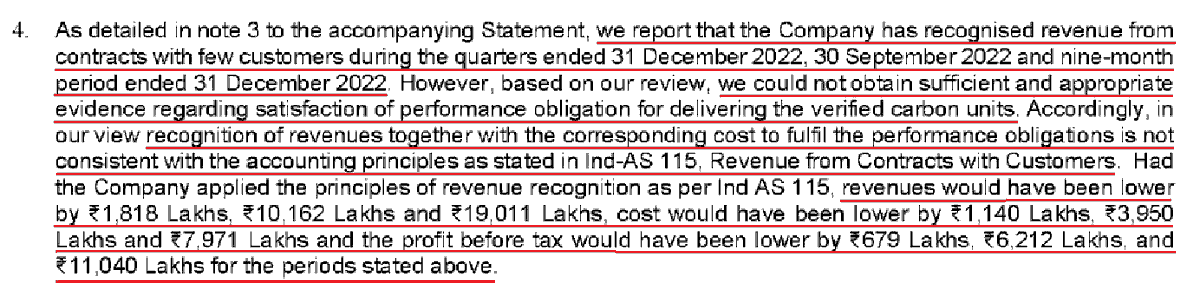

Noticed Shri Jagdamba Polymer Limited (SJPL) featuring recently, as a long term pick.

It's difficult to find a bigger potential conflict of interest from a minority investor's perspective.

Let's see👇 (1/11)

It's difficult to find a bigger potential conflict of interest from a minority investor's perspective.

Let's see👇 (1/11)

Fact: SJPL promoters have another unlisted entity Shakti Polyweave Pvt Ltd (SPPL) with exact same business. ALways a red flag, but lots of promoters have small side-busineses. Fortunately, public credit reports of SPPL have tons of useful information to understand further. (2/11)

SJPL was founded by RB in 1985, whereas Shakti Polyweave Private Limited (SPPL) founded in 1997 and identifies HA as the main promoter. While RB serves as director on both SJPL and SPPL, HA seems full-time in SPPL but does not seem to have any fixed role in SJPL. (3/11)

First, neither company has paid surveillance fees to CARE for FY20-21, which now gets an "ISSUER NOT COOPERATING" tag with any mention of the credit rating. Wonder why any promoter would let this happen, even if they're switching agencies. (4/11)

Second, its clear that SJPL and SPPL both have nearly identical businesses with same product lines. The business description in the credit reports for both identities are nearly identical, word for word. (5/11)

Third, capacity expansion has been undertaken in both SJPL and SPPL in FY20-21, but SPPL has expanded more on absolute basis and has substantially more capacity (+40%) than SJPL. Indicates promoters may be focusing on SPPL rather than SJPL in the long run. (6/11)

One interesting point - SJPL increased capacity from by 8500 MTPA (+71%) for Rs 46 Cr, which equates to Rs 54,000 per MTPA, whereas SPPL expanded 10,000 MTPA (45%) for Rs 68.55 Cr, equating to Rs 68,550 per MTPA. Better specifications, more expensive expansion at SPPL? (7/11)

Fourth, SPPL is much bigger than SJPL. It has 65% higher revenue, at Rs ~430 Cr (SPPL) vs Rs 260 Cr (SJPL), but lesser margin, clocking PAT of 44 Cr (SPPL) vs Rs 40 Cr (SJPL) on higher revenue base. Both companies showed ~50% increase in PAT in FY21 vs FY 20. (8/11)

Fifth, both companies are not dealing in complex products. Product line has many competitors, including listed, with low barrier to entry. The increased margin and financial ratios thus may not be permanent (those who have tracked the SJPL may know better on margin front). (9/11)

The above indicates promoter group is more focused on SSPL as the growth engine, as evidenced by 65% higher sales, higher absolute capex, higher capacities, and more expensive capex in related entity. Next generation (HA) is also focused on SPPL and not SJPL. (10/11)

At CMP of ~1300 and 1100 Cr market cap, valuation is 23x earnings and 3x sales for a business that may not be the main focus of the promoter. The potential conflict of interest here is unmitigable and merits deep regard for margin of safety. (11/11)

As always, this is not advise or a recommendation to invest, or not to invest. It is just an example of how to look at situations involving related entities in the same line as the listed entity. RT if useful.

• • •

Missing some Tweet in this thread? You can try to

force a refresh