Humour me, let's just imagine that QE does actually debase a currency then it surely would have effects something very much like this... (SPX vs Fed Balance Sheet).

Over the longer run, since QE started it would probably look something like this if the currency was being debased...

If money was being debased then Real Estate would also most likely follow the increase in the central bank balance sheet...

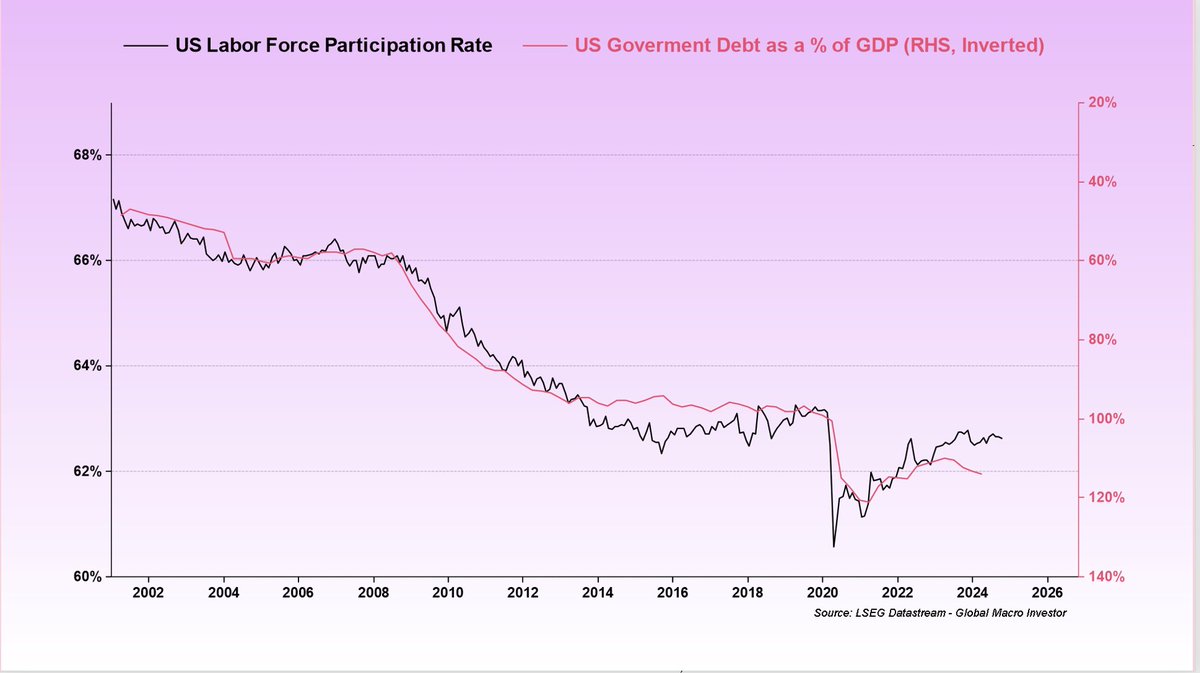

And normally, when currencies are debased (and the public doesn't yet realize it), wages tend to not rise and thus assets versus wages get really really expensive...(and CPI inflation can't rise).

Eventually, anyone who doesn't own scarce assets will realize that they have been totally fucked, If an asset is stored future wealth for consumption, they have gotten a LOT poorer through no fault of their own.

This process can happen slowly enough that people dont realize it

This process can happen slowly enough that people dont realize it

I have spend since 2008 pondering what QE means and I have gone from "It increases risk taking" to "its a passing pavlovian response by investors" to "Fuck, they really are debasing fiat currency globally to avoid a debt crisis".

It sounds kind of crazy. I get that.

It sounds kind of crazy. I get that.

It's hard, because to believe in debasement is to believe that the social contract has been torn up and its the governments vs the people in whoever goes bust.

It is just too far fetched but the evidence is simply overwhelming. I have written hundreds of pages in coming to this.

It is just too far fetched but the evidence is simply overwhelming. I have written hundreds of pages in coming to this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh