The Account Aggregator ecosystem is going live tomorrow!

Be sure to follow our Twitter Handle @Setu_API as we live-tweet the whole launch!

It’s going to be an exciting event and you don’t want to miss it.

In case you haven’t registered yet, sign up—airmeet.com/e/49da68f0-019….

Be sure to follow our Twitter Handle @Setu_API as we live-tweet the whole launch!

It’s going to be an exciting event and you don’t want to miss it.

In case you haven’t registered yet, sign up—airmeet.com/e/49da68f0-019….

One hour to go for the #AccountAggregator launch!

Watch this space to catch the action live on Twitter!

@sahamati @Product_nation

Watch this space to catch the action live on Twitter!

@sahamati @Product_nation

Today’s launch sets in motion a global-first architecture for consented data sharing!

Please note that the first session is the Keynote address by Sri M Rajeshwar Rao, @RBI Deputy Governor moderated by the host @kamyachandra, @Product_nation fellow.

#AccountAggregator

Please note that the first session is the Keynote address by Sri M Rajeshwar Rao, @RBI Deputy Governor moderated by the host @kamyachandra, @Product_nation fellow.

#AccountAggregator

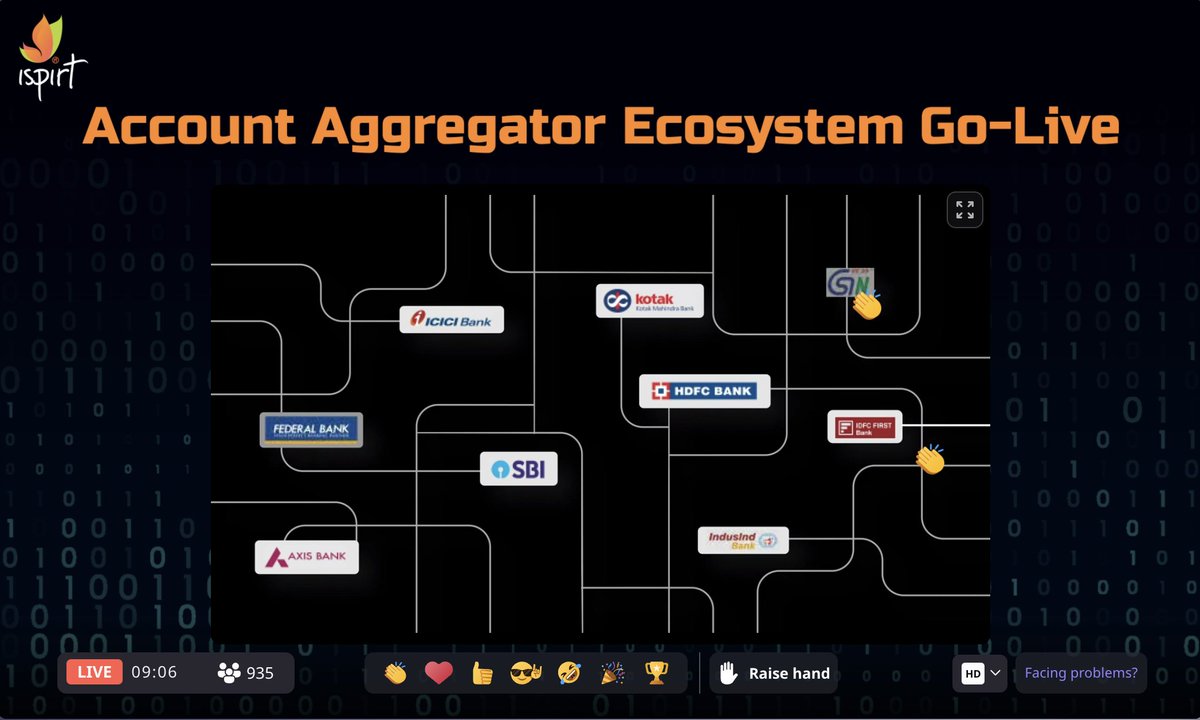

@kamyachandra, @Product_nation fellow kicks off the launch announcing that eight major banks will be adopting AA, making the ecosystem a reality.

#AccountAggregator #FreeyourData

#AccountAggregator #FreeyourData

Sri M Rajeshwar Rao, @RBI Deputy Governor said there will be a big shift in democratisation of data, with the shift of data control to the user and break down the fragmentation of data—to enable the surge in P2P lending, wealth management, smart contracts, AI/ML, robo-advisories.

He also said that AA can enable access to credit for underserved segments by removing information asymmetry including MSMEs, pivotal role in the economy, but face hurdles due to lack of credit and financial health—made worse by COVID-19.

He added that AAs require generic tech standards so that movement of data has smooth consent-driven flow.

ReBIT has come up with standards for AA so that movement of data has smooth consent-driven flow, with interoperability and integrity of data is maintained.

ReBIT has come up with standards for AA so that movement of data has smooth consent-driven flow, with interoperability and integrity of data is maintained.

The @RBI Deputy Governor also said that the account aggregators can thus bolster the lending ecosystem, which can make India, a data-rich country and also use the digital economy.

#AccountAggregator #FreeyourData

#AccountAggregator #FreeyourData

To conclude, @RBI supports innovation in the financial space, while ensuring we develop a robust system to support a vibrant, growing economy.

Next, we have @NandanNilekani with the agenda "The Account Aggregator Leapfrog is Here!".

Next, we have @NandanNilekani with the agenda "The Account Aggregator Leapfrog is Here!".

@NandanNilekani started off by stating that as we emerge from the pandemic, small businesses having access to credit is critical. They need to be able to leverage their data, which is a powerful instrument. This is called info collateral.

#AccountAggregator #FreeyourData

#AccountAggregator #FreeyourData

He continued on saying that common and unified data consenting architecture was a path-breaking decision, taken by our financial regulators. This led to the Account Aggregator framework.

#AccountAggregator

#AccountAggregator

AAs are consent managers, which is unique in the Indian model, sitting between financial info providers (like GST, bank accounts, GeM) and financial info users (banks, NBFCs, innovators).

#AccountAggregator

#AccountAggregator

He also said that AAs are traffic cops: ensuring safety, privacy, and control to the user. This is a unique architecture to empower users with their data.

We have 8 banks in the process of becoming FIPs, and along with in-principle approval for the GSTN to become a FIP.

We have 8 banks in the process of becoming FIPs, and along with in-principle approval for the GSTN to become a FIP.

@imsiddshetty, @Product_nation fellow takes the stage now.

He says that we’re sharing data in broken ways: PDF downloads/uploads of financial statements, which comprises security and privacy.

#AccountAggregator #FreeyourData

He says that we’re sharing data in broken ways: PDF downloads/uploads of financial statements, which comprises security and privacy.

#AccountAggregator #FreeyourData

He shows us a demo—FI can enable spend analytics with AA on top of the OneMoney AA, accessing data from Axis data.

Credit moving to info-based collateral. @Lendingkart can use AA to access my transactions data from HDFC Bank to pull cash flow data.

Credit moving to info-based collateral. @Lendingkart can use AA to access my transactions data from HDFC Bank to pull cash flow data.

AA users can view where the data resides, & revoke access based on their consent.

While offering consumer durable loans, @DMIFinance needs access to bank account statements who can use AA to link my @MyIndusIndBank account, authenticate with the bank & review the data consent.

While offering consumer durable loans, @DMIFinance needs access to bank account statements who can use AA to link my @MyIndusIndBank account, authenticate with the bank & review the data consent.

He closed by saying that multiple AAs are live, and you can download apps of these AAs (like Finvu or Onemoney) from the Play Store or the App Store. Hundreds of consents are being approved today and it’s only going to grow. It’s time to start building!

#AccountAggregator

#AccountAggregator

@NandanNilekani summarised by saying that the same framework can be applied for other financial data—like pension funds, insurance. Talks are on to get telecom data on this as well. This architecture can be applied to any sector (like health).

#AccountAggregator

#AccountAggregator

There is no other country in the world that is enabling billions of users to use their data to get better credit, better healthcare, better job. We’re getting global recognition – countries are grappling with how to deal with data. This will be India's public good for the world.

Watch on as Siddharth Tiwari, Head of @BIS_org takes the floor with the agenda "A Global Perspective on India's Account Aggregator Model".

Tell us your thoughts and feel free to ask us questions!

#AccountAggregator

Tell us your thoughts and feel free to ask us questions!

#AccountAggregator

He hopes to shares learnings from innovators like RBI in India globally.

Privacy laws enable users to exercise control over their data. However, users cannot operationalize consent for 2 reasons: service providers seek consent and this is ex-ante, broad & sweeping in nature.

Privacy laws enable users to exercise control over their data. However, users cannot operationalize consent for 2 reasons: service providers seek consent and this is ex-ante, broad & sweeping in nature.

He added that the cost to consumers and society—the absence of ownership on the part of users and businesses, and absence of consequential benefits that ownership will bring. Consent-based user-friendly efficient systems have the potential to help users to drive value from data.

He continued saying that—as a concrete example, users cannot access credit today—this is across developing and developed countries with high tech and financial literacy. Tangible capital is collateral, which is inaccessible to the young and poor.

#AccountAggregator

#AccountAggregator

He then went on to say that AA in India is one great example of a consent-based data sharing framework that allows users and businesses to leverage their own information capital to access financial services.

#AccountAggregator #FreeyourData

#AccountAggregator #FreeyourData

Can this work at scale? India has leveraged technology to leapfrog in identity, payments, and opening bank accounts. Data will be the next layer of this stack to improve access and efficiency.

#AccountAggregator

#AccountAggregator

He concluded by saying that AA is a balanced framework that protects consumers and promotes market innovation. As this becomes global, data standards should continue to be open and interoperable. @BIS_org is eager to engage in this discussion and evolution.

#AccountAggregator

#AccountAggregator

Next on the agenda, we have the fireside chat on Cross-Sectoral Data Empowerment with three powerhouses @amitabhk87, @rssharma3, and Shri Pankaj Jain, Additional Secretary of the Ministry of Finance.

Watch on!

#AccountAggregator

Watch on!

#AccountAggregator

@amitabhk87 said that while the west has focused on data privacy for users, we want to empower users so they make the most of their data.

#AccountAggregator

#AccountAggregator

@rssharma3 added on that we’ve been working towards transforming India with digital public utilities with an emphasis on empowering citizens, & DEPA makes that possible in data. Users can utilize the data, any type of data, and use it for multiple purposes.

#AccountAggregator

#AccountAggregator

Shri Pankaj Jain continued on to say that AA will open up opportunities for partnerships, remove boundaries between institutions and companies, that will improve the experience for the customer.

#AccountAggregator

#AccountAggregator

@rssharma3 said that reducing the transaction costs is critical to enable sachet-sized financial products. This is the start of the innovation, and we will have the UPI movement for data. Telecommunication data will bridge the lack of credit reports.

#AccountAggregators

#AccountAggregators

Shri Pankaj Jain chipped in to say that just as UPI enabled multiple use-cases, we have been working on sachet-sized loans, invoice-based financing to enable low-ticket, low-transaction cost products even with no credit history.

#AccountAggregator

#AccountAggregator

@rssharma3 concluded by saying that a generic foundation enables continuous innovation. Health data is sensitive and requires different aggregators for health records – to share my data with doctors, hospitals, based only on my consent.

#AccountAggregator

#AccountAggregator

Next, we have an interesting agenda—Fintech Roundtable: Innovating on AA for Improved Financial Services!

The panelists are @rajeshbansal @Sucharita_2011 @Nithin0dha, @Naveenkukreja5, & other founders at leading fintech companies.

Keep watching this space!

#AccountAggregator

The panelists are @rajeshbansal @Sucharita_2011 @Nithin0dha, @Naveenkukreja5, & other founders at leading fintech companies.

Keep watching this space!

#AccountAggregator

Harshvardhan Lunia, @Lendingkart kicked off the chat by saying that AA will trigger a massive data revolution. We’re focusing on two problem statements: designing products for under-served audiences and how do you get constant access to financial data.

#AccountAggregator

#AccountAggregator

He continued by saying that his team is working on AA awareness and the UX to make AA user-friendly. Collaborating on multiple use-cases for data that go beyond underwriting & origination.

#AccountAggregator

#AccountAggregator

Shiv Chatterjee from @DMIFinance chipped in to say that many users today don’t have access to credit, because they lack bureau footprint. AA promises to increase convenience for existing customers and increase access for those who don’t.

#AccountAggregator

#AccountAggregator

He also said that past credit performance is not an indicator of future credit performance, and the ability to repay debt evolves. We want to make that happen with AA and by collaborating with the RBI Innovation hub.

#AccountAggregator

#AccountAggregator

Sumit Gwalani, @Bank_on_Fi added on to say that AA is a huge step to a connected financial ecosystem. Young customers have huge fragmentation - in their accounts and investments - and AA brings unification. This can enable hyper-personalization for customers.

#AccountAggregator

#AccountAggregator

@Naveenkukreja5 of @PaisaBazaar_in said that AA seemed impossible, but has come true—and it improves the convenience of using data and increasing the reach of financial products. Transaction data, especially for the self-employed will cover for the lack of strong credit history.

@Nithin0dha of @zerodhaonline shared his opinion—we have nudges for overweights towards stock for our users, and with AA, we can enable customers to see their portfolios across Demat accounts. We’re looking forward to seeing Demat accounts come on board.

#AccountAggregator

#AccountAggregator

He also said that AA will also bring up the missing ecosystem of advisors in India, which is crucial to bridge the education gap and enable users to make the most of their money.

#AccountAggregator

#AccountAggregator

@Sucharita_2011 from @kaleidofin said that we have opportunities to create assisted flows that enable the underserved 1.2B people, which will make AA relevant for the low-income segments served by the informal financial sector.

#AccountAggregator

#AccountAggregator

She also said that passbooks are not always readable, even with sophisticated OCR, and data from AA can help us provide tailored financial products.

#AccountAggregator

#AccountAggregator

@Sucharita_2011 said something important—how do we judge this was successful? AA should reduce costs and improve the design of financial products. Widespread delivery of financial products is crucial, & we need innovation. Many users don’t read text, and we could build on voice.

@Naveenkukreja5 of @PaisaBazaar_in chipped in to say that majority of consumers still think that their own credit and banking data belongs to the bank, and not them! We need a lot more awareness to enable and protect users.

#AccountAggregator

#AccountAggregator

Shiv Chatterjee of @DMIFinance: When data is walled and siloed, tools are also fragmented. The platform flourishes when you have a common language to enable it—just like how TCP/IP enabled the Internet, and how MS Word enabled writers to focus on their stories, and not on tools.

Well, that was the end of an extremely interesting and tight round table session!

Make sure you go through our thread to get a gist of what went down.

We now have the closing session "Building for India" with @pramodkvarma, Chief Architect @UIDAI & @India_Stack!

Make sure you go through our thread to get a gist of what went down.

We now have the closing session "Building for India" with @pramodkvarma, Chief Architect @UIDAI & @India_Stack!

Kicking off the closing session, Dr @pramodkvarma said that it’s unusual to see so many motivated people voluntarily join the effort to build a powerful ecosystem around data. Imagination is the only limit to what is possible, and today is a milestone worth celebrating!

@pramodkvarma summarised the launch with a powerful thought. Building infrastructure is not enough—value is created by applications on top and which is where YOU as entrepreneurs come in. India depends on you, millions of people depend on the work you will do.

#AccountAggregator

#AccountAggregator

Well, that was an exhilarating launch!

Come join India’s first AA community: join.slack.com/t/aa-india-com…

Read all about AAs here: blog.setu.co/columns/free-y…

If you're looking to use Account Aggregator in your app, sign up to our sandbox right away! Go to bridge.setu.co

Come join India’s first AA community: join.slack.com/t/aa-india-com…

Read all about AAs here: blog.setu.co/columns/free-y…

If you're looking to use Account Aggregator in your app, sign up to our sandbox right away! Go to bridge.setu.co

• • •

Missing some Tweet in this thread? You can try to

force a refresh