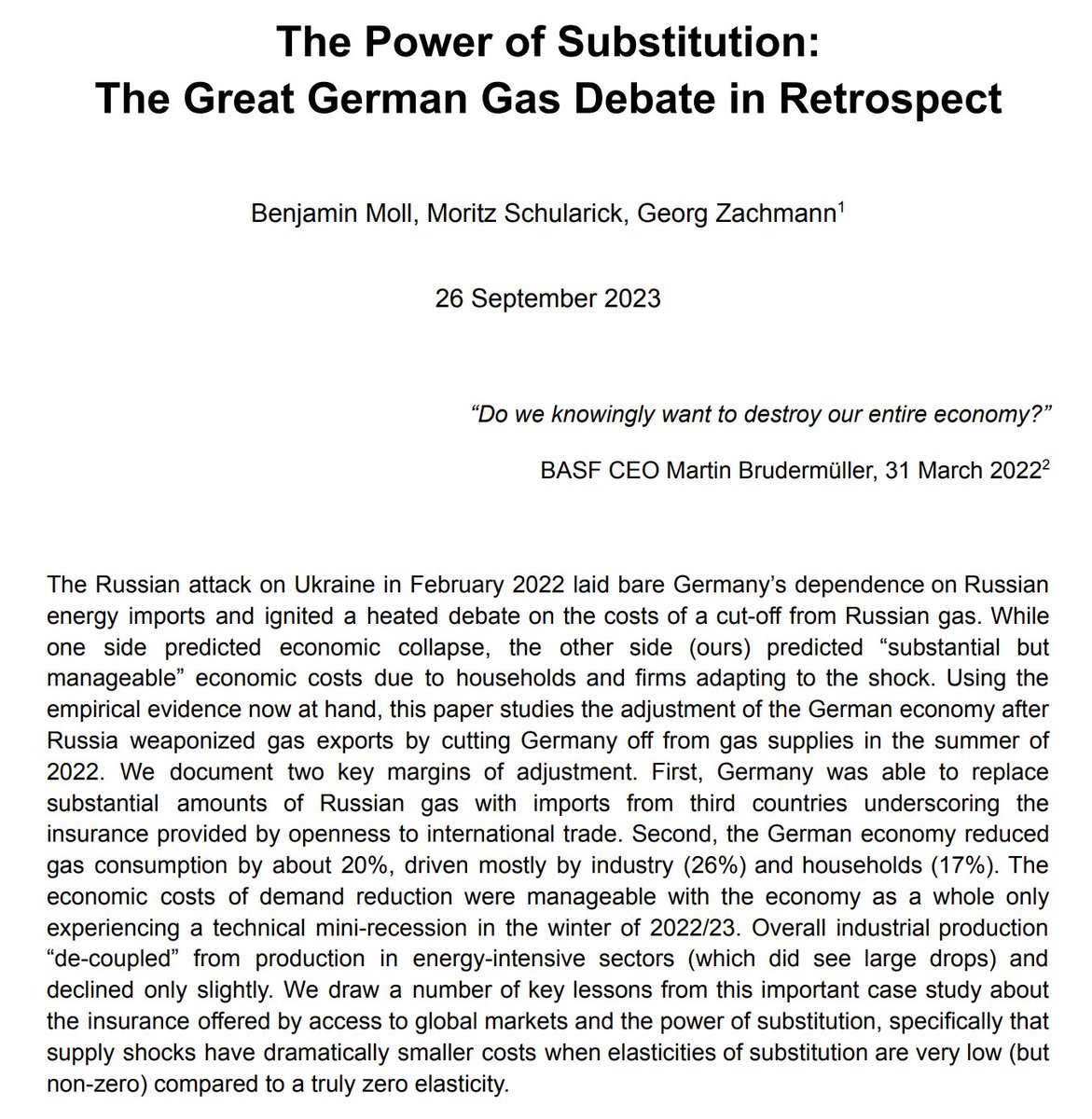

I finally read this & thought the following was interesting: exercises quite similar to this ("saving rates rise with income, hence inequality increases aggregate saving") were a prime motivation for Friedman to develop the permanent income hypothesis in the 1950s.

1/

1/

https://twitter.com/AtifRMian/status/1431336139433070596

The excerpts above are from the conclusion of Friedman's "A Theory of the Consumption Function"

nber.org/system/files/c…

Whole book here nber.org/books-and-chap…

2/

nber.org/system/files/c…

Whole book here nber.org/books-and-chap…

2/

This 1975 Alan Blinder paper "Distribution Effects and the Aggregate Consumption Function" has a nice exposition of the evolution of economic thought up to the 70s

jstor.org/stable/1837107

3/

jstor.org/stable/1837107

3/

Just to be clear, Friedman's basic idea is: if you see someone with high income in a given year who saves a large share of that income (a high saving rate), it could just be that she had a lucky year and is putting some of it aside.

4/

4/

But then a secular shift in the income distribution that shifts income toward her wouldn't necessarily increase aggregate saving or would at least increase it by less.

Here's a more strongly-worded version of the argument by @paulkrugman krugman.blogs.nytimes.com/2013/01/20/ine…:

5/

Here's a more strongly-worded version of the argument by @paulkrugman krugman.blogs.nytimes.com/2013/01/20/ine…:

5/

Of course, @AtifRMian @ludwigstraub & @profsufi are very much aware of this classic argument and try to address it in some robustness checks.

But, as they say, without better data = panel data which basically doesn't exist for the U.S. it's very hard to do better.

6/

But, as they say, without better data = panel data which basically doesn't exist for the U.S. it's very hard to do better.

6/

To be clear: I definitely don't subscribe to the permanent income hypothesis, see my work on HANK & MPCs, and think that inequality is super important for macro.

@AtifRMian @ludwigstraub @profsufi may well be (qualitatively) right that higher inequality causes higher saving

7/

@AtifRMian @ludwigstraub @profsufi may well be (qualitatively) right that higher inequality causes higher saving

7/

But I do think that the basic point about transitory income gains inflating measured saving rates of high-income households could be important, especially because top income status seems far from permanent, see e.g. @fatihguvenen @GregWKaplan Song gregkaplan.me/s/guvenen_kapl…

8/

8/

I also don't think it's at all obvious that saving rates increase with (the relevant notion of) income. Here's Krugman again...

9/

9/

... and @AndreasFagereng @BlomhoffHolm @GNatvik & I studied how saving rates vary with wealth (as opposed to current income) & found that they are flat

... which is theoretically consistent with saving rates being relatively flat w permanent income

10/

... which is theoretically consistent with saving rates being relatively flat w permanent income

https://twitter.com/ben_moll/status/1392909642536206347

10/

As I said, I'm very sympathetic to this paper's argument and the great work of @AtifRMian @ludwigstraub & @profsufi on these topics more generally.

11/

11/

But I find it interesting (or perhaps depressing?!) that data availability in the U.S. & many other countries means that almost 70 years after Friedman we still can't be sure to what extent saving rates increase with income and whether inequality increases aggregate saving

12/12

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh