How to get URL link on X (Twitter) App

We “put the ‘finance’ into ‘public finance’”, meaning that we study optimal redistributive taxation with changing asset prices.

We “put the ‘finance’ into ‘public finance’”, meaning that we study optimal redistributive taxation with changing asset prices.

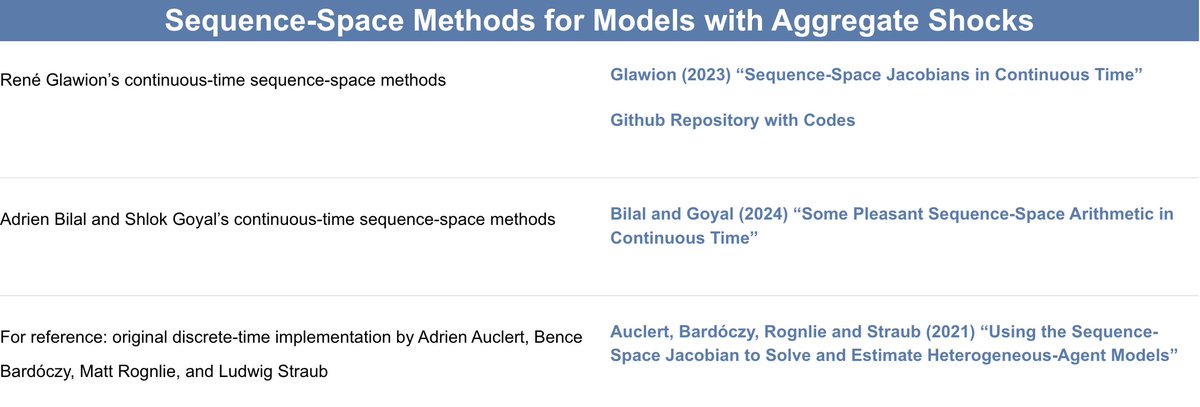

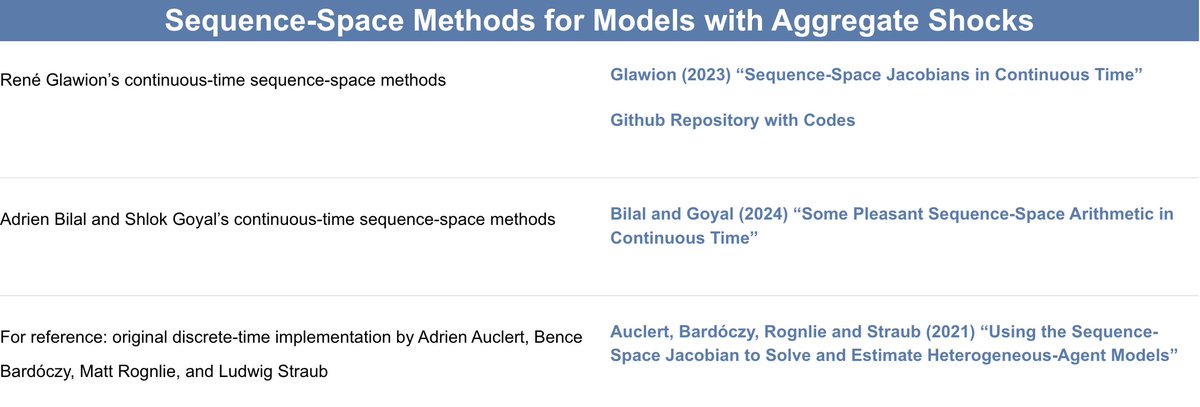

1. René Glawion's very nice continuous-time implementation of the @a_auclert @BardoczyBence Rognlie @ludwigstraub sequence-space method:

1. René Glawion's very nice continuous-time implementation of the @a_auclert @BardoczyBence Rognlie @ludwigstraub sequence-space method:

https://twitter.com/kielinstitute/status/17352640162288440161. Cold-turkey decoupling would be costly: "financial crisis in short-run + Brexit in long-run" is good way of thinking about it. So costly though still not Armageddon.

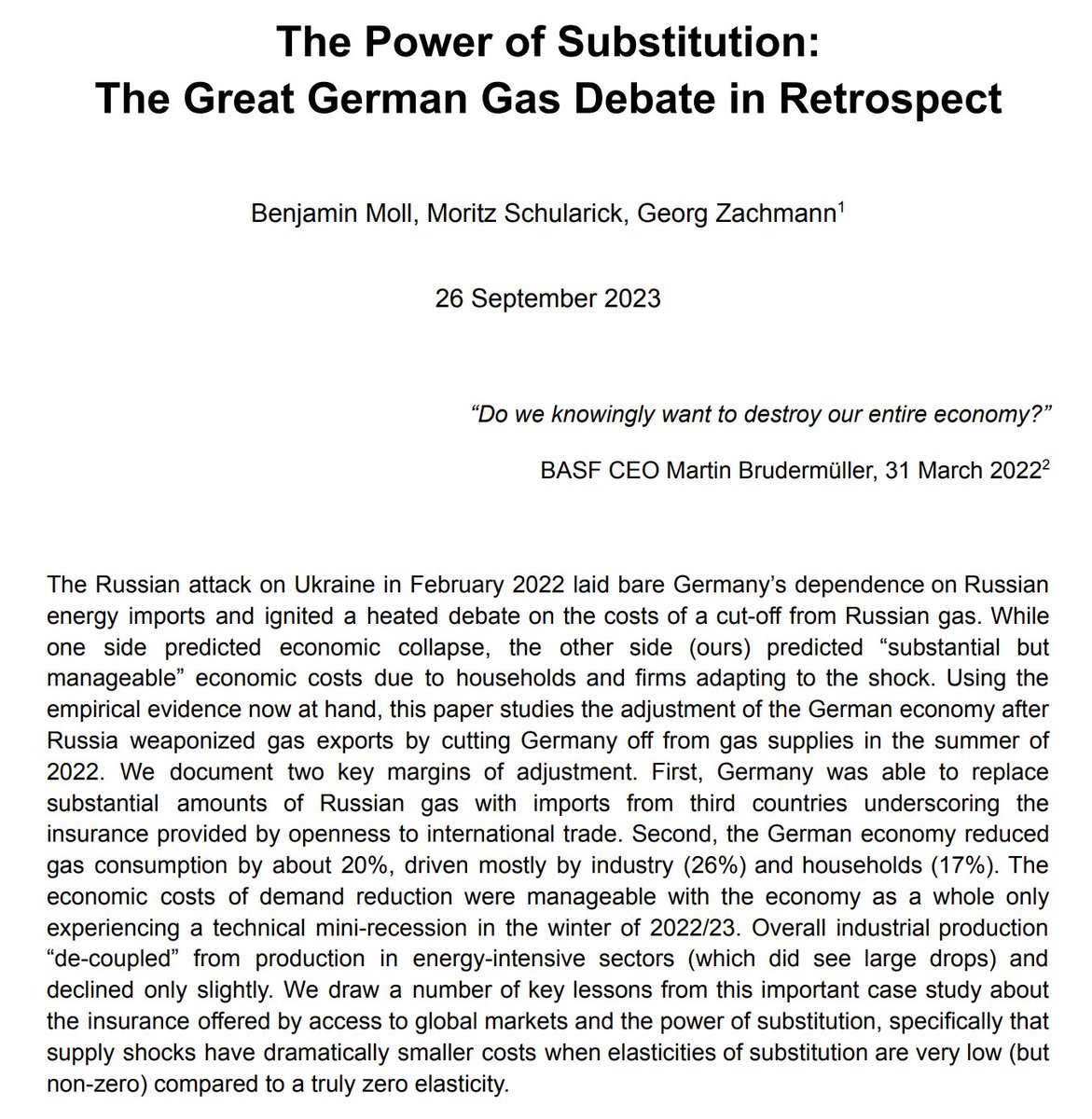

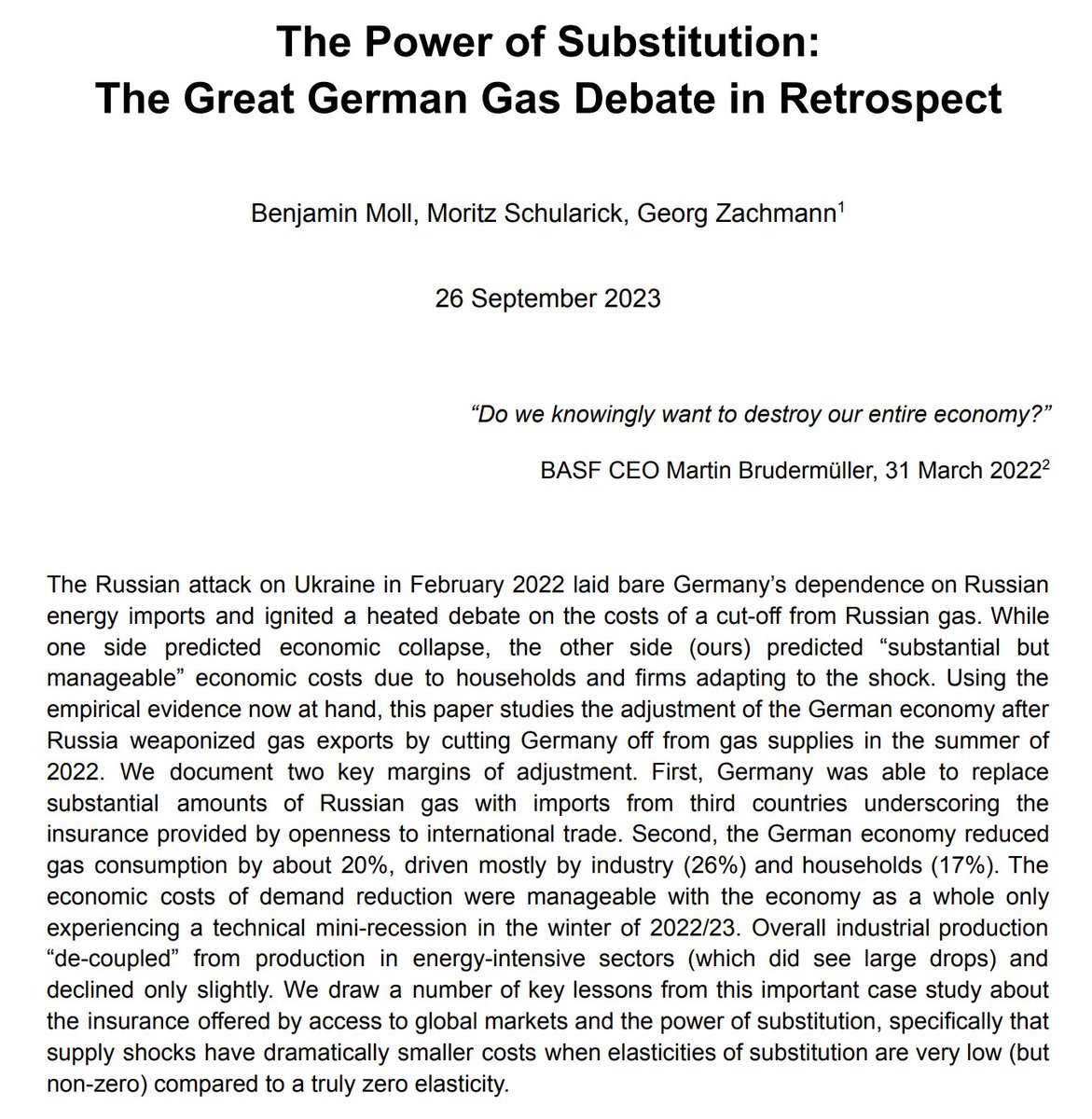

This is another follow-up on our "What If?" paper with @BachmannRudi @DBaqaee @christianbaye13 @kuhnmo @andreasloeschel @APeichl #KarenPittel.

This is another follow-up on our "What If?" paper with @BachmannRudi @DBaqaee @christianbaye13 @kuhnmo @andreasloeschel @APeichl #KarenPittel.https://x.com/kuhnmo/status/1500937765814517774

Course description here

Course description here

https://twitter.com/ben_moll/status/1655837631756877824Here is a collection of some of the most extreme doomsday predictions. Two reasons:

A year after our "What If?" paper with @BachmannRudi @DBaqaee @christianbaye13 @kuhnmo @andreasloeschel @APeichl #KarenPittel we take stock of what actually happened using the latest data.

A year after our "What If?" paper with @BachmannRudi @DBaqaee @christianbaye13 @kuhnmo @andreasloeschel @APeichl #KarenPittel we take stock of what actually happened using the latest data.https://x.com/kuhnmo/status/1500937765814517774?s=20

https://twitter.com/LionHirth/status/1583013637584977920

My reason for taking another shot at explaining this: if people don't understand the policy, then it won't work as intended. So communication is key. Just as @R2Rsquared writes here.

My reason for taking another shot at explaining this: if people don't understand the policy, then it won't work as intended. So communication is key. Just as @R2Rsquared writes here.https://twitter.com/R2Rsquared/status/1583032839255117824?s=20&t=I0OjIxIVqYLahXa8hqlghw

https://twitter.com/IsabellaMWeber/status/1582835419003379712The payment is

.@kielinstitute's unemployment prediction: "The unemployment rate is expected to rise from 5.3 percent (2022) to 5.6 percent (2023) and then fall slightly to 5.5 percent (2024)."

.@kielinstitute's unemployment prediction: "The unemployment rate is expected to rise from 5.3 percent (2022) to 5.6 percent (2023) and then fall slightly to 5.5 percent (2024)."

The analogy is hopefully clear

The analogy is hopefully clear

https://twitter.com/bnetza/status/1556617640428425217Herleitung der Faustregel am 🧵-Ende.

The paper is joint work with @AndreasFagereng, Matthieu Gomez, Emilien Gouin-Bonenfant @BlomhoffHolm and @GNatvik

The paper is joint work with @AndreasFagereng, Matthieu Gomez, Emilien Gouin-Bonenfant @BlomhoffHolm and @GNatvik

Source gov.uk/government/spe… HT @toxvaerd1

Source gov.uk/government/spe… HT @toxvaerd1

https://twitter.com/GuntramWolff/status/1546436433837170689?s=20&t=yZkHwHO3jTSUH91c1uPBYQ

https://twitter.com/BLSchmitt/status/1540144079975104519

The thread will focus on the German case with (warning!) lots of references in German.

The thread will focus on the German case with (warning!) lots of references in German.

https://twitter.com/HannoLustig/status/1533353938400989185An example by @M_C_Klein: "Russia has lost access to many imports" and therefore "the oil boycott will hurt ordinary Europeans at least as much as it impairs Putin’s war effort. It should be understood mainly as a moral gesture rooted in self-denial"

https://twitter.com/M_C_Klein/status/1532306429339545604?s=20&t=kV-kfoXrdQbkmNEE0NmJyQ

https://twitter.com/tom_krebs_/status/1523591395415834625Where does this "production multiplier" of 5 come from?