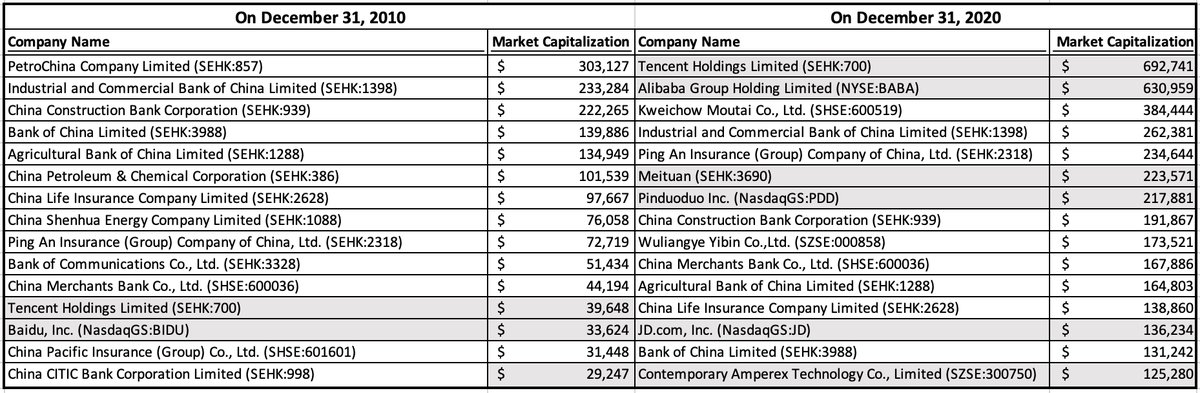

Can governments affect company value? Of course, in both positive and negative ways. As the Chinese government cracks down on its big tech companies, I revisit the many consequences of government action or inaction for the value of a company. bit.ly/3BvzPHx

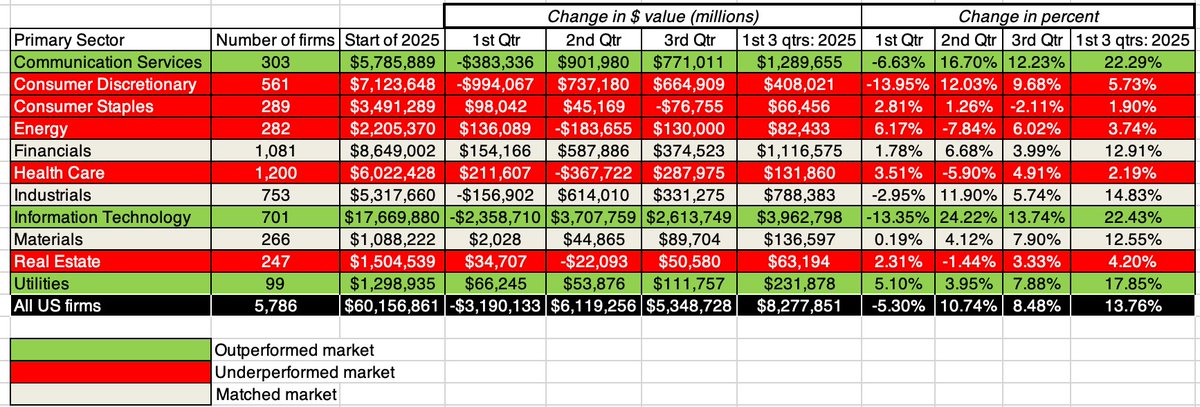

As the Chinese economy has risen to become the second largest in the world, its equity markets have also risen, with Chinese tech taking the lead in the last decade. Tencent & Alibaba sit on top of China's market cap tables at the start of 2021. bit.ly/3BvzPHx

The biggest Chinese tech companies range the spectrum in terms of business, but they all (a) benefit from big markets (China + Disruption) (b) are tailored to Chinese consumers (c) are corporate governance nightmares and (d) have Beijing as a key player. bit.ly/3BvzPHx

The tech crackdown surprised investors, used to viewing Beijing as a net plus, and it has altered the calculus, making it a net minus, for value. My estimates of value for $BABA, $TCEHY, $JD and $DIDI, with government as net minus, benefactor or adversary. bit.ly/3BvzPHx

While Alibaba and Tencent, both look under valued in the net minus (base case) scenario, I prefer Tencent for its more diverse business mix, the power of its WeChat platform and not having a lightning rod (like Jack Ma) as founder. bit.ly/3BvzPHx

China's crack down on tech, in my view, has nothing to do with its stated reasons of protecting consumer privacy and increasing competition, and everything to do with maintaining control over data and companies. bit.ly/3BvzPHx

• • •

Missing some Tweet in this thread? You can try to

force a refresh