Ami Organics IPO notes ⚗️

Supplies Raw materials (Intermediates) to API players (7% of revenues from Laurus Labs for example)

Hit the 'retweet' & help us educate more investors

A Thread 🧵👇

Supplies Raw materials (Intermediates) to API players (7% of revenues from Laurus Labs for example)

Hit the 'retweet' & help us educate more investors

A Thread 🧵👇

1/ Basics about the IPO.

Raising 200crs of Fresh Issue (& OFS of 370crs): will be used for repayment of debt & WC

MCap at 2200crs: EV/S of 6 & EV/EBITDA of 26 (stretched for an unknown company)

Promoters only hold 41% after the IPO

Raising 200crs of Fresh Issue (& OFS of 370crs): will be used for repayment of debt & WC

MCap at 2200crs: EV/S of 6 & EV/EBITDA of 26 (stretched for an unknown company)

Promoters only hold 41% after the IPO

2/ An Pharma intermediates player that sells to API players focusing on high-growth therapeutics.

Caters to 150 customers (incl. Laurus, Cadila & MNC players, etc) | 50% exports

Caters to 150 customers (incl. Laurus, Cadila & MNC players, etc) | 50% exports

3/ R&D Expertise: Market leader across many intermediates | 66 R&D Personnel | 8 Process Patents | 1-2% of rev

High Entry Barriers due to the complex chemistries

The capacity of 6060 MTPA (3600MTPA recently through inorganic): old plant of 2460 MTPA at 60% utilisation

High Entry Barriers due to the complex chemistries

The capacity of 6060 MTPA (3600MTPA recently through inorganic): old plant of 2460 MTPA at 60% utilisation

4/ Breakup of the rev 👇

Could be helpful in tracking how the offtake of other companies are; for ex: they supply intermediates of Dolutegravir to Laurus Labs.

Could be helpful in tracking how the offtake of other companies are; for ex: they supply intermediates of Dolutegravir to Laurus Labs.

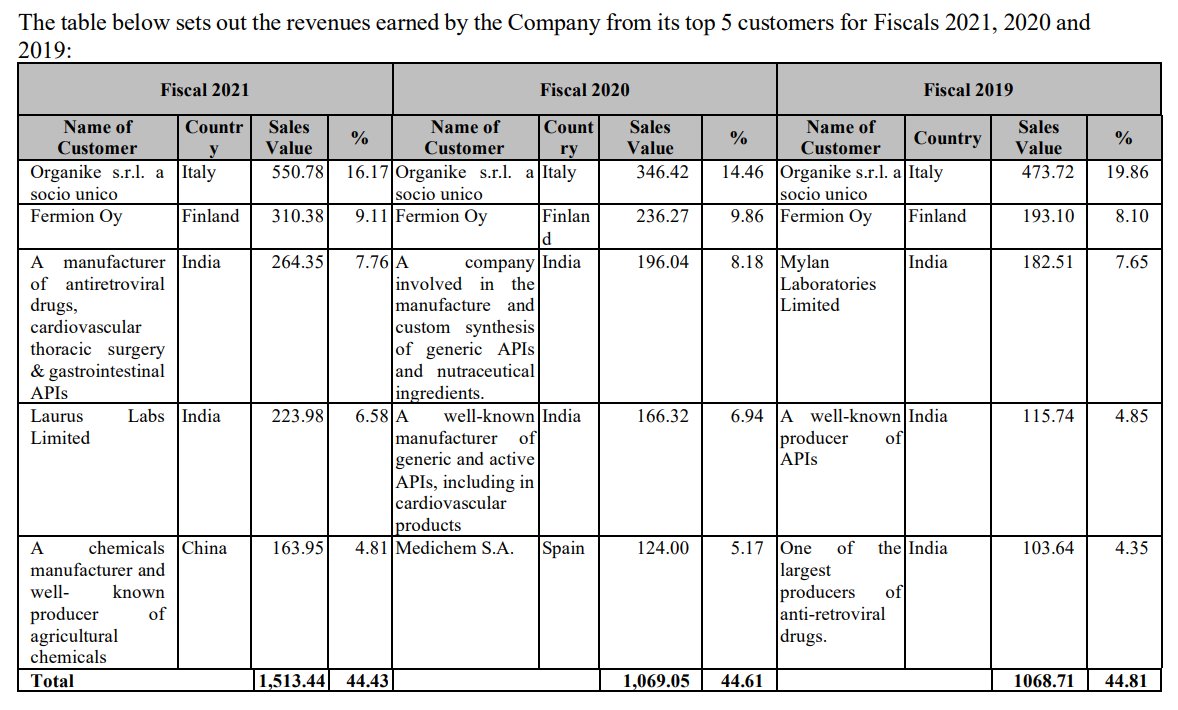

5/ 5 customers account for 44% of the rev: Concentration risk; any change in end product offtake will have reverberations into their P&L.

GMs have increased from 33% to 45% in 3yrs: Might not be sustainable

GMs have increased from 33% to 45% in 3yrs: Might not be sustainable

6/ Acquired the incremental 3600 MTPA capacity for just 93crs; ability to scale up with higher value products is a key trackable.

7/ Financials:

High Working capital requirements: weak cash flow conversion | High Asset Turnover ensures a good return on capital

Revenue growth might sustain as the new plants ramp up, although margins look to be on the higher side (Gross margins look subnormal)

High Working capital requirements: weak cash flow conversion | High Asset Turnover ensures a good return on capital

Revenue growth might sustain as the new plants ramp up, although margins look to be on the higher side (Gross margins look subnormal)

8/ Risks:

- Unlisted group company into APIs which wasn't mentioned in the IPO prospectus; check out the tweets below by @arpit971 & @tusharbohra

- Any adverse USFDA reaction

- Not clear if they can pass on the RM price increases

- Unlisted group company into APIs which wasn't mentioned in the IPO prospectus; check out the tweets below by @arpit971 & @tusharbohra

- Any adverse USFDA reaction

- Not clear if they can pass on the RM price increases

9/

- Operations are dependent on the ability to collaborate & innovate; a key trackable

- Newly acquired plants (60% of total capacity) from Gujarat Organics might not yield effective results.

- Product concentration risks: 40-45% of rev from 2 products 👇

- Operations are dependent on the ability to collaborate & innovate; a key trackable

- Newly acquired plants (60% of total capacity) from Gujarat Organics might not yield effective results.

- Product concentration risks: 40-45% of rev from 2 products 👇

10/

Outlook:

Better be cautious rather than aggressive in betting on a new company (not to forget, in a sector which is currently valued as if nothing can go wrong) with so many unknowns; even the valuations are not in our favour.

Comparison with the peers 👇

End of Thread.

Outlook:

Better be cautious rather than aggressive in betting on a new company (not to forget, in a sector which is currently valued as if nothing can go wrong) with so many unknowns; even the valuations are not in our favour.

Comparison with the peers 👇

End of Thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh