There's been a decent amount of self-congratulations and attribution bias amongst the compounder-bro community of fund managers...time for an alpha-debunking thread...yes, I am referring to @BlueWhaleCap, @FundsmithLLP and Lindsell Train.

🧵👇

🧵👇

Many people think managers like the ones referenced above are incredibly insightful/geniuses/market wizards. This is a lie, even Fundsmith can be replicated using a 25-stock portfolio rebalanced every 6 months from a simple quant screen:

https://twitter.com/hindsightcapllp/status/1427563232798126081?s=20

Lindsell Train even admits that their returns are remarkably similar to the Quality factor...actually they are 💥statistically identical💥 - The LT portfolio is more concentrated, hence it did better when Quality performed well!

lindselltrain.com/application/fi…

lindselltrain.com/application/fi…

Bluewhale capital is touting their track record vs Fundsmith, yes, they have outperformed...but why...?

https://twitter.com/stephenyiu/status/1433072192535908353?s=20

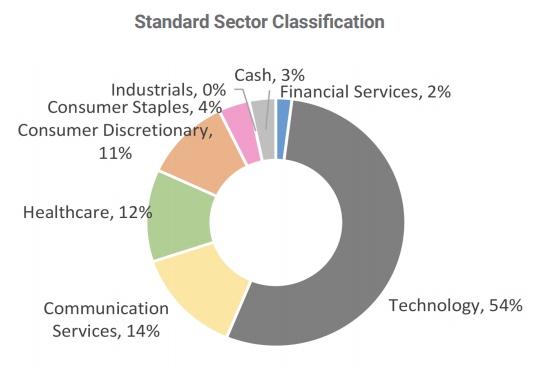

The simple answer is that @BlueWhaleCap is holding a portfolio of technology stocks in addition to many of the Quality stocks held by @FundsmithLLP . 54% of their holdings are Technology stocks...but so what I hear you say? Isn't that skill?

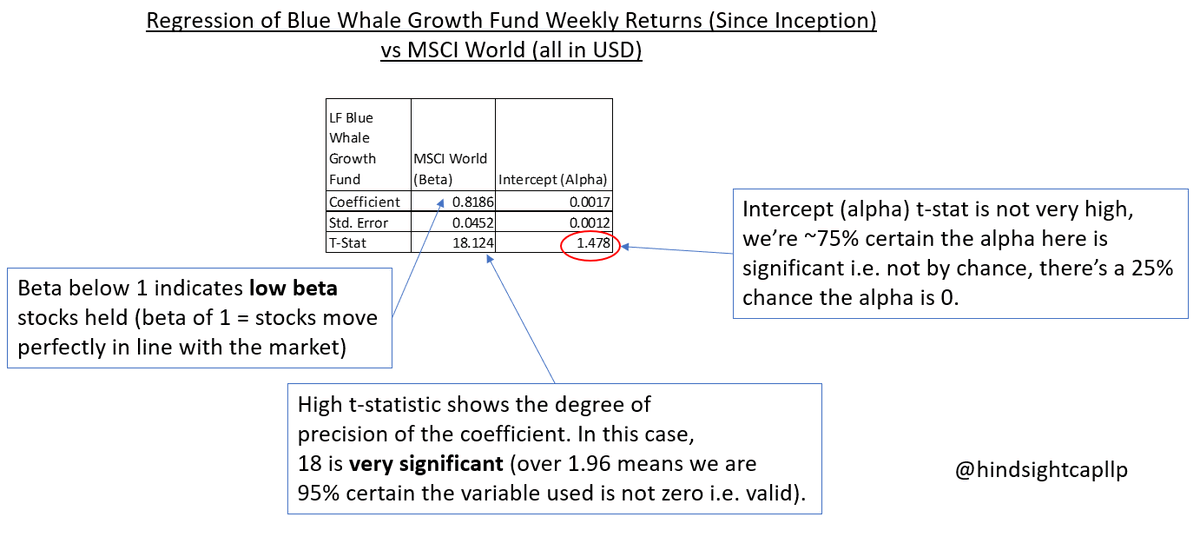

In active management, fees should be paid for "alpha", not "beta" - these terms come from linear regression (beta being the coefficients in the regression). "beta" can be obtained through ETFs e.g. the $QQQ ETF gives us exposure to Technology stocks...

Adding the $QQQ to the performance chart illustrates an interesting point. Fundsmith holds much less Tech vs. BlueWhale...Tech performance has been much better than any Quality portfolio...but can we quantify this? YES!! Trust science over bullshit stories...

Running a quick returns-based regression (if I had holdings, I would run a Brinson attribution), using the LF Blue Whale Growth Fund returns since inception shows that the alpha shrinks rapidly (falls by -76%) if we consider 2 simple betas: $QQQ and $QUAL:

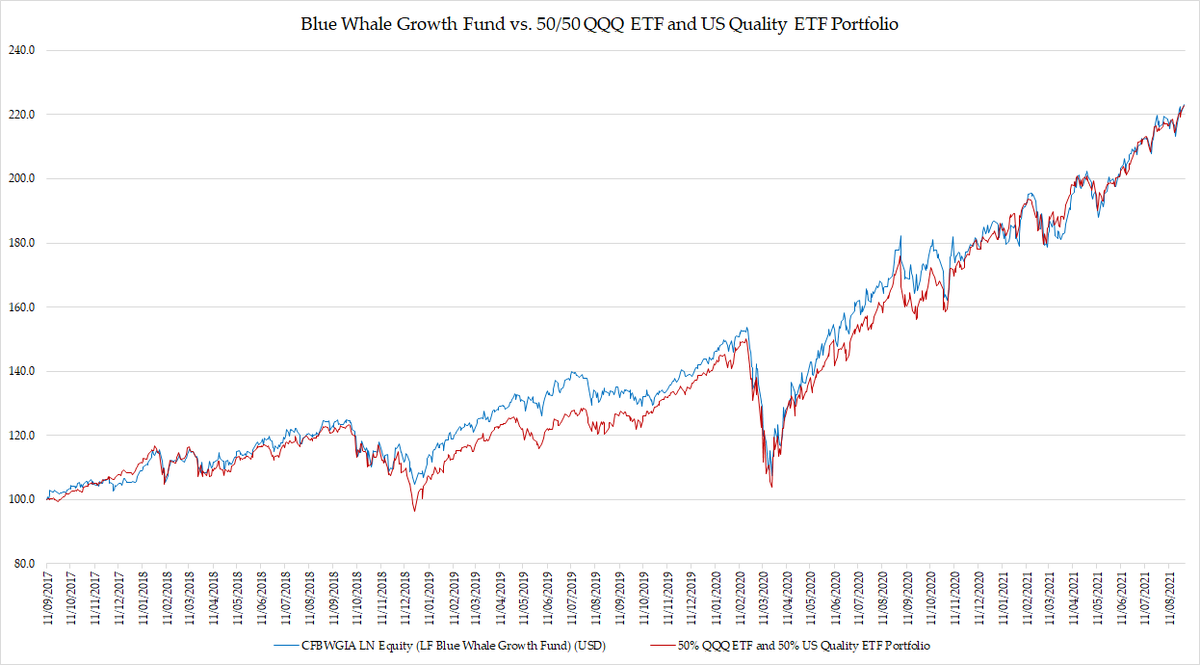

But regressions are just statistics...what if we take a 50/50 portfolio of $QQQ and $QUAL and compare this against the performance of @BlueWhaleCap Growth fund? The results are remarkably similar! Investors can replicate the betas using cheap ETFs and get very similar returns!!

On the perf comparison vs the 3 Quality-Growth managers, Lindsell Train holds almost NO Tech, Fundsmith holds some, and Blue Whale holds the most...perhaps the BETAS are explaining the relative performance of these managers and NOT skill...a 60/40 Fundsmith / $QQQ portfolio:

And we can do the same thing with Lindsell Train and $QQQ - but we put 60% into $QQQ this time...clearly the betas are driving the returns here and not the underlying stock picking skill. A useful lesson for investors. I hope you enjoyed this thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh