𝗤𝗖𝗣 𝗠𝗮𝗿𝗸𝗲𝘁 𝗨𝗽𝗱𝗮𝘁𝗲 𝟬𝟮 𝗦𝗲𝗽

1/ This week, ETHBTC cross started moving towards our 0.0850 target level [view from 03 Aug Market Update

The outsized move higher in ETHUSD has been largely spot and vol driven (rather than leverage in futures)

1/ This week, ETHBTC cross started moving towards our 0.0850 target level [view from 03 Aug Market Update

The outsized move higher in ETHUSD has been largely spot and vol driven (rather than leverage in futures)

2/ Spot demand from unprecedented transaction amounts in NFTs along with the constant buying of calls in large blocks. All this on the back of the EIP-1559 catalyst. With this recent push through 3800 we are starting to see some funding pressure as leveraged players..

3/ ..join in on the move higher. In spite of the decisive rally, the market remains wary of potential downside risk. We can see this from the risk reversal levels:

(a) BTC risk reversals have not broken out of range and remain close to par in spite of the call buying onslaught

(a) BTC risk reversals have not broken out of range and remain close to par in spite of the call buying onslaught

4/

(b) ETH front-end risk reversals have flipped violently to the put side.

With the speed of this move higher, a sharp mean reversion move would not be too surprising.

(b) ETH front-end risk reversals have flipped violently to the put side.

With the speed of this move higher, a sharp mean reversion move would not be too surprising.

5/ Generally speaking, BTC vols have been relatively muted as spot struggles to break above 50k. We expect BTC spot to be sticky around the 47-52k range for the following reasons:

6/

(i) 46,850 is the 50% Fibonacci retracement level from ATH of 64,900 in Apr to 28,800 low in Jun. This resistance level turned into a strong support level as evidenced in past 2 weeks

(ii) 46,850 also proved to be strong support when BTC corrected from ATHs in Apr this year

(i) 46,850 is the 50% Fibonacci retracement level from ATH of 64,900 in Apr to 28,800 low in Jun. This resistance level turned into a strong support level as evidenced in past 2 weeks

(ii) 46,850 also proved to be strong support when BTC corrected from ATHs in Apr this year

7/

(iii) We expect a good resistance at the 61.8% Fibonacci retracement level (51,110).

(iv) Downtrending RSI hints at possible lack of follow through.

(iii) We expect a good resistance at the 61.8% Fibonacci retracement level (51,110).

(iv) Downtrending RSI hints at possible lack of follow through.

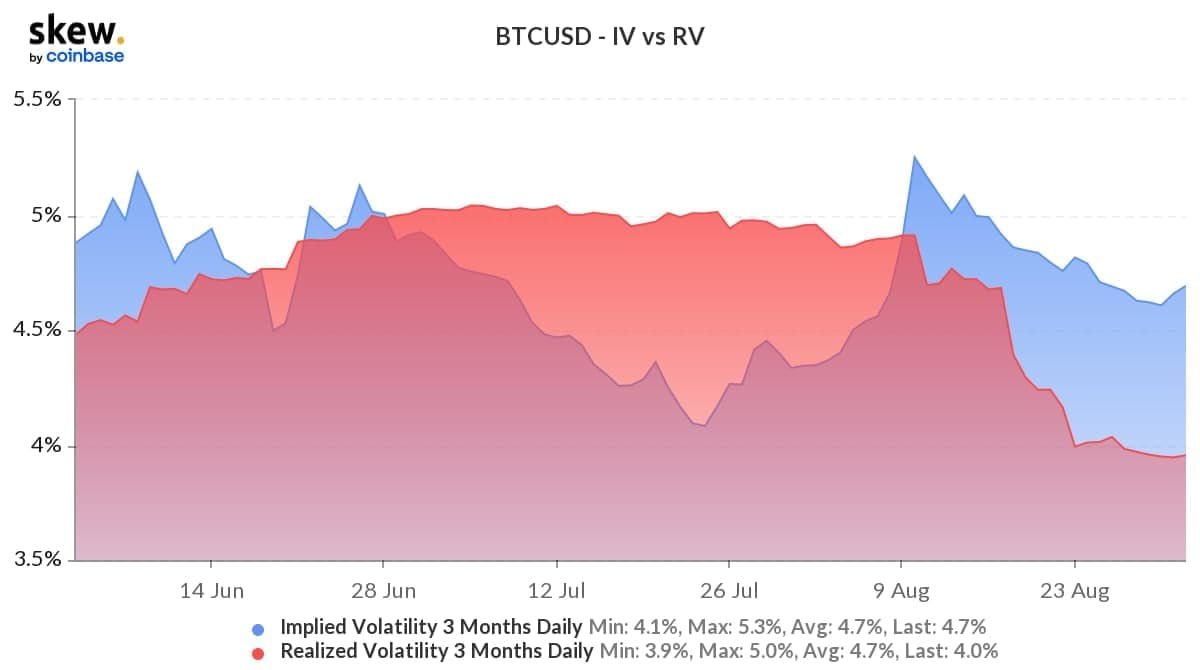

8/ BTC realised vols remain low causing the implied-realised gap to widen. There has also been a slight steepening in the term structure with Dec vols remaining elevated. We remain short BTC gamma and vega against our long spot position.

9/ For ETH, we have squared up short vega and we are slightly long gamma here alongside long spot.

For alts like BCH, DOGE, ALGO, LUNA and SOL we are long both gamma and vega alongside long spot.

For alts like BCH, DOGE, ALGO, LUNA and SOL we are long both gamma and vega alongside long spot.

10/ Among the alts, SOL has had an outstanding rally. Fibonacci trend projections show that we are at the 1.618 extension at 115 level. With a likely TD 9 tomorrow, we anticipate an interim top at these levels. With vols this high, SOL calls might be a decent sell.

11/ Full story here qcpcapital.medium.com/market-update-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh