Thread: Risk hai toh ishq hai ?

1) A lot of people talking about today’s freak trade in 37100 PE in BNF

We as traders are always exposed to various types of risk and it’s a part of our business.

Let me highlight certain risk faced in past years & also ways to manage it

1) A lot of people talking about today’s freak trade in 37100 PE in BNF

We as traders are always exposed to various types of risk and it’s a part of our business.

Let me highlight certain risk faced in past years & also ways to manage it

2) Gap Risk

18th may 2009

Markets opened at 9:55 AM as this was the market opening time at that time

Nifty immediately hit an 20 % upper circuit at 10.01 am and the markets froze.

So markets were open only for 6 minutes.

There are many such instances of overnight gaps

18th may 2009

Markets opened at 9:55 AM as this was the market opening time at that time

Nifty immediately hit an 20 % upper circuit at 10.01 am and the markets froze.

So markets were open only for 6 minutes.

There are many such instances of overnight gaps

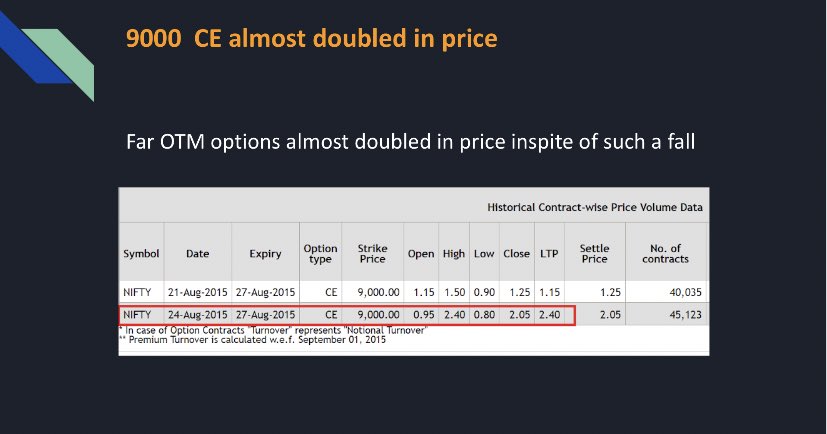

3) Vega Risk

On 24th August 2015, the Indian markets declined close to 5.92%.

Nifty around 490 points but something unusual happened on that day.

Far otm Call options shot up inspite of such a huge fall😲

Vix shot up 64%

On 24th August 2015, the Indian markets declined close to 5.92%.

Nifty around 490 points but something unusual happened on that day.

Far otm Call options shot up inspite of such a huge fall😲

Vix shot up 64%

4)Gamma Risk

26th sept 2019

It was an expiry day and 30000 CE went from 50 to 1000+ in minutes and eventually closed at 0

This move caused lot of leveraged traders to lose a significant amount of their capital

Many such instances of gamma risk on expiry day

26th sept 2019

It was an expiry day and 30000 CE went from 50 to 1000+ in minutes and eventually closed at 0

This move caused lot of leveraged traders to lose a significant amount of their capital

Many such instances of gamma risk on expiry day

5) Flash Crash

31st may 2019

Flash crash in Banknifty of 1000+ points.

Friday’s high of the Bank Nifty was 31,783 and the low point of the index was 30,623

Such flash crash has been seen in many stocks as well on other instances

31st may 2019

Flash crash in Banknifty of 1000+ points.

Friday’s high of the Bank Nifty was 31,783 and the low point of the index was 30,623

Such flash crash has been seen in many stocks as well on other instances

6) Black swan risk

13th march 2020

Nifty hit 10% lower circuit and trading was halted for 45 mins and when the circuit opened markets rallied and close around 4% in the green.

Sensex which was 3300 points down in the morning, at day end closed at 1300 points in the positive😲

13th march 2020

Nifty hit 10% lower circuit and trading was halted for 45 mins and when the circuit opened markets rallied and close around 4% in the green.

Sensex which was 3300 points down in the morning, at day end closed at 1300 points in the positive😲

7) Algo/Execution Risk

August 1, 2012

Due to algo issue Knight capital did 397 million shares and assumed a net long position in 80 stocks of approximately $3.5 billion as well as a net short position in 74 stocks of approximately $3.15 billion. Knight lost over $460 million

August 1, 2012

Due to algo issue Knight capital did 397 million shares and assumed a net long position in 80 stocks of approximately $3.5 billion as well as a net short position in 74 stocks of approximately $3.15 billion. Knight lost over $460 million

8) Price can below 0 as well

21st april 2020

A historic drop occurred on April 20, when the price of West Texas Intermediate crude dropped by almost 300%, trading at around negative $37 per barrel.

21st april 2020

A historic drop occurred on April 20, when the price of West Texas Intermediate crude dropped by almost 300%, trading at around negative $37 per barrel.

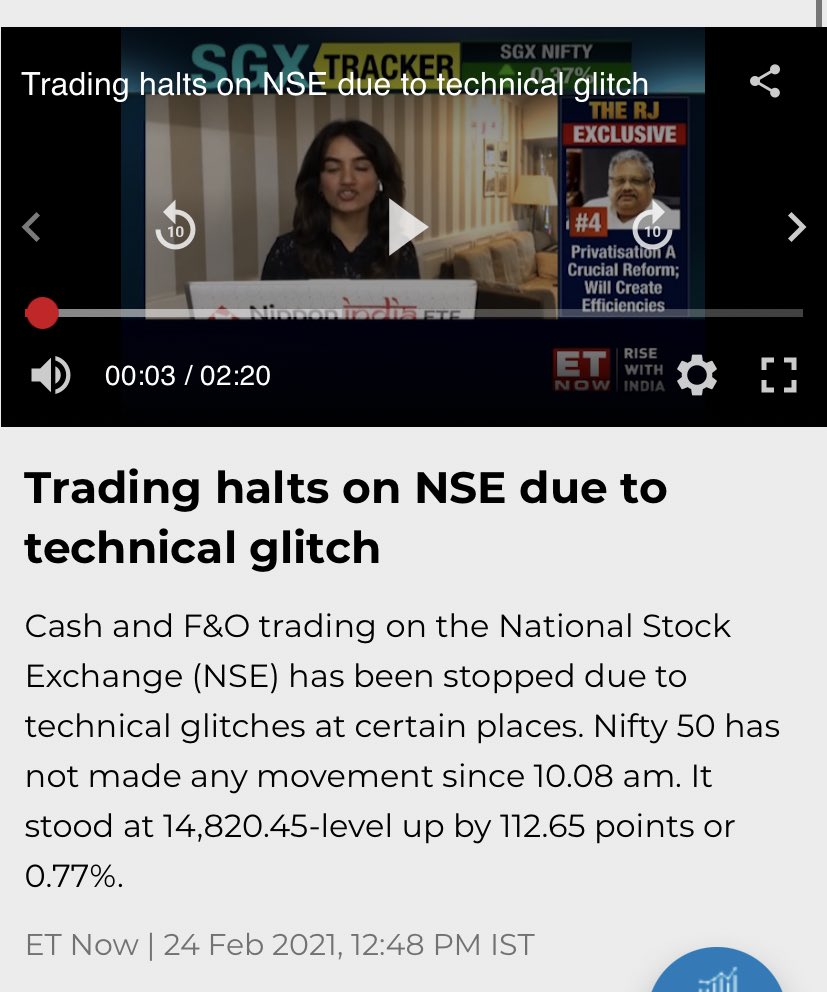

9) Exchange issue(Technical Glitch)

On 24th Feb 2021, NSE faced a technical glitch for the entire day and trading was halted.

This caused a lot of issue and completely out of a hands of a trader

On 24th Feb 2021, NSE faced a technical glitch for the entire day and trading was halted.

This caused a lot of issue and completely out of a hands of a trader

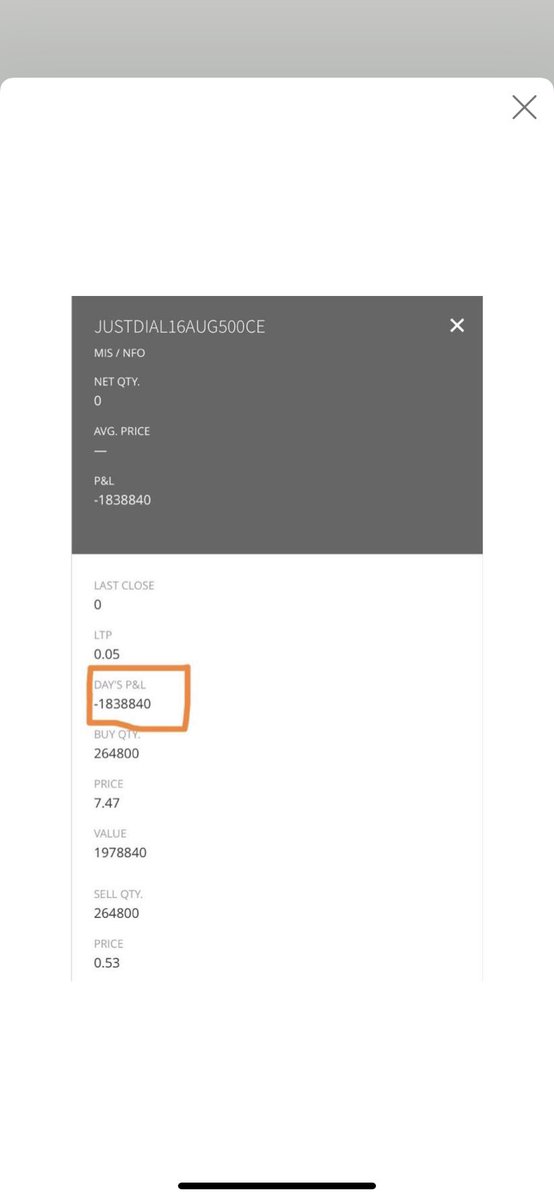

10) Liquidity Risk

This happened with me

I had sold justdial 500 CE on MIS when spot was at 485. I had sold 2.68 L qty and was in profit of 1.5 L at 3.19

But at 3:20, my mtm was -18.3 L

Lost 20 L in a minute due to liquity risk (see response from @zerodhaonline to understand)

This happened with me

I had sold justdial 500 CE on MIS when spot was at 485. I had sold 2.68 L qty and was in profit of 1.5 L at 3.19

But at 3:20, my mtm was -18.3 L

Lost 20 L in a minute due to liquity risk (see response from @zerodhaonline to understand)

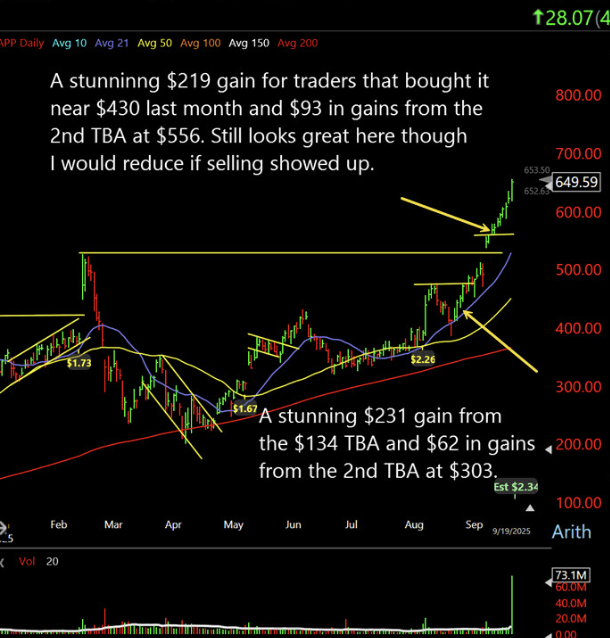

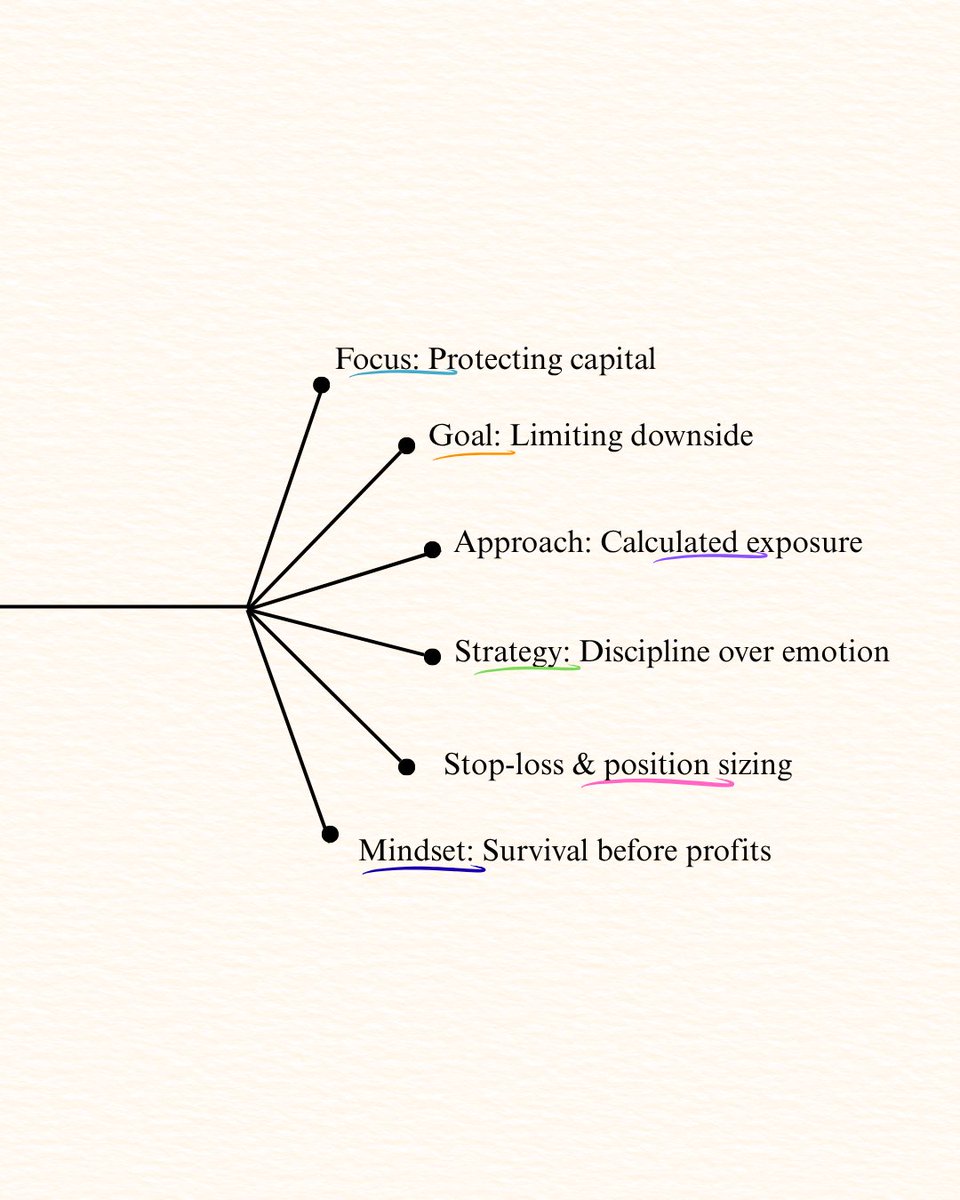

11) Risk and ways to manage !

I have highlighted some common risk and ways to manage it

See the image below

I have highlighted some common risk and ways to manage it

See the image below

12) As a trader, we have signed up for these risks and we cannot complain about it. All we can do is be prepared & manage them

-Never take the markets lightly

-Anything can happen anytime in the markets

-Be aware of the risk you are exposed to

-Manage risk at all times

End

-Never take the markets lightly

-Anything can happen anytime in the markets

-Be aware of the risk you are exposed to

-Manage risk at all times

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh