1/ As Tuesday's Bitcoin legal tender law looms for more than 6 million Salvadorans, many if not most of them fear a big monetary change.

This is partly because of the dollarization which occurred exactly 20 years ago, in a similarly rushed, top-down way 🧵 🇸🇻

This is partly because of the dollarization which occurred exactly 20 years ago, in a similarly rushed, top-down way 🧵 🇸🇻

2/ Last week I attended the anti-Bitcoin law protest in San Salvador. This is the secretary of a union for judicial employees.

She was against the law for many reasons, but a big one was that last time the govt changed the money system in 2001, it was bad for the lower classes.

She was against the law for many reasons, but a big one was that last time the govt changed the money system in 2001, it was bad for the lower classes.

3/ Dollarization was fairly unique in El Salvador's case. The country wasn't experiencing high inflation, or any kind of economic crisis. But policymakers said it would help bring down interest rates and fuel the banking sector. Which it did. But it had unintended consequences.

4/ This 2004 paper shows how dollarization had a negative impact on El Salvador's poor.

The process had a striking similarity in suddenness to this year's Bitcoin law: just 39 days passed between the initial announcement and implementation:

jstor.org/stable/4141619

The process had a striking similarity in suddenness to this year's Bitcoin law: just 39 days passed between the initial announcement and implementation:

jstor.org/stable/4141619

5/ At first, one might struggle to see how dollarization could be bad.

Why wouldn't a country benefit from moving to a stronger currency?

Well, one surprising reason it was a painful experience for many was the result of the new exchange rate of 8.75 colones per dollar.

Why wouldn't a country benefit from moving to a stronger currency?

Well, one surprising reason it was a painful experience for many was the result of the new exchange rate of 8.75 colones per dollar.

6/ 21% of Salvadorans couldn't read or write, much less do conversions in their head. So they would fall prey to a system where what *used* to cost seven colones might now be rounded up to one dollar. From seven colones to a dollar is 25% inflation.

7/ There was also the psychological effect of ditching a national currency, familiar to and even loved by many, for the currency of a foreign power that had backed a brutal dictatorship in the 1980s that committed unimaginably bad war crimes like these:

nytimes.com/1982/01/27/wor…

nytimes.com/1982/01/27/wor…

8/ By 2007, as this @latimes article then reported, many unbanked small business owners were still crushed by dollarization, having never recovered.

The stories here are powerful, and one of the women interviewed even called the dollar a "curse":

latimes.com/archives/la-xp…

The stories here are powerful, and one of the women interviewed even called the dollar a "curse":

latimes.com/archives/la-xp…

9/ This is Mama Rosa, one of the first vendors in El Zonte to start accepting Bitcoin back in 2019.

She is the mother of @jorgebitcoinES, a Bitcoin Beach founder.

When I asked her about dollarization, she grimaced, as if someone had hurt her. She said it had been very painful.

She is the mother of @jorgebitcoinES, a Bitcoin Beach founder.

When I asked her about dollarization, she grimaced, as if someone had hurt her. She said it had been very painful.

10/ Dollarization was brought up by many of the protestors I spoke to in San Salvador.

They had other legitimate fears, of course: virtually no one knows what Bitcoin is, and the government is being highly opaque with its roll-out plans and has provided very little education.

They had other legitimate fears, of course: virtually no one knows what Bitcoin is, and the government is being highly opaque with its roll-out plans and has provided very little education.

11/ As you can see here, another big fear from critics is that the government is going to use Bitcoin to launder money or steal from the people.

This is not an unreasonable fear, given that the last three Salvadoran presidents all looted the country.

This is not an unreasonable fear, given that the last three Salvadoran presidents all looted the country.

12/ More than anything, it seems that out of the $200M+ being spent on: the BTC rollout, convertibility trust (to ensure merchants who accept BTC don't need to touch it + can just receive $), and ATMs, people don't yet grok Bitcoin and think it's a waste.

bitcoinist.com/el-salvadors-l…

bitcoinist.com/el-salvadors-l…

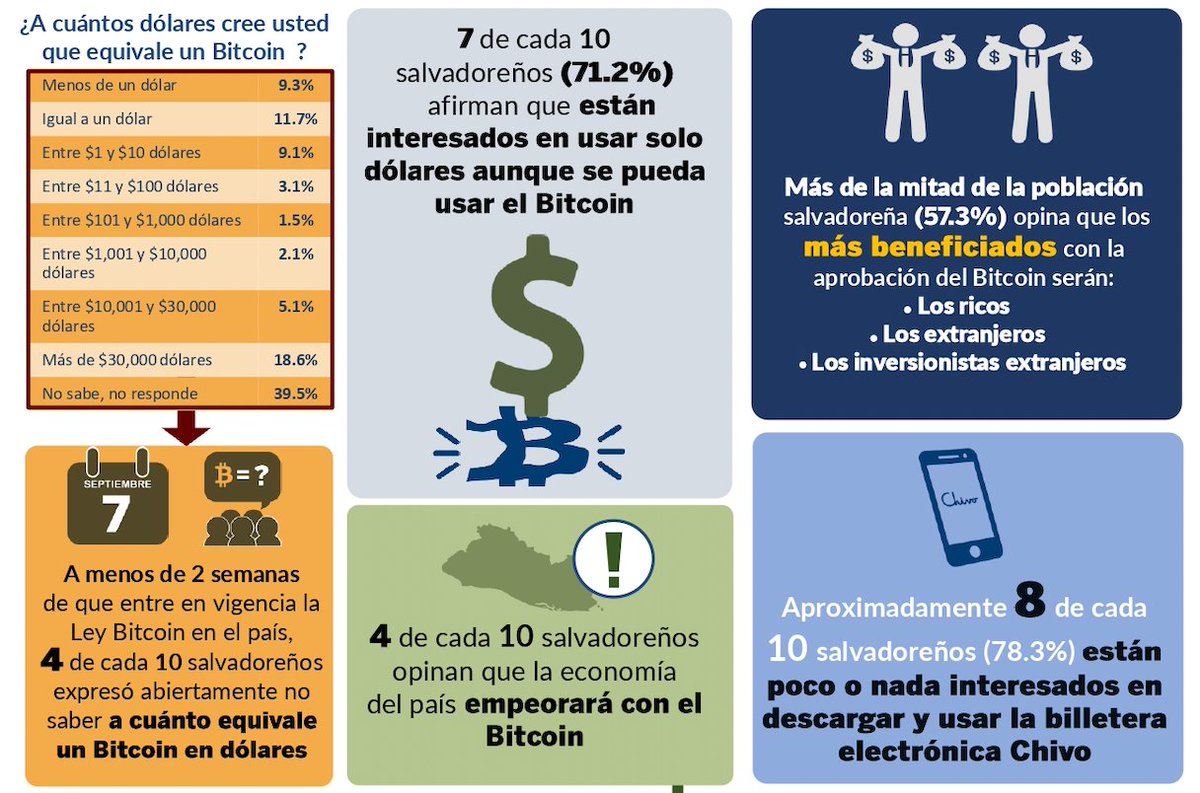

13/ This is totally reasonable and shows in recent polls, where virtually all respondents did not agree with such a mandate, and most had unfavorable views of BTC.

Interview 100 people in any random town in America or China or Brazil today and you'd likely get similar results

Interview 100 people in any random town in America or China or Brazil today and you'd likely get similar results

14/ The lack of knowledge and misinformation being spread among the protestors was staggering. The union secretary, for example, told me you needed $50,000 to buy Bitcoin, and that it would be hard for anyone in the country to use--despite the iPhone in her shirt pocket.

15/ And it's true that the government has been extremely opaque about the plans for the state-run Chivo wallet. Initially, it seemed to be a Lightning-based idea, but now leaked plans seem to point to a Cash App-type dollar app, that can simply receive/send BTC on-chain.

16/ We are going to learn a lot on Tuesday.

Will Salvadorans be able to download the app, claim their $30, and spend it?

Will the ATMs work?

For the first country to attempt national Bitcoin adoption, it could be a boondoggle.

Will Salvadorans be able to download the app, claim their $30, and spend it?

Will the ATMs work?

For the first country to attempt national Bitcoin adoption, it could be a boondoggle.

17/ However, the promise of the technological leap is massive. Around 25% of the country's GDP relies on remittances.

If families can receive these funds in Bitcoin from abroad and save in BTC or USD, or cash out at Chivo ATMs across the country, that's a major life upgrade.

If families can receive these funds in Bitcoin from abroad and save in BTC or USD, or cash out at Chivo ATMs across the country, that's a major life upgrade.

18/ Most likely the launch will be buggy, there will be issues, and delays.

It also seems that from talking to local business owners, that some are getting Bitcoin software to be able to accept BTC to be compliant with the law, but that they won't want to touch Bitcoin at first.

It also seems that from talking to local business owners, that some are getting Bitcoin software to be able to accept BTC to be compliant with the law, but that they won't want to touch Bitcoin at first.

19/ So in the early days of this new era, it seems likely that most Bitcoin flowing in to El Salvador from abroad, or being spent at stores in the capital, will go straight to the government. There are also major surveillance and confiscation concerns over the Chivo wallet.

20/ With that in mind, it's critical to help Salvadorans understand that not your keys, not your coins.

Education to help people download non-custodial, non-KYC wallets will be essential and important.

"Si no tienes las llaves, no es tu dinero" should be a rallying cry.

Education to help people download non-custodial, non-KYC wallets will be essential and important.

"Si no tienes las llaves, no es tu dinero" should be a rallying cry.

21/ As El Salvador takes a massive technological jump into the financial future, before any other country, there are bound to be mishaps.

The process may be derailed or discredited by Bukele himself, who has taken alarming actions in the past few months:

The process may be derailed or discredited by Bukele himself, who has taken alarming actions in the past few months:

https://twitter.com/NatashaFatah/status/1434344121364275200?s=20

22/ Most recently, by planning a purge of more than 100 of the country's top judges, and by getting clearance from the new judicial system to run for another term, something that was previously forbidden by the constitution.

https://twitter.com/HRF/status/1433470934443302914?s=20

23/ All that being said, El Zonte and the founders of Bitcoin Beach remain an incredible inspiration for El Salvador and the world.

The reality is, the situation is messy. There is no black and white, no "hot take" possible of capturing the full picture.

The reality is, the situation is messy. There is no black and white, no "hot take" possible of capturing the full picture.

24/ For Salvadorans who are open-minded and willing to put in work to understand Bitcoin it could yield enormous fruits.

Mama Rosa, for example, has operated her business in Bitcoin for the past 2 years, and has been able to afford assets like this truck for the first time ever:

Mama Rosa, for example, has operated her business in Bitcoin for the past 2 years, and has been able to afford assets like this truck for the first time ever:

25/ Either way, I look forward to reporting on the story of El Zonte and El Salvador's Bitcoin transition for @BitcoinMagazine.

Look out for my article to drop on September 15th ✌️

Look out for my article to drop on September 15th ✌️

26/ P.S. all of these photos were taken by me personally on my trip last week.

The charts are from the Instituto Universitario de Opinión Publica.

The charts are from the Instituto Universitario de Opinión Publica.

• • •

Missing some Tweet in this thread? You can try to

force a refresh