Chief Strategy Officer: @HRF + @OsloFF / Author: https://t.co/JbAaLXQAib + https://t.co/AsDltMVMam / Nostr: npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu

14 subscribers

How to get URL link on X (Twitter) App

2/ The essay is broken down into 9 parts, as follows

2/ The essay is broken down into 9 parts, as follows

https://twitter.com/profplum99/status/1765292018626933211So in this case the Scottish government paid for (donated) the microhydro setup that converted this river into electricity for this village and the surrounding area. But they don’t pay for OpEx. A local conservationist in charge of a nearby national park created a power company…

Like paper dollars or euros, CBDCs are liabilities of central banks

Like paper dollars or euros, CBDCs are liabilities of central banks

#2 On Natural vs Manmade Ledgers

#2 On Natural vs Manmade Ledgers

His theory is essentially that fossil fuels have given humanity a temporary subsidy (he calls it the "carbon pulse") to rapidly increase the size of our economies

His theory is essentially that fossil fuels have given humanity a temporary subsidy (he calls it the "carbon pulse") to rapidly increase the size of our economies

2/ Who gets hired to build the mine, the rail link, and the port so that the ore can be extracted, transported and then sold to international markets?

2/ Who gets hired to build the mine, the rail link, and the port so that the ore can be extracted, transported and then sold to international markets?

Random acts of insurrection are occurring constantly throughout the galaxy.

Random acts of insurrection are occurring constantly throughout the galaxy.

Worth watching the 2005 doc entirely for the classic scene where they get McCain to criticize Cheney’s influence and ties to Halliburton but then the interview is literally interrupted by a phone call to McCain’s office from Cheney and he has to go 🥶

Worth watching the 2005 doc entirely for the classic scene where they get McCain to criticize Cheney’s influence and ties to Halliburton but then the interview is literally interrupted by a phone call to McCain’s office from Cheney and he has to go 🥶

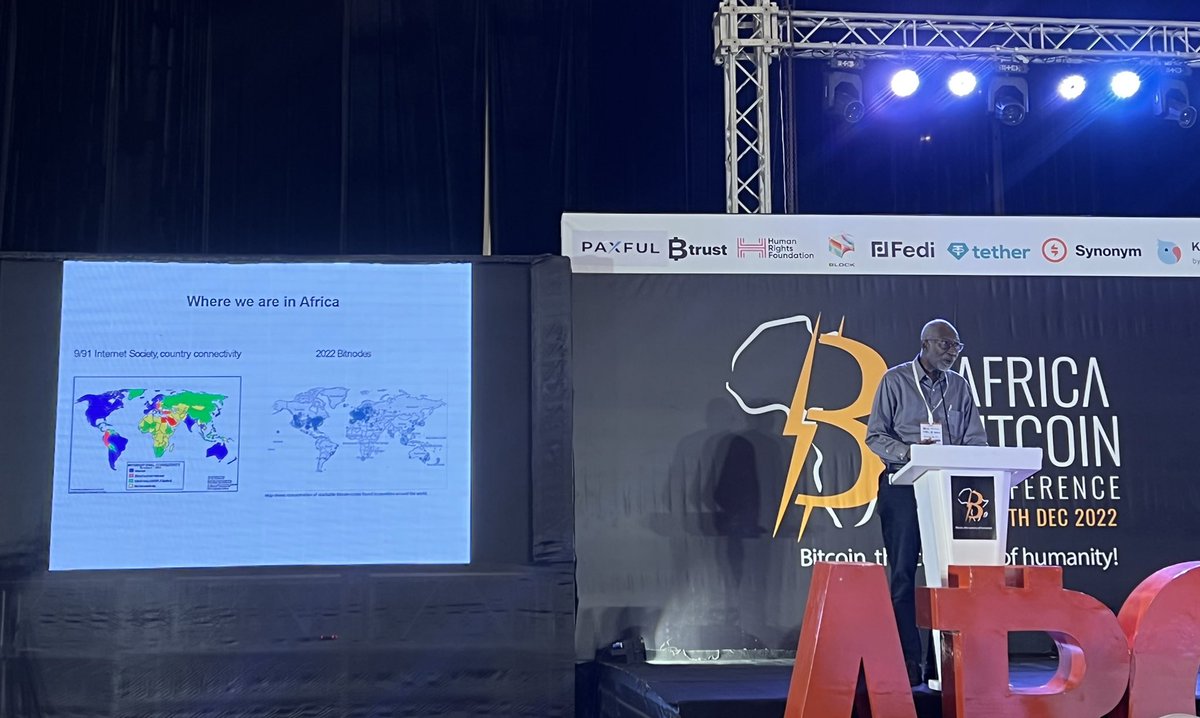

The Professor talks about the challenge ahead

The Professor talks about the challenge ahead