🚨🚨A Timeline of Contagion (9/8/21)👇👇

Why do I believe contagion in the property sector could cause a Chinese banking crisis? Well, because its been underway for some time...

Why do I believe contagion in the property sector could cause a Chinese banking crisis? Well, because its been underway for some time...

https://twitter.com/TheLastBearSta1/status/1435260167612997638?s=20

2. Evergrande is the Gorilla, but it is not unique nor is it the first. Below is the debt and equity trading of large stressed developers, in chronological order from when their debt began to fall. (these are USD bonds - onshore debt would be better but data is less accessible)

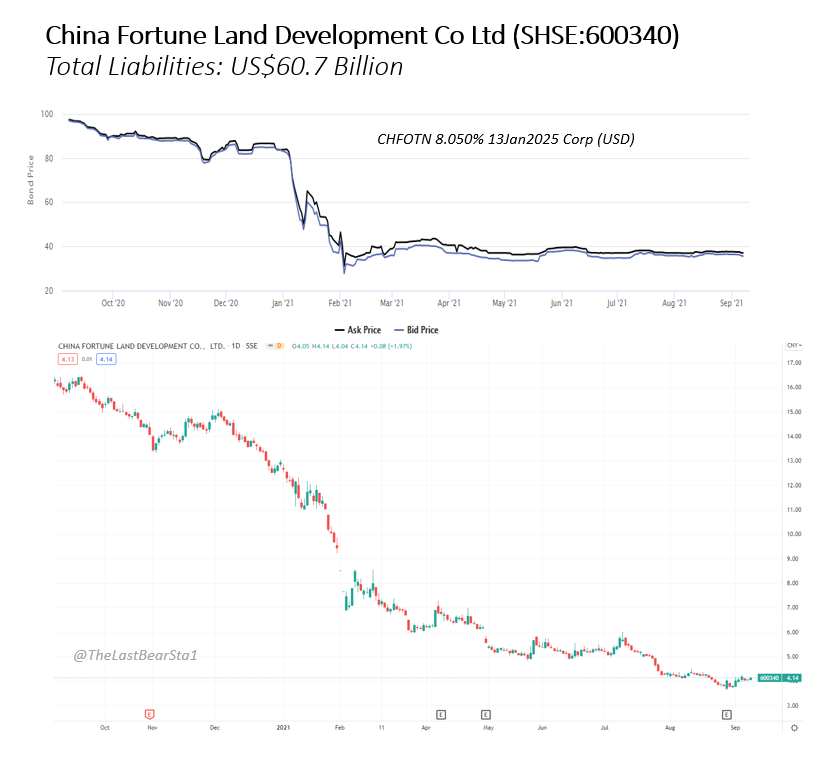

3. The First Domino: China Fortune Land Development ($61bn of liabilities): Defaulted in January - the first major default of this tightening cycle. Ping An - largest insurer in China - reported a $5.5bn loss relating to China Fortune in its 1H21 results.

4. China South City Holdings ($10bn of liabilities): Bonds trading at 100 as of Jan21 but has consistently traded down since February with a big step down in the past two weeks. Current price: 69. Current yield: 42%.

5. Yuzhou ($21bn of liabilities): Massive debt selloff in late March. Since then, its debt has remained surprisingly sturdy although its equity continues to fall.

6. Sichuan Languang ($31bn of liabilities): Initial weakness showed up in February but legged down in April before settling at just 25c on the dollar in July. Pricing now solely on recovery.

7. Evergrande ($304bn of liabilities): The Gorilla. You know the story. After surviving a big scare in Sept 2020, its debt stabilized for 9 months, until it began to sink in June. Three months later the most indebted developer in the world is functionally insolvent.

8. Central China Real Estate ($23bn of liabilities):

2024 USD bond prices:

January: 100

July: 87

Sept: 68

2024 USD bond prices:

January: 100

July: 87

Sept: 68

9. RiseSun ($36bn of liabilities):

Issued a new USD bonds on January 11th at 100.

Price on July 5: 87.

Price on Sept 6: 59.

*swings in the debt since June show what illiquidity looks like*

Issued a new USD bonds on January 11th at 100.

Price on July 5: 87.

Price on Sept 6: 59.

*swings in the debt since June show what illiquidity looks like*

10: Sunshine City ($7bn of liabilities):

Smaller fish, same story. Selloff has accelerated in the past 6 weeks. Clearly illiquid but the trend is one-way.

Smaller fish, same story. Selloff has accelerated in the past 6 weeks. Clearly illiquid but the trend is one-way.

11. Fantasia ($12bn of liabilities):

Post Evergrande - things are falling faster. Bonds traded at par in June. By September, banks stopped accepting it as collateral: bloomberg.com/news/articles/…

Post Evergrande - things are falling faster. Bonds traded at par in June. By September, banks stopped accepting it as collateral: bloomberg.com/news/articles/…

12. Guangzhao R&F ($51bn of liabilities): This is *shit your pants* territory. R&F is a major developer that did not even show stress even as Evergrande began to fall. The chart below speaks for itself:

13. What does this tell us? First - Evergrande is not unique, rather its one of many. Second - collateral has been getting squeezed for months as defaults mount. Third - the most recent selloffs have been more abrupt and violent in issuers whose stress emerged just weeks ago.

14. Its not coincidental - its a chain reaction. If a developer defaults, lenders cut lending to its peers. As lending dries, it makes those peers much more likely to fail. Each default also decreases the expected recovery as fire sales crush the market of the underlying.

15. Combined, the names above - each in default or significant stress - represent over half a trillion dollars of total liabilities. Liabilities are not just debt, but payments to suppliers, employees, remaining construction costs etc. The whole ecosystem is on the brink.

16. The key questions at this point are (1) which developers are next and (2) will this spill into the bank sector, which I believe poses the largest systematic risk

17. On (1) the developers that would pose the highest risk to the system based on size and leverage are Greenland and Sunac (each over $150bn in liabilities). Vanke and Country Garden probably follow. So far their debt remains sturdy, but that can change quickly.

18. On (2) Rural banks with the highest exposure to the worst property markets would be the most obvious candidates. But it could come from elsewhere less obvious as well- recall Ping An.

19. Regulators are probing Ping An - the only insurer labeled "systematically important" and down 40% since January. Most reporting suggests losses were direct investment - but they were ordered to stop selling "alternative investment products". Hm..

cnbc.com/2021/08/31/chi…

cnbc.com/2021/08/31/chi…

20. To reiterate a point I've made repeatedly - we quote bond prices because its the only data we have. Most lending however is bank and trust loans - much more opaque. But we know that these banks have massive loan exposure to these developers and their collateral is withering.

21. While the situation continues to deteriorate - there still seems to be no *plan* at all. Recent central comments have stressed the importance of maintaining calm markets - but there is no indication of exactly how that will be achieved. Meanwhile the levees are breaking.

21. Finally - The point of these threads are not to fearmonger, but merely my share analysis for you to consider in your risk outlook, whether you agree or disagree with the conclusions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh