Avita Medical Inc. $AVH $AVH.AX is best known for its product ReCell $RCEL – spray on skin for burns victims. After a long history of innovation, commercial success has evaded this once-darling. Is this time different?

Let’s take a deep dive on 3 key metrics to watch.👇

Let’s take a deep dive on 3 key metrics to watch.👇

1. Investment thesis: Fast grower / turnaround.

Innovative product with clear use case, competition falling way, optionality on new applications, top-line growth as adoption improves. Questionable management.

Innovative product with clear use case, competition falling way, optionality on new applications, top-line growth as adoption improves. Questionable management.

2. History in a nutshell. Founded as ‘Clinical Cell Culture’ in 1993 by Prof. Fiona wood who developed the tech with Marie Stone. First big test for ReCell was after the 2002 Bali Bombings treating the burn victims. renamed Avita in 2008.

3. Interesting Fun fact. In 2015 Avita divested it’s Breath-A-Tech products to $MVP for $2.64m. This followed a strategic review to focus on ReCell. MVP is doing a strategic review, and on the table is divesting Breath-A-Tech to focus on Penthrox.

https://twitter.com/DownunderValue/status/1435076635561119750

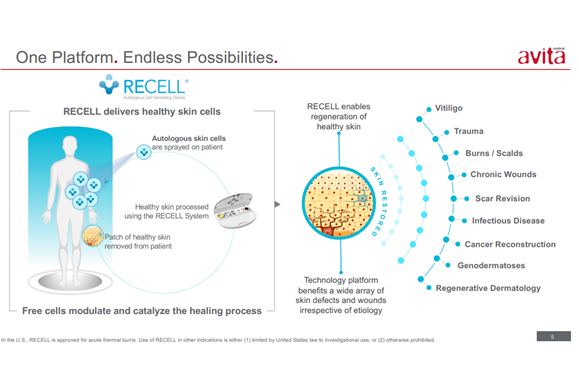

4. The technology. ReCell is a device that uses the patients skin to produce cells in 30mins that are sprayed on to the patient. This is a huge improvement over skin graft in terms of cost effectiveness, patient outcomes, and surgeons ease of use, etc.

avitamedical.com/product/

avitamedical.com/product/

5. So that’s the set up. So much has been written about it’s history, let’s just agree to move on.

These are the three metrics I'm closely following:

🩹Adoption

🩹Revenue Growth, and

🩹'Adjusted’ SAM.

These are the three metrics I'm closely following:

🩹Adoption

🩹Revenue Growth, and

🩹'Adjusted’ SAM.

6. Adoption in medical devices struggles to go from early adopters (intrinsic belief in tech) to early majority (evidence and experience driven). Avita has been stuck at this flat / early stage of the adoption curve.

meddeviceonline.com/doc/take-the-n…

meddeviceonline.com/doc/take-the-n…

7. Super users. In CY19, 6% of burns centers accounted for ~60% of the revenue, and ~20% of the trained surgeons accounted for over ~80% of the procedures. These were the super users. New sites and more trainings simply wasn’t impacting revenue.

And then…

And then…

8. June 2021, FDA approves the use of ReCell in extensive burns (+50% of body) and pediatric applications (age 1month+). Kids are ~50% of the burns victims, and extensive burns are difficult procedures. So this massively expands the use case for surgeons.

9. Early majority is now converted, late majority is next.

In 4Q21, 49% of all US burns surgeons used ReCell at least once, bringing the market share to 8%. 81% surgeons are certified and 73% of all burns units activated.

In 4Q21, 49% of all US burns surgeons used ReCell at least once, bringing the market share to 8%. 81% surgeons are certified and 73% of all burns units activated.

10. Scuttlebut from a burns nurse, one of the challenges has been the device.

With a new ‘ease of use’ ReCell device submitted to FDA for approval, it seems that broader adoption is ready for take off. This has been my biggest barrier to investing in Avita.

With a new ‘ease of use’ ReCell device submitted to FDA for approval, it seems that broader adoption is ready for take off. This has been my biggest barrier to investing in Avita.

11. Next, revenue growth.

Revenue had been pitiful, particularly if you remove the BARDA (US emergency stockpiles) income and sales since Sep ‘15, ending in Dec ‘23. All figures reported are $US.

Revenue had been pitiful, particularly if you remove the BARDA (US emergency stockpiles) income and sales since Sep ‘15, ending in Dec ‘23. All figures reported are $US.

12. Commercial sales grew 54% yoy and 45% QoQ. These are the green shoots of technological adoption and commercial execution, albeit from a low base.

This needs to be monitored closely, but my benchmark of success would be $35m FY22 / $50m FY23.

This needs to be monitored closely, but my benchmark of success would be $35m FY22 / $50m FY23.

13. SAM I Am. Reporting by Avita is focused on excessively high TAMs, and SAMs that seem to be like shifting sands. So be wary on using their reported figures.

In FY21 they reported SAM of $1.5-$2bn including their pipeline (image from FY20)

In FY21 they reported SAM of $1.5-$2bn including their pipeline (image from FY20)

14. The ‘Adjusted SAM’ I think is reasonable is ~$300m right now, with a full potential of ~$850m. This includes thermal burns ($300m), Japan expansion ($100m), and other skin injuries ($450m) in trauma centres (same procedure, different sites, but for non burn victims).

15. Free optionality on the ‘never never’. I exclude from the SAM Vitiligo ($750m) as it is at such an early stage (current clinical trial 23 patients), Epidermolysis Bullosa & Rejuvenation. If they come off, great, but I won’t pay for it in the share price right now.

16. De risking events. @7MaxxChatsko writes on $RCEL for @7investing and considers de-risking events as catalysts for investing. Nice framework.👍

I won’t share his analysis (go and subscribe), but just to note there are things coming up to keep an eye on.

I won’t share his analysis (go and subscribe), but just to note there are things coming up to keep an eye on.

17. Risks – Competition. RenovaCare $RCAR is developing CellMist. They defeated Avita in court of patent issues in 2018. But since June, RCAR has been under SEC investigation for fraud / marketing, and their clinical trial only has 14 patients.. 😬

18. Risks - Management. CEO Michael Perry has many detractors. A main issue is not just an under performance of the company, but his massive paychecks. Indeed, management pays more in bonuses and options to themselves than they are getting in revenue.

19. Valuation. Avita trades at US$470m market cap, ~x22 FY21 and ~x10 FY23 revenues. Reasonable or even cheap for a fast growing medical device with a decent runway.

Though if growth falters or competition heats up, could go to 10x FY21/22 sales and see >30% drops. ⚠️

Though if growth falters or competition heats up, could go to 10x FY21/22 sales and see >30% drops. ⚠️

20. Summary. I expect Avita has passed an inflection point. Adoption should ramp up in this clinically proven and approved tech, and growth should continue.

This is sufficient for me to take a starter position, and I’ll continue to monitor my three key metrics.

This is sufficient for me to take a starter position, and I’ll continue to monitor my three key metrics.

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DM’s open. DYOR.

Disclaimer, I am long $AVH.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DM’s open. DYOR.

Disclaimer, I am long $AVH.

In case you missed it, Avita announced yesterday they received approval for US Medicare to reimburse the device costs for hospital outpatients and ambulatory surgery centers.

This was a major cause of recent revenue misses... Let's see if it changes things... market liked it.

This was a major cause of recent revenue misses... Let's see if it changes things... market liked it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh