0/ Yesterday was $AFRM's 3rd earnings call as a public co but @mlevchin treated it like Day 1 articulating the vision for AFRM to "unbundle the credit card," discussing TAM, product roadmap, the 10-year+ vision, & recent trends / consolidation

Worth a listen given BNPL debates.

Worth a listen given BNPL debates.

1/ For FY21 $AFRM facilitated 16M+ transactions & $8B+ in GMV for 7M users with merchants +5x YoY

Initial FY22 guidance of $12.75B of GMV vs. high-end Street at ~$12B (doesn't include $AMZN, or Debit+, modelling $PTON (-30-35%) YoY vs. Street +, $SHOP is implied at ~$600M-$1.0B.

Initial FY22 guidance of $12.75B of GMV vs. high-end Street at ~$12B (doesn't include $AMZN, or Debit+, modelling $PTON (-30-35%) YoY vs. Street +, $SHOP is implied at ~$600M-$1.0B.

2/ He spent a lot of time talking about the @Returnly acquisition & looking at other ways to add value for their merchants.

He highlighted their merchant marketplace (~1/3 of FY21 tx's occurred here)

He highlighted their merchant marketplace (~1/3 of FY21 tx's occurred here)

3/ In his view the next frontier of "unbundled payments" is daily spend: groceries, restaurants, incidental purchases

This is why they're rolling out Affirm Debit+ card (1M+ waitlist already) this will connect to existing bank accounts & turn any tx into a pay over time product

This is why they're rolling out Affirm Debit+ card (1M+ waitlist already) this will connect to existing bank accounts & turn any tx into a pay over time product

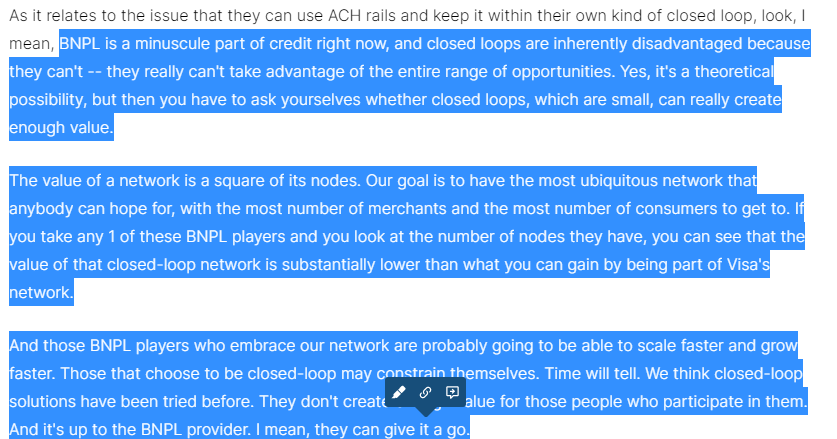

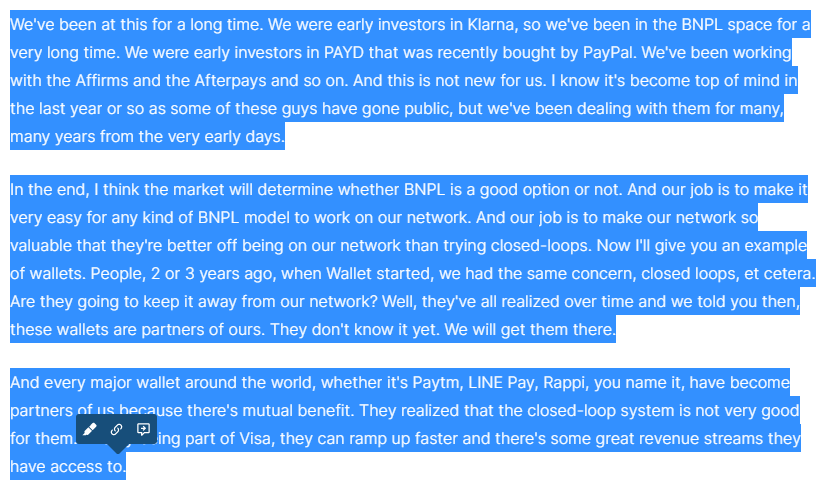

4/ $V CFO spoke at DB yesterday & was asked re: BNPL & ACH payments to create a parallel network w/ SKU level-data & disintermediate the card networks:

Full transcript below but a couple of highlights

Full transcript below but a couple of highlights

5/ $V will enable money movement & credit anyway in which merchants, issuers, and consumers want to offer, accept, or borrow money.

He points out the MDR fees & that at some point merchants will need to decide about the cost of BNPL vs. traditional credit

He points out the MDR fees & that at some point merchants will need to decide about the cost of BNPL vs. traditional credit

6/ He also mentions the tailwinds from BNPL for $V (e.g., large ticket items they may not have gotten, multiple usage of credentials for multiple transactions)

In models where the BNPL provider has to pay the merchant, they offer a virtual card solution that allows them to pay

In models where the BNPL provider has to pay the merchant, they offer a virtual card solution that allows them to pay

7/ In other use cases they also want to be issuers where they issue our own credentials into their apps, & when a purchase is made, it all happens on V credentials, including repayments; this adds new issuers to their network.

9/ They also answered questions on open banking highlighting their network of network strategy:

"We want to be interoperable across networks. We want to be able to get your money wherever it needs to go....If you need to get your money through an ACH network, an RTP network...."

"We want to be interoperable across networks. We want to be able to get your money wherever it needs to go....If you need to get your money through an ACH network, an RTP network...."

10/ "We're also going to be interoperable across blockchains. We've already started to settle in USDC. We will settle in additional stable coins over time. We will be very interoperable across currencies, we'll be interoperable across cryptocurrencies."

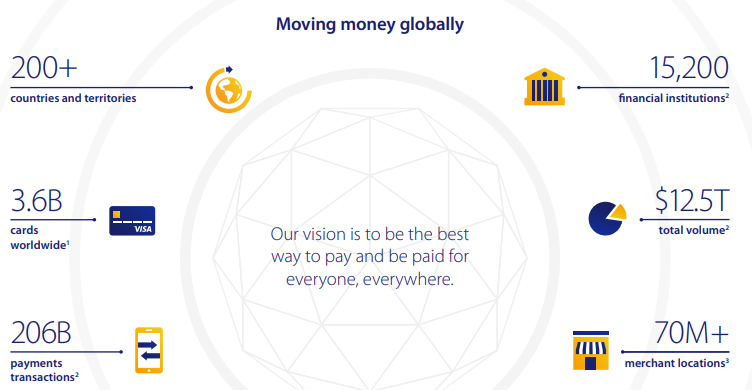

11/ He kept emphasizing the size & omnipresence of the $V network....credentials are accepted at 70m+ merchants, with 3.6B+ cards globally.

Going to be a lot of twists & turns of how these business converge / compete / work together, etc...

Going to be a lot of twists & turns of how these business converge / compete / work together, etc...

• • •

Missing some Tweet in this thread? You can try to

force a refresh