How to get URL link on X (Twitter) App

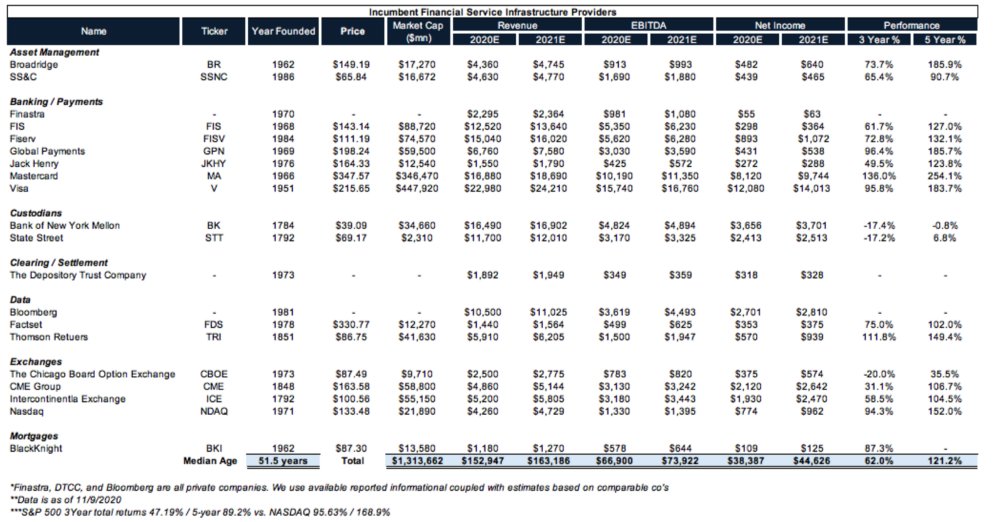

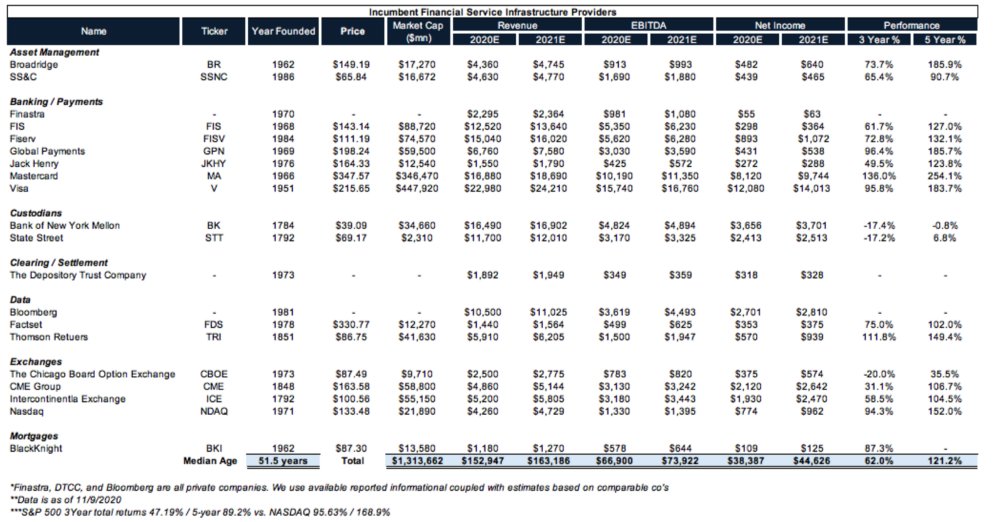

1/ When looking at the opportunity for FinTech / Crypto to disrupt banks there's the view that payments are a "solved" problem despite a ~$2T+ rev opportunity

1/ When looking at the opportunity for FinTech / Crypto to disrupt banks there's the view that payments are a "solved" problem despite a ~$2T+ rev opportunity

1/ These customer bases are starting to surpass incumbents: E.g., $BAC has 39.3M "digital users" (12.9M Zelle) while $JPM has 63.4M households, 55.3M digital / 40.9M mobile customers

1/ These customer bases are starting to surpass incumbents: E.g., $BAC has 39.3M "digital users" (12.9M Zelle) while $JPM has 63.4M households, 55.3M digital / 40.9M mobile customers

1/ They talk about extending their expertise in the public market, "We believe there is a robust pipeline of high quality software companies that are both ready to take advantage of the opportunities that the public market has to offer & would benefit from partnering with us."

1/ They talk about extending their expertise in the public market, "We believe there is a robust pipeline of high quality software companies that are both ready to take advantage of the opportunities that the public market has to offer & would benefit from partnering with us."

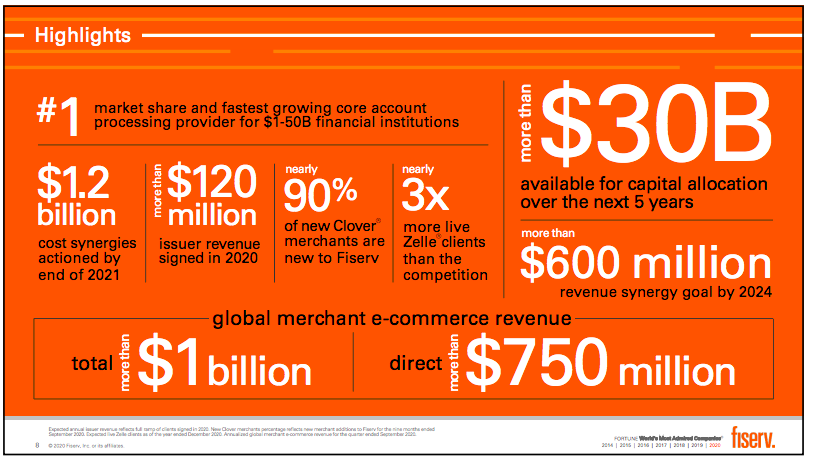

1/ $FISV highlights the fact that they have #1 market share in core accounting processing for $1-$50B FI’s; they are doing $1.0B in global e-Commerce revenue, and have more than $30B available for capital allocation over the next 5 years (read more M&A for FinTech co's)

1/ $FISV highlights the fact that they have #1 market share in core accounting processing for $1-$50B FI’s; they are doing $1.0B in global e-Commerce revenue, and have more than $30B available for capital allocation over the next 5 years (read more M&A for FinTech co's)