A few setups/strategies that can make your intraday trading easy. I follow them personally:

Add these stocks in your watchlist for next few days -

-If a stock closed exactly at resistance with good volumes or it has been consolidating near resistance for a long time. (1/10)

Add these stocks in your watchlist for next few days -

-If a stock closed exactly at resistance with good volumes or it has been consolidating near resistance for a long time. (1/10)

In other words.. if a stock is on the verge of a breakout..

- If any stock gave a breakout and then a good closing.

You can find out these stocks through top gainers/losers in live market but it's good if have the watchlist ready. (2/10)

- If any stock gave a breakout and then a good closing.

You can find out these stocks through top gainers/losers in live market but it's good if have the watchlist ready. (2/10)

If a stock is giving breakout in a higher timeframe, it should be on your radar for the next few days. Look if there is any pattern forming in a lower timeframe - flag & pole, triangles, inside bar, rising and falling wedges/parallel channels. H&S. cup and handle. (3/10)

It gets easy to trade through patterns and we get an idea of the target as well.

Target is simply the height of the pattern.

These are the basic patterns which we use in case you're not aware: 👇

(4/10)

Target is simply the height of the pattern.

These are the basic patterns which we use in case you're not aware: 👇

(4/10)

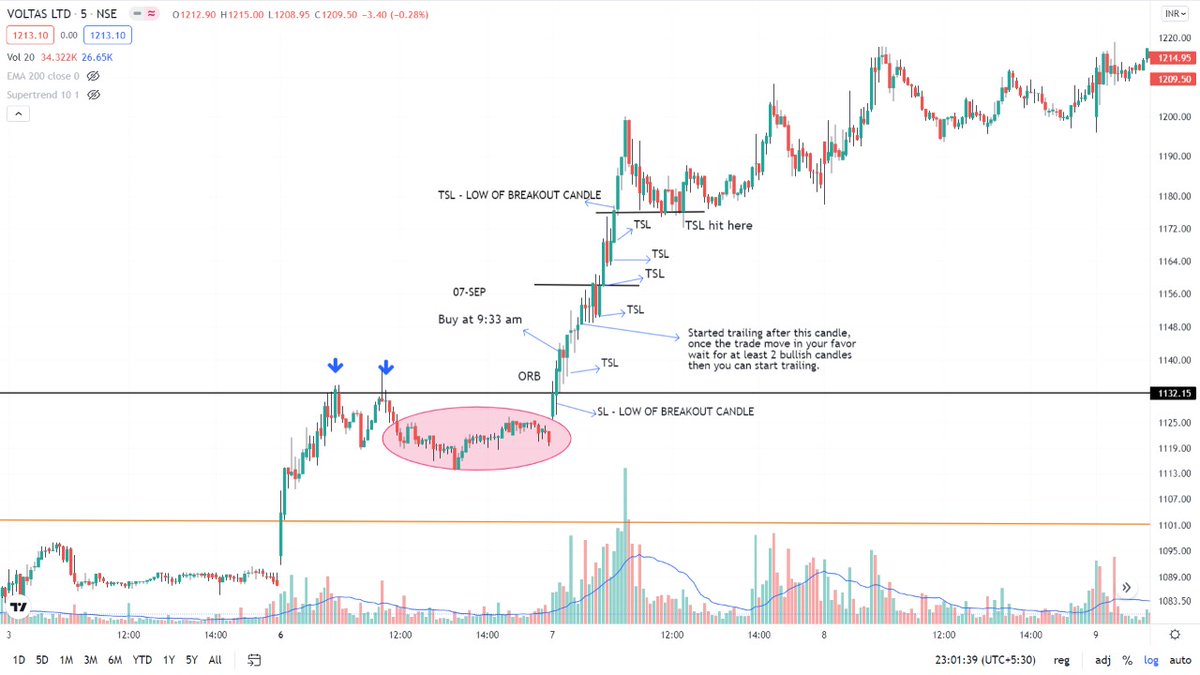

ORB Setup - Opening range breakout

Let's say if a stock opens gap up above the breakout level with good volumes. (In a bull market, you easily get these breakouts every other day).

- I observe that stock between 9:25 and 9:30 to check if it's giving any bullish candles. (5/10)

Let's say if a stock opens gap up above the breakout level with good volumes. (In a bull market, you easily get these breakouts every other day).

- I observe that stock between 9:25 and 9:30 to check if it's giving any bullish candles. (5/10)

If I see the first 2-3 good bullish candles with volumes in those 5 mins, I take an entry with 5 mins/3 mins (for fast entry) timeframe with day low SL. If the first candle itself is too big, I keep SL at half of the candle or take a small quantity (as per my risk mgmt.). (6/10)

Once the stock moves in my favour, I start trailing my SL to the last candle's low. (I shift my trailing SL, only when the next candle is a proper bullish one).

Here are the recent examples of ORB 👇

(7/10)

Here are the recent examples of ORB 👇

(7/10)

P.S. - I follow candlestick for trailing when stock gives one sided move post breakout and swing low for trailing if it's a pullback trade. People use methods like vwap and dma also for trailing. But you would need back testing and see if it works for you. (8/10)

I used to trade ORB setup but I got more confidence after seeing @AnandableAnand sir's tweets. I started doing this aggressively on a regular basis. He is really good at this. You can check his timeline or YouTube videos for more information.

Eg.

(9/10)

Eg.

https://twitter.com/AnandableAnand/status/1434759703699996673?s=19

(9/10)

Next example is of IEX- How can you use a stock for Intraday post breakout using patterns in lower timeframe.

and Nifty symmetrical triangle in 5 min. timeframe. 👇

Hope this helps!

(10/10)

and Nifty symmetrical triangle in 5 min. timeframe. 👇

Hope this helps!

(10/10)

Correction- I observe the stock between 9:15 to 9:30 am.

For more examples check this tweet also.

https://twitter.com/RijhwaniSheetal/status/1430010069433806852?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh