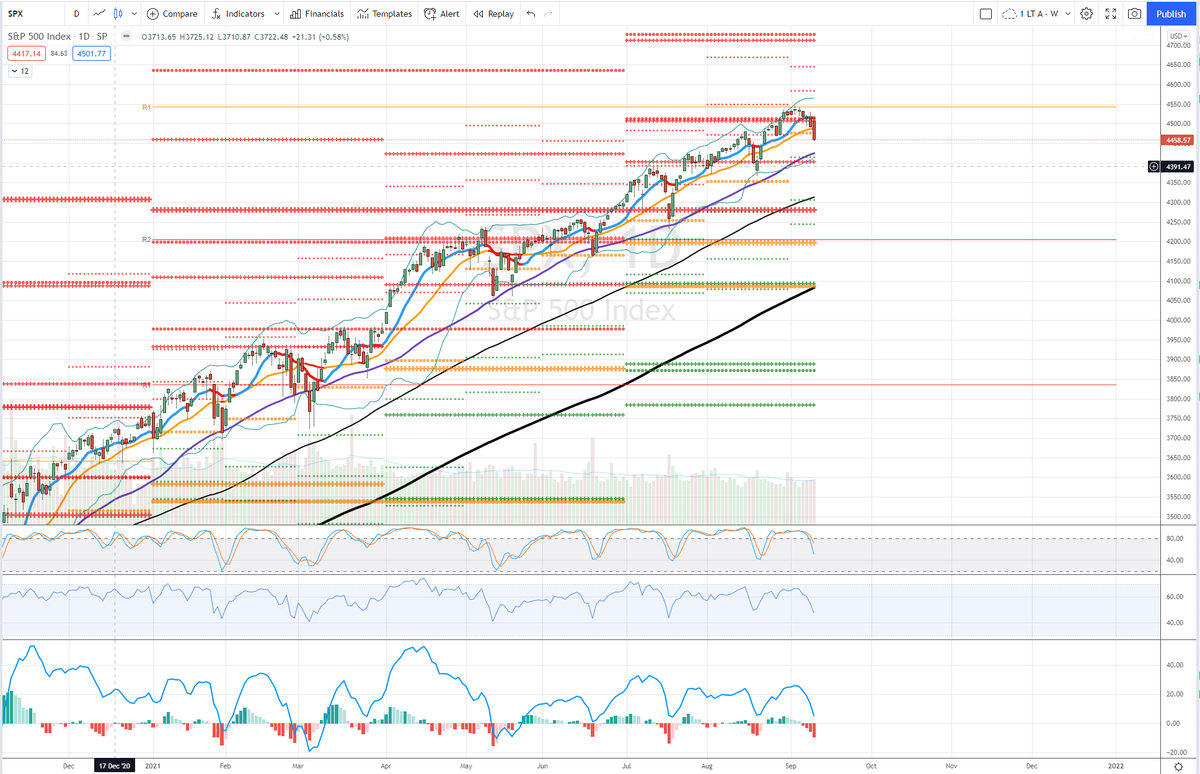

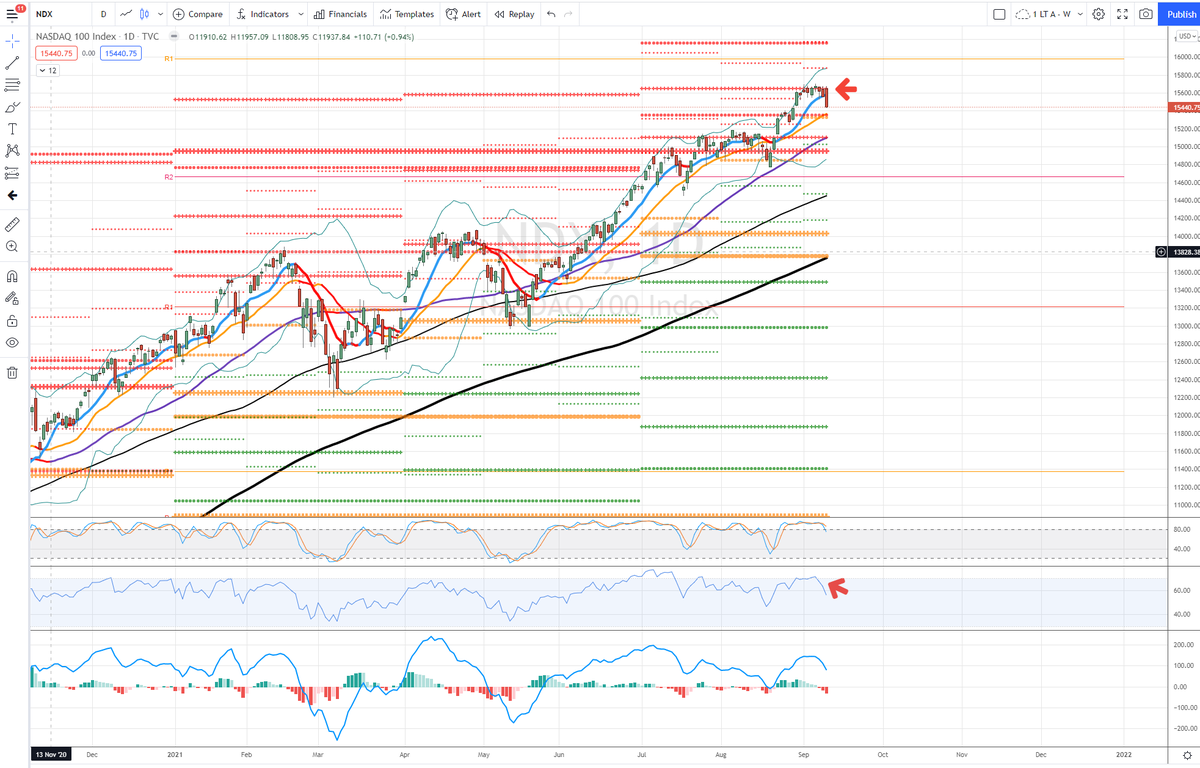

Index TA

Now some of these lines will make more sense to those who read TA threads

DJI exceeded QR1 AugR1 combo for 2 trading days, since then levels as resistance; slight poke above QR1 9/2 (small red arrow)

Broke SepP 9/7 (orange)

Broke D50MA 9/9

Back under YR1 9/10 (red)

Now some of these lines will make more sense to those who read TA threads

DJI exceeded QR1 AugR1 combo for 2 trading days, since then levels as resistance; slight poke above QR1 9/2 (small red arrow)

Broke SepP 9/7 (orange)

Broke D50MA 9/9

Back under YR1 9/10 (red)

This is significant technical deterioration in short amount of time

Medium term levels acting as resistance

Pivot status change

Break of D50 & yearly level

So, comeback or smash? With astro, thinking smash

Medium term levels acting as resistance

Pivot status change

Break of D50 & yearly level

So, comeback or smash? With astro, thinking smash

RUT

Under QP (bigger orange)

Testing SepP

Another lower high, how much longer before big breakdown of range?

D200 area tested 2x so next time could smash

Under QP (bigger orange)

Testing SepP

Another lower high, how much longer before big breakdown of range?

D200 area tested 2x so next time could smash

Oh PS!

SPX high on DeMark YR1!

Last week: "Testing DeMark YR1 - jeez I'd like for some real institutional pros to take a whack at this"

SPX high on DeMark YR1!

Last week: "Testing DeMark YR1 - jeez I'd like for some real institutional pros to take a whack at this"

https://twitter.com/MarsiliosMM/status/1434547330460504066

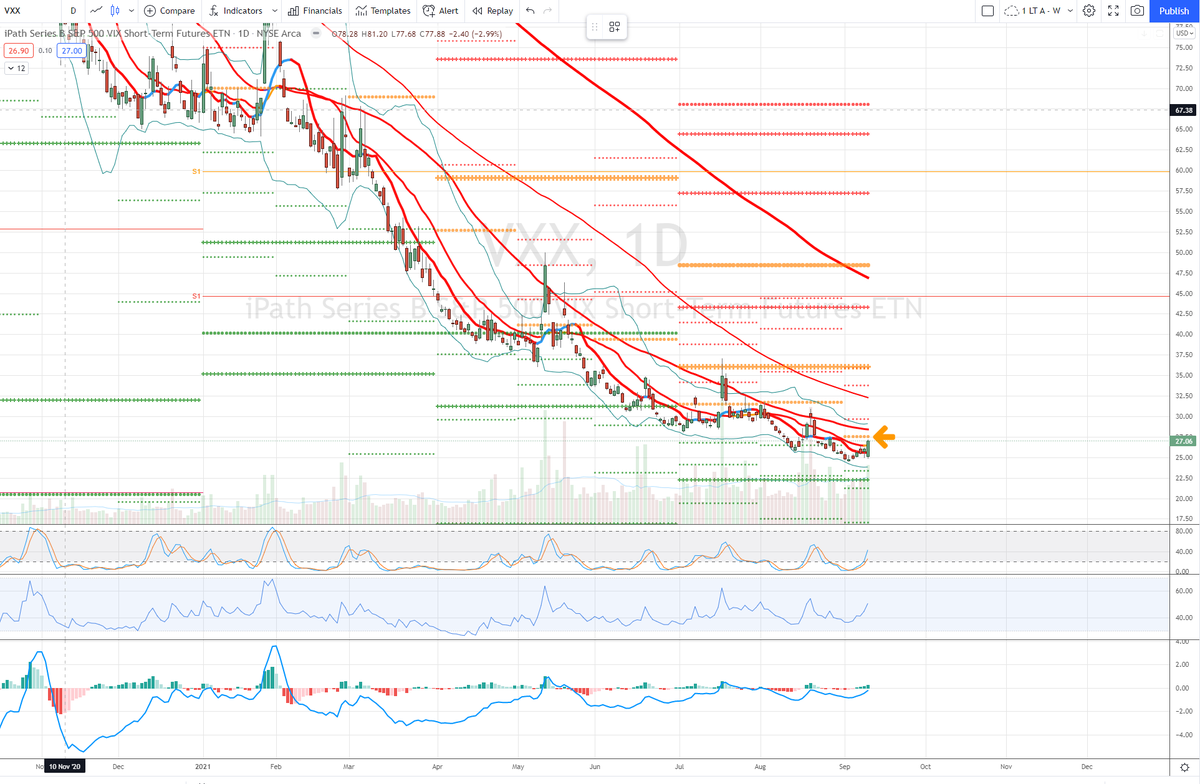

VIX

Support at DeMark YS1 (orange line with arrow)

Lifted above SepP (small arrow)

and QP (larger arrow

Plus D200MA!

All we need is VXX SVXY a bit more for full volatility confirm

Support at DeMark YS1 (orange line with arrow)

Lifted above SepP (small arrow)

and QP (larger arrow

Plus D200MA!

All we need is VXX SVXY a bit more for full volatility confirm

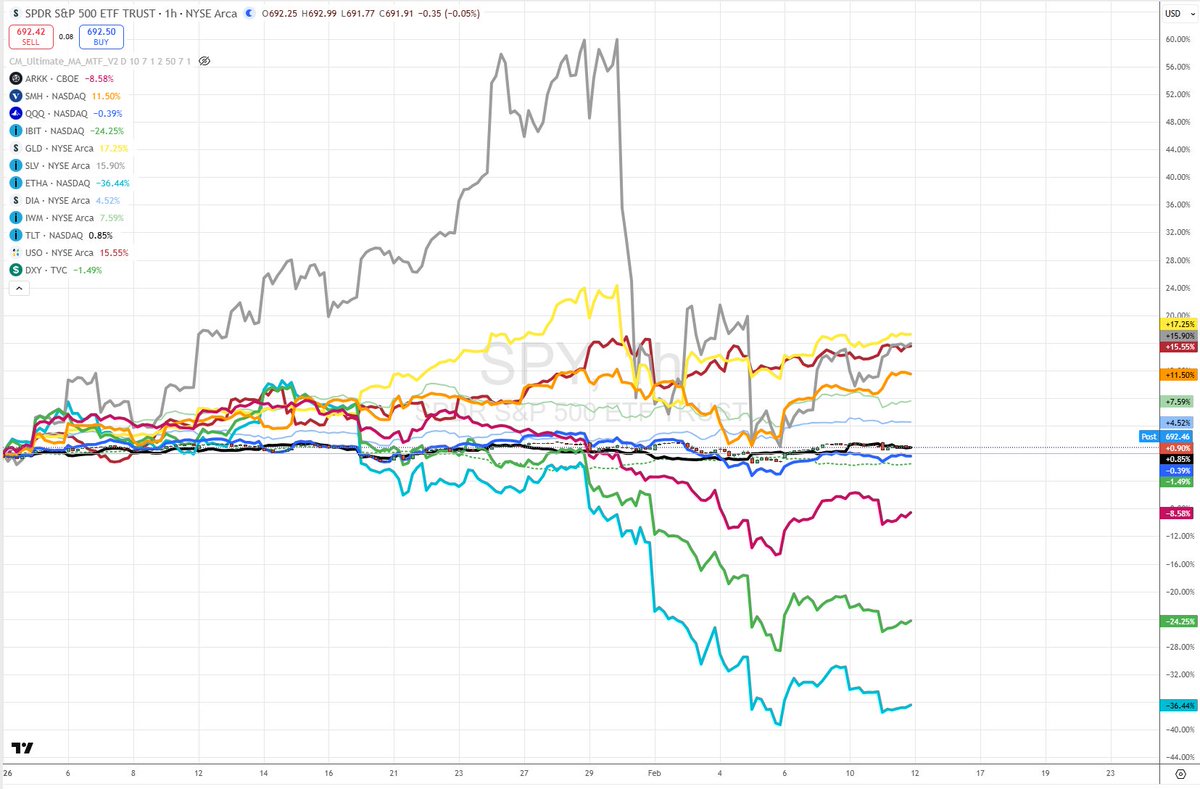

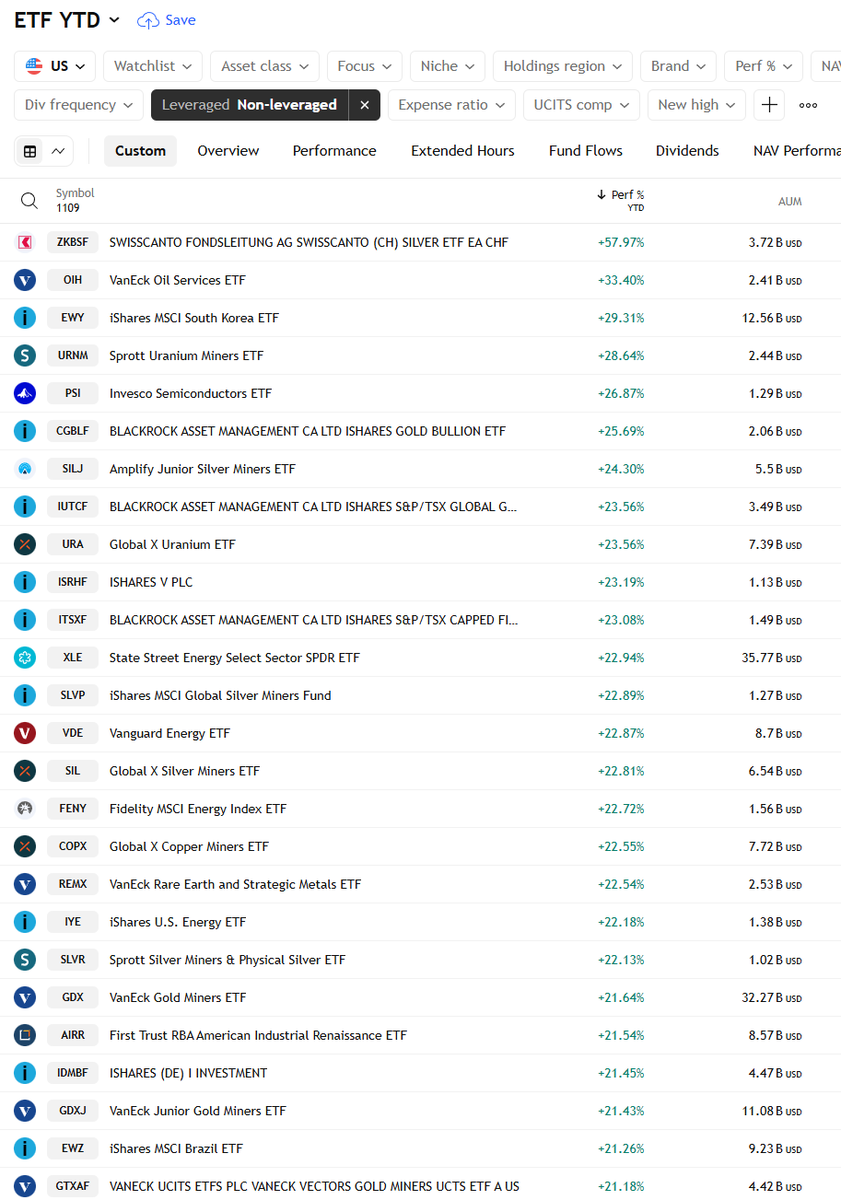

Stage is all set for Sept smash

All indexes resistance highs

Some pivot status changes

VIX confirming

"September"

Astro Mars very weak and negative aspects ahead, with Mercury slowing in Air sign (historical negative)

unroll @threadreaderapp

All indexes resistance highs

Some pivot status changes

VIX confirming

"September"

Astro Mars very weak and negative aspects ahead, with Mercury slowing in Air sign (historical negative)

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh