Europe’s energy crunch is deepening 🚨

With about a month to go before the start of the heating season, Europe doesn’t have enough natural gas in storage and isn’t building inventories fast enough either. Gas and power prices are hitting new records

bloomberg.com/news/articles/…

With about a month to go before the start of the heating season, Europe doesn’t have enough natural gas in storage and isn’t building inventories fast enough either. Gas and power prices are hitting new records

bloomberg.com/news/articles/…

Europe is struggling to refill natural gas inventories, with flows from No. 2 supplier Norway currently limited due to maintenance

Top seller Russia is “is coming off an extended period of inexplicably low supply” at a time when US deliveries of LNG can’t be increased further

Top seller Russia is “is coming off an extended period of inexplicably low supply” at a time when US deliveries of LNG can’t be increased further

Bloomberg wrote in late-June that there just isn't enough natural gas to calm down the global rally in prices

TTF has DOUBLED since the article was published

bloomberg.com/news/articles/…

TTF has DOUBLED since the article was published

bloomberg.com/news/articles/…

And what happens when there is a natural gas supply crunch?

A "simply incredible" surge in the price of electricity

A "simply incredible" surge in the price of electricity

https://twitter.com/JavierBlas/status/1437352577130278923?s=20

And the energy crunch isn't just isolated to Europe...

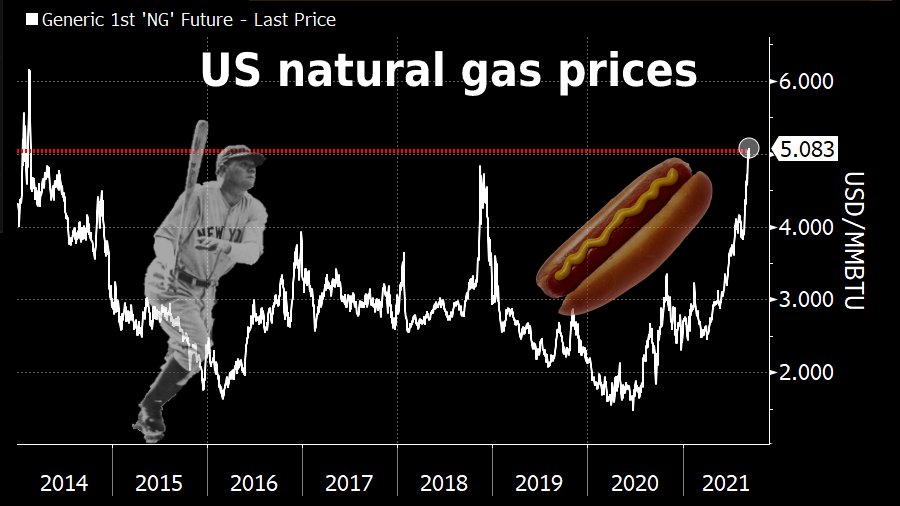

🇺🇸 US natural gas prices have jumped to the highest level in 7 years. Shale drillers haven't been able to lift production fast enough to refill seasonally low inventories, while LNG exports are near an all-time high

🇺🇸 US natural gas prices have jumped to the highest level in 7 years. Shale drillers haven't been able to lift production fast enough to refill seasonally low inventories, while LNG exports are near an all-time high

Germany’s power price traded above 100 euros/MWh for the first time, boosted by the natural gas supply crunch 🇩🇪

Germany relies on fossil fuels for more than 1/3rd of its electricity, and soaring costs set to boost bills for millions of consumers

bloomberg.com/news/articles/…

Germany relies on fossil fuels for more than 1/3rd of its electricity, and soaring costs set to boost bills for millions of consumers

bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh