1/ A random DeFi story: My colleague @VetleLunde at @ArcaneResearch told me about an arb opportunity on Aug 18 between HEZ<>MATIC. HEZ holders will be able to swap 1 HEZ for 3.5 MATIC after the announced @PolygonHermez launch.

HEZ was trading at $4.18

3.5x MATIC traded at $4.83

HEZ was trading at $4.18

3.5x MATIC traded at $4.83

2/ At first I did not believe the arb was real--buying HEZ was essentially buying MATIC at a 13.5% discount if the merger would happen as announced. It was a long time since I made an effort to chase easy arbs manually in crypto (I thought they would be gone by now).

3/ There are a number of risks and limitations that can cause a discount. In this case, the obvious ones were:

- What is the % that the merger does not happen?

- How long will it take until the merger?

- How expensive is it to short $MATIC for said duration?

- How liquid is $HEZ?

- What is the % that the merger does not happen?

- How long will it take until the merger?

- How expensive is it to short $MATIC for said duration?

- How liquid is $HEZ?

4/ There's multiple variables here so it's not really clear if the discount was just fair or actually attractive. All that we know is that the market shows us a signal of 13.5%, but there's no way to know for sure if this is a discrepancy/mispricing or an apt assessment of risk.

5/ Personally, the 13.5% discount felt pretty rare, but I was interested in learning about why the discount was so big. So I decided to try it out and see what happened, hoping that the discount would atleast net me out above +-0 after all network and interest fees were paid.

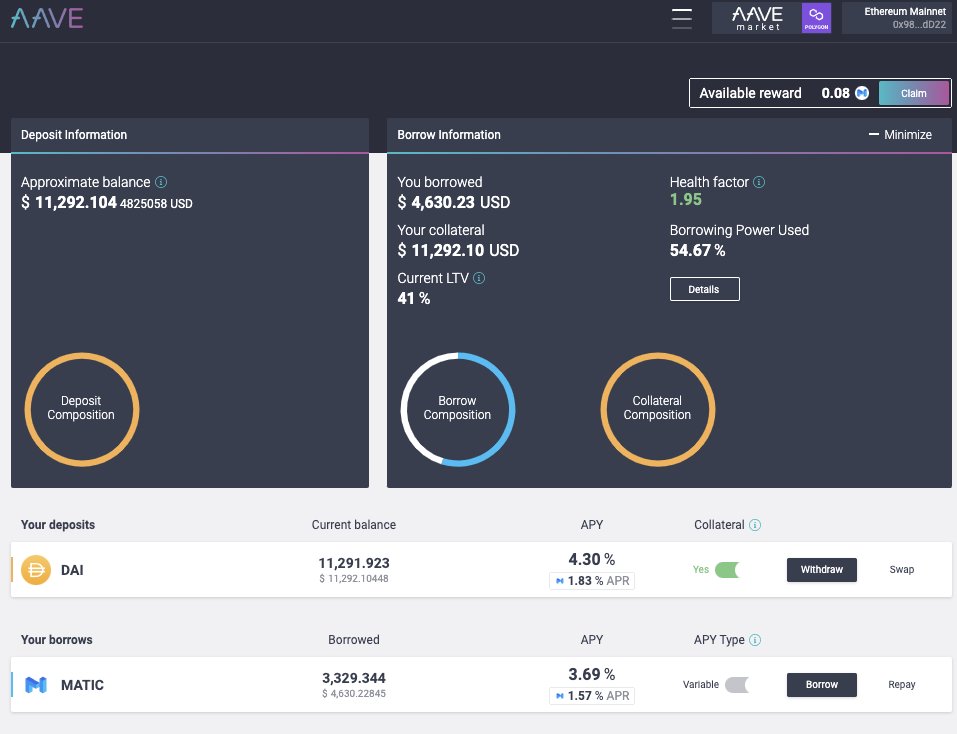

6/ I decided to play the arb this way:

1. Transfer $DAI to @0xPolygon

2. Put $DAI in @AaveAave Polygon as collateral

3. Borrow $MATIC

4. Sell $MATIC for $ETH using @QuickswapDEX

5. Send $ETH back to Ethereum mainnet using Polygon PoS bridge

6. Buy $HEZ with $ETH on @Uniswap v2

1. Transfer $DAI to @0xPolygon

2. Put $DAI in @AaveAave Polygon as collateral

3. Borrow $MATIC

4. Sell $MATIC for $ETH using @QuickswapDEX

5. Send $ETH back to Ethereum mainnet using Polygon PoS bridge

6. Buy $HEZ with $ETH on @Uniswap v2

7/ Now, the idea is that as the merger approaches, the value of $HEZ should approach 3.5 $MATIC. So when the date gets closer, I should be able to sell $HEZ, buy $MATIC and repay the loan. Ultimately I would be putting free $MATIC in the pocket, minus network fees/interest rates.

8/ This process came with a gazillion of issues for me (ofc). I was doing this exactly as EIP-1559 was getting rolled out and none of my wallets had accounted properly for the change yet. In the middle of getting my ETH out of Polygon, ETH mainnet fees shot through the roof.

9/ I was only playing with $10k and due to overcollateralization I was only expecting to pocket $620. This tx alone would siphon $182 in fees because of an airdrop people were fighting for. I waited for the fee spike to drop and bit the bullet at $70 (yes I know this is nothing).

10/ These fees alone didn't explain the discount for me. You don't need to short $MATIC via a @AaveAave loan, you can use a CEX like @FTX_Official. I was curious about the @AaveAave Polygon yields though and how it would all net out (rates being variable and all). Results soon.

11/ When I had gotten into position, my acquired $HEZ was worth $4575. My $MATIC loan put me $4630 in debt (discrepancy coming from the fees I paid along the way). @VetleLunde sent me this chart to track the arb. At 0, the arb would be complete (13.5% arb going into my pocket).

12/ 12 days after entering the position, $HEZ had started to gain on $MATIC.

My $HEZ were now worth $4888

My $MATIC debt was now worth $4528

Meanwhile, I was earning single digit APYs on my @AaveAave positions and getting paid slightly more than I was paying (+0.61%).

My $HEZ were now worth $4888

My $MATIC debt was now worth $4528

Meanwhile, I was earning single digit APYs on my @AaveAave positions and getting paid slightly more than I was paying (+0.61%).

13/ I could swap my DAI collateral for ETH collateral and be less overcollateralized, assuming $MATIC and $ETH are more correlated. If $MATIC goes up increasing the size of my debt, ETH would help collateralize it by going up aswell. Then I could have arbed a lot more in total.

14/ I chose not to do that because I liked the aspect of having the borrow/lend APYs net each other out in favor for me, so no matter how long the @PolygonHermez merger would take, I would not be bleeding any interest in the meantime.

15/ About a week ago, something strange happened to the HEZ<>MATIC exchange rate. The discount vanished completely (means we get to pocket the full arb). But it kept going further and turned into a premium for some reason. If you buy $HEZ you pay a ~20% overprice vs. 3.5 $MATIC.

16/ I personally have no idea why this has happened. The HEZ token is going to be entirely converted into 3.5 MATIC. I can't see a reason why it would be worth *more* than 3.5 MATIC.

My $HEZ tokens were now worth $5557

My $MATIC loan was now worth $4203

My $HEZ tokens were now worth $5557

My $MATIC loan was now worth $4203

17/ I immediately sold all my $HEZ and $MATIC.

Paying back the loan: @AaveAave has a feature which allows you to swap your collateral to some other asset using a flashloan. So I swapped my DAI collateral to MATIC collateral, repaid the MATIC loan, and exited Aave and Polygon.

Paying back the loan: @AaveAave has a feature which allows you to swap your collateral to some other asset using a flashloan. So I swapped my DAI collateral to MATIC collateral, repaid the MATIC loan, and exited Aave and Polygon.

18/ The last thing I did before leaving @AaveAave was claiming a 14.5 $MATIC reward that I had accumulated (extra yield sprinkled ontop of lenders/borrowers to incentivize people to use Polygon I guess).

19/ I'd like to think I made $1252.

$11386 was what I originally put in, $12638 is what I got out. But looking at my wallet history, I know I spent atleast $250 on gas fees.

In any case, ty @VetleLunde for the very real alpha. Throw me an ETH address and we'll split the $1000.

$11386 was what I originally put in, $12638 is what I got out. But looking at my wallet history, I know I spent atleast $250 on gas fees.

In any case, ty @VetleLunde for the very real alpha. Throw me an ETH address and we'll split the $1000.

20/ Actually, apologies Vetle.

I have changed my mind.

I aped all of our money into @arbitrum to farm NYAN in the @arbinyan +5000% APR ETH-NYAN LP Pool.

We've made $3 bucks already.

You're riding with me to the end of the rug on this one.

I have changed my mind.

I aped all of our money into @arbitrum to farm NYAN in the @arbinyan +5000% APR ETH-NYAN LP Pool.

We've made $3 bucks already.

You're riding with me to the end of the rug on this one.

• • •

Missing some Tweet in this thread? You can try to

force a refresh