1/💩-ton

(perhaps so many that I should use 2💩emojis😬)

OK, time to get this show on the road!

We now have a draft version of Subtitle I of Dems proposed legislation. And WOW is there a lot to discuss.

You might want to buckle up, b/c this is going to be a bumpy ride...

(perhaps so many that I should use 2💩emojis😬)

OK, time to get this show on the road!

We now have a draft version of Subtitle I of Dems proposed legislation. And WOW is there a lot to discuss.

You might want to buckle up, b/c this is going to be a bumpy ride...

2/

...The final version of this bill isn't likely to come anywhere near the length of some more recent pieces of legislation, but Subtitle I (pictured below), which has the bulk of the tax changes most planners will be concerned with, still clocks in at over 225 pages...

...The final version of this bill isn't likely to come anywhere near the length of some more recent pieces of legislation, but Subtitle I (pictured below), which has the bulk of the tax changes most planners will be concerned with, still clocks in at over 225 pages...

3/

...Add in provisions that expand/enhance the Child Tax Credit + the Child and Dependent Care Credit and there are about 300 pages w/ major planning implications.

In fact, upon quick glance, if enacted, this would have a MUCH bigger impact on planning for some than TCJA! 👀

...Add in provisions that expand/enhance the Child Tax Credit + the Child and Dependent Care Credit and there are about 300 pages w/ major planning implications.

In fact, upon quick glance, if enacted, this would have a MUCH bigger impact on planning for some than TCJA! 👀

4/

Alright... Subtitle I is officially titled "Responsibly Funding Our Priorities."

I consider this a lost opportunity for Chairman (Richard) Neal, who, to lighten the mood + give a nod to an all-time great band formed in his home state (Mass), could have gone w/ (drumroll)...

Alright... Subtitle I is officially titled "Responsibly Funding Our Priorities."

I consider this a lost opportunity for Chairman (Richard) Neal, who, to lighten the mood + give a nod to an all-time great band formed in his home state (Mass), could have gone w/ (drumroll)...

5/

"Subtitle I -- Eat the Rich"

Indeed, Subtitle I is packed full of provisions designed to help reduce net the cost of various spending initiatives, mostly by raising taxes on those w/ income above $400,000 (which is about the top 2% of households)...

"Subtitle I -- Eat the Rich"

Indeed, Subtitle I is packed full of provisions designed to help reduce net the cost of various spending initiatives, mostly by raising taxes on those w/ income above $400,000 (which is about the top 2% of households)...

6/

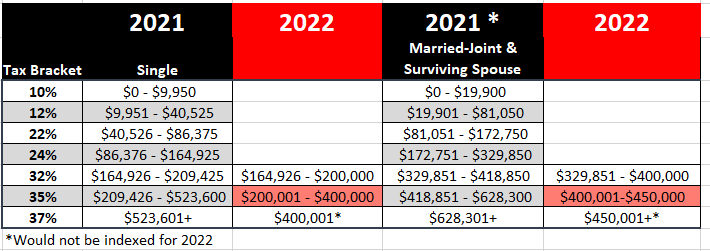

...Section 138201 of the draft would "squish" the current 32% bracket a bit, the current 35% bracket a lot (to a fraction of its current size), and would create a new top bracket of 39.6% above that.

I quickly put this👇together (if you see mistakes, lemme know)

Notably...

...Section 138201 of the draft would "squish" the current 32% bracket a bit, the current 35% bracket a lot (to a fraction of its current size), and would create a new top bracket of 39.6% above that.

I quickly put this👇together (if you see mistakes, lemme know)

Notably...

7/

...the income levels at which the top rate of 39.6% would kick in are actually LOWER than the income levels proposed by President Biden earlier this year via his budget request🤔

This could be just a negotiation tactic on the part of House Dems, knowing the more...

...the income levels at which the top rate of 39.6% would kick in are actually LOWER than the income levels proposed by President Biden earlier this year via his budget request🤔

This could be just a negotiation tactic on the part of House Dems, knowing the more...

8/

...moderate Senate Dems will likely want to raise the thresholds from whatever they see first. Or maybe it's in an effort to try and manage the net cost of the bill?

Who knows, and frankly, who cares? It's in there now.

In addition to increasing the top ordinary tax...

...moderate Senate Dems will likely want to raise the thresholds from whatever they see first. Or maybe it's in an effort to try and manage the net cost of the bill?

Who knows, and frankly, who cares? It's in there now.

In addition to increasing the top ordinary tax...

9/

rate, the bill would also increase the top capital gains bracket. But, and this is a big but...

rate, the bill would also increase the top capital gains bracket. But, and this is a big but...

10/

...It's a MUCH smaller increase in the top rate than had been proposed by Biden. Biden had proposed making the top cap gains rate equal to the top ordinary income tax rate of 39.6%.

This bill proposes a much more modest increase in the top cap gains rate, to a max of 25%...

...It's a MUCH smaller increase in the top rate than had been proposed by Biden. Biden had proposed making the top cap gains rate equal to the top ordinary income tax rate of 39.6%.

This bill proposes a much more modest increase in the top cap gains rate, to a max of 25%...

GAH! Seems there was a break in the Twitter space-time continuum. The "fun" continues below!

https://twitter.com/CPAPlanner/status/1437565350032330755?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh