1/ The immune system is the primary surveillance system for preventing cancer. We have mutations occur all the time, but it only evolves into cancer once it learns to escape the immune system.

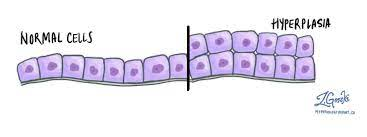

2/ The tumor begins when a cell gains a mutation that allows it to grow and replicate faster then normal. Otherwise, these cells are completely normal cells in every way. We call this hyperplasia or a benign growth.

3/ Natural Killer (NK) cells are the primary cells for detecting damaged or defective cells. They have pattern recognition receptors on their surface for Damage Associated Molecular Patterns (DAMPs).

4/ As cancer cells grow and mutate, the mutated self proteins can become antigens which the immune system can recognize and use to mount a response. These are called Tumor Associated Antigens (TAA).

5/ The T cells can recognize these new mutated self proteins and mount a cell mediated response against these tumor cells. As the T cell kill tumor cells, the Antigen Presenting Cells (APCs) will clean up the dead cells.

6/ This allows the APC to present new antigens from the tumor cells to the T cells and activate a further response. This called Epitope Spreading. As the tumor cells die, they release more tumor antigens for the immune cells to use to continue to kill more tumor cells.

7/ The tumor can only survive in this hostile environment if it develops mutations that allow it to escape this process of immune surveillance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh