1/ I've been diving into the numbers on @terraswap_io, the native AMM DEX of @terra_money.

Using data from the amazing @flipsidecrypto I establish a lower bound of 1.5 million USD in liquidity necessary to minimise high slippage.

Using data from the amazing @flipsidecrypto I establish a lower bound of 1.5 million USD in liquidity necessary to minimise high slippage.

2/ Also, while slippage is driven by low liquidity, it is accelerated by market sentiment. Greed in particular drives slippage as investors fomo into the next must-have asset.

Full report is here on @loop_finance, but here is a thread of the key points:

loop.markets/terraswap-liqu…

Full report is here on @loop_finance, but here is a thread of the key points:

loop.markets/terraswap-liqu…

3/ First let's make sure we are clear on what slippage is, and why it's important.

Slippage is the difference between the spot and realised price of a trade. This can be a big deal on DEXs because of how pricing works.

Slippage is the difference between the spot and realised price of a trade. This can be a big deal on DEXs because of how pricing works.

4/ Prices on DEXs are decided by ratio of assets in a liquidity pool. Any swap will have slippage since it adds to one side of pool and takes from other, putting it out of balance.

Low liquidity means pools are taken more out of balance by swaps, causing high slippage.

Low liquidity means pools are taken more out of balance by swaps, causing high slippage.

5/ If you are wondering how bad it can get, I found this poor soul while digging through the data who paid 75% slippage on a $UST to $Luna swap.

This cost them a whopping 3000 Luna, which at today’s prices is over $120,000 USD.

Quite a lot for a transaction fee…

This cost them a whopping 3000 Luna, which at today’s prices is over $120,000 USD.

Quite a lot for a transaction fee…

6/ Here we can see % of swaps in each terraswap pool that suffer high slippage (>5%).

The trend is very clear. Most pools experience very little slippage, with the single exception of LOTA-UST pair. A little over 5% of transactions in the LOTA-UST pool suffer high slippage.

The trend is very clear. Most pools experience very little slippage, with the single exception of LOTA-UST pair. A little over 5% of transactions in the LOTA-UST pool suffer high slippage.

7/ Second highest slippage count is $MINE - $UST pair at just 0.35% of transactions. The remaining 31 of 33 pools all have less than 0.1% of transactions with high slippage.

When we look at liquidity depth of the pools, it becomes clear what is going on.

When we look at liquidity depth of the pools, it becomes clear what is going on.

8/ This shows USD value of liquidity of all pools on Terraswap.

Deepest pool is $ANC - $UST pair at over $150 million USD. Unsurprisingly lowest is LOTA-UST pair, at just 322k USD.

Deepest pool is $ANC - $UST pair at over $150 million USD. Unsurprisingly lowest is LOTA-UST pair, at just 322k USD.

9/ Marginally deeper than LOTA-UST is LUNA-MNT, with 1.5 million USD liquidity. However, LUNA-MNT sees just 0.04% of transactions suffering high slippage.

From this we can establish an initial lower bound of liquidity necessary to prevent high slippage at 1.5 million USD.

From this we can establish an initial lower bound of liquidity necessary to prevent high slippage at 1.5 million USD.

10/ Hypothesis proposed by @loop_finance is that average trade size might impact slippage.

This makes sense, since larger transactions put pools more out of balance, and hence are more prone to slippage. However, when we look at the data, we see the complete opposite trend.

This makes sense, since larger transactions put pools more out of balance, and hence are more prone to slippage. However, when we look at the data, we see the complete opposite trend.

11/ Looking at average trade size by pool, we see that LOTA-UST, which has highest % transactions suffering large slippage, in fact has lowest average transaction size.

Average transaction size across all pools is $4237 USD, while it is just $628 USD for the LOTA-UST pool.

Average transaction size across all pools is $4237 USD, while it is just $628 USD for the LOTA-UST pool.

12/ Instead of transaction sizes driving slip, the opposite is true: transaction sizes are responsive, and react to the depth of available liquidity.

This gives us an important insight into the behaviour of traders on Terraswap.

This gives us an important insight into the behaviour of traders on Terraswap.

13/ It tells us that they are observant, and pay close attention to slip. They don't blindly accept high slip (except for our unfortunate friend in the LUNA-UST pool).

As convenient as Terraswap is to use, slippage will still drive traders away when it lacks liquidity.

As convenient as Terraswap is to use, slippage will still drive traders away when it lacks liquidity.

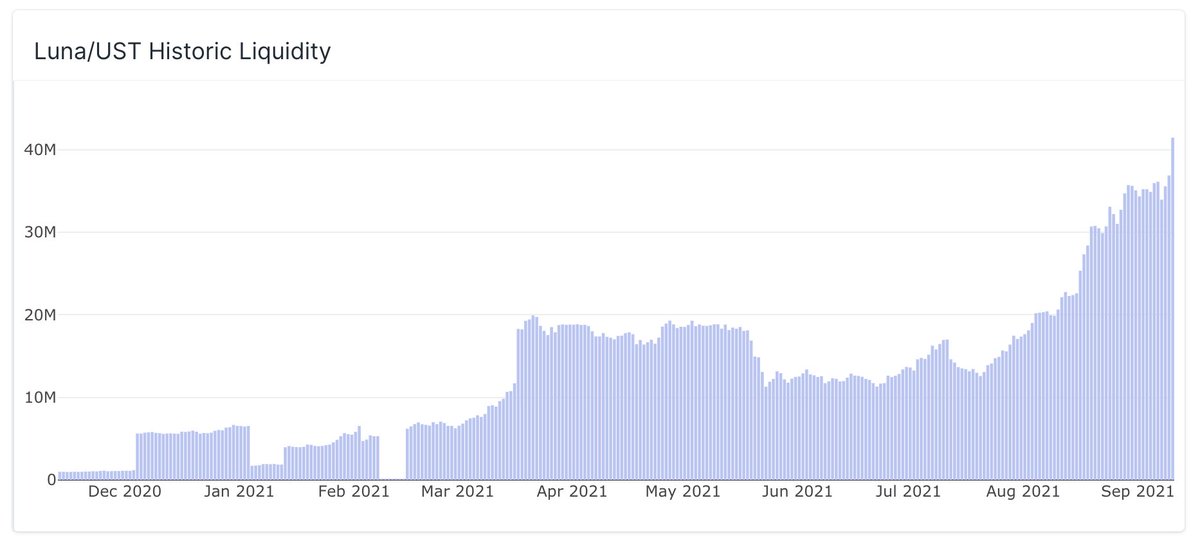

14/ Dived into historic slippage rates to try refine my lower bound of liquidity estimate. Good example is the LUNA-UST pool, since large sample size of transactions over a long period of time. However, no obvious point at which we can claim liquidity is sufficiently deep.

15/ Instead, we see consistently very low slippage, with a large spike on the week starting Feb 8th.

This spike was caused by the first Luna bull-run. Investors rushed to cash out their Luna to UST, and in the process were willing to accept higher slippage.

This spike was caused by the first Luna bull-run. Investors rushed to cash out their Luna to UST, and in the process were willing to accept higher slippage.

16/ Exacerbating this, user’s withdrew their liquidity to take profits and minimise impermanent loss, which increased the slippage on every transaction.

Looking at daily liquidity, it almost looks like a gap in the data. Dropped from 5.3 million USD on 7th to just 15.3k on 8th.

Looking at daily liquidity, it almost looks like a gap in the data. Dropped from 5.3 million USD on 7th to just 15.3k on 8th.

17/ This hints at an idea I have discussed in some of my THORChain Data Digest reports. Market sentiment, and in particular high fear and high greed, are key drivers of slip payments on decentralised exchanges.

18/ In periods of greed, investors get blinded by fomo and accept higher slip payments if it means they can get their hands on the asset. Similarly, in periods of fear, investors rush to convert assets to stable coins to protect portfolios, accepting higher slip in the process.

19/ Across all Terraswap pools, baseline occurrence of transactions with high slip was 0.08%.

In periods of extreme fear this increased to 0.11%.

In periods of extreme greed this was a staggering 0.22%.

Greed above all appears to be a key driver of high slippage on Terraswap

In periods of extreme fear this increased to 0.11%.

In periods of extreme greed this was a staggering 0.22%.

Greed above all appears to be a key driver of high slippage on Terraswap

20/ I will be analysing similar ideas in an upcoming THORChain Data Digest report, and seeing how the lower bound of liquidity necessary to minimise slip compares. @THORChain uses a unique LP and slip model, so follow if you want to find out about that!

• • •

Missing some Tweet in this thread? You can try to

force a refresh