Still worried about high health care prices?

So are we. But the form of the remedy matters. New in @Health_Affairs, @Michael_Chernew, @LeemoreDafny, and I show that hospital price regulation based on market concentration is likely to miss the mark. 1/9

healthaffairs.org/doi/10.1377/hl…

So are we. But the form of the remedy matters. New in @Health_Affairs, @Michael_Chernew, @LeemoreDafny, and I show that hospital price regulation based on market concentration is likely to miss the mark. 1/9

healthaffairs.org/doi/10.1377/hl…

There is broad consensus that hospital consolidation increases prices, on avg. This has been studied extensively, motivating proposals to regulate hospital prices based on market concentration including a bipartisan think tank proposal and Congressional bills. However, … 2/9

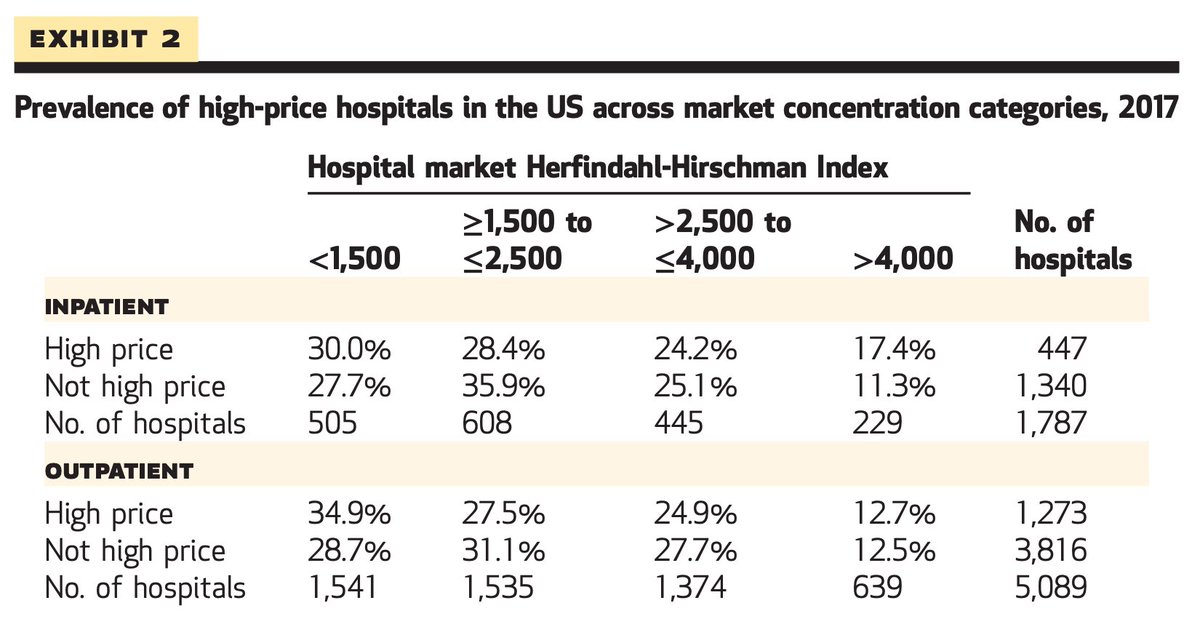

… it turns out that using the geographic market definition commonly used in such proposals (the HRR), most high-price hospitals are in markets that would be deemed competitive or “moderately concentrated” under antitrust guidelines. 3/9

This means most hospitals would not be subject to such market concentration-based price regulation.

Even under narrower market definitions, many high-price hospitals remain in markets of fairly low concentration, both for hospitals with high IP and those with high OP prices. 4/9

Even under narrower market definitions, many high-price hospitals remain in markets of fairly low concentration, both for hospitals with high IP and those with high OP prices. 4/9

We used a large sample of 2017 US commercial insurance claims from @HealthCostInst, defining high hospital prices as those in the upper quartile of the adjusted national hospital price distribution. Results were similar using different cutoffs for “high price”. 5/9

If regulating hospital prices based on market concentration does not appear to be a good idea if we care about effectively constraining high prices, what else can be done?

Policies to promote hospital competition are a start, but are unlikely to be enough. 6/9

Policies to promote hospital competition are a start, but are unlikely to be enough. 6/9

Instead of attempting to regulate prices by regulating a (flawed) proxy, policymakers could regulate the outcome of interest--high prices--directly.

This is complex, but important to remember that price regulation need not be price administration (i.e., price setting). 7/9

This is complex, but important to remember that price regulation need not be price administration (i.e., price setting). 7/9

@Michael_Chernew, @LeemoreDafny, and I have a proposal to cap the highest of prices, limit price growth, and provide oversight for potential circumvention.

This is just a conversation starter. 8/9

hamiltonproject.org/papers/a_propo…

This is just a conversation starter. 8/9

hamiltonproject.org/papers/a_propo…

For a much more extensive (and fun!) discussion than is possible on twitter, listen to @LeemoreDafny discuss our paper and hospital prices more generally with @alanrweil on #AHealthPodyssey 9/9

healthaffairs.org/do/10.1377/hp2…

healthaffairs.org/do/10.1377/hp2…

• • •

Missing some Tweet in this thread? You can try to

force a refresh