2/ The vault is currently netting ~3.90% APY and ~4.5% fixed APR. With a total duration of four months and a half, the new term will be live until the end of January.

3/ You can easily deposit by first going to app.element.fi/earn, and then clicking on “Show” under the USDC v2 Jan 28, 2022 Term Vault.

4/ Then you just input the amount of USDC you want to deposit in the term, and voila! You’ll start having exposure to USDC fixed rates!

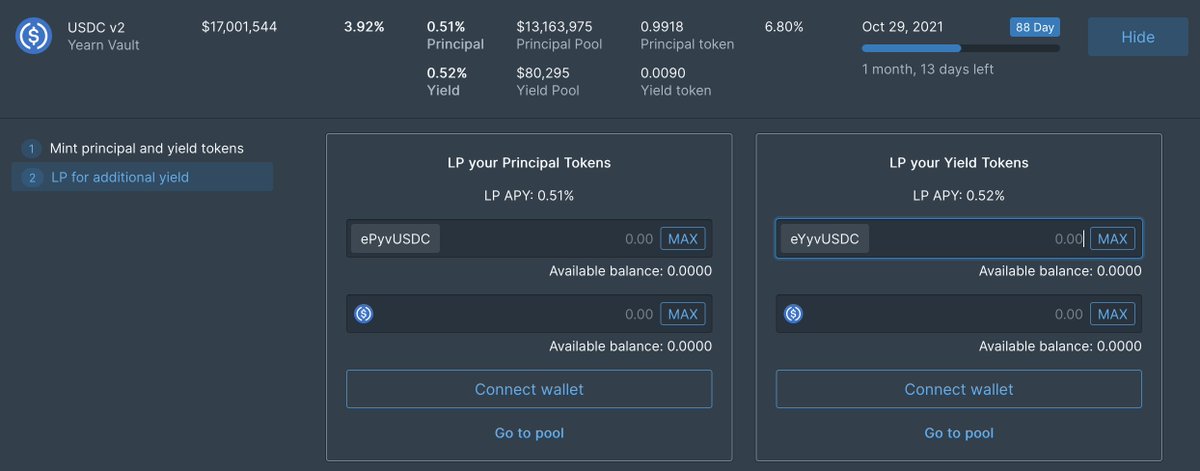

5/ But that’s not it. Once you deposit you will get 2 different types of tokens that represent your position:

-Principal tokens: which represent your fixed position (starting at a discount).

-Yield Tokens: which represent the yield that position accrues over time.

-Principal tokens: which represent your fixed position (starting at a discount).

-Yield Tokens: which represent the yield that position accrues over time.

6/ You can also provide liquidity by becoming an LP for both positions to get additional yield 🚀

Just click on "LP for additional yield", and deposit your Principal and Yield tokens😉. Don’t forget you will also need to provide liquidity for the base asset, in this case USDC.

Just click on "LP for additional yield", and deposit your Principal and Yield tokens😉. Don’t forget you will also need to provide liquidity for the base asset, in this case USDC.

7/ So, why roll out a new term while the previous one is still live?

Simple: offering terms that overlap allows each asset to be offered on a rolling basis, providing an overall better user experience for the community.

Simple: offering terms that overlap allows each asset to be offered on a rolling basis, providing an overall better user experience for the community.

8/ Have any doubts? We got you! Join our Discord community and ask any questions that you may have in our #questions channel 🧝♂️ 🤝 🧝♀️! discord.gg/CwmxHBav

• • •

Missing some Tweet in this thread? You can try to

force a refresh