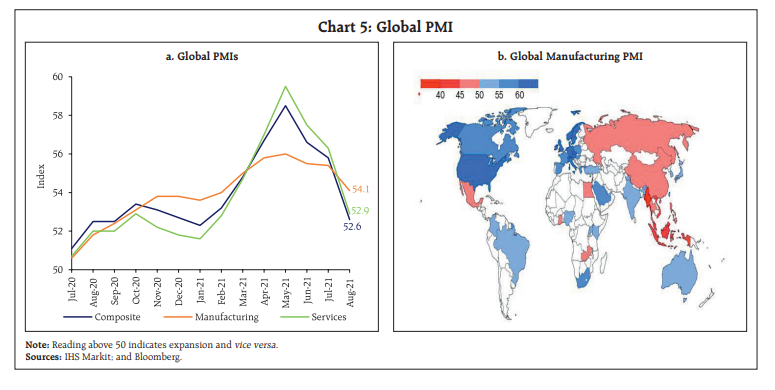

Finally, a better map of the world in the RBI Bulletin - moving away from that degrading Mercator projection.

Vehicles and transport don't look greawt. Petrol consumption (by volume) is up above Feb 2020, but Diesel and others are still low. Vehicle registrations still struggling.

Air passenger traffic sucks (40% of Feb 2020 domestic, 15% of international)

But cargo is back to Feb 2020 levels. Has not risen though.

But cargo is back to Feb 2020 levels. Has not risen though.

The labour market (read: not you people on twitter) is struggling to reach back to the 2020 pre covid levels:

• • •

Missing some Tweet in this thread? You can try to

force a refresh