2/

Evergrande is China's second-largest property developer with $110 billion in sales in 2020 alone. Evergrande was founded in 1996 by Chairman Hui Ka Yan in Guangzhou China 🇨🇳

The company was listed in Hong Kong in 2009, helping it grow its asset size to $355 billion today.

Evergrande is China's second-largest property developer with $110 billion in sales in 2020 alone. Evergrande was founded in 1996 by Chairman Hui Ka Yan in Guangzhou China 🇨🇳

The company was listed in Hong Kong in 2009, helping it grow its asset size to $355 billion today.

5/

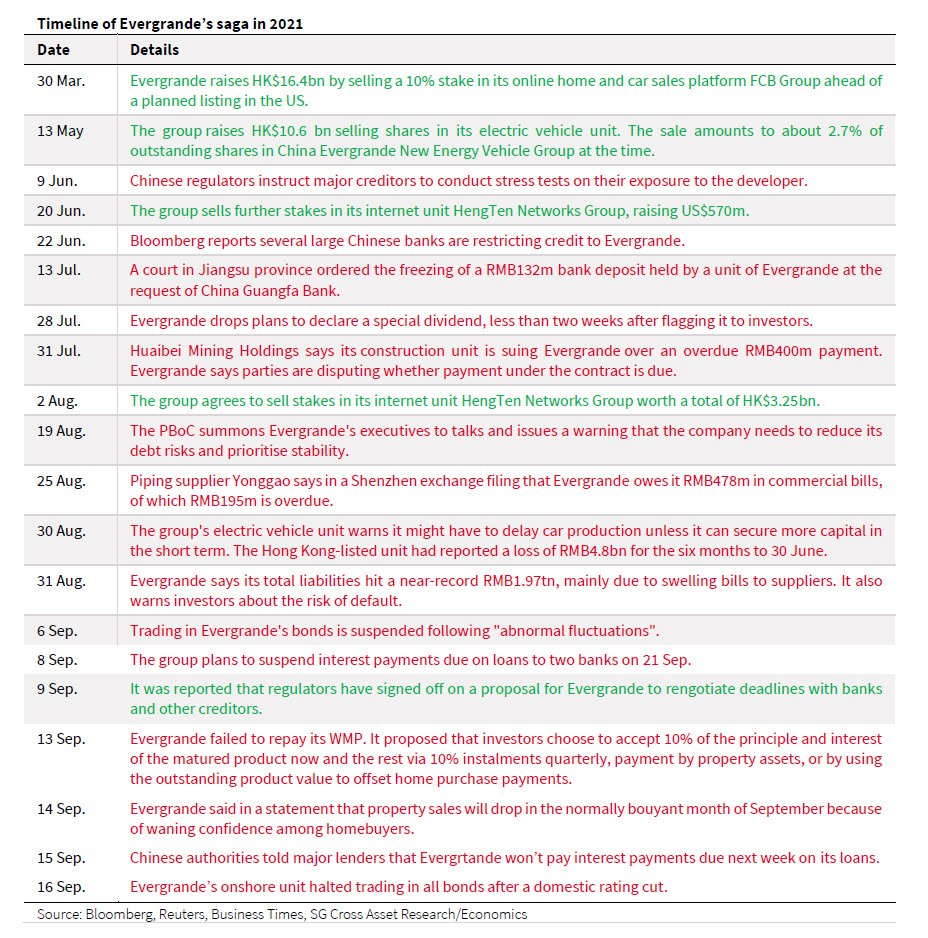

Concerns intensified after Evergrande admitted in June it did not pay some commercial paper on time, and news in July a Chinese court froze a $20 million bank deposit held by the firm on the request of Guangfa Bank.

Concerns intensified after Evergrande admitted in June it did not pay some commercial paper on time, and news in July a Chinese court froze a $20 million bank deposit held by the firm on the request of Guangfa Bank.

6/

Evergrande's demise came from accumulating massive amounts to debt to grow as quickly as possible.

Evergrande's fast expansion fueled by loans to support its land buying spree, and selling apartments quickly despite low margins so as to start the cycle again.

Evergrande's demise came from accumulating massive amounts to debt to grow as quickly as possible.

Evergrande's fast expansion fueled by loans to support its land buying spree, and selling apartments quickly despite low margins so as to start the cycle again.

7/

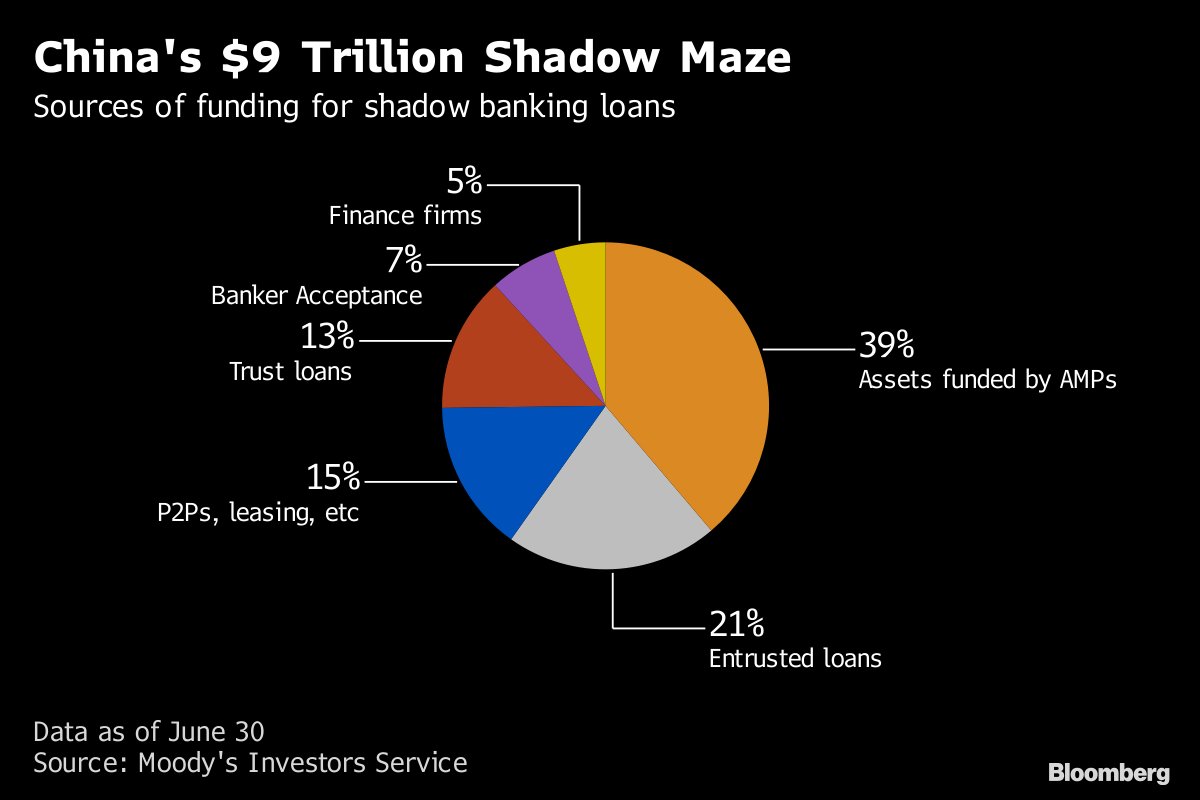

Its total liability, which include payables, is at 1.97 trillion yuan ($306.3 billion), or around 2% of the Chinas GDP. Other than bank and bond channels, the developer has been tapping the shadow banking market, including trusts, wealth mgmt. products and commercial paper.

Its total liability, which include payables, is at 1.97 trillion yuan ($306.3 billion), or around 2% of the Chinas GDP. Other than bank and bond channels, the developer has been tapping the shadow banking market, including trusts, wealth mgmt. products and commercial paper.

8/

Evergrande accelerated its debt-reduction efforts last year after regulators introduced caps on three debt ratios, dubbed the "three red lines" policy. It aims to meet all the requirements by the end of 2022.

Evergrande accelerated its debt-reduction efforts last year after regulators introduced caps on three debt ratios, dubbed the "three red lines" policy. It aims to meet all the requirements by the end of 2022.

9/

Evergrande gave buyers steep discounts for its residential developments & sold the bulk of its commercial properties. Since the second half of 2020, it has had a $555 million secondary share sale, raising $1.8 billion by listing its property management unit in Hong Kong.

Evergrande gave buyers steep discounts for its residential developments & sold the bulk of its commercial properties. Since the second half of 2020, it has had a $555 million secondary share sale, raising $1.8 billion by listing its property management unit in Hong Kong.

10/

China's central bank highlighted in 2018 that companies including Evergrande might pose systemic risks to the nation's financial system. The leaked letter last year said Evergrande's liabilities involve more than 128 banks and over 121 non-banking institutions.

China's central bank highlighted in 2018 that companies including Evergrande might pose systemic risks to the nation's financial system. The leaked letter last year said Evergrande's liabilities involve more than 128 banks and over 121 non-banking institutions.

11/

JPMorgan estimated China Minsheng Bank has the highest exposure to Evergrande. Late payments could trigger cross-defaults as many financial institutions have exposure to Evergrande via loans and indirect holdings.

Almost Lehman Brothers style.

JPMorgan estimated China Minsheng Bank has the highest exposure to Evergrande. Late payments could trigger cross-defaults as many financial institutions have exposure to Evergrande via loans and indirect holdings.

Almost Lehman Brothers style.

12/

In the dollar bond market, Evergrande accounts for 4% of Chinese real estate high-yields, according to DBS. Any defaults will also trigger sell-offs in the high-yield credit market.

A collapse will have a large impact on the job market.

In the dollar bond market, Evergrande accounts for 4% of Chinese real estate high-yields, according to DBS. Any defaults will also trigger sell-offs in the high-yield credit market.

A collapse will have a large impact on the job market.

13/

Evergrande has 200,000 staff and hires 3.8 million people every year for project developments.

Evergrande owns an office tower in Hong Kong's Wan Chai district. It has one completed and two nearly-completed residential developments in the city, & a vast undeveloped land.

Evergrande has 200,000 staff and hires 3.8 million people every year for project developments.

Evergrande owns an office tower in Hong Kong's Wan Chai district. It has one completed and two nearly-completed residential developments in the city, & a vast undeveloped land.

16/

China's central bank said it summoned executives of the country's most indebted property developer, China Evergrande Group. It comes days after President Xi Jinping highlighted efforts to forestall major financial risks.

China's central bank said it summoned executives of the country's most indebted property developer, China Evergrande Group. It comes days after President Xi Jinping highlighted efforts to forestall major financial risks.

17/

Evergrande has more than 240 billion yuan ($37 billion) of bills & trade payables from contractors to settle over the next 12 months.

Concern over the developer's financial health intensified in June when it failed to pay some commercial paper on time.

Evergrande has more than 240 billion yuan ($37 billion) of bills & trade payables from contractors to settle over the next 12 months.

Concern over the developer's financial health intensified in June when it failed to pay some commercial paper on time.

18/

Its bonds carry junk ratings from S&P, Moody's and Fitch, all of whom recently issued downgrades, and its troubles have sent jitters through China's entire junk-debt market at a time when corporate credit is rallying in the rest of the world.

Its bonds carry junk ratings from S&P, Moody's and Fitch, all of whom recently issued downgrades, and its troubles have sent jitters through China's entire junk-debt market at a time when corporate credit is rallying in the rest of the world.

19/

In the hearings, at least one bond investor said the move could mean Evergrande is on the verge of a default that would reverberate through the banking system.

Lehman Brothers anyone 🤔

In the hearings, at least one bond investor said the move could mean Evergrande is on the verge of a default that would reverberate through the banking system.

Lehman Brothers anyone 🤔

20/

Buried under its crushing debt of about $300 billion, Evergrande is so huge that the fallout from any failure could hurt not just China’s economy. Contagion could spread to markets beyond China.

This collapse would be the biggest test of China’s financial system in years.

Buried under its crushing debt of about $300 billion, Evergrande is so huge that the fallout from any failure could hurt not just China’s economy. Contagion could spread to markets beyond China.

This collapse would be the biggest test of China’s financial system in years.

21/

Banks have responded to its deteriorating cash flow. Some in Hong Kong, including HSBC & Standard Chartered, have declined to extend new loans to buyers of two uncompleted Evergrande residential projects.

Ratings agencies downgraded the firm, citing its liquidity problems.

Banks have responded to its deteriorating cash flow. Some in Hong Kong, including HSBC & Standard Chartered, have declined to extend new loans to buyers of two uncompleted Evergrande residential projects.

Ratings agencies downgraded the firm, citing its liquidity problems.

22/

Evergrande share price plunged nearly 80% so far this year, and trading of its bonds was repeatedly halted by Chinese stock exchanges in the past weeks.

Evergrande share price plunged nearly 80% so far this year, and trading of its bonds was repeatedly halted by Chinese stock exchanges in the past weeks.

23/

In an August report, S&P estimated that over the next 12 months, Evergrande will have over 240 billion yuan ($37.16 billion) of bills and trade payables from contractors to settle — around 100 billion yuan of that amount is due this year.

In an August report, S&P estimated that over the next 12 months, Evergrande will have over 240 billion yuan ($37.16 billion) of bills and trade payables from contractors to settle — around 100 billion yuan of that amount is due this year.

24/

A paint supplier to Evergrande, Shanghai-listed Skshu Paint, said in a filing that the real estate firm repaid part of its debt in properties – and uncompleted ones at that.

Who'd want to be paid in incomplete properties instead of cash.

😂😂😂😂

A paint supplier to Evergrande, Shanghai-listed Skshu Paint, said in a filing that the real estate firm repaid part of its debt in properties – and uncompleted ones at that.

Who'd want to be paid in incomplete properties instead of cash.

😂😂😂😂

25/

Just in 2021 alone, Chinese billionaires lost so much money due to Evergrande, it's insane.

Colin Huang - $30 Billion

Zhong Shanshan - $18 Billion

Jay Y Lee - $16 Billion

Hui Ka Yan - $15 Billion

Pang Kang - $12 Billion

Just in 2021 alone, Chinese billionaires lost so much money due to Evergrande, it's insane.

Colin Huang - $30 Billion

Zhong Shanshan - $18 Billion

Jay Y Lee - $16 Billion

Hui Ka Yan - $15 Billion

Pang Kang - $12 Billion

To understand the CCP intricacies of what’s going down with Evergrande, Check this out.

https://twitter.com/INArteCarloDoss/status/1438944431734919175

Chinese real estate market is the largest asset class of any kind in the world. It’s inflated and if it slides, then the contagion financial effects could be felt world wide to be honest 🤷♂️

https://twitter.com/Mayhem4Markets/status/1549158690078482435

Chinese money inflating the real estate markets in Canada 🇨🇦

Chinese investors realizing their domestic real estate is much more inflated than other countries, moving capital out of the country

Chinese investors realizing their domestic real estate is much more inflated than other countries, moving capital out of the country

https://twitter.com/Karl_Schamotta/status/1550226299238715392

China 🇨🇳 demolishing unfinished huge buildings… wow 😮

A large Chinese shadow bank Zhongrong International Trust Co. missed payments on dozens of products and has no immediate plans to make their clients whole.

Chinese Real Estate bubble and the lack of demand for Chinese exports is a major cause for concern.

Chinese Real Estate bubble and the lack of demand for Chinese exports is a major cause for concern.

• • •

Missing some Tweet in this thread? You can try to

force a refresh