"The Five Rules of Successful Stock Investing" by Pat Dorsey is one of the best books for individual investors (Top 5 in my opinion). Excellent summary of that book. h/t @suru27 👏

My fav slides in the thread below. ⬇️

slideshare.net/suru27/book-su…

My fav slides in the thread below. ⬇️

slideshare.net/suru27/book-su…

Sources of Economic Moats ⬇️

Some of Co.'s cited obviously change over a period of time, due to changes in trends, Customer preferences, Management issues and so on. No list is permanent.

Some of Co.'s cited obviously change over a period of time, due to changes in trends, Customer preferences, Management issues and so on. No list is permanent.

Analyzing a Company (This section's summary obviously cannot be fully captured in few bullet pts) ⬇️

✔️Growth

✔️Profitability

✔️Financial Health

✔️Risk Factors

✔️Management

✔️Growth

✔️Profitability

✔️Financial Health

✔️Risk Factors

✔️Management

Analyzing Management. ⬇️

Most important factor in my opinion, as they're the ones defining the culture/vision/strategy and empowering the employees to serve the Customers while balancing all other factors. Even more important in today's Tech enabled world.

Most important factor in my opinion, as they're the ones defining the culture/vision/strategy and empowering the employees to serve the Customers while balancing all other factors. Even more important in today's Tech enabled world.

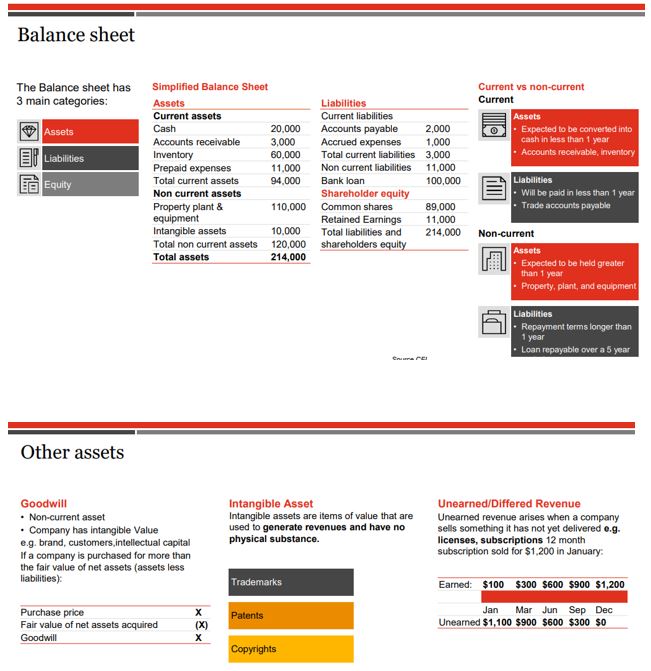

Valuation Basics⬇️

This is where most people trip up. Learning to contextualize Valuation based on the specific Co.'s characteristics (Quality/Growth-past & future/Management/Financial Strength/ROIC & runway/Moats....) is definitely more art than science.

This is where most people trip up. Learning to contextualize Valuation based on the specific Co.'s characteristics (Quality/Growth-past & future/Management/Financial Strength/ROIC & runway/Moats....) is definitely more art than science.

If you're a long-term investor dealing with individual stocks, buy and read the whole book if you can.

The overview of all the important concepts and analysis of various Industries is very useful and highly practical.

/END

The overview of all the important concepts and analysis of various Industries is very useful and highly practical.

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh