Book: Billion Dollar Lessons 💰 by Paul B. Carroll

“Read and learn about the costly mistakes of others; it could save you tremendous time and money.”

This thread will be updated as I read further.

“Read and learn about the costly mistakes of others; it could save you tremendous time and money.”

This thread will be updated as I read further.

2/ “Organizations involved in life-and-death situations—such as hospitals, airlines, and the military—routinely do after-action analyses that help them keep from repeating catastrophic errors.”

Investors should follow the same.

Investors should follow the same.

3/ “The extent of the failures was stunning. Since 1981, 423 U.S. companies with assets of more than $500 million filed for bankruptcy. Their combined assets at the time of their bankruptcy filings totaled more than $1.5T. Their combined annual revenue was ~ $830B.”

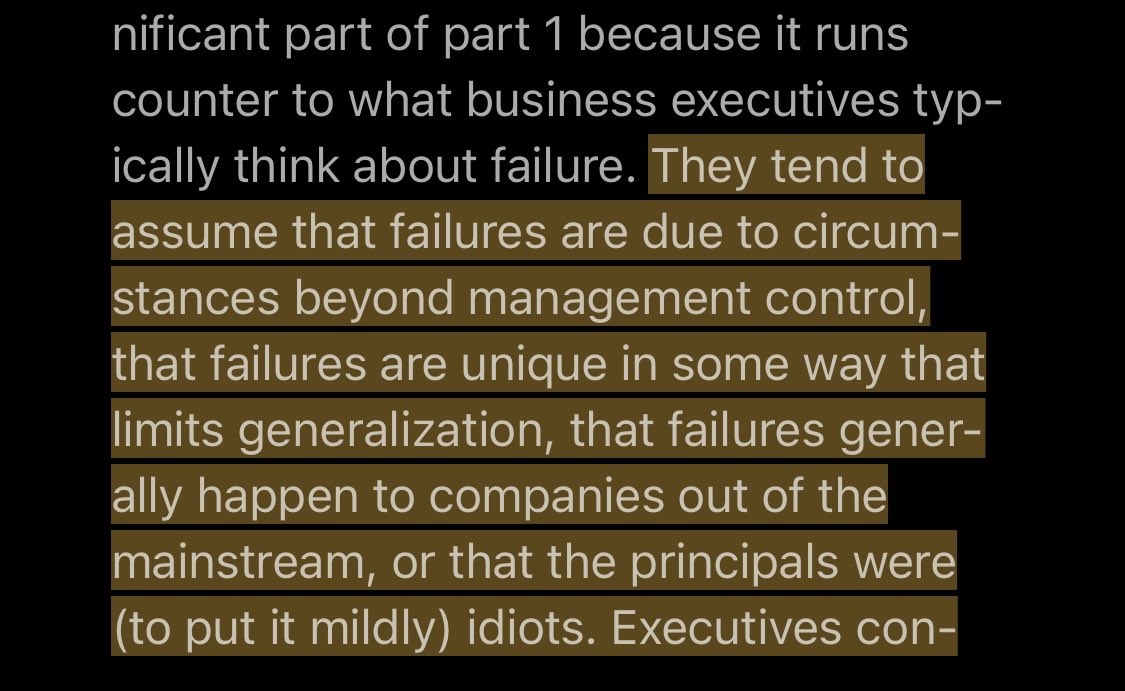

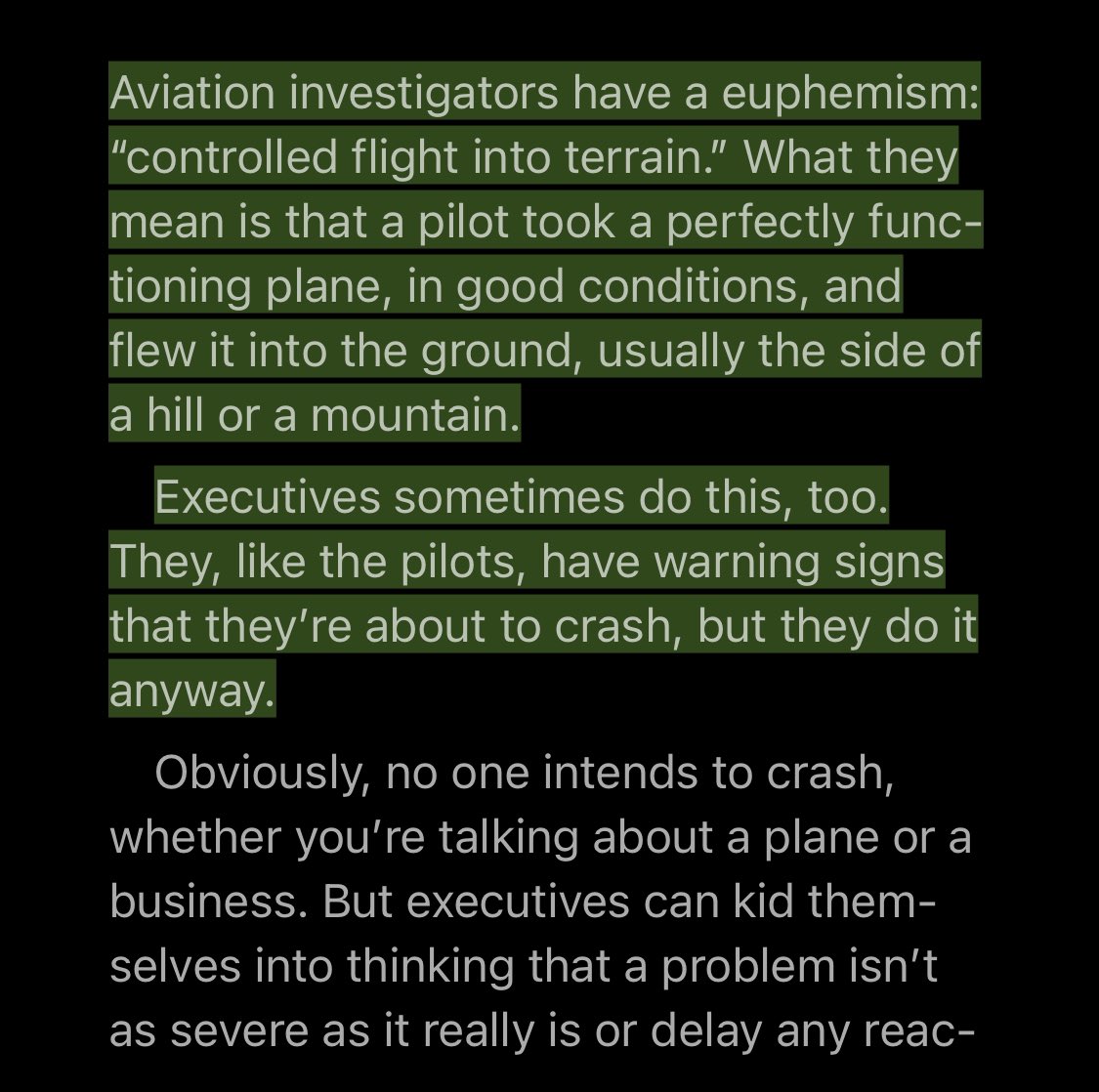

4/ “We found that failures often don’t stem from lack of execution. Nor are they due to timing or luck. What we found, instead, is that many of the really big failures stemmed from bad strategies.

Once launched, the strategies were doomed to fail.”

Once launched, the strategies were doomed to fail.”

8/ “As Alfred Hitch-cock said, the scariest villains aren’t the ones who arrive on camera wearing black hats and accompanied by eerie music; the scariest are those who seem like normal, even nice, people and only gradually reveal themselves to be evil at the core.”

9/ “Armies of bright young people go to business school so they can learn strategic frameworks, regression analysis, and other arcana. Yet most analysis goes to support a decision that’s already been made, rather than to see whether it’s really a good idea in the first place.”

10/ “Investment bankers (who get their fees anytime a company completes a transaction, regardless of whether it succeeds—and who get paid again when they’re hired to unwind transactions they proposed in the first place)”

12/ “Business isn’t physics. Business isn’t about finding the exact right answer, but rather is about avoiding the wrong answers and then executing as hard and as well as possible the answers that might be right.”

21/ Why it makes me suspicious when big conglomerates are buying start-ups like we buy groceries (once, every day)

22/ “When consulting firms do studies like, on how hard it is to achieve synergies, the suggestion usually is that there are ways to get those synergies if you just execute properly—by hiring that consulting firm.” 😂

30/ “They basically jacked up their sales by lending more to people with bad credit,” one industry analyst observed. “It’s one of those retailing things that just gets repeated and repeated.”

Also, this 👇 (Spiegel)

Also, this 👇 (Spiegel)

31/ “The great pity is that they did not know how to take advantage of their advantages.”

32/ “In a survey of 743 U.S., European, & Asian CFOs, a third responded that if their companies were going to miss analyst expectations, they would use “discretion” to buff the numbers; 46 percent of the U.S. executives said they could influence earnings by at least 3 percent.”

35/ Will it survive-

What if the company’s strategy is announced in Harvard business review? Onset of competitors.

What if a company goes through a decadal slowdown? Worst of Cashflows.

What if the company’s strategy is announced in Harvard business review? Onset of competitors.

What if a company goes through a decadal slowdown? Worst of Cashflows.

36/ “A small chance of distress or disgrace cannot, in our view, be offset by a large chance of extra returns.”

38/ “If the rabbit was running, we shot at it. It didn’t matter whether the rabbit had two legs, one leg or three ears. And a lot of the time it turned out to be a skunk.” ~An Executive of a company, aggressive on acquisitions.

40/ “In theory, a company should be able to raise prices as it grows in size and squeezes out the competition. But, sometimes, just enough competition remains and keeps a lid on prices, or customers are obstinate about not paying more, or something else goes wrong.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh