In today’s Delphi Daily, we looked at some signs of seasonal market exhaustion.

We examined historical BTC trends, the recent short-term basis spike, market sentiment, and the performance of L1 tokens.

For a deeper dive 🧵👇

We examined historical BTC trends, the recent short-term basis spike, market sentiment, and the performance of L1 tokens.

For a deeper dive 🧵👇

1/ Market Update-

🔹Today was yet another dicey day for crypto, with a second (and furious) leg down at midnight UTC.

🔹Since then, markets have bounced a bit.

🔹A handful of tokens are in the green today, but the majority are down as fear cripples investors across the globe

🔹Today was yet another dicey day for crypto, with a second (and furious) leg down at midnight UTC.

🔹Since then, markets have bounced a bit.

🔹A handful of tokens are in the green today, but the majority are down as fear cripples investors across the globe

2/ Q4 is usually a good quarter for markets after a slow, consolidated Q3.

But considering this year deviated from otherwise strong quarterly trends, there is, of course, a possibility that Q4 ends in tears as well.

But considering this year deviated from otherwise strong quarterly trends, there is, of course, a possibility that Q4 ends in tears as well.

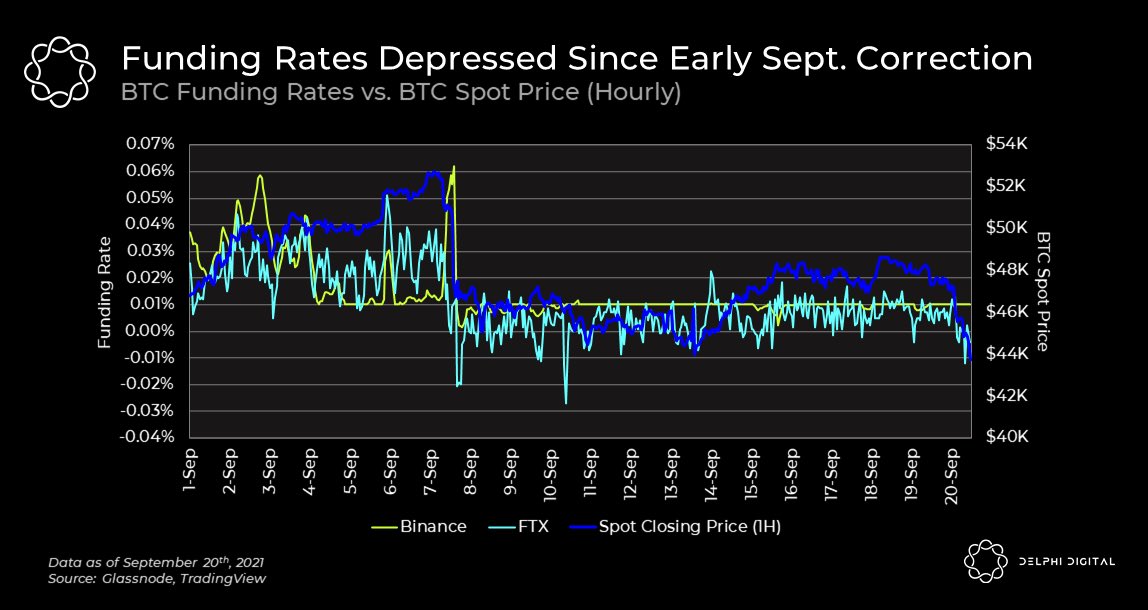

3/ Earlier this month, the Sept. expiring futures contract had run up so much that it was offering investors the best basis opportunity on the market.

In hindsight, it’s clear this was a sign that the market was getting overheated in the short-term.

In hindsight, it’s clear this was a sign that the market was getting overheated in the short-term.

4/ The skew for options expiring on Dec. 31, the implied volatility of strikes near current price are flat, and the tails are even with a slightly more aggressive skew towards the right.

This implies that the option market still has a balanced view on markets over the mid-term.

This implies that the option market still has a balanced view on markets over the mid-term.

5/ L1 season has taken a short pause in light of recent market movements.

With that said, ATOM and AVAX are holding quite well.

SOL is, surprisingly, the worst performing L1 over that time horizon, which is unexpected given the strength it had well into Sept.

With that said, ATOM and AVAX are holding quite well.

SOL is, surprisingly, the worst performing L1 over that time horizon, which is unexpected given the strength it had well into Sept.

6/ Tweets of the day!

Details on @mars_protocol’s token launch!

Details on @mars_protocol’s token launch!

https://twitter.com/mars_protocol/status/1440356558911639560

10/ Join the channel below to get all Delphi updates as soon as they are released!

t.me/DelphiDigitalA…

t.me/DelphiDigitalA…

• • •

Missing some Tweet in this thread? You can try to

force a refresh