Evergrande was a Fortune 500 real-estate developers in China, through its debt-fueled growth, quick turnover approach, and higher-than-market bid on land (bet on China's property price going up). It's on watchlist of the financial world and media.

Here's breakdown analysis:

Here's breakdown analysis:

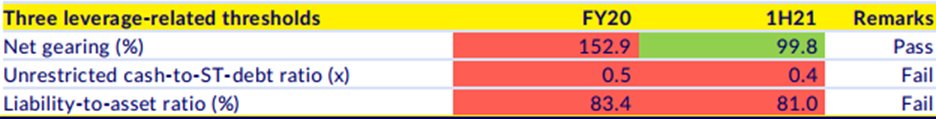

1/It started from the background of Chinese property sector regulation change including the introduction of the 3 red lines a year ago:

- L/A < 70%

- net leverage < 100%

- cash to ST debt > 1

- L/A < 70%

- net leverage < 100%

- cash to ST debt > 1

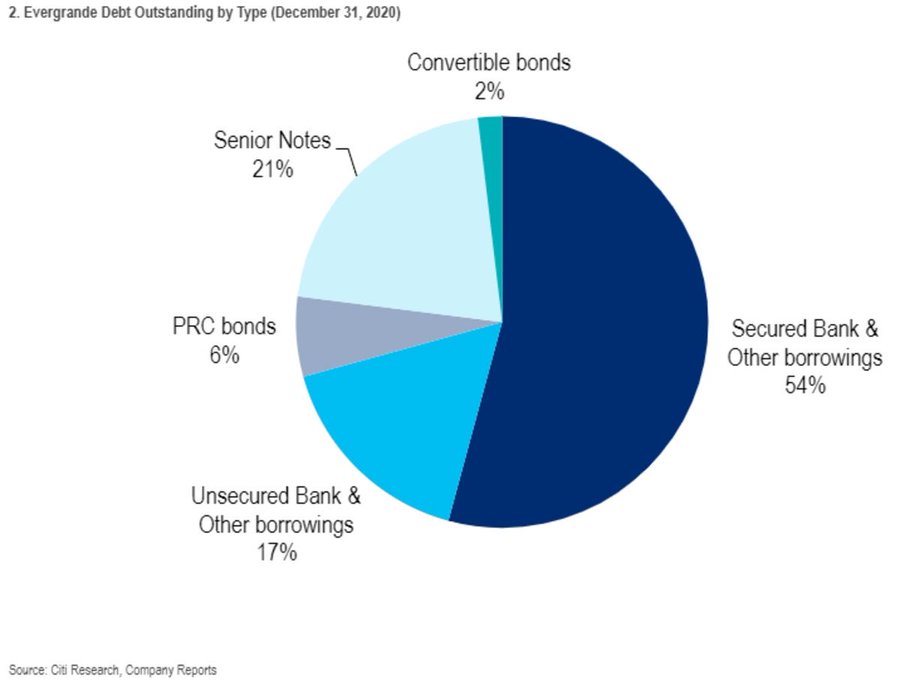

2/How serious is the problem:

From the company's interim results (doc.irasia.com/listco/hk/ever…)

We can catch a glimpse in the world's most heavily-indebted developer, with a debt load of over $100 billion and over $300 billion in liabilities.

From the company's interim results (doc.irasia.com/listco/hk/ever…)

We can catch a glimpse in the world's most heavily-indebted developer, with a debt load of over $100 billion and over $300 billion in liabilities.

3/Where does the fund go:

As 70% shareholder, Boss Hui Ka Yan cashed out RMB50bn during the past 10 years!

And the "new" Evergrande Group diversifies into all kinds of business, including cash burning EV and football....

As 70% shareholder, Boss Hui Ka Yan cashed out RMB50bn during the past 10 years!

And the "new" Evergrande Group diversifies into all kinds of business, including cash burning EV and football....

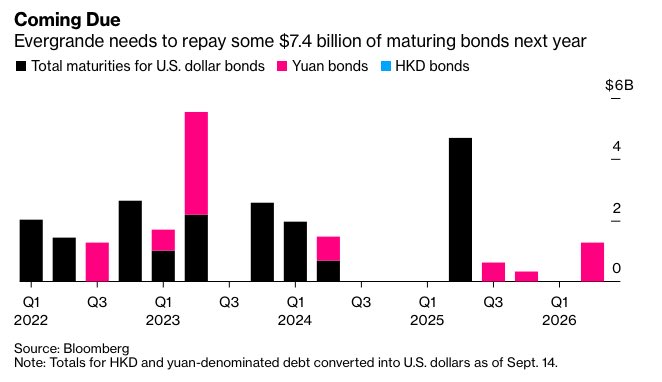

4/Is it a big problem?

According to rating agency S&P, the company liquidity is drying up.

According to latest disclosure from the company (doc.irasia.com/listco/hk/ever…),

the contract sales is dropping month by month and asset sale progress doesn't look promising so far.

According to rating agency S&P, the company liquidity is drying up.

According to latest disclosure from the company (doc.irasia.com/listco/hk/ever…),

the contract sales is dropping month by month and asset sale progress doesn't look promising so far.

5/What are choices for Evergrande?

1) Disorderly bankruptcy 2) orderly bankruptcy 3) government bailout

Now the questions is if the Chinese Government will step in. Yes, but maybe after seeing real effort from the Company and wait for the asset price to drop further🙃.

1) Disorderly bankruptcy 2) orderly bankruptcy 3) government bailout

Now the questions is if the Chinese Government will step in. Yes, but maybe after seeing real effort from the Company and wait for the asset price to drop further🙃.

6/ Will this be a Lehman moment again?

Well, there are some similarities with Lehman: related to real estate, debt crisis, contagious.

However, there are some differences vs. Lehman:

Well, there are some similarities with Lehman: related to real estate, debt crisis, contagious.

However, there are some differences vs. Lehman:

7/

1) Lehman crisis is from residential leverage, while Evergrande is from enterprise leverage, with much less effect on the economy.

1) Lehman crisis is from residential leverage, while Evergrande is from enterprise leverage, with much less effect on the economy.

8/

2) The key of Lehman crisis was the freefall housing prices, which led to fast deprecation of collateral; However, such fall in housing prices would be impossible in China.

2) The key of Lehman crisis was the freefall housing prices, which led to fast deprecation of collateral; However, such fall in housing prices would be impossible in China.

9/

3) Chinese Banks are mostly SOEs and respond well to instructions from regulatory authorities and the government, which will be the key to slowdown/speed up crisis.

3) Chinese Banks are mostly SOEs and respond well to instructions from regulatory authorities and the government, which will be the key to slowdown/speed up crisis.

10/

4) China is experienced in dealing with big enterprise crisis, with examples like Huarong, Anbang, HNA, etc.

China has its approach: Self-rescue -> Local government comes in providing liquidity and credit support -> Form credit committee and debt restructuring committee.

4) China is experienced in dealing with big enterprise crisis, with examples like Huarong, Anbang, HNA, etc.

China has its approach: Self-rescue -> Local government comes in providing liquidity and credit support -> Form credit committee and debt restructuring committee.

How will the story unroll? We'll see.

@threadreaderapp unroll

@threadreaderapp unroll

11/

Evergrande stocks shoot up today.

However, news came out Chinese authorities are asking local governments to prepare for the potential downfall of the Group, signaling a reluctance to bail out the developer while bracing for any economic and social fallout.

Evergrande stocks shoot up today.

However, news came out Chinese authorities are asking local governments to prepare for the potential downfall of the Group, signaling a reluctance to bail out the developer while bracing for any economic and social fallout.

12/

Will the shareholders bleed?

In HNA bankruptcy restructuring case, HNA Group is broken into four independent units (aviation, airport, financial and commercial). Shares of HNA's HK-listed unit get a boost from restructuring news.

Will the shareholders bleed?

In HNA bankruptcy restructuring case, HNA Group is broken into four independent units (aviation, airport, financial and commercial). Shares of HNA's HK-listed unit get a boost from restructuring news.

• • •

Missing some Tweet in this thread? You can try to

force a refresh