1/ The capsid is a strong protein structure that encloses and protects the viral genome. The most basic viruses will use a single protein produced many times to build the capsid. The more complex viruses will use multiple proteins to build their capsid structure.

2/ The basic structure of the viral capsid comes in 3 basic designs. They are Icosahedral, Helical and Complex.

3/ The Helical symmetry of capsids takes 1 protein and links them together into a very long string. That string is then wrapped into a helical structure like a tube.

4/ An example of a helical capsid virus is Ebola. This virus actually looks like a worm because of its helical capsid.

5/ The Icosahedral capsid is made up of triangles to form a sphere like shape. If you ever seen a 20 sided die from the D&D game, that is a perfect example of an icosahedral shape.

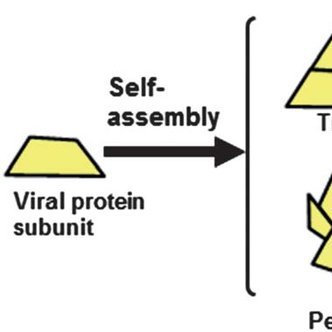

6/ The basic unit of the icosahedral capsid is a single viral protein often designated as Viral Protein 1 (VP1). Some viruses will use multiple proteins to form its basic triangle structure and will designate them VP1, VP2 and VP3.

7/ This small structure is the most basic building block of the icosahedral structure. When 3 of these proteins come together, they form the basic triangle of the icosahedral capsid. The single triangle is called a facet.

8/ The most basic virus is made up of only 20 facets. This is also called its T number. A T-1 virus would have 20 facets. A T-2 virus would have 40 facets and a T-3 virus would have 60 facets.

9/ Since each facet is made up of the 3 basic proteins, the T number that represents the facets gets multiplied by 3 to find out the total proteins in the capsid. For example a T-1 capsid has 20 facets with 3 proteins per facet = 60 total proteins.

10/ A T-3 capsid would have 20 x 3 facets or 60 total facets with 3 proteins to make up every facet. That would be 60 x 3 = 180 total proteins.

11/ When a capsid falls into icosahedral symmetry, it will have specific shapes if forms. There are 2 fold, 3 fold and 5 fold axes in each 20 facet capsid.

12/ As the virus capsid gets bigger into the T scale, the number of 5 fold axes increase so that the capsid goes from a basic of triangle faces to pentagon shaped faces made up of these 5 fold triangles shown below.

13/ In a large enough capsid, you will begin to see 6 fold axes of symmetry. They begin to look like the pattern on a soccer ball.

14/ The last Capsid is the Complex which is made up of both helical and icosahedral parts. The classic example of this type of virus is the bacteriophage.

15/ The head of the bacteriophage is made up of a basic icosahedral shape which is attached to a long tube that is made up of a helical structure. These do not harm humans and prey on bacteria hence their names.

16/ The Adeno Associated Virus (AAV) is a basic T-1 icosahedral capsid. Its made up of 20 facets. The most basic uses only 1 protein VP1 with 60 copies to make up the capsid. Others will use 3 different proteins with VP1, VP2 and VP3 in 20 copies of each to build the capsid.

17/ The AAV capsid is the smallest you can find. It only holds about 4,500 bases (4.5kb) of RNA or DNA genetic material.

• • •

Missing some Tweet in this thread? You can try to

force a refresh