#JubilantIngrevia - Thread ⚡️

Global Integrated Life Science Products and Innovative Solutions Provider

Market Cap- 12,153Cr

FY21 Sales- 3,491Cr

Q1FY22 Sales- 1,145 Cr

~1,400 Total customers

3 Segments and 165+Products

60+ New products in the pipeline over the next 3-4 years

Global Integrated Life Science Products and Innovative Solutions Provider

Market Cap- 12,153Cr

FY21 Sales- 3,491Cr

Q1FY22 Sales- 1,145 Cr

~1,400 Total customers

3 Segments and 165+Products

60+ New products in the pipeline over the next 3-4 years

(2/n)

Ingrevia has strong presence in diverse sectors like Pharmaceuticals, Life Science Ingredients, Contract Research & Development Services, and Therapeutics, Performance Polymers, Food Service, Auto, Consulting in Aerospace

FY21- EBITDA-627Cr(17.9%)

ROCE-20.2%

900Cr CAPEX

Ingrevia has strong presence in diverse sectors like Pharmaceuticals, Life Science Ingredients, Contract Research & Development Services, and Therapeutics, Performance Polymers, Food Service, Auto, Consulting in Aerospace

FY21- EBITDA-627Cr(17.9%)

ROCE-20.2%

900Cr CAPEX

(3/n)

Ingrevia is born out of a union of ‘Ingredients’ and ‘Life’ (‘Vie’ in French)

Demerged from Jubilant Life sciences on 01.02.2021 and was listed on 19.03.2021

Increased focus on the LSI and Pharma Businesses, Capture Growth Opportunities and Unlock Value for Shareholders

Ingrevia is born out of a union of ‘Ingredients’ and ‘Life’ (‘Vie’ in French)

Demerged from Jubilant Life sciences on 01.02.2021 and was listed on 19.03.2021

Increased focus on the LSI and Pharma Businesses, Capture Growth Opportunities and Unlock Value for Shareholders

(4/n)

Vision to double the Revenue by FY’26

Global presence through investments in India, USA, Canada, Europe, Singapore, China, Sri Lanka and Bangladesh

39% Of Revenue from Exports to 60 Countries

60 plants across 5 Manufacturing Units

Vision to double the Revenue by FY’26

Global presence through investments in India, USA, Canada, Europe, Singapore, China, Sri Lanka and Bangladesh

39% Of Revenue from Exports to 60 Countries

60 plants across 5 Manufacturing Units

(5/n)

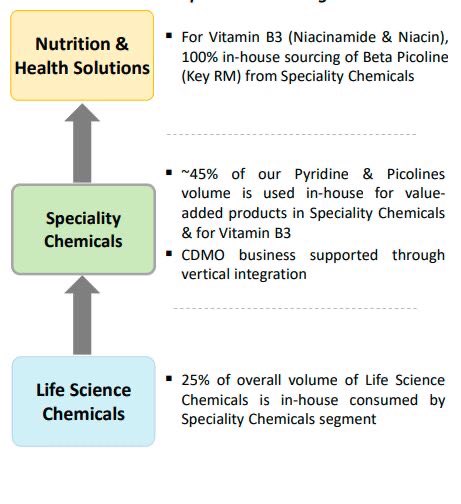

Segments and Revenue Contribution:

Speciality Chemical - 32%

Nutrition & Health Solutions - 18%

Life Science Chemicals - 50%

How Vertical integration across the value chain enables cost-competitive advantage for Ingrevia 👇🏻

Segments and Revenue Contribution:

Speciality Chemical - 32%

Nutrition & Health Solutions - 18%

Life Science Chemicals - 50%

How Vertical integration across the value chain enables cost-competitive advantage for Ingrevia 👇🏻

(6/n)

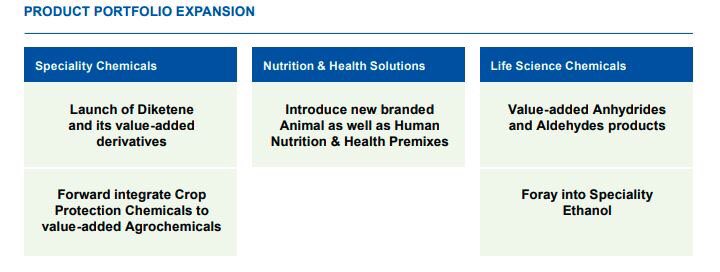

Specialty Chemicals Segment

FY21 Sales- 1,124Cr

EBITDA - 268Cr

72,000+ TPA Capacity

85 Products (Pyridines & Picolines, Cyanopyridines, Piperidines, Aminopyridines, Lutidines)

Amongst top 2 Globally in (Pyridine+Beta)

Globally #1 in 11 Pyridine Derivatives

Specialty Chemicals Segment

FY21 Sales- 1,124Cr

EBITDA - 268Cr

72,000+ TPA Capacity

85 Products (Pyridines & Picolines, Cyanopyridines, Piperidines, Aminopyridines, Lutidines)

Amongst top 2 Globally in (Pyridine+Beta)

Globally #1 in 11 Pyridine Derivatives

(7/n)

Globally lowest cost producer of Pyridine offering significant long term advantage

Serving 15 of top 20 Global Pharma & 7 of top 10 Global Agrochem companies

Partner of Choice to ~420 global customers

Around 40% export in regulated markets leading to sustainable revenue

Globally lowest cost producer of Pyridine offering significant long term advantage

Serving 15 of top 20 Global Pharma & 7 of top 10 Global Agrochem companies

Partner of Choice to ~420 global customers

Around 40% export in regulated markets leading to sustainable revenue

(8/n)

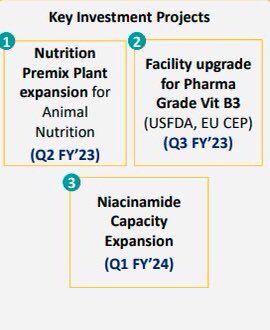

Investment of ~INR 550 Cr. by FY’24

Got 36 Products in Pipeline

Completely backward integrated range of products in Pyridines, Picolines, and its derivatives, globally places it in a unique position

Strong RDT capabilities with expertise in 35 key technology platforms

Investment of ~INR 550 Cr. by FY’24

Got 36 Products in Pipeline

Completely backward integrated range of products in Pyridines, Picolines, and its derivatives, globally places it in a unique position

Strong RDT capabilities with expertise in 35 key technology platforms

(9/n)

Company is venturing into Diketene Chemistry platform to develop 12‑14 forward integrated products to cater to the needs of Pharma, Agro and other applications

Expect to start commercial production of diketene derivates from Gajraula plant some time during Q4FY22.

Company is venturing into Diketene Chemistry platform to develop 12‑14 forward integrated products to cater to the needs of Pharma, Agro and other applications

Expect to start commercial production of diketene derivates from Gajraula plant some time during Q4FY22.

(10/n)

Nutrition & Health Solutions – Segment

FY21 Sales- 630Cr

EBITDA - 130Cr

5 Nutrition Ingredients & 18+ branded solutions (For Animal Health)

Global largest producer of Niacinamide

19% Global market share in Vitamin B3 and 60% domestic share in Vitamin B4

Nutrition & Health Solutions – Segment

FY21 Sales- 630Cr

EBITDA - 130Cr

5 Nutrition Ingredients & 18+ branded solutions (For Animal Health)

Global largest producer of Niacinamide

19% Global market share in Vitamin B3 and 60% domestic share in Vitamin B4

(11/n)

Investment of ~INR 100 Cr. by FY’24

Got 18 Products in Pipeline.

Being fully Backward integrated and the lowest cost producer gives Ingrevia an advantage in expanding across geographies and adding more value-added products to its portfolio

Investment of ~INR 100 Cr. by FY’24

Got 18 Products in Pipeline.

Being fully Backward integrated and the lowest cost producer gives Ingrevia an advantage in expanding across geographies and adding more value-added products to its portfolio

(12/n)

Life Sciences Chemicals – Segment

FY21 Sales- 1,738Cr

EBITDA - 236Cr

Q1FY22 Sales- 673Cr [103% YoY]

8 Products

Leadership in merchant market of Acetic Anhydride and Propionic Anhydride

9% Global market share in LSI & 10% domestic share in Speciality Alcohol

Life Sciences Chemicals – Segment

FY21 Sales- 1,738Cr

EBITDA - 236Cr

Q1FY22 Sales- 673Cr [103% YoY]

8 Products

Leadership in merchant market of Acetic Anhydride and Propionic Anhydride

9% Global market share in LSI & 10% domestic share in Speciality Alcohol

(13/n)

Among top suppliers of Fuel grade Ethanol to Oil Marketing

Investment of ~ INR 250 Cr. by FY’24

Got 7 Products in Pipeline.

Foraying into ENA facility to cater to distilleries markets

Multiple investments in the Segment to become the largest merchant marketer

Among top suppliers of Fuel grade Ethanol to Oil Marketing

Investment of ~ INR 250 Cr. by FY’24

Got 7 Products in Pipeline.

Foraying into ENA facility to cater to distilleries markets

Multiple investments in the Segment to become the largest merchant marketer

(14/n)

STRENGTHS + GROWTH DRIVERS

Engaged in a long-term contract with feed stock suppliers, which protects from any unseen price shocks in sourcing key raw materials

Shift of manufacturing from China to India will encourage growth in various industrial applications in India

STRENGTHS + GROWTH DRIVERS

Engaged in a long-term contract with feed stock suppliers, which protects from any unseen price shocks in sourcing key raw materials

Shift of manufacturing from China to India will encourage growth in various industrial applications in India

(15/n)

Research Development & Technology(RDT)-In addition to new product development, RDT unit focuses on Process Intensification, Absorption and Establishing Technologies on a commercial scale

3 RDT centers in Noida, Gajraula, Bharuch

90 highly qualified scientists(~20 PhDs)

Research Development & Technology(RDT)-In addition to new product development, RDT unit focuses on Process Intensification, Absorption and Establishing Technologies on a commercial scale

3 RDT centers in Noida, Gajraula, Bharuch

90 highly qualified scientists(~20 PhDs)

(16/n)

35 Key technology platforms developed & commercialized to global standards

152 Patent applications; 94 Patents granted

39% Of Revenue from Exports to 60 Countries

35 Key technology platforms developed & commercialized to global standards

152 Patent applications; 94 Patents granted

39% Of Revenue from Exports to 60 Countries

(17/n)

Key financial highlights of FY21 and Q1FY22 - summarized

Life Sciences Chemical revenue grew by 103% YoY, driven by higher prices on account of favorable market conditions and pass-on of higher input cost of acetic acid

Key financial highlights of FY21 and Q1FY22 - summarized

Life Sciences Chemical revenue grew by 103% YoY, driven by higher prices on account of favorable market conditions and pass-on of higher input cost of acetic acid

(18/n)

Jubilant Ingrevia with a diversified customer base, low cost of production and longstanding relationships with its customers, highly experienced management team, 60+ products in pipelines, 900Cr+ CAPEX, is ideally positioned to capitalise on the growth opportunities :)

Jubilant Ingrevia with a diversified customer base, low cost of production and longstanding relationships with its customers, highly experienced management team, 60+ products in pipelines, 900Cr+ CAPEX, is ideally positioned to capitalise on the growth opportunities :)

(19/n)

Sources: Investor Presentation, Annual Report, Datacrunch

If you find this thread simple and helpful, please retweet, the first tweet of this thread :)

Sources: Investor Presentation, Annual Report, Datacrunch

If you find this thread simple and helpful, please retweet, the first tweet of this thread :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh