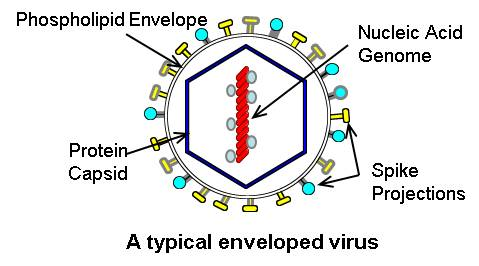

1/ In the first 2 threads we looked at the viral genome and the protein capsid. There are 2 other major structural components of the virus with the binding proteins and a membrane.

2/ All viruses come with proteins that project from their surface. These are ligands that bind to specific receptors on cells to gain entry. These proteins give the virus its tropism.

3/ The concept of tropism means a virus will only be able to infect cells of tissues that display the receptor for the proteins it has on its surface. Each virus will have different proteins on its surface which will make it able to infect specific tissues.

4/ The influenza virus has a protein called Hemagglutinin which binds to the Sialic Acid receptor in the upper and lower respiratory tract. This gives influenza tropism for the respiratory tract.

5/ The HIV virus has a protein called the glycoprotein that binds to CD4 on helper T cells and Dendritic cells to make entry. It also uses a co-receptor of the T cell with CCR5 or CXCR5 to bind. This gives HIV tropism for Helper T cells.

4/ The Hepatitis B virus (HBV) has 3 proteins on its surface with an L, M and S protein. The HBV virus will make binding to the heparin sulfate receptor with one protein then use others to make binding to the NTCP and EFGR receptors.

6/ For a cell to become infected with a virus, it must be susceptible and permissible for infection. Susceptible means that cell has the receptor for that virus to make entry. Permissible means that cell is capable of allowing the virus to replicate inside.

7/ Susceptible is the idea of tropism, but permissible is a factor of the cell itself. Not every cell will be able to allow viral replication. This can often be related to cellular host defenses like Interferons and the Antiviral state.

8/ The last part of the virus is the membrane. Not every virus will have a membrane. When the virus only has a protein shell, we call it a capsid. When the virus has a membrane, we call it a nucleocapsid. We call a virus with a membrane and enveloped virus.

9/ When a virus has no membrane the protein structure is very strong. This makes these viruses very hardy. They can survive on surfaces for long periods of time. They can also survive the low Ph of the stomach.

10/ All enteroviruses are this kind of structure. They make up one of the many families that cause Gastroenteritis. Another is the Norovirus which is commonly called the Cruise ship virus. This baby is even resistant to hand sanitizers. Always wash your hands before eating.

11/ The membrane gives viruses benefits. It makes them slippery so they are harder to target by host immunity. They have lipid membranes which helps them blend in with the cells of the host.

12/ The membrane makes them less hardy outside the body. They don't live as long before they dry out. They also don't survive the Ph of the stomach. The Corona virus is an example of an enveloped virus.

• • •

Missing some Tweet in this thread? You can try to

force a refresh