1/ a thread on cross chain liquidity - my talk from last monday at @MessariCrypto's #MainNet2021 but without the leather pants and on-stage tequila shot

what is liquidity and how does it work? liquidity is a measure of market depth - how quickly you can sell and at what price

what is liquidity and how does it work? liquidity is a measure of market depth - how quickly you can sell and at what price

2/ illiquid assets have poor price discovery and wide spreads, they're difficult to trade in size or trade quickly without having to pay a premium

liquid assets, on the other hand, have tighter spreads and are easier to trade in size at a moment's notice

liquid assets, on the other hand, have tighter spreads and are easier to trade in size at a moment's notice

3/ the workflow of a trade in traditional markets requires the constant moving of data between databases - creating entries and deleting entries forever

tradfi markets are ngmi - execution speed will *always* suffer due to the double spend problem and lack of settlement finality

tradfi markets are ngmi - execution speed will *always* suffer due to the double spend problem and lack of settlement finality

4/ bitcoin's core innovation is enabling settlement finality for digital money ie data with robust security guarantees

basically, bitcoin was the first to turn computation into money

basically, bitcoin was the first to turn computation into money

5/ the bitcoin network prices demand for secure financial transactions in the form of tsxn fees

ethereum prices demand for secure financial computation in the form of gas fees

blockchain networks make financial computation a fungible, priced asset

ethereum prices demand for secure financial computation in the form of gas fees

blockchain networks make financial computation a fungible, priced asset

6/ as such, block space itself is a financial primitive

the demand for block space ie financial computation will persistently exceed supply on all networks

this has been the case since as early as 2017

so we make trade-offs to enable more financial computation on blockchains

the demand for block space ie financial computation will persistently exceed supply on all networks

this has been the case since as early as 2017

so we make trade-offs to enable more financial computation on blockchains

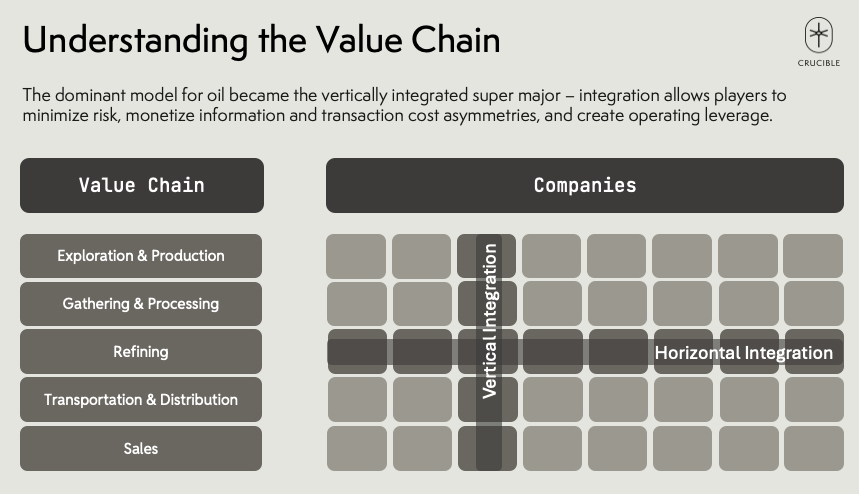

7/ for commodities to be tradable, you have to be able to move it around in a cost effective manner - hence the creation of synthetic / paper contracts representing physical commodities

how do we make financial compute liquid and fungible?

how do we make financial compute liquid and fungible?

9/ the first experiment started in 2013, when Tether put dollars on the bitcoin blockchain via the Omni Relay protocol, effectively bridging USD liquidity into bitcoin

but not all stablecoins are created equal - tether still makes up 90% of daily crypto dollar velocity

but not all stablecoins are created equal - tether still makes up 90% of daily crypto dollar velocity

10/ the next experiment was bridging Bitcoin onto Ethereum to be utilized as collateral in various DeFi protocols

nearly 1.5% of bitcoin is now used on Ethereum, but nearly all of this is fully custodial - again, trade-offs!

nearly 1.5% of bitcoin is now used on Ethereum, but nearly all of this is fully custodial - again, trade-offs!

11/ the current experiment, given the demand for Ethereum block space exceeds its supply, is bridging Ethereum from L1 into L2

in the last two weeks, the TVL of ETH on L2 has grown explonentially

in the last two weeks, the TVL of ETH on L2 has grown explonentially

12/ to date, nearly $8 of TVL has been bridged from Ethereum into not only L2's, but also other L1's

in the quest for available and affordable financial compute, all assets are becoming fungible liquidity across all chains

in the quest for available and affordable financial compute, all assets are becoming fungible liquidity across all chains

13/ today, 8% of blockchain-based assets are used on other networks

over the next 12 months, i expect this will be over 50%

if you want to bet on this, lmk

over the next 12 months, i expect this will be over 50%

if you want to bet on this, lmk

14/ what's exciting about this is now anyone, not just boomers in blazers, can be a market maker and supply liquidity

it makes markets absolutely massive. it makes liquidity possible in ways that we've never imagined before. it blows the doors open on the fungibility of assets.

it makes markets absolutely massive. it makes liquidity possible in ways that we've never imagined before. it blows the doors open on the fungibility of assets.

15/ we can put the FUN back in FINANCIAL COMPUTATION

assets are now interoperable across L1 and L2, and can be made liquid and fungible. liquidity itself is becoming a fungible asset.

mind. blown.

assets are now interoperable across L1 and L2, and can be made liquid and fungible. liquidity itself is becoming a fungible asset.

mind. blown.

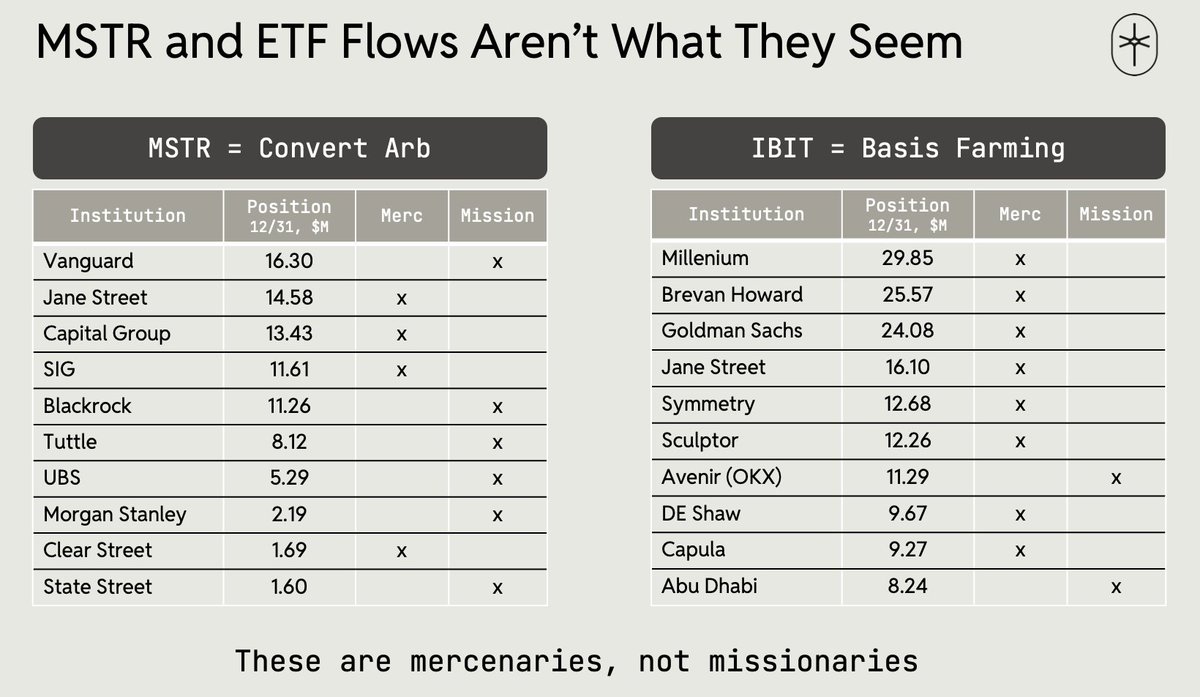

15/ and crypto markets are just the beginning.

at @CoinSharesCo, we believe blockchain-based financial computation will eat all markets.

every market will be on-chain, global, and trading 24/7/365

they just don't know it yet

at @CoinSharesCo, we believe blockchain-based financial computation will eat all markets.

every market will be on-chain, global, and trading 24/7/365

they just don't know it yet

16/ to read or download the whole presentation, see drive.google.com/file/d/1Pp0g0q…

if you wanna chat or are building liquidity focused primitives, DM me. our team at CoinShares would love to talk and see how we can bring liquidity to your network.

if you wanna chat or are building liquidity focused primitives, DM me. our team at CoinShares would love to talk and see how we can bring liquidity to your network.

17/ i apologize in advance for any typos or conceptual leaps, i made this presentation on a red-eye flight and i'm still wrapping my brain around things

i'm always happy to trade notes, so feel free to DM me if u disagree or if u wanna help me get the framing tighter

/fin

i'm always happy to trade notes, so feel free to DM me if u disagree or if u wanna help me get the framing tighter

/fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh