Every annual report tells a story.

In small companies, you can read between the lines to get a feel of the management style and business economics.

I take Fredun Pharmaceuticals Ltd (FPL) to illustrate how to go about this (it's not pretty).

Let's go 👇 (1/n)

In small companies, you can read between the lines to get a feel of the management style and business economics.

I take Fredun Pharmaceuticals Ltd (FPL) to illustrate how to go about this (it's not pretty).

Let's go 👇 (1/n)

Please note that the main objective of this review is to get a preliminary understanding without doing a thesis.

It is oriented towards a "quick and dirty" review to decide if you want to dig deeper.

Review financials on a screener website before reading further. (2/n)

It is oriented towards a "quick and dirty" review to decide if you want to dig deeper.

Review financials on a screener website before reading further. (2/n)

Now, you can already guess Fredun Pharmaceuticals is named after Fredun Medhora. His mother, Dr Daulat Medhora and his father, Nariman Medhora, are the original promoters of the company. Interestingly, Nariman Medhora has stepped down from active involvement in June 2021. (3/n)

Then we have Dr Daulat Medhora, who seems to have the qualifications and a decent background in the pharma industry. However, she is 76 years old and unlikely to be actively involved for much longer. (4/n)

That leaves Fredun Medhora, who does not have a technical or scientific background and his primary qualification is an MBA.

The biography provided in the AR describes the CV of an MBA student, nothing on the contribution or role in the company. (5/n)

The biography provided in the AR describes the CV of an MBA student, nothing on the contribution or role in the company. (5/n)

It is clear this company will primarily be run by Mr Fredun Medhora in the future, which is amply evident from the gradual exit of Nariman Medhora, and the advanced age of Dr Daulat Medhora.

Therefore, we know any investment thesis will be primarily betting on new gen. (6/n)

Therefore, we know any investment thesis will be primarily betting on new gen. (6/n)

Given this background, let's start with notice of AGM and see what FPL proposed this year.

First is a special resolution for approving a substantial 125% hike in remuneration for Managing Director and CFO Fredun Medhora. (7/n)

First is a special resolution for approving a substantial 125% hike in remuneration for Managing Director and CFO Fredun Medhora. (7/n)

Cut a long story short, the resolution & explanatory statement highlight 3 things:

(a) New remuneration is 54L p.a. (previous 24L p.a.)

(b) Subject to Schedule V of CA (due to inadequate profits)

(c) Previous remuneration was approved for 3 years (Sept 2020-2023) (8/n)

(a) New remuneration is 54L p.a. (previous 24L p.a.)

(b) Subject to Schedule V of CA (due to inadequate profits)

(c) Previous remuneration was approved for 3 years (Sept 2020-2023) (8/n)

The proposed remuneration is 27% of profit (Rs 2 Cr), beyond the permissible limits under the Companies Act. This is common in smaller companies, and isn't a strong factor to judge management.

Readers may gauge the merits of the remuneration as we go along. (9/n)

Readers may gauge the merits of the remuneration as we go along. (9/n)

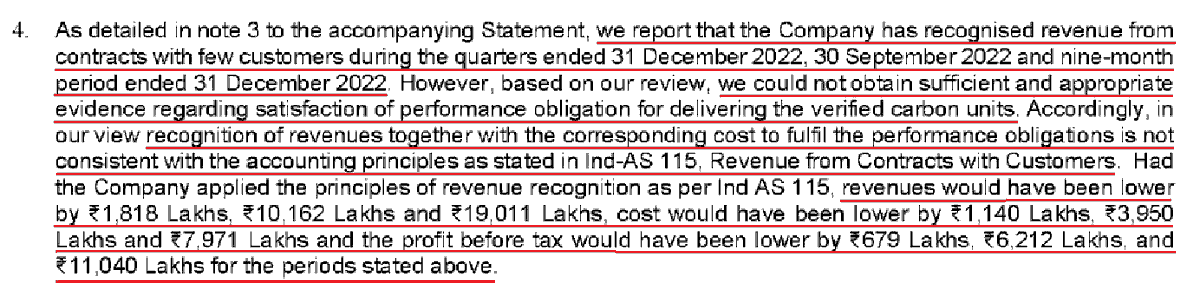

Let's see the other agenda item for AGM - providing for approval to appoint cost auditors for FY21-22.

Interestingly, the remuneration is subject to future "mutual" agreement.

Even in FY19-20, same cost auditor appointed w/o disclosing remuneration. (10/n)

Interestingly, the remuneration is subject to future "mutual" agreement.

Even in FY19-20, same cost auditor appointed w/o disclosing remuneration. (10/n)

U/ S.148 of CA2013, remuneration of cost auditor is required to be approved by members.

However, FPL has taken approval for appointment but left remuneration to be subject to "mutual agreement".

This is an egregious lapse . Opportunity to make some money @SEBI_India! (11/n)

However, FPL has taken approval for appointment but left remuneration to be subject to "mutual agreement".

This is an egregious lapse . Opportunity to make some money @SEBI_India! (11/n)

A review of past ARs shows a fluctuating trend of audit fees with no fixed remuneration. It w as 3L in 2017, 6.5L in 2018, 2.5L in 2019, 3L in 2020 and 6.5L in 2021. (12/n)

For such elaborate arrangements, related party transactions usually follow.

FPL has large purchases (FY21: Rs 39 Crore) primarily from Fredun Healthcare, related company.

New gen also gets annual 1.1 5 Cr rent + loan on interest

Making profit is tough w/ promoter cuts. (13/n)

FPL has large purchases (FY21: Rs 39 Crore) primarily from Fredun Healthcare, related company.

New gen also gets annual 1.1 5 Cr rent + loan on interest

Making profit is tough w/ promoter cuts. (13/n)

However, low PAT isn't a significant observation in microcaps and smallcaps, since you are betting primarily on future growth or change in circumstances.

Operating cash flows > reported PAT is a good sign.

Anything that shows efficient cash use is a bonus. (14/n)

Operating cash flows > reported PAT is a good sign.

Anything that shows efficient cash use is a bonus. (14/n)

FPL has negligible cash flows, generating only 16 lakh in operating cash. Of special note here is the substantial inventory and high trade receivables. Outstanding dues are significantly aged too, though showing some improvement from last fiscal w/ write offs. (15/n)

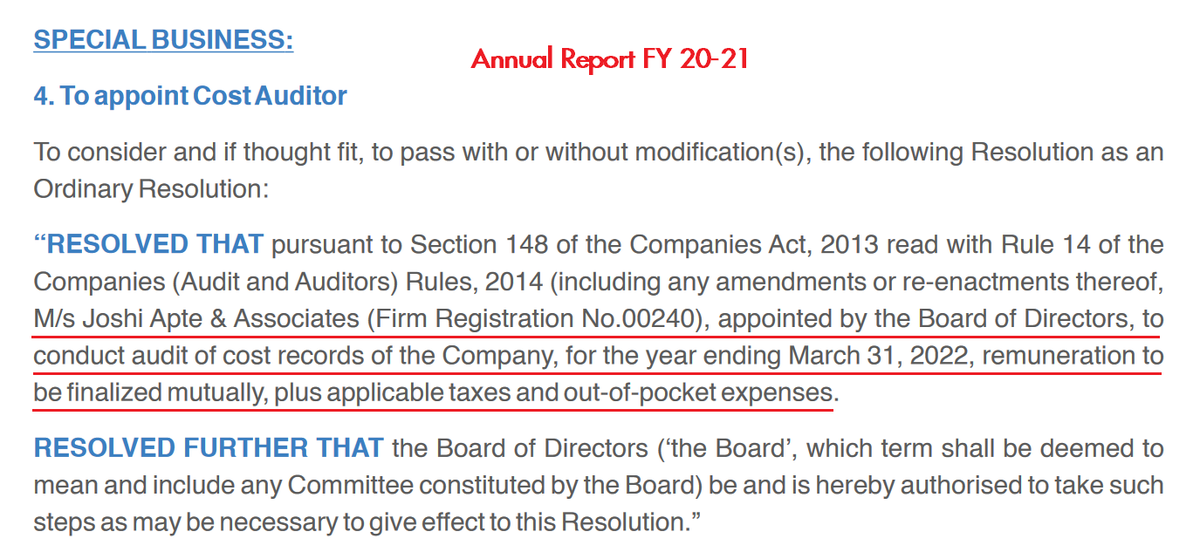

Poor cashflows generally translate into high debt. There's short term loans, including from related parties. The secured term loans are at astronomical 18% interest!

Apart from no operating cash flow, FPL has substantial interest outgo, which is further funded with debt. (16/n)

Apart from no operating cash flow, FPL has substantial interest outgo, which is further funded with debt. (16/n)

Here's an interesting thought. If cash flows are zilch and there are high value of related party transactions, why not check the closing balances of related party transactions to see if cash flows to related parties are being prioritized? (17/n)

Financial statements always disclose opening/closing balance for such transactions (check image 1). This disclosure is missing in AR FY20-21 despite the header saying "balances". So you *cannot* ascertain the cash movement between related entities during the fiscal. (18/n)

This isn't the only impact of omission. Note 20 says loans from related entities are at "Market Lending Rate" and redirects to further information in related party disclosures (Note 39).

With omission of balances table in note 39, terms of loan are a complete mystery. (19/n)

With omission of balances table in note 39, terms of loan are a complete mystery. (19/n)

Compliance/regulatory lapses are also relevant for assessing management.

"Other expenses" shows substantial fines/penalties under GST for non-compliance with procedures like timely filing of returns and payment of tax. Res ipsa loquitor - the thing speaks for itself. (20/n)

"Other expenses" shows substantial fines/penalties under GST for non-compliance with procedures like timely filing of returns and payment of tax. Res ipsa loquitor - the thing speaks for itself. (20/n)

Recently, FPL did a preferential issue to 23 public investors, with highest allotment to Nikhil Vora. The AR FY20-21 specifies him as already the 3rd largest shareholder with 5.85% holding. Interestingly, even new gen promoter doesn't have that much stake in FPL. (21/n)

Essentially, we have the following observations:

A. New gen pay is sky rocketing

B. Strange arrangement w/ auditors

C. Gaps in financial statements, missing disclosures

D. Poor cash flow with high debt

E. Poor legal compliance

F. Large related party transactions

(22/n)

A. New gen pay is sky rocketing

B. Strange arrangement w/ auditors

C. Gaps in financial statements, missing disclosures

D. Poor cash flow with high debt

E. Poor legal compliance

F. Large related party transactions

(22/n)

At the end of this analysis, you have a decently good idea of how FPL is run from a governance perspective.

Next step, if you remain interested, would be to look into the commercial side of things. (23/n)

Next step, if you remain interested, would be to look into the commercial side of things. (23/n)

No smallcap or microcap and sometimes even larger companies are devoid of governance issues.

Having a quick and dirty framework is useful to shortlist companies for further analysis.

Every case has to be evaluated on its own merits. (24/n)

Having a quick and dirty framework is useful to shortlist companies for further analysis.

Every case has to be evaluated on its own merits. (24/n)

Hope you enjoyed this thread. RT first tweet for greater reach, please.

As always, this is not a recommendation to invest or not to invest into FPL. Just an example to illustrate. (25/n)

As always, this is not a recommendation to invest or not to invest into FPL. Just an example to illustrate. (25/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh