My fav investing Teachers & what I learned from them.

✔️Long-term focus🔭

Warren Buffett

Charlie Munger

Chuck Akre

✔️Growth📈

Philip Fisher

Clayton Christensen

David Gardner

✔️Behavioral🧠

Benjamin Graham

Howard Marks

Seth Klarman

✔️Process🗒️

Peter Lynch

Pat Dorsey

Nick Sleep

✔️Long-term focus🔭

Warren Buffett

Charlie Munger

Chuck Akre

✔️Growth📈

Philip Fisher

Clayton Christensen

David Gardner

✔️Behavioral🧠

Benjamin Graham

Howard Marks

Seth Klarman

✔️Process🗒️

Peter Lynch

Pat Dorsey

Nick Sleep

Some key points on each.

✔️Long-term focus

Buffett : Business Owner mindset (as an investor) will prompt you to think/act long-term. Time is a friend of excellent Business and a foe of the mediocre ones.

✔️Long-term focus

Buffett : Business Owner mindset (as an investor) will prompt you to think/act long-term. Time is a friend of excellent Business and a foe of the mediocre ones.

Munger : Learn and practice multi-disciplinary thinking. Patience & common sense are rewarded in the long-term.

Akre : Developing a simple approach (for buying/holding) that will help you stay with the good companies for a long time.

Akre : Developing a simple approach (for buying/holding) that will help you stay with the good companies for a long time.

✔️Growth

Fisher : How to research growth Co.'s (Product, Sales, Management, Culture...) and then hold for the long-term.

Christensen : Always think about innovation, disruption, trends and how they are helping or hurting the Companies you are interested in or holding.

Fisher : How to research growth Co.'s (Product, Sales, Management, Culture...) and then hold for the long-term.

Christensen : Always think about innovation, disruption, trends and how they are helping or hurting the Companies you are interested in or holding.

@DavidGFool : Winners win (for a reason). Invest in Companies that are creating a better future. Seek/Buy/Hold/Add to Excellence.

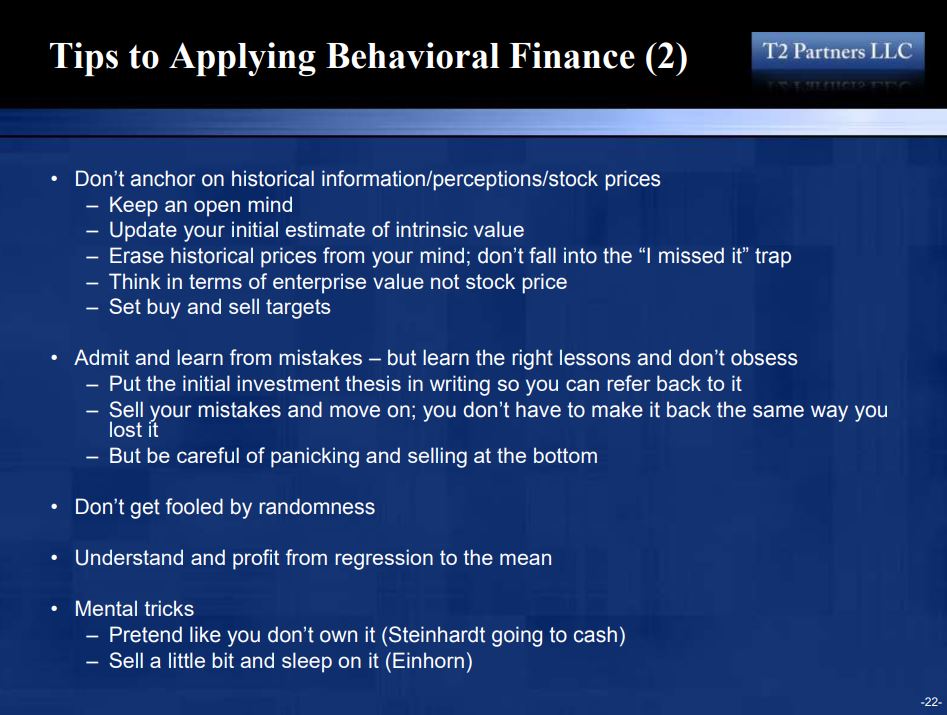

✔️Behavioral

Graham : For the concepts of Intrinsic Value, Margin of Safety and taking advantage of Mr. Market’s occasional crazy behavior.

Marks : How Market & Investor psychology influences cycles & occasionally take prices far away from intrinsic values in both directions.

Graham : For the concepts of Intrinsic Value, Margin of Safety and taking advantage of Mr. Market’s occasional crazy behavior.

Marks : How Market & Investor psychology influences cycles & occasionally take prices far away from intrinsic values in both directions.

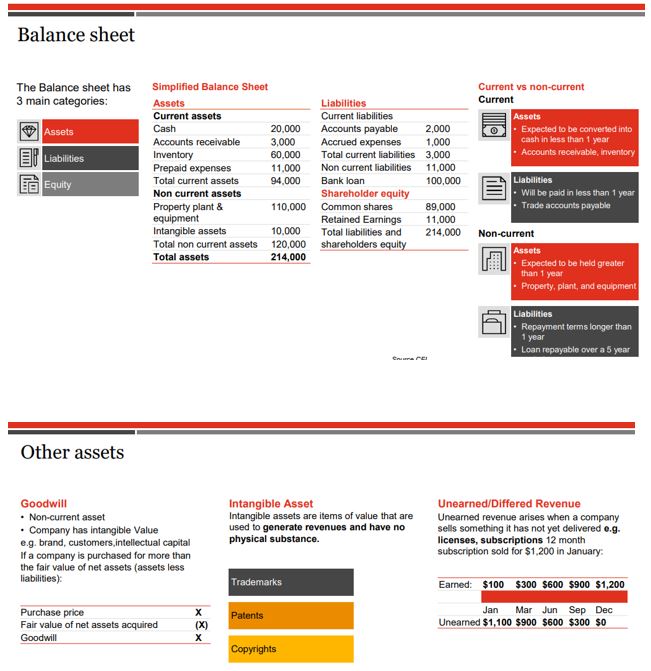

Klarman : Before you get excited about the upside, make sure you think about the downside (quality, Balance sheet, expectations embedded in the stock price...)

✔️Process

Lynch : Leveraging your edge as an individual investor and investing in Companies that you know or can understand. How to analyze based on what type of Company it is.

Dorsey : Focus on Moats, re-investment opportunities, and Capital Allocation skills of Management.

Lynch : Leveraging your edge as an individual investor and investing in Companies that you know or can understand. How to analyze based on what type of Company it is.

Dorsey : Focus on Moats, re-investment opportunities, and Capital Allocation skills of Management.

Sleep : Putting effort to identify the deep reality of good Businesses and understanding what makes them special.

My fav part of investing process (apart from company research) is how you can learn from various investors, concepts, pick what fits your goals/process, making it better which will ultimately deliver good long-term results.

Happy Friday!

Happy Friday!

• • •

Missing some Tweet in this thread? You can try to

force a refresh