János Kornai spent his life studying socialist economies. But what did he learn by studying the capitalist system?

If Kornai believes socialism creates a shortage economy, capitalism creates a surplus economy. Surplus inventory, capacity, and workers.🧵

apricitas.substack.com/p/capitalism-a…

If Kornai believes socialism creates a shortage economy, capitalism creates a surplus economy. Surplus inventory, capacity, and workers.🧵

apricitas.substack.com/p/capitalism-a…

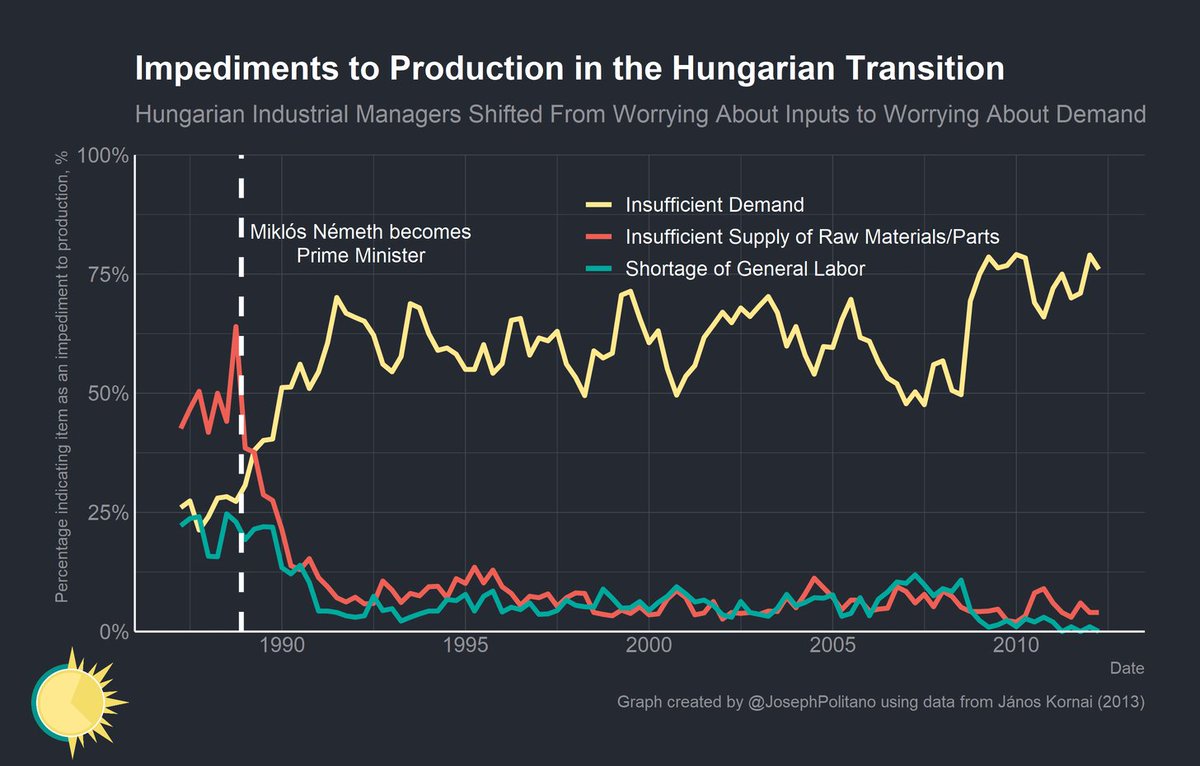

In planned economies, firms are resource constrained because of their soft budget constraint. Because the state covers their financial losses, they hoard inputs and workers with no regard to productivity. In market economies, firms are constrained by profits and therefore demand.

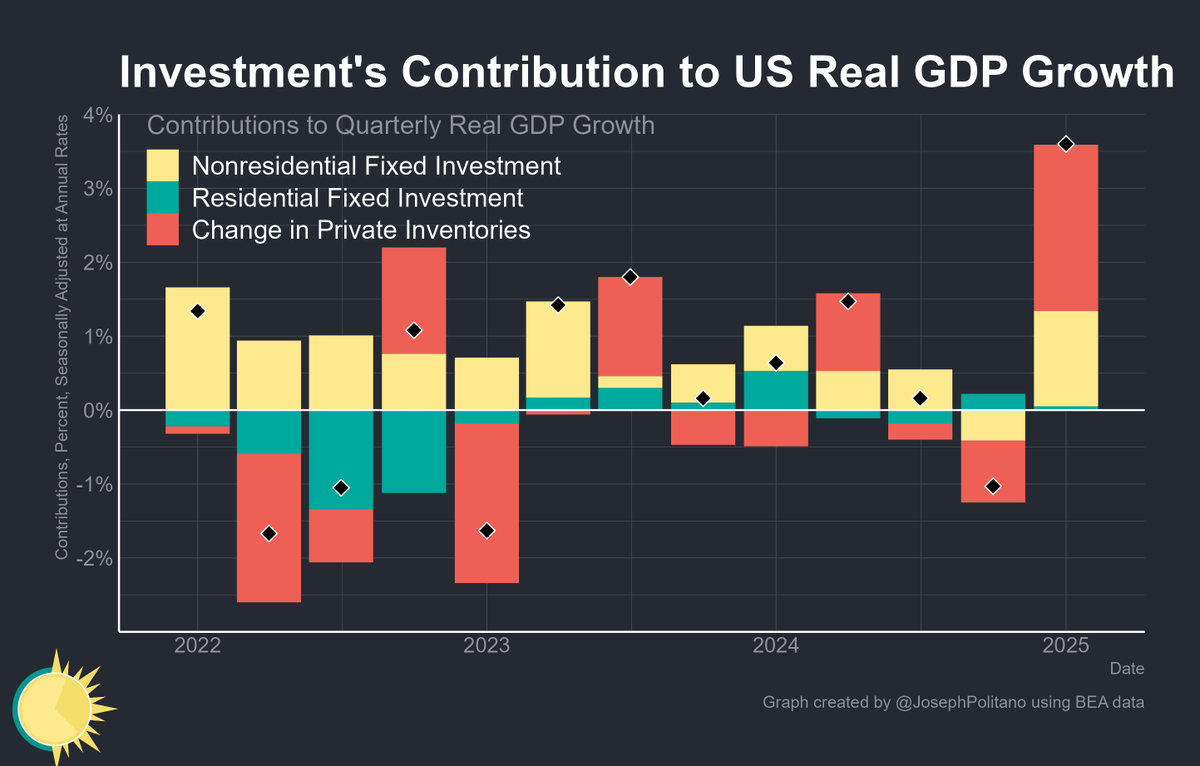

Since demand is finnicky and unpredictable, firms keep surplus capacity and inventory. That way they always have products for consumers and can pounce on any opportunity for expansion.

In Kornai's mind, this surplus inventory and capacity is one of capitalism's main benefits.

In Kornai's mind, this surplus inventory and capacity is one of capitalism's main benefits.

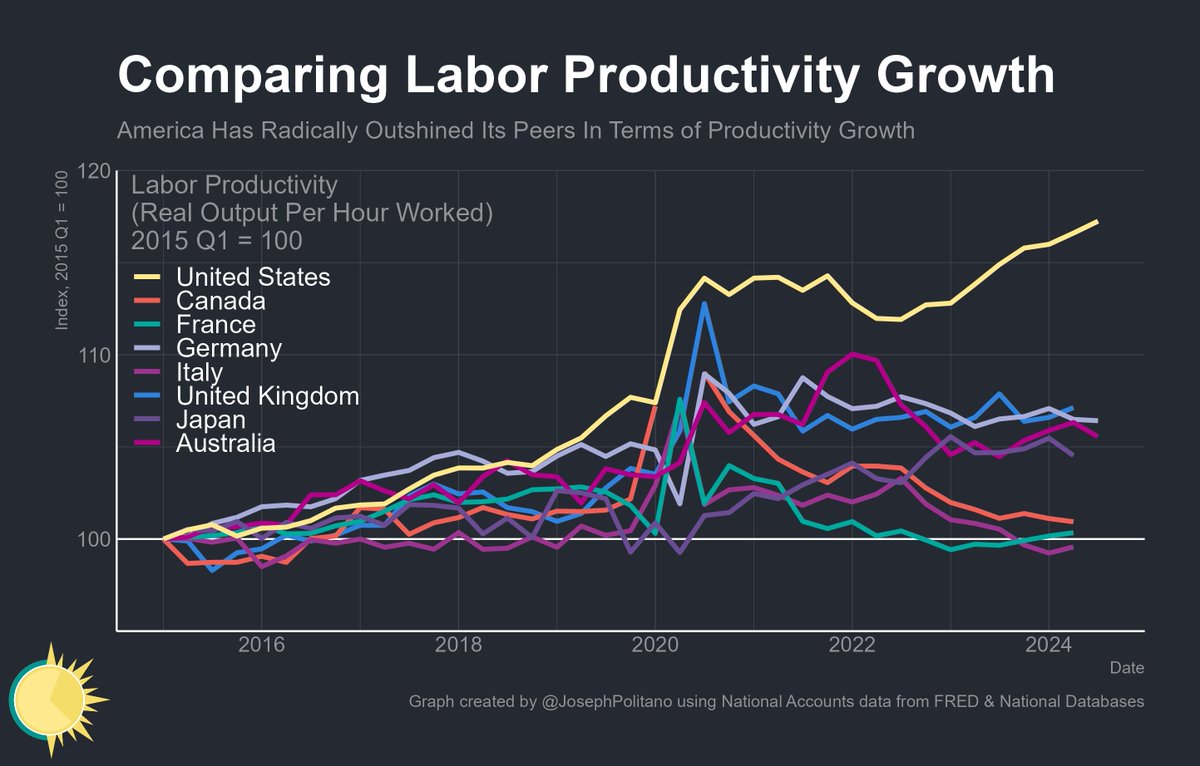

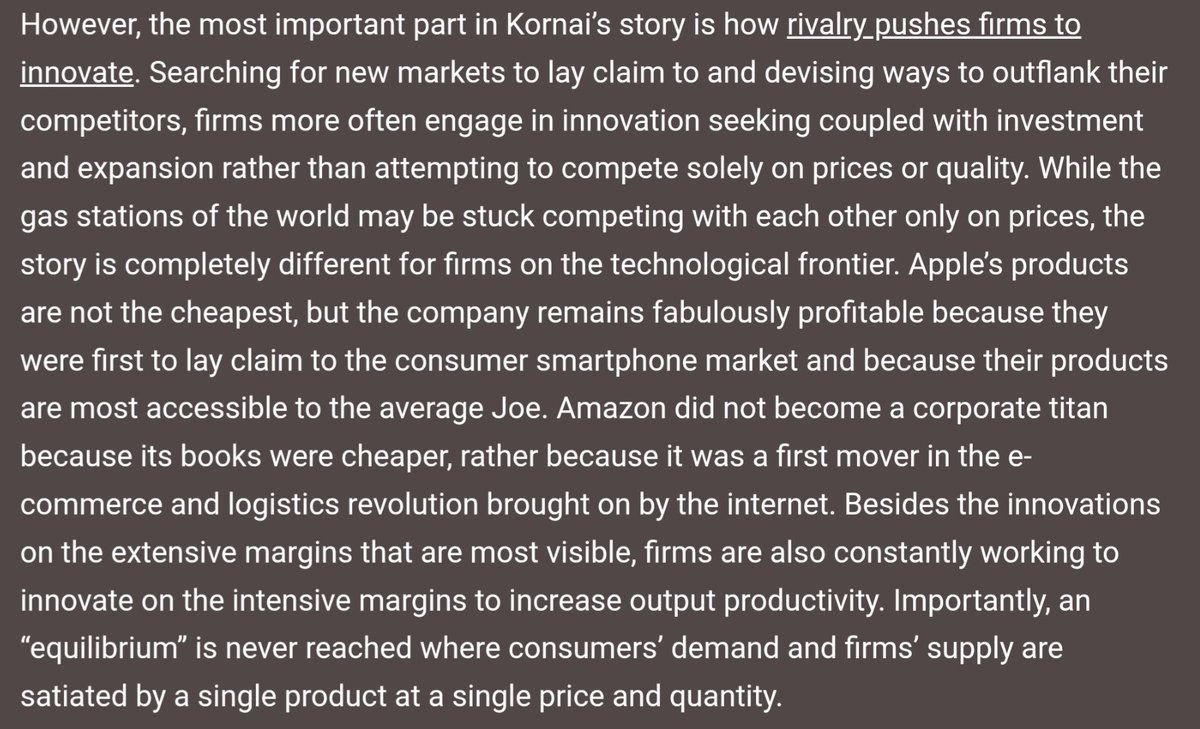

This is because markets are never in equilibrium. Firms in capitalist economies engage in rivalry, which is analogous to monopolistic/oligopolistic competition. Rivalry and surplus drive innovation, as firms desperately try to get an edge through technological improvements.

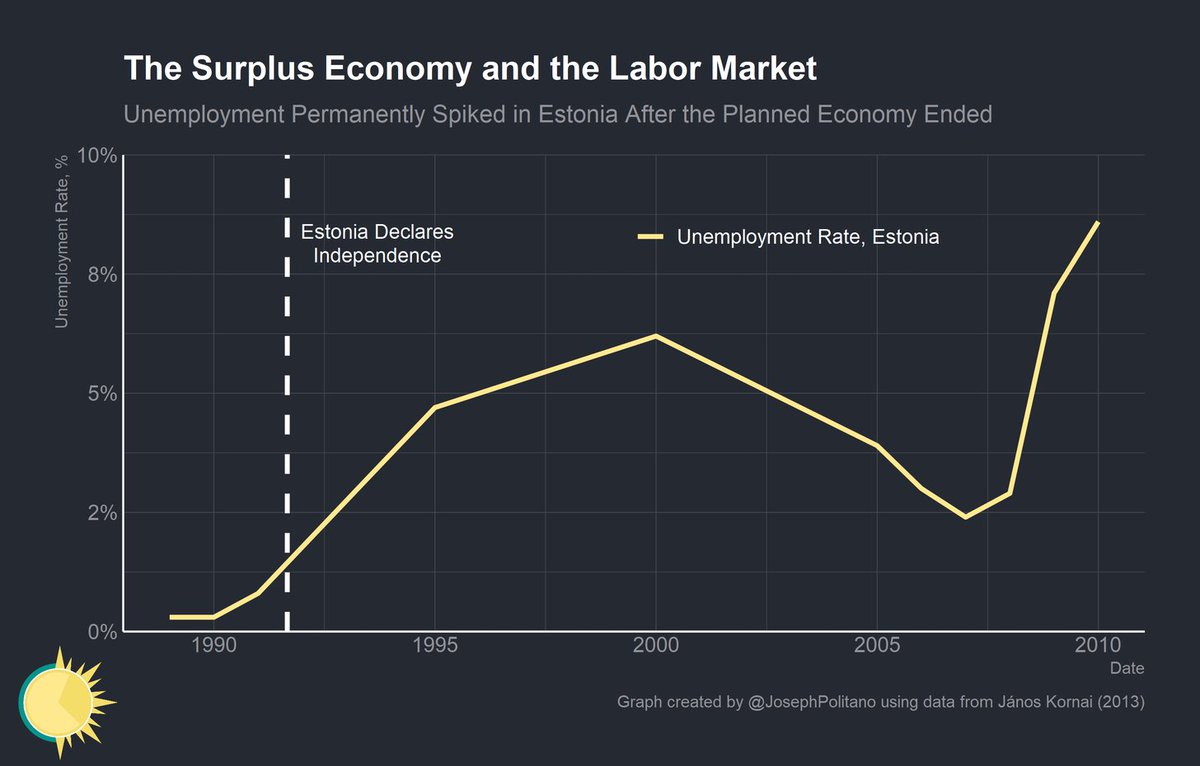

Kornai also posits that unemployment is a core part of capitalist economies. Where socialist economies had constant labor shortages, capitalist economies have endemic labor surplus. Firms use the threat of unemployment to discipline workers and solidify their bargaining position.

So what can we do with this understanding of the capitalist system? For one, it underscores the importance of system wide demand validation in capitalism. If aggregate demand is allowed to fall in a demand constrained system, permanently lower output can result (see 2008).

For two, it means that introducing elements of planning, redistribution, and other interventions will not eliminate the benefits of capitalism. If the hard budget constraint is preserved, the surplus economy will remain—and these interventions may actually improve the economy!

If you like what I do, consider subscribing! It's free, and helps me out a ton.

Next week's post will be on innovation spillovers in economics, so stay tuned!

apricitas.substack.com

Next week's post will be on innovation spillovers in economics, so stay tuned!

apricitas.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh